A Quick Guide to enter an adjusting entry for QuickBooks reconciliation

advertisement

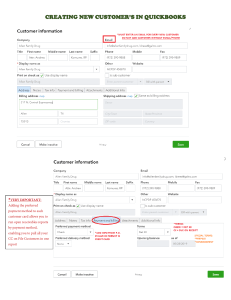

Let’s Enter an Adjusting Entry for QuickBooks Reconciliation Reconciliation in QuickBooks is crucial for maintaining accurate financial records and ensuring that your bank statements match your internal accounting records. However, discrepancies can arise, often requiring adjusting entries to balance the accounts. Here’s a step-by-step guide on how to enter an adjusting entry for QuickBooks reconciliation and contribute to the overall accuracy of your financial reports. Although this blog is all you need to learn how to adjust an entry, nothing is comparable to the assistance from accounting experts. So, connect with our team of experts by dialing +1.833.802.0002 and resolve the issue in minutes Let’s Understand How to Adjusting Entries in QuickBooks Adjusting entries is necessary when you encounter small discrepancies that you cannot resolve through regular transaction review. These entries force your accounts to balance, allowing you to complete the reconciliation process. It’s essential to note that adjusting entries should be used sparingly and only for minor discrepancies. For reconciliation discrepancies in QuickBooks, consult your accountant to avoid potential accounting issues. Step-by-Step Guide to Enter an Adjusting Entry • • • • • • Launch QuickBooks Desktop and go to the Transactions menu. Select Reconcile from the dropdown options. Ensure that you have reviewed all transactions for errors. Make sure there are no missing or duplicated entries. After reviewing, select Start reconciling. QuickBooks will display the reconciliation screen where you can match your transactions with your bank statement. • If there is a small discrepancy remaining after matching all transactions, select Finish now from the dropdown menu. Adding Adjustment in Transaction 1.A Click message will Add appear indicating adjustment that your and account isn’t then balanced. Done. 2.QuickBooks will create an expense transaction automatically if the discrepancy is negative or an income transaction. In case it is positive, thus balancing the account. Important Considerations 1.Always double-check the discrepancy to ensure it’s minor and not due to an overlooked error.Make a note of why the adjustment was necessary, as this will be helpful for future reference or audits. 2.If unsure about making an adjusting entry, especially for larger discrepancies, consult your accountant to prevent any long-term accounting issues. 3.If you want to locate an adjusting entry, QuickBooks will allow you to view past reconciliation adjustments easily. This feature is handy for tracking changes and maintaining transparency in your accounting practices. Enter an adjusting entry for QuickBooks reconciliations is a powerful way, to allow you to resolve small discrepancies during reconciliation. By following the steps outlined above, you can ensure your accounts remain balanced and accurate. If discrepancies are still not fixed, you can reach out to us by dialing +1.833.802.0002 and connecting with professionals for assistance.