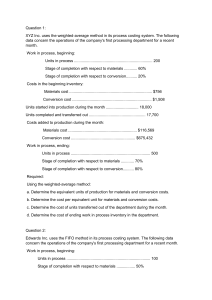

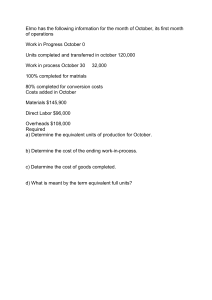

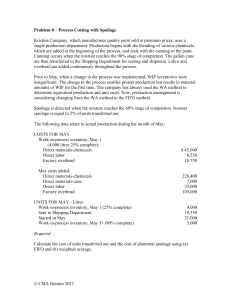

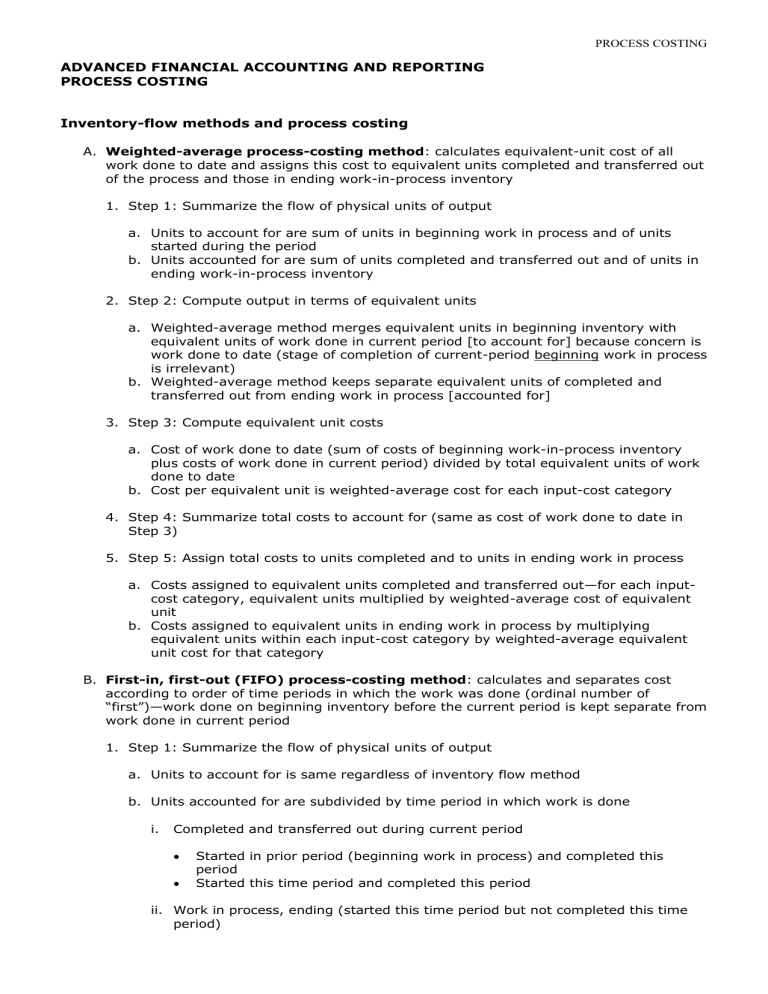

PROCESS COSTING ADVANCED FINANCIAL ACCOUNTING AND REPORTING PROCESS COSTING Inventory-flow methods and process costing A. Weighted-average process-costing method: calculates equivalent-unit cost of all work done to date and assigns this cost to equivalent units completed and transferred out of the process and those in ending work-in-process inventory 1. Step 1: Summarize the flow of physical units of output a. Units to account for are sum of units in beginning work in process and of units started during the period b. Units accounted for are sum of units completed and transferred out and of units in ending work-in-process inventory 2. Step 2: Compute output in terms of equivalent units a. Weighted-average method merges equivalent units in beginning inventory with equivalent units of work done in current period [to account for] because concern is work done to date (stage of completion of current-period beginning work in process is irrelevant) b. Weighted-average method keeps separate equivalent units of completed and transferred out from ending work in process [accounted for] 3. Step 3: Compute equivalent unit costs a. Cost of work done to date (sum of costs of beginning work-in-process inventory plus costs of work done in current period) divided by total equivalent units of work done to date b. Cost per equivalent unit is weighted-average cost for each input-cost category 4. Step 4: Summarize total costs to account for (same as cost of work done to date in Step 3) 5. Step 5: Assign total costs to units completed and to units in ending work in process a. Costs assigned to equivalent units completed and transferred out—for each inputcost category, equivalent units multiplied by weighted-average cost of equivalent unit b. Costs assigned to equivalent units in ending work in process by multiplying equivalent units within each input-cost category by weighted-average equivalent unit cost for that category B. First-in, first-out (FIFO) process-costing method: calculates and separates cost according to order of time periods in which the work was done (ordinal number of “first”)—work done on beginning inventory before the current period is kept separate from work done in current period 1. Step 1: Summarize the flow of physical units of output a. Units to account for is same regardless of inventory flow method b. Units accounted for are subdivided by time period in which work is done i. Completed and transferred out during current period Started in prior period (beginning work in process) and completed this period Started this time period and completed this period ii. Work in process, ending (started this time period but not completed this time period) PROCESS COSTING 2. Step 2 a. Equivalent units calculated only for work done during current period for each inputcost category, includes i. Work done to complete units in beginning work-in-process inventory ii. Work done to complete units started this time period iii. Work done on units started this time period but not completed b. No equivalencies calculated for work done in prior period 3. Step 3: Compute equivalent unit costs—only costs for each input category added in the current period divided by equivalent units for each input-cost category of work done in current period 4. Step 4: Summarize total costs to account for (costs of beginning work-in-process inventory plus costs added in the current period ) 5. Step 5: Assign total costs to units completed and to units in ending work in process a. Units completed and transferred out assigned costs according to i. Beginning work-in-process units assigned costs from costs to account for in beginning work-in-process ii. Beginning work-in-process units also assigned costs of costs used to complete them using equivalent units of work for each input-cost category multiplied by equivalent cost per unit of work done this period iii. Started and completed this time period—assigned costs from multiplying equivalent units of work for each input-cost category by equivalent cost per unit of work for input category b. Units in work in process, ending—equivalent units of work for the current time period multiplied by equivalent cost for corresponding input-cost category