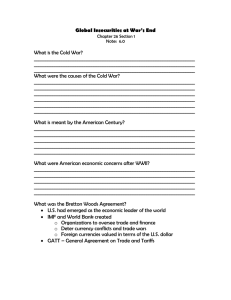

I N T E R N AT I O N A L FINANCIAL INSTITUTIONS A CRASH COURSE ON MONEY What is Money? -To an economist, money does not refer to all wealth only to one type of it. -Money: the stock of assets that can be readily used to make transactions. -It has three functions: unit of account, store of value, and medium of exchange. 3 Functions of Money 4 Unit of Account -It provides a common measurement in which prices and debts are recorded or displayed. -Money is the yardstick to the things that we measure in the economy. 5 Medium of Exchange -This is the thing that we use to purchase and sell items in the market. -It has no inherent value but due to the trust that other people can also use this money to buy other items in the market makes them acceptable as payment. -An asset’s liquidity is its ability to be turned into money. 6 Store of Value -The ability of money to do deffered payments. -Money can delay the consumption of any given goods or services, given that the product can be transferred in time. -It transfers the buying power of money from now to the future. 7 Types of Money -Money is usually distinguished using their inherent values. -Many cultures used different materials for money, but in the modern types, the use of fiat curreny is the most agreed upon convention due to its ease of use and the government’s ability to regulate it. 8 Fiat Money -Money that has no intrinsic value and is established as money by government decree or fiat. -Has a history with gold standard due to it being once a proof of ownership of gold deposits. 9 Commodity Money -Using items with intrinsic value as a form of money. -Gold is the prime example of this type of money but historically, items such as clam shells, huge boulders and even cocoa beans have been known to be used as a form of currency. 10 Development of Money 11 Development of Money -Societies usually use some primitive form of commodity money to start with. -In the context of Fiat Money, it is facinating to see how the progress of man from Gold Reserves to pieces of paper shaped the world’s perception of value. 12 Development of Money -Setting: an economy that uses Gold to trade -Problem 1: carrying a lot of Gold is heavy -Problem 2: the process of verification is long and hard. -Solution 1: the government standardized gold coins to create an ease of transaction by reducing transaction costs. 13 Development of Money -Solution 2: the government offers gold certificates to the people in representation of their stored gold in the government. -Eventually, nobody cashes out and just use the certificates for trade, therefore introducing money to the system, regardless of the gold backing system. 14 GLOBAL FINANCIAL INSTITUTIONS • Due to the two world wars, world leaders sought to create a global economic system that would ensure a longer-lasting global peace. They believed that one of the ways to achieve this goal was to set up a network of global financial institutions that would promote economic interdependence and prosperity. • An international structure for money, power and interest was created in order to set a system in the financial and economic relations in the modern day. Thus, the International Monetary System (IMS) was established. • It refers to internationally agreed rules, conventions and institutions for facilitating international trade, investments and flow of capital among nation-states. I N T E R N AT I O N A L M O N E TA RY S Y S T E M • The Gold Standard – it functions as a fixed exchange rate regime, with gold as the only international reserve. • The Bretton Woods System – the US Dollar became the global currency and was the only convertible currency into gold. o The Bretton Woods system was inaugurated in 1944 during the United Nations Monetary and Financial Conference to prevent the catastrophes of the early decades of the century from reoccuring and affecting international ties o The system was largely influenced by the ideas of British economist John Maynard Keynes who believed that economic crises occur not when a country does not have enough money, but when money is not spent, thereby, not moving. I N T E R N AT I O N A L M O N E TA RY S Y S T E M • When economies slow down, according to Keynes, government have to reinvigorate markets with infusions of capital. This active role of governments in managing spending served as the anchor for what would be called a system of Global Keynesianism. I N T E R N AT I O N A L M O N E TA RY S Y S T E M • European Monetary System – it was established in 1979 after the collapse of Bretton Woods System. It was later succeeded by the European Economic and Monetary Union (EMU), which established a common currency, the euro. FINANCIAL INSTITUTIONS o Now known as the World Bank, it was established for funding postwar reconstruction projects. It was a critical institution at a time when many of the world’s cities had been destroyed by the war. o As the largest development bank in the world at present, it supports the World Bank Group’s mission by providing loans, guarantees, risk management products, and advisory services to middle-income and creditworthy low-income countries, as well as by coordinating responses to regional and global challenges. 5 ORGANIZATIONS THAT BELONG TO THE WORLD BANK GROUP • International Bank for Reconstruction and Development • International Development Association • International Financial Corporation • Multilateral Investment Guarantee Agency • International Center for Settlement and Investment Disputes I N T E R N AT I O N A L B A N K F O R RECONSTRUCTION AND DEVELOPMENT • Created in 1944 to help Europe rebuild after World War II • They work closely with all institutions of the World Bank Group and the public and private sectors in developing countries to reduce poverty and build shared prosperity. I N T E R N AT I O N A L D E V E L O P M E N T A S S O C I AT I O N • Established in 1960, IDA aims to reduce poverty by providing zero to low-interest loans (called “credits”) and grants for programs that boost economic growth, reduce inequalities, and improve people’s living conditions. I N T E R N AT I O N A L F I N A N C I A L C O R P O R AT I O N • Established in 1956 • pioneered the idea of the private sector as a catalyst for progress in developing countries. M U LT I L AT E R A L I N V E S T M E N T G U A R A N T E E AGENCY • Established in 1988 • Its goal is to promote foreign direct investment into developing countries to support economic growth and more. I N T E R N AT I O N A L C E N T E R F O R S E T T L E M E N T A N D INVESTMENT DISPUTES • Founded in 1966 • the world’s leading institution devoted to international investment dispute settlement. I N T E R N AT I O N A L M O N E TA RY F U N D o It aims to promote international financial cooperation and strengthen international trade. o Like World Bank, it also grants financial assistance and loans to developing countries. • The IMF was originally created in 1945 as part of the Bretton Woods Agreement, which attempted to encourage international financial cooperation by introducing a system of convertible currencies at fixed exchange rates. TWO TYPES OF FINANCIAL INSTITUTION INTERGOVERNMENTAL • World Bank Group • International Monetary Fund • Asian Development Bank • African Development Bank PRIVATE • Citigroup – American multi-national investment banking and financial corporation. • Merrill Lynch – wealth management division of the Bank of America. • Today, the world economy operates based on what are called fiat currencies—currencies issued by the government that are not backed by precious metals and whose value is determined by their cost relative to other currencies.