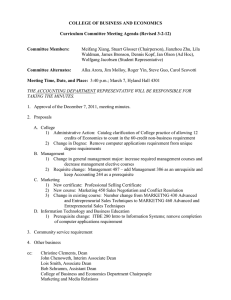

CHAPTER 9 Human Capital Labour Economics Professor: Dr. Jason Dean 1 HUMAN CAPITAL • We have talked about the quantity of labour supply but not the quality. • Human capital refers to the economic value of the unique set of abilities and acquired skills of a worker. – People bring into the labour market a unique set of abilities and acquired skills known as human capital. – Workers add to their stock of human capital throughout their lives, especially through formal education and on-the-job experience. Labour Economics Professor: Dr. Jason Dean 2 HUMAN CAPITAL • Education: Stylized Facts – Education is strongly correlated with: – Labour force participation rates – Much lower for less educated – Unemployment rates – Much higher for less educated – Earnings – Strong positive correlation Educations plays a significant role in improving one’s labour market outcomes. Labour Economics Professor: Dr. Jason Dean 3 HUMAN CAPITAL INVESTMENT: THE BASIC MODEL • Investments in human capital are made to improve productivity and earnings. • Is the investment worthwhile? – Costs incurred with the expectation of future benefits. – Thus, expected benefits must exceed costs. Labour Economics Professor: Dr. Jason Dean 4 OPTIMAL HUMAN CAPITAL INVESTMENT • The optimal investment in human capital is determined by comparing the: – Costs and the benefits of an additional year of education, using the following concepts: 1. Marginal costs and benefits of education 2. Rate of return on investment in education Labour Economics Professor: Dr. Jason Dean 5 HUMAN CAPITAL INVESTMENT: THE BASIC MODEL • EXPECTED RETURNS OR BENEFITS – To education and training investments (human capital) are in the form of: 1. Higher future earnings. 2. Increased job satisfaction – More responsibility autonomy etc. 3. A greater appreciation of non-market activities and interests – Reading, hobbies, internet etc. Labour Economics Professor: Dr. Jason Dean 6 HUMAN CAPITAL INVESTMENT: THE BASIC MODEL • COSTS OF ACQUIRING OR ADDING TO HUMAN CAPITAL – Fall into three categories: 1. Out-of-pocket or direct expenses – tuition costs, expenditures on books, and other supplies. Labour Economics 2. Forgone earnings – salaries/income given up (i.e. opportunity cost). 3. Psychic losses – occur because learning is often difficult and tedious for some people. Professor: Dr. Jason Dean 7 SIMPLE ILLUSTRATION OF MODEL Potential Earnings Streams Faced by a High School Graduate Dollars • after getting her high school Goes to College w A person who quits school COL diploma can earn wHS from D age 18 until retirement. Quits After High School w HS • A B If she decides to go to college, she foregoes these 0 18 22 C -H 65 Age earnings and incurs a cost of H dollars for 4 years and then earns wCOL until retirement. If Area D > (B + C) then she should go to college. Labour Economics Professor: Dr. Jason Dean 8 Alternative Income Streams A 16-year old faces 3 choices: He can drop out of high school at 16 and get income stream A for the remainder of his working life. $Earnings Complete high school and earn nothing between 16-18, but get income stream B after graduation. The opportunity cost of staying in school is the foregone earnings (area a), while the benefits are increased earnings, (area b + e). University: will incur direct costs, in addition to foregoing income stream B, while attending university. The total cost of attending university equals the area b + c + d, while the benefit is the higher earnings stream corresponding to area f. f e b Direct costs d 16 18 STREAM B (HIGH SCHOOL) STREAM A (NO HIGH SCHOOL) Age c a STREAM C (UNIVERSITY) 22 9 OPTIMAL HUMAN CAPITAL INVESTMENT • BENCHMARK MODEL • Which lifetime income stream should the individual choose? • To address this question we will initially make the following simplifying assumptions: 1. No direct (consumption) utility or disutility from education 2. Hours of work are fixed 3. Income streams associated with education amounts are known 4. Individuals can borrow and lend at the real interest rate (perfect capital markets) Labour Economics Professor: Dr. Jason Dean 10 PRESENT VALUE CALCULATIONS • Present value allows comparison of dollar amounts spent and received in different time periods. (An idea from finance.) • Present Value = 𝑷𝑽 = 𝒚 (𝟏 + 𝒓)𝒕 – r is the per-period discount rate which depends on: – The market rate of interest. – Time preferences: how a person feels about giving up today’s