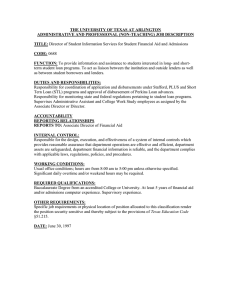

Accelerate Your Business with Two-Wheeler Financing Solutions

advertisement

Accelerate Your Business with TwoWheeler Financing Solutions In today’s fast-paced world, businesses constantly seek efficient and costeffective ways to enhance productivity and maintain a competitive edge. One such solution that has gained popularity is two-wheeler financing. Whether you’re a small business owner looking to expand your delivery fleet or a professional needing reliable transportation, two wheeler finance offers numerous benefits. This guide will explore the advantages of two-wheeler finance, how it works, and tips for securing the best financing options. Understanding Two-Wheeler Finance Two-wheeler finance refers to loans or credit facilities provided by financial institutions to individuals or businesses for purchasing motorcycles, scooters, or other two-wheeled vehicles. These loans are designed to make it easier for borrowers to acquire a vehicle without the need for a large upfront payment. Instead, the cost of the vehicle is spread over a period, typically ranging from 12 to 48 months, making it more manageable to pay off. Benefits of Two-Wheeler Finance 1. Affordable Access to Vehicles: Two-wheeler finance allows businesses and individuals to purchase a vehicle without having to pay the full amount upfront. This accessibility can be particularly beneficial for small businesses or startups with limited capital. 2. Improved Cash Flow Management: By spreading the cost of the vehicle over several months or years, borrowers can better manage their cash flow. This approach ensures that they can allocate funds to other critical areas of their business or personal expenses. 3. Flexible Repayment Options: Financial institutions often provide flexible repayment options to suit different needs. Borrowers can choose a repayment tenure that aligns with their financial situation, ensuring that monthly installments are affordable. 4. Competitive Interest Rates: Due to the competitive nature of the lending market, many financial institutions offer attractive interest rates on twowheeler loans. Borrowers can benefit from lower interest costs, making the overall cost of the vehicle more affordable. 5. Tax Benefits: In some cases, businesses can claim tax benefits on the interest paid on two-wheeler loans. This advantage can reduce the overall cost of borrowing and provide additional financial relief. 6. Enhanced Productivity: For businesses, having a reliable two-wheeler can enhance productivity by improving delivery times and reducing transportation costs. It allows employees to reach customers or clients more efficiently, leading to better service and increased revenue. How Two-Wheeler Finance Works 1. Application Process: The first step in securing two-wheeler finance is to apply for a loan. Most financial institutions offer online applications, making the process quick and convenient. Applicants need to provide personal and financial information, along with details about the vehicle they wish to purchase. 2. Eligibility Criteria: Lenders have specific eligibility criteria for twowheeler loans. These typically include age requirements, income thresholds, and employment status. Ensuring that you meet these criteria can expedite the approval process. 3. Documentation: To process the loan application, lenders require certain documents. These usually include proof of identity, address, income, and employment. Having these documents ready can streamline the application process. 4. Loan Approval: Once the application and documentation are submitted, the lender reviews the information to determine the borrower’s creditworthiness. If the application is approved, the lender will offer a loan amount, interest rate, and repayment terms. 5. Vehicle Purchase: After loan approval, the borrower can proceed with purchasing the two-wheeler. The lender may disburse the loan amount directly to the vehicle dealer, simplifying the purchase process. 6. Repayment: The borrower repays the loan amount in monthly installments over the agreed tenure. It’s crucial to make timely payments to maintain a good credit score and avoid any penalties or late fees. Tips for Securing the Best Two-Wheeler Finance 1. Check Your Credit Score: Your credit score plays a significant role in determining the interest rate and loan approval. Before applying for a loan, check your credit score and take steps to improve it if necessary. 2. Compare Lenders: Different lenders offer varying interest rates and loan terms. Take the time to compare multiple lenders to find the best deal that suits your financial situation. 3. Negotiate Terms: Don’t hesitate to negotiate the loan terms with your lender. If you have a good credit score and a stable income, you may be able to secure better interest rates and repayment terms. 4. Opt for a Shorter Tenure: While longer tenures reduce the monthly installment amount, they often come with higher interest costs. If possible, opt for a shorter tenure to save on interest expenses. 5. Read the Fine Print: Before signing the loan agreement, read the terms and conditions carefully. Ensure you understand the interest rate, repayment schedule, and any additional fees or charges. 6. Consider Prepayment Options: Some lenders offer the option to prepay the loan without any penalties. Prepayment can reduce the overall interest cost and help you become debt-free sooner. 7. Use a Loan Calculator: Online loan calculators can help you estimate the monthly installments and total interest payable on your loan. Use these tools to plan your finances effectively. Conclusion Two-wheeler finance provides a practical solution for individuals and businesses looking to acquire a reliable mode of transportation without the burden of a large upfront payment. By understanding the benefits and working mechanisms of twowheeler finance, you can make informed decisions and secure the best financing options available. Whether you’re expanding your delivery fleet or simply looking for a convenient way to get around, two-wheeler finance can help you accelerate your business and achieve your goals.