of current time period Accounting for Spoilage If spoilage is normal and continuous, the calculations for EUP do not include this spoilage (method of neglect), and the good units simply absorb the cost of such spoilage. If spoilage is normal and discrete, the equivalent units are used in the EUP calculations, and the spoilage cost is assigned to all units that passed through the inspection point during the current period. If the spoilage is abnormal and either discrete or continuous, the equivalent units are used in EUP calculations and costed at the cost per EUP; the total cost is then assigned to a loss account. PROCESS COSTING Problem 1. Malinta Woolens is a manufacturer of wool cloth. The information for March is as follows: Beginning work in process Units started Units completed 10,000 units 20,000 units 25,000 units Beginning work-in-process direct materials Beginning work-in-process conversion Direct materials added during month Direct manufacturing labor during month Factory overhead P 6,000 P 2,600 P30,000 P12,000 P 5,000 Beginning work in process was half converted as to labor and overhead. Direct materials are added at the beginning of the process. All conversion costs are incurred evenly throughout the process. Ending work in process was 60% complete. Required: Prepare a production cost worksheet using the weighted-average method. Include any necessary supporting schedules. Problem 2 .The Avenida Factory produces expensive boots. It has two departments that process all the items. During January, the beginning work in process in the tanning department was 40% complete as to conversion and 100% complete as to direct materials. The beginning inventory included P6,000 for materials and P18,000 for conversion costs. Ending work-in-process inventory in the tanning department was 40% complete. Direct materials are added at the beginning of the process. Beginning work in process in the finishing department was 60% complete as to conversion. Beginning inventories included P7,000 for transferred-in costs and P10,000 for conversion costs. Ending inventory was 30% complete. Additional information about the two departments follows: Beginning work-in-process units Units started this period Units transferred this period Ending work-in-process units Material costs added Conversion costs Transferred-out cost Tanning 5,000 14,000 16,000 ? Finishing 4,000 ? 18,000 2,000 P18,000 32,000 50,000 ? P19,000 ? Required: Prepare a production cost worksheet using weighted-average costing for the finishing department. PROCESS COSTING Problem 3. New Image Sports uses a process-costing system. For March, the company had the following activities: Beginning work-in-process inventory (1/3 complete)6,000 units Units placed in production 24,000 units Good units completed 18,000 units Ending work-in-process inventory 10,000 units Cost of beginning work in process P 5,000 Direct material costs, current P18,000 Conversion costs, current P13,800 Direct materials are placed into production at the beginning of the process. All spoilage is normal and is detected at the end of the process. Ending WIP is 50% completed as to conversion. Required: Prepare a production cost worksheet using the FIFO method. Problem 4. Tide Products Company uses an automated process to clean and polish its souvenir items. For March, the company had the following activities: Beginning work in process inventory Units placed in production Units completed Ending work in process inventory Cost of beginning work in process Direct material costs, current Conversion costs, current 3,000 items, 1/3 complete 12,000 units 9,000 units 6,000 items, 1/2 complete P2,500 P9,000 P7,700 Direct materials are placed into production at the beginning of the process and conversion costs are incurred evenly throughout the process. Required: Prepare a production cost worksheet using the FIFO method. Problem 5. Fairview Company produces baseball bats and cricket paddles. It has two departments that process all products. During July, the beginning work in process in the cutting department was half completed as to conversion, and complete as to direct materials. The beginning inventory included P40,000 for materials and P60,000 for conversion costs. Ending work-in-process inventory in the cutting department was 40% complete. Direct materials are added at the beginning of the process. Beginning