consumption in return for future rewards. – y is the future value. – t is the number of time periods. Labour Economics Professor: Dr. Jason Dean 11 HUMAN CAPITAL INVESTMENT: THE BASIC MODEL The Concept of Present Value in more detail: • The FV (= B1) of $100 at 5% interest rate a year from now is: B1 = B0 + B0(r) = B0(1 + r) = 100(1.05) = $105 (9.1) • Solving for B0 (= PV) yields: B0 B1 105 100 (1 r ) 1.05 (9.2) where r = market interest rate, and (1 + r) = discount factor. Labour Economics Professor: Dr. Jason Dean 12 HUMAN CAPITAL INVESTMENT: THE BASIC MODEL • If the return is two years from now, the FV (= B2) is: B2 = B1 + B1(r) = B1(1 + r) (9.3) Recall: B1 = B0(1 + r) and substituting equation (9.1) into equation (9.3) yields: B2 = B0(1+ r) + B0(1+ r)(r) = B0(1+ r)(1+ r) = B0(1+ r)2 (9.4) Since B2 = B0(1 + r)2, therefore, solving for B0 (= PV) will yield: • E.g. If the PV of a human capital investment yields return B1 in the 1st year, B2 in the 2nd year and so forth, and for T years, it is expressed as: Present Value = Labour Economics B3 B1 B2 BT ... T 1 r 1 r 2 1 r 3 1 r Professor: Dr. Jason Dean (9.6) 13 OPTIMAL HUMAN CAPITAL INVESTMENT • Formal analysis: • The costs and benefits can be more formally represented in terms of the present value formula. • Consider an 18-year-old high school graduate faced with a decision to work or go to college: • The present value of benefits at age 18 over T – 18 remaining years of work would be: PV = Y/(1+r)0 + Y/(1+r) 1 + … + Y/(1+r) T-18 T-18 PV = Y + ∑ Y/(1+r) t t=1 OR 𝒀 𝑷𝑽 ≈ 𝒀 + 𝒓 Where, Y = income (constant over working years, T – 18) r = market interest rate (discount rate) T = age Labour Economics Professor: Dr. Jason Dean 14 OPTIMAL HUMAN CAPITAL INVESTMENT • Now let’s consider the marginal cost and marginal benefit of investing in further (post-secondary) education. • Marginal Cost (MC) – As illustrated in Figure 9.1, the cost consists of: – The direct cost of schooling, D. – Plus the foregone earnings while attending school, Y. – Thus, the marginal cost, MC, of investing in a further year of schooling is: MC = Y + D Labour Economics Professor: Dr. Jason Dean 15 OPTIMAL HUMAN CAPITAL INVESTMENT • Marginal Benefit (MB) – On the benefits side, assume that a further year of schooling permanently increases the salary of the student by ΔY. – Since annual earnings are now Y + ΔY the present value of net income with one further year of education, PV*, is 𝑷𝑽∗ = (𝒀 + 𝜟𝒀) –D 𝒓 – Where, ΔY = increase in annual income due to extra year of schooling (MB) Labour Economics Professor: Dr. Jason Dean 16 OPTIMAL HUMAN CAPITAL INVESTMENT – The net gain from an additional year of school is s given by the difference in the two present values: (𝑌 + 𝛥𝑌) 𝑌 PV∗ − PV = –D − 𝑌+ 𝑟 𝑟 = Recall: PV ≈ Y + Y/r (𝜟𝒀) − (Y + D) 𝒓 MB MC It is optimal to keep acquiring education up to the point where MB = MC (𝜟𝒀) = (Y + D) 𝒓 Labour Economics Professor: Dr. Jason Dean 17 OPTIMAL HUMAN CAPITAL INVESTMENT MC increase b/c: Forgone earnings increase with schooling and also direct costs. The net benefit of obtaining education level E equals the difference between benefits and costs, and is maximized by setting marginal benefit (MB) equal to marginal cost (MC). MB falls b/c: Diminishing returns Labour Economics Professor: Dr. Jason Dean 18 OPTIMAL HUMAN CAPITAL INVESTMENT • To maximize the net present value of lifetime earnings: – Increase education: – Until the present value of benefits of additional year (MB) equals present value of additional costs (MC) OR – Until the internal rate of return i exceeds the market rate of interest r, the opportunity cost of financing the investment. Labour Economics Professor: Dr. Jason Dean 19 INTERNAL RATE OF RETURN • Internal Rate of Return • For any specific amount of education, the IIR can be defined as the implicit rate of return earned by an individual acquiring that amount of education. • How large could the discount rate be and still render the investment profitable? The Internal Rate of Return is the interest rate that makes the Net Present Value zero Set PV = C and solve for r The IRR is the rate at which the present value of all future cash flows is equal to the initial investment or in other words the rate at which an investment breaks even. Labour Economics Professor: Dr. Jason Dean 20 OPTIMAL HUMAN CAPITAL INVESTMENT • The internal rate of return as a function of The individual should invest until the internal rate of return equals the opportunity cost of the