Stay Organized and Profitable Essential Tips for Accounting Bookkeeping

advertisement

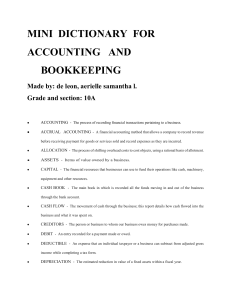

Stay Organized and Profitable: Essential Tips for Accounting Bookkeeping In the realm of business, maintaining exemplary accounting bookkeeping practices is not just about compliance; it's a critical component of success. Efficient bookkeeping ensures that financial data is accurate, accessible, and actionable, empowering businesses to make informed decisions and optimize profitability. Here at Starters' CFO, we understand the pivotal role that organized bookkeeping plays in the trajectory of any enterprise. Let's delve into some indispensable tips for staying on top of your accounting game. Establish a Structured System The foundation of effective bookkeeping lies in establishing a structured and consistent system. Begin by categorizing transactions accurately, distinguishing between expenses, revenues, assets, and liabilities. Embrace digital tools such as accounting software (e.g., QuickBooks, Xero) to streamline processes and minimize manual errors. A well-organized system not only saves time but also facilitates seamless financial reporting and analysis. Regular Reconciliation To maintain financial accuracy, conduct regular reconciliations. This entails matching transactions in your accounting records with corresponding bank statements. Reconciliation helps identify discrepancies early, ensuring that your financial data remains reliable and up-to-date. It's a proactive measure that mitigates risks and enhances the credibility of your financial reports. Monitor Cash Flow Vigilantly Cash flow is the lifeblood of any business. Efficient bookkeeping involves monitoring cash flow meticulously, tracking both inflows and outflows of funds. This practice enables timely identification of potential issues and allows for strategic adjustments to optimize liquidity. A healthy cash flow cycle is essential for sustaining operations and fueling growth. Stay Compliant with Regulations Adhering to accounting regulations and tax requirements is non-negotiable. Keep abreast of evolving financial regulations and ensure your bookkeeping practices are compliant with local laws. Failure to comply can result in penalties or legal complications, which could impede your business's growth and reputation. Embrace Technology In the digital age, leveraging technology is imperative for efficient bookkeeping. Explore cloud-based accounting solutions that offer real-time data access and collaboration capabilities. Automation features can streamline repetitive tasks like invoicing and payroll, freeing up time for strategic financial management. Regular Audits and Reviews Implement a schedule for regular audits and financial reviews. Independent assessments provide insights into the accuracy and integrity of your financial records. Conducting periodic reviews helps identify inefficiencies or potential areas for improvement, ensuring that your accounting practices evolve alongside your business needs. Invest in Professional Expertise While DIY bookkeeping might seem cost-effective, investing in professional expertise can yield significant returns in the long run. Consult with experienced accountants or financial advisors who can offer tailored guidance and ensure compliance with best practices. Their insights can help optimize tax strategies and financial planning, contributing to sustained profitability. Educate and Train Your Team Bookkeeping isn't solely the responsibility of your finance team. Educate all relevant stakeholders within your organization about the importance of accurate record-keeping and financial transparency. Offer training sessions to enhance understanding of basic accounting principles, empowering employees to contribute to the financial management of the business. In conclusion, mastering the art of accounting bookkeeping is essential for maintaining organizational efficiency and fostering profitability. By implementing these essential bookkeeping tips, businesses can navigate financial challenges confidently and pave the way for sustainable growth.