work in process in the finishing department was 80% complete as to conversion. Direct materials for finishing the units are added near the end of the process. Beginning inventories included P24,000 for transferred-in costs and P28,000 for conversion costs. Ending inventory was 30% complete. Additional information about the two departments follows: Beginning work-in-process units Units started this period Units transferred this period Ending work-in-process units Material costs added Conversion costs Transferred-out cost Cutting 20,000 60,000 64,000 Finishing 24,000 P48,000 28,000 128,000 P34,000 68,500 68,000 20,000 Required: Prepare a production cost worksheet, using FIFO for the finishing department. PROCESS COSTING Problem 6. New Image Sports uses a process-costing system. For March, the company had the following activities: Beginning work-in-process inventory (1/3 complete) Units placed in production Good units completed Ending work-in-process inventory Cost of beginning work in process Direct material costs, current Conversion costs, current 6,000 units 24,000 units 18,000 units 10,000 units P 5,000 P18,000 P13,800 Direct materials are placed into production at the beginning of the process. All spoilage is normal and is detected at the end of the process. Ending WIP is 50% completed as to conversion. Required: Prepare a production cost worksheet using the FIFO method. Problem 7. Springfield Sign Shop manufactures only specific orders. It uses a standard cost system. During one large order for the airport authority, an unusual number of signs were spoiled. The normal spoilage rate is 10% of units started. The point of first inspection is half way through the process, the second is three-fourths through the process, and the final inspection is at the end of the process. Other information about the job is as follows: Units started Units spoiled 3,000 450 Direct materials put into process at beginning P 60,000 Conversion costs for job P120,000 Standard direct material costs per sign P27 Standard conversion cost per sign P54 Average point of spoilage is the 3/4 completion point Average current disposal cost per spoiled sign P15 Required: Make necessary journal entries to record all spoilage. PROCESS COSTING MULTIPLE CHOICES. THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 1 THROUGH 4. The Rest-a-Lot Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 75,000 chairs. During the month, the firm completed 85,000 chairs and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Rest-a-Lot. 1. How many chairs were in inventory at the beginning of the month? Conversion costs are incurred uniformly over the production cycle. a. 10,000 chairs b. 20,000 chairs c. 15,000 chairs d. 25,000 chairs 2. What were the equivalent units for materials for February? a. 95,000 chairs b. 85,000 chairs c. 80,000 chairs d. 75,000 chairs 3. What were the equivalent units for conversion costs for February if beginning inventory was 70% complete as to conversion costs and ending inventory was 40% complete as to conversion costs? a. 89,000 b. 75,000 c. 85,000 d. 95,000 4. Of the 75,000 units Rest-a-Lot started during February, how many were finished during the month? a. 75,000 b. 85,000 c. 65,000 d. 95,000 THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 5 THROUGH 8. The Rest-a-Lot chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 75,000 chairs. During the month, the firm completed 80,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Rest-a-Lot. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs. Beginning inventory: Direct materials Conversion costs P24,000 P35,000 Manufacturing costs added during the accounting period: Direct materials P168,000 Conversion costs P278,000 5. How many of the units that were started during February were completed during February? a. 85,000 b. 80,000 c. 75,000 d. 65,000 PROCESS COSTING 6. What were the equivalent units for conversion costs during February? a. 83,500 b. 85,000 c. 75,000 d. 79,500 7. What is the amount of direct materials cost assigned to ending work-in-process inventory at the end of February? a. P19,200 b. P22,400 c. P25,600 d. P22,500 8. What is the cost of the goods transferred out during February? a. P417,750 b. P456,015 c. P476,750 d. P505,000 THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 9 THROUGH 13. Gilmore Computer Systems, Inc., manufactures printers. All direct materials are added at the inception of the production process. During January, the accounting department noted that there was no beginning inventory. Direct materials purchases totaled P100,000 during the month. Work-in-process records revealed that 4,000 cards were started in January, 2,000 cards were complete, and 1,500 units were spoiled as expected. Ending work-inprocess units are complete in respect to direct materials costs. Spoilage is not detected until the process is complete. 