dokumen.pub managerial-economics-6nbsped-1032145404-9781032145402

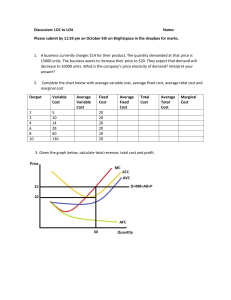

advertisement