investment, given by the interest rate, r. years of schooling is given by the schedule i in panel (b). • The individual should invest until the internal rate of return equals the opportunity cost of the investment, given by the interest rate, r. • This condition yields the same education choice E*, when we look at MB=MC. Labour Economics Professor: Dr. Jason Dean 21 IMPLICATIONS OF THEORY • Investment should be made early in one’s life – When older: – Period to enjoy benefits is shorter – Forgone earnings are higher • Less incentive for individuals experiencing discontinuity in the workforce • Investment in education and progressive tax system – Higher taxes means a shift downwards in income streams – MB=MC will be at a lower level Labour Economics Professor: Dr. Jason Dean 22 AGE-EARNINGS PROFILES • Three important properties of age-earnings profiles: – Highly educated workers earn more than less educated workers. – Earnings rise over time at a decreasing rate. – The age-earnings profiles of different education cohorts diverge over time (they “fan outward”). – Earnings increase faster for more educated workers. Labour Economics Professor: Dr. Jason Dean 23 AGE-EARNINGS PROFILES Labour Economics Professor: Dr. Jason Dean 24 AGE-EARNINGS PROFILES Labour Economics Professor: Dr. Jason Dean 25 ACTIVE LEARNING • Calculate the present value of earnings for a discount rate of 10%, 45 time horizons, and per period wages w of 10. Assume the person works 5 days a week, 48 weeks a year, and works 8 hours per day. Annual hours: Estimate using Y+ Y/r formula 48×5×8=1,920 Annual earnings: 1,920×$10=$19,200 𝑃𝑉 = 𝑌 + Labour Economics 𝑌 19200 45 𝑡=1 (1+𝑟)𝑡 = 19200 + .10 =$211,200 Professor: Dr. Jason Dean 26 ACTIVE LEARNING • Debbie is about to decide which career path to pursue. She has narrowed her options to two alternatives: – She can become either a marine biologist or a concert pianist. • Debbie lives for two periods. In the first, she gets an education. In the second, she works in the labour market. If Debbie becomes a marine biologist, she will spend $15,000 on education in the first period and earn $472,000 in the second period. If she becomes a concert pianist, she will spend $40,000 on education in the first period and then earn $500,000 in the second period. a) Suppose Debbie can lend and borrow money at a 5 percent annual rate. Which career will she pursue? b) What if she can lend and borrow money at a 15 percent rate of interest? Will she choose a different option? Why? c) Suppose musical conservatories raise their tuition so that it now costs Debbie $60,000 to become a concert pianist. What career will Debbie pursue if the discount rate is 5 percent? Labour Economics Professor: Dr. Jason Dean 27 ACTIVE LEARNING - SOLUTION a) Debbie will compare the present value of income for each career choice and choose the career with the greater present value. If the interest rate is 5 percent, PVBiologist = -$15,000 + $472,000/(1.05) = $434,523.81 and PVPianist = -$40,000 + $500,000/(1.05) = $436,190.48 Therefore, she will become a concert pianist. b) If the rate of interest is 15 percent, however, the present value calculations become PVBiologist = -$15,000 + $472,000/(1.15) = $395,434.78 and PVPianist = -$40,000 + $500,000/(1.15) = $394,782.61 In this case, Debbie becomes a biologist. As the interest rate increases, the worker discounts future earnings more, lowering the returns from investing in education. Labour Economics Professor: Dr. Jason Dean 28 ACTIVE LEARNING - SOLUTION • C) Debbie will compare the present value of being a biologist from part (a) with the present value of becoming a pianist. The relevant present values are: PVBiologist = -$15,000 + $472,000/(1.05) = $434,523.81 and PVPianist = -$60,000 + $500,000/(1.05) = $416,190.48 In this case Debbie will become a biologist, showing that as the cost of an investment increases, the chance of pursuing that investment falls. Labour Economics Professor: Dr. Jason Dean 29 SCHOOLING AS A SIGNAL The Signaling Model • Recall the stylized fact that there is a positive relationship between education wages. – We tend to think that education is productivity enhancing. – In terms of causality: education wages. • Here we explore an alternative idea that suggests education may just be a signal of ability. • Thus, the positive relationship between higher wages and education could be due to ability rather than any productivity enhancing attributes of education. Labour Economics Professor: Dr