9. What are the respective direct material costs per equivalent unit, assuming spoiled units are recognized or ignored? a. P20.00; P35.00 b. P25.00; P40.00 c. P30.00; P45.00 d. P35.00; P50.00 10. What is the direct material cost assigned to good units completed when spoilage units are recognized? a. P50,000 b. P100,000 c. P80,000 d. P87,500 11. What is the cost transferred out assuming spoilage units are ignored? a. P87,500 b. P80,000 c. P50,000 d. P77,500 12. What are the amounts allocated to the work-in-process ending inventory assuming spoilage units are recognized and ignored, respectively? a. P20,000; P24,500 b. P30,000; P34,250 c. P12,500; P20,000 d. P37,500; P40,000 13. Spoilage costs allocated to ending work in process are larger by which method and by how much? a. When spoiled units are recognized by P2,500 b. When spoiled units are recognized by P4,250 c. When spoiled units are ignored by P7,500 d. When spoiled units are recognized by P7,500 PROCESS COSTING 14. THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 14 THROUGH 23. The Marcelo Plastic Manufacturing Company produces a product known as “wal-astik” which undergoes processing through two production departments, In Department 2, the process is completed in ten days , during which time the units in process suffer a loss of 15% through evaporation. During the month of April, 2011 Department 1 transferred to Department 2, 120,000 units costing p 240,000. The records of Department 2 showed the following information regarding its operations for the month: Quantity: In process, April 1 …………………………………………………... 1,925 units (1/4) Transferred to Storeroom ………………………………………….. 86,700 units In process, April 30 …………………………………………………. 18,500 units (1/2) Cost: In process, April 1 …………………………………………………... p 4,165.00 Costs during April, 2011 Materials ………………………………………………………... 56,865.00 Labor ……………………………………………………………. 28,432.50 Overhead ………………………………………………………... 9,477.50 From the above data, choose the appropriate answer from the listed items enumerated under each independent cases: 14. The total evaporation loss suffered in April is: a. 15,000 units b. 11,500 units c. 16,725 units 15. The total equivalent production for the month is: a. 94,775 units b. 95,525 units c. 95,500 units 16. The unit cost for Material is: a. p 0.50 b. p 0.45 c. p 0.60 17. The unit cost for labor is: a. p 0.30 b. p 0.20 c. p 0.10 18. The unit cost for overhead is: a. p 0.30 b. p 0.20 c. p 0. 10 19. The cost of completion of the in-process units, April 1, is. a. p 6,475 b. p 5,440 c. p 5,450 20. The costs of completion of 100,000 units currently received from Department 1, is: a. p 300,000 b. p 250,000 c. p 285,000 21. The total costs of transfer of the 86,700 units to storeroom is: a. p 290,440 b. p 305,450 c. p 312,450 22. The in-process at the end is charged for the costs from prior department, in the amount of: a. p 40,000 b. p 39,000 c. p 45,000 23. The total costs charged to the in-process April 30, is: a. p 48,500 b. p 45,000 c. p 50,000 24. On occasion, the FIFO and the weighted-average methods of process costing will result in the same peso amount of costs being transferred to the next department. Which of the following scenarios would have that result? a. When the beginning and ending inventories are equal in terms of unit numbers. b. When the beginning and ending inventories are equal in terms of the percentage of completion for both direct materials, and conversion costs. c. When there is no ending inventory. d. When there is no beginning inventory. PROCESS COSTING 25. An assumption of the FIFO process-costing method is that a. the units in beginning inventory are not necessarily assumed to be completed by the end of the period. b. the units in beginning inventory are assumed to be completed first. c. ending inventory will always be completed in the next accounting period. d. no calculation of conversion costs is possible. 