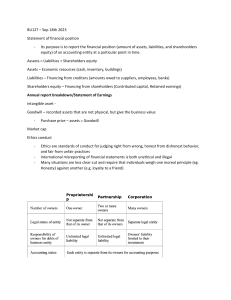

Financial Accounting & Reporting: A Global Perspective Textbook

advertisement