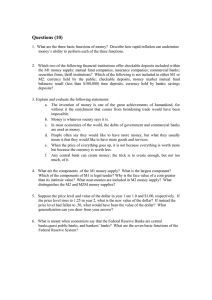

SP 2024 Apr. 13 ECON 202: Principles of Macroeconomics Name: _______Carissa Andres________ Problem Set #8 for Ch.14 due Apr. 16 (Tuesday) 11:00PM Note: You should submit via D2L Brightspace’s “Drop Box” link on the course web site as directed in the syllabus. Use your last name as file name, for example, John_HW#8.doc or John_HW#8.pdf Complete all questions by filling the blanks and/or circling(or highlighting) a correct choice. 1. What are the three basic functions of money? Describe how rapid inflation can undermine money’s ability to perform each of the three functions. Money is used as a medium_ of exchange for goods and services, as a unit__ of account for expressing price, and as a store__ of value. People will only accept money in exchange for goods and services and for the work they perform if they can be reasonably certain that the medium of exchange—money—will retain its value until they are ready to spend it. In runaway inflations of the thousands or tens of thousands of percent a year, people revert to bartering_. Again, drastic inflation greatly reduces money’s use as a measure of value (unit of account), for it is ( possible, impossible ) to adjust instantaneously all prices strictly in line with their relative values. Thus, opportunities are afforded to speculators to profit at the expense of the less sophisticated who, eventually, will learn to distrust money’s usefulness as a measure of value. Finally, and most obviously, money’s usefulness as a store of value is destroyed in a drastic inflation. The “rule of 70” is instructive here. By dividing the absolute inflation rate into 70, one can estimate how long it takes one’s dollar savings to lose half their purchasing power. At 7 percent inflation, the dollar will be worth half as much in __10__ years. 2. What “backs” the money supply in the United States? What determines the value (domestic purchasing power) of money? How does the purchasing power of money relate to the price level? Who in the United States is responsible for maintaining money’s purchasing power? There is ( no, some ) concrete backing to the money supply in the United States. Paper money, which has ( some, no ) intrinsic value, has value only because people are willing to accept it in exchange for goods and services, including their labor services as employees. And people are willing to accept paper as money because they know that everyone else is also willing to do so. If the monetary authorities were issuing new banknotes at a rate far in excess of available output, the acceptability of paper money would ( increase, diminish ). People would start to worry about whether the banknotes would be worth much after they received them. Checks are part of the money supply and ( are, are not) legal tender, but people accept them willingly from people believed trustworthy. The purchasing power of money is ( directly, inversely ) related to the price level. The Board of Governors of the Federal Reserve System (the Fed) is responsible for managing the United States’ money supply so that money retains its purchasing power. 3. Suppose that a small country currently has $4 million of currency in circulation, $6 million of checkable deposits, $200 million of savings deposits, $40 million of small denominated time deposits, and $30 million of money market mutual fund deposits. From these numbers we see that this small country’s M1 money supply is _$10 million M2 is: $__280__ million - According to the textbook, in November 2021, M1 money supply is: $__20.3___ trillion. - M2 money supply is $ - Thus M1 money supply is ( larger, smaller ) than M2 money supply. 21.4 trillion. SP 2024 Apr. 13 ECON 202: Principles of Macroeconomics Name: _______Carissa Andres________ 4. (Consider This…p.292) Are credit cards money? Answer by filling blanks and/or circling a correct answer. Credit cards represent the ability to get an instant short-term loan__ from the financial institution that issued that card. They can be exchanged for goods or services and account for about _27_ percent of the dollar value of all transactions in the United States, according to or textbook. At some point, however, that loan must be paid with money (checks or currency). Your checking account balance that you use to pay your credit card bill is ( money, not money ); the credit card is ( money, not money ), as officially defined. So credit card balances ( are, are not ) a component of M2. 5. Why is money considered to be debt? The major parts of the money supply are currency and checkable deposits. These items are debts, or promises__ to pay. Paper money is the circulating debt of the (commercial banks and thrifts, Federal Reserve banks). Checkable deposits are debts of (commercial banks and thrifts, Federal Reserve banks). Paper currency and checkable deposits have ( some, no ) intrinsic value. They are simply circulating paper to which people must attach value. A checkable deposit is merely a bookkeeping entry. 