26. Which one of the following statements is true? a. In a job-costing system, individual jobs use different quantities of production resources. b. In a process-costing system each unit uses approximately the same amount of resources. c. An averaging process is used to calculate unit costs in a job-costing system. d. Both (a) and (b) are true. 27. Conversion costs a. include all the factors of production. b. include direct materials. c. in process costing are usually considered to be added evenly throughout the production process. d. include both (b) and (c). 28. An example of a business which would have no beginning or ending inventory but could use process costing to compute unit costs would be a. a clothing manufacturer. b. a corporation whose sole business activity is processing the customer deposits of several banks. c. a manufacturer of custom houses. d. a manufacturer of large TVs. 29. Which of the following statement (s) concerning conversion costs is correct? a. Estimating the degree of completion of direct materials in a partially completed unit is usually easier to calculate than estimating the degree of completion for conversion costs. b. The calculation of equivalent units is relatively easy for the textile industry. c. Estimates are usually not considered acceptable. d. Both (b) and (c) are correct. 30. The purpose of the equivalent-unit computation is a. to convert completed units into the amount of partially completed output units that could be made with that quantity of input. b. to assist the business in determining ending inventory. c. to convert partially completed units into the amount of completed output units that could be made with that quantity of input. d. both (b) and (c). 31. Forte Co. has the following information for May: Beginning Work In Process Inventory (70% complete as to conversion) 6,000 units Started 24,000 units Ending Work In Process Inventory (10% complete as to conversion) 8,500 units Beginning WIP Inventory Costs: Material P 23,400 Conversion 50,607 Current Period Costs: Material P 31,500 Conversion 76,956 All material is added at the start of the process and all finished products are transferred out. How many units were transferred out in May? PROCESS COSTING a. b. 15,500 18,000 c. 21,500 d. 24,000 32. Assume that weighted average process costing is used. What is the cost per equivalent unit for material? a. P 1.83 c. P 0.55 b. P 1.05 d. P 1.31 33. Assume that FIFO process costing is used. What is the cost per equivalent unit for conversion? a. P 7.03 c. P 4.24 b. P 3.44 d. P 5.71 The following information is available for OP Company for the current year: Beginning WIP (75% complete) 14,500 units Started 75,000 units Ending WIP (60% complete) 16,000 units Abnormal Spoilage 2,500 units Normal Spoilage (continuous) 5,000 units Transferred Out 66,000 units All materials are added at the start of production. Cost of Beginning Work in Process Materials P 25,100 Conversion 50,000 Current Cost Materials P120,000 Conversion 300,000 34. Using weighted average, what are equivalent units for materials? a. 82,000 c. 84,500 b. 89,500 d. 70,000 35. Using weighted average, what are equivalent units for conversion costs? a. 80,600 c. 83,100 b. 78,100 d. 75,600 36. What is the cost per equivalent unit for materials using weighted average? a. P 1.72 c. P 1.77 b. P 1.62 d. P 2.07 37. What is the cost per equivalent unit for conversion costs using weighted average? a. P 4.62 c. P 4.48 b. P 4.21 d. P 4.34 38. What is the cost assigned to normal spoilage using weighted average? a. P31,000 c. P30,850 b. P15,500 d. None of the above 39. T Company has the following information for July: Units started 100,000 units Beginning WIP (35% complete) 20,000 units Normal Spoilage (discrete) 3,500 units Abnormal Spoilage 5,000 units Ending WIP (70% complete) 14,500 units Transferred Out 97,000 units Beginning Work in Process Costs: Materials P 15,000 Conversion 10,000 PROCESS COSTING All materials are added at the start of the production process. T Co. inspects goods at 75% completion as to conversion. a. b. What are the equivalent units of production for materials assuming FIFO? 100,000 c. 95,000 96,500 d. 120,000 40. What are the equivalent units of production for conversion costs, assuming FIFO? a. 108,900 c. 108,650 b. 103,900 d. 106,525 -END-