Money!

advertisement

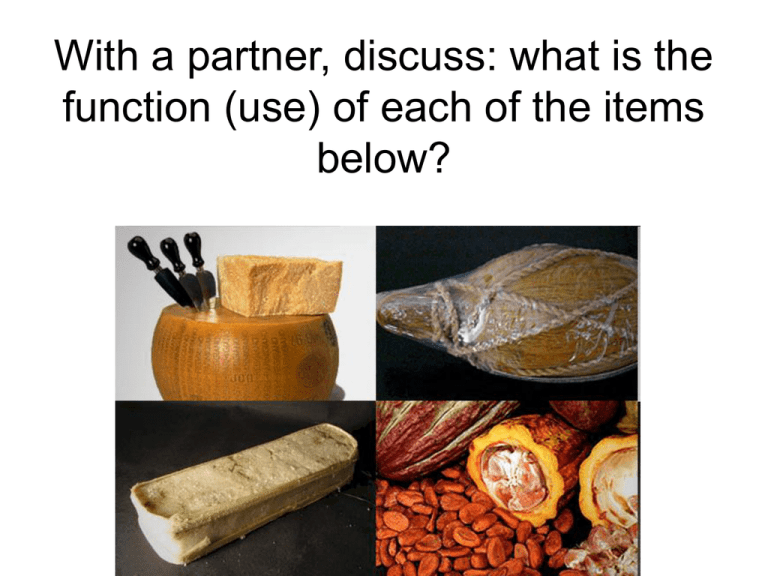

With a partner, discuss: what is the function (use) of each of the items below? Answer: • Salt is one of the world's oldest forms of payment. In fact, the word salary derives from the Latin "salarium," which was the money paid to Roman soldiers to buy salt. It was the main form of currency in the Sahara Desert during the Middle Ages, and was used extensively throughout East Africa. Typically, one would lick a salt block to make sure it was real and break off pieces to make change. Doty's block, seen here, is 1,500 years old. Other incredible, edible currencies include "reng," a yarn-ball of tumeric spice wrapped in coconut fibers that is used for trade in the Solomon Islands; cacao (or chocolate beans), widely used throughout Mexico and Central America; and Parmigiano Reggiano cheese, so highly regarded that it was used both as currency and bank collateral in Italy. One particularly inedible currency: the poisonous money seeds of Burma. Which if nothing else proves that money does indeed grow on trees — or at least bushes. • http://www.cnbc.com/id/31763263/The_Weirdest_Currencies_In_the_World?slide=5 Money! What is money? What are money’s three functions? Can you trade without money? How are credit and money different? What are the two major types of money? What is money? Money is anything people accept as payment for goods and services – Can be used to pay debts Money has three functions: – Medium of exchange – Unit of account – Store of value Exchange (trade) can happen without money. Barter—direct exchange of one good/service for another – Problem: you waste time in transactions Medium of Exchange A medium of exchange is anything widely accepted in exchange for goods and services • Removes problem of barter, because everyone is willing to accept it as payment • This is called being fungible— interchangeable for a valued good/service • Increases trade by providing a more convenient way to exchange Unit of account Unit of account—function of money that provides a common measurement of value for goods/services • Allows us to compare the value of two items • Monetary units are what we call our money (US/Australia—dollar; El Salvador—colon, Japan—yen, Afghanistan—dinar) Store of value Store of value—the function of money to hold value over time • This allows us to save our money and spend it in the future • Does not mean that the value will remain constant (inflation) Other properties of money • Money must be scarce, but not too scarce • Should be portable—easy to carry • Should be divisible—able to “make change” • Must be uniform—easy to tell how much it is worth, look the same as other money of its type What stands behind U.S. money? • Commodity money—anything that serves as money, has market value based on the material it’s made from (tangible value) – In other words, has value as money AND as a good – Should the penny be considered commodity money? – Used to be backed by gold/silver • Fiat money—money accepted by law, not because of its tangible value – In other words, what the government says is acceptable for exchange – Dollar bills – “THIS NOTE IS LEGAL TENDER…” means your paper money is fiat money Think about it… • • • • Are credit cards money? Are debit cards money? Are seashells money? Is sand money? THE ANSWER (in the U.S.) is NO.