6. Explain and evaluate the following statements: “When the price of everything goes up, it is not because everything is worth more but because the currency is worth less.” The statement is ( true, false). If the price of one thing goes up relative to another, it is fair to claim that it has become more valuable, but if the price of everything rises, it means that the currency has ( more, less ) purchasing power (i.e. is worth less). 7. Why don’t economists agree with backing paper money with a certain commodity, such as gold? Supplies of commodities like gold can change ( expectedly, unexpectedly ). A sudden increase in the availability of a commodity could ( increase, decrease) the money supply too quickly and trigger inflation. If the government backed the currency with gold, then the money supply ( would, would not ) vary with the availability of gold. A persistent scarcity of a commodity could (increase, reduce ) the money supply too much and cause a recession and unemployment. 8. Discuss three major points about what gives money its value. First, Acceptability__. Currency and demand deposits (M1 definition) are considered money because these items are accepted as payment for goods and services. Money must be acceptable to serve its function as a medium__ of exchange. Second, Legal__ tender___. The government mandates through law that paper money be accepted as payment for debts. While checks ( are, are not ) mandated by law as money, government agencies do back demand deposits at banks with deposit insurance that helps to maintain the acceptability of this form of money. Third, Relative__ Scarcity__. There is a reasonably constant demand for money for transactions purposes and future uses. The supply of money will determine the value or “purchasing_ power” of each unit of money. The ( demand for, supply of ) money is controlled by monetary institutions (the Federal Reserve System) that attempt to maintain a reasonably stable purchasing power for money. 9. Formula for the relationship between the purchasing power of the U.S. dollar and the price level. The purchasing power of the U.S. dollar is ( directly, inversely ) related to the price level: when the consumer price index (CPI) goes up, the value of the dollar goes (down, up ). Higher prices ( increase, decrease) the dollar’s purchasing power because people need (fewer, more ) dollars to obtain specific quantity of goods and services. Value of the dollar ($V) = ___1/P__________________________________ SP 2024 Apr. 13 ECON 202: Principles of Macroeconomics Name: _______Carissa Andres________ 10. Complete the table showing the relationship between a percentage change in the price level and the percentage change in the value of money. Calculate the percentage change of money to one decimal place. Change in price level Change in value of money a. rises by: 9% − ___9__% 16% − ___16___ b. falls by: 9% + __9___ 20% + __20___ 11. What is the goal of monetary policy? The goal of monetary policy is to stabilize the economy to promote price____ stability_, full__ employment__ and economic growth. It is recommended that you visit the Federal Reserve System’s website (www.federalreserve.gov) and find that Minnesota was in the _9_th district among 12 districts, each having one central bank. The 12 Federal Reserve Banks together constitute the U.S. “ central___ bank__ ),” nicknamed the “feds__ .” The Fed’s primary influence is on the money_ supply__ and interest__ rates. (Relating to Fed’s monetary policy in chapter 16, it is required to read the Federal Reserve & the Banking system in your text pp 292-298, and answer the following questions from 12 to 16 . These will help understand Ch.16). 12. Describe the three major units of the Federal Reserve System and their functions. First, the Federal Reserve System is overseen by the Board_ of Governors__. This Board___ is responsible for control of the supply of money and the banking system. The President appoints the 7 members of the Board. Second, there are 12 regional Federal Reserve Banks. Third, the Federal Open Market Committee (FOMC) helps the Board by establishing policy over the buying_ and selling__ of government securities such as bills, notes, and bonds. 13. What are the three major characteristics of the twelve Federal Reserve Banks? They act together as the central bank of the United States. They are quasi_-public_ in that they are owned by private commercial bank members, but are controlled by the government since the system was established by an act of Congress. Finally, they are bankers’ banks because they perform essentially the same functions for depository institutions that those institutions perform for their customers. That is, the Federal Reserve Banks make loans to financial institutions, keep their reserve deposits, and provide them with paper money. Just as banks and thrifts accept deposits of and make loans to the public, so the Federal Reserve Banks accept deposits and make loans to banks and thrifts. 14. Who sits on the Federal Open Market Committee (FOMC) and what does the committee do? The FOMC is made up of the ( 7 ) members of the Board of Governors plus five of the presidents of the twelve Federal Reserve Banks (always including the president of the New York Fed). The other seven presidents attend meetings but do not have voting power. This committee sets monetary___ policies__ with regard to the purchase and sale of government securities, a major tool in regulating the supply__ of money in the economy. 15. What are the seven functions of the Federal Reserve System? Which one is most important? The seven functions are: (1) issuing currency_; (2) setting reserve requirements and holding required reserves of banks and thrift institutions; (3) lending money_ to banks and thrifts; (4) collecting and clearing checks___ for banks and thrifts; (5) serving as the fiscal agent for the U.S. government; (6) supervising the operation of member banks; and (7) controlling the money supply. Among all seven functions which is the most important function? ___controlling the money supply______. SP 2024 Apr. 13 ECON 202: Principles of Macroeconomics Name: _______Carissa Andres________ 16. Identify and explain the main factors that contributed to the financial crisis of 2007-2008. (See PPT slides and http://crisisofcredit.com) The Financial Crisis of 2007-2008 started in (consumer durables, real estate & housing , foreign ) sector. What factors led to the mortgage default crisis that triggered the Financial Crisis of 2007-2008? Government programs encouraging home ownership, declining real estate values, bad incentives provided by mortgage backed bonds. 17. Why is the banking system in the United States referred to as a fractional reserve banking system? __A portion of checkable deposits are backed by reserves of currency either stored on site in vaults of commercial banks or thrifts or kept as reserve balances on deposit at the central bank__ 18. What is the role of deposit insurance in a fractional reserve system? The role of deposit insurance is to assure depositors that they will have access to their insured funds even if their bank fails 19. Relating to the above question, read the following as an extension to the textbook reading of ch14. Then circle (or highlight) the correct answer from choices and fill the blanks below. Concept Illustration – Deposit Insurance We can easily extend the story of the goldsmiths to show: 1.Why the Fed’s reserve requirement is inadequate to stop bank runs. 2.The reason deposit insurance is needed. Recall that the goldsmiths wrote out gold receipts when people deposited their gold for storage. The persons receiving the receipts began to use them to buy goods and services, and, thereafter, the gold receipts circulated as money in the economy. Observing that holders of gold receipts rarely withdrew gold, the goldsmiths began to issue loans in the form of newly issued gold receipts. The amount of gold receipts circulating in the economy therefore exceeded the amount of gold in storage (or “in reserve”). The fractional Reserve banking system was born. Suppose that a fictional Federal Gold Reserve Board decided to place a 10 percent reserve requirement on the goldsmiths. Thus, goldsmiths would need to hold 10 ounces of gold for each set of gold receipts representing 100 ounces of gold. This requirement would not protect gold depositors from potential losses. If holders of gold receipts lost confidence in the goldsmiths and simultaneously demanded gold in exchange for their receipts, the goldsmiths would face bankruptcy__. Anything less than a 100 percent reserve requirement would be inadequate to protect those holding receipts from losses. So it is with the legal reserve requirement in the modern banking system. The requirement that banks hold currency reserves equal to 10 percent of their total checkable deposits is ( adequate, inadequate ) to protect depositors from losses resulting from bank runs. As we noted in the chapter, such protection ( is, is not ) its purpose. In the goldsmith economy, government could prevent “gold runs” through deposit__ insurance____ that guaranteed gold payments for gold receipts. Knowing that the government has insured the gold deposits, private owners of gold would view their gold receipts “as good as gold” and therefore have no incentive to retrieve their gold from storage. So, it is in the modern economy. The Federal Deposit Insurance Corporation (FDIC) ensures each individual bank and thrift deposit up to $250,000_. (see https://www.fdic.gov/resources/depositinsurance/ ) Depositors thus view their checking account entries “as good as currency” and are dissuaded from simultaneously running to banks and thrifts to convert their checkable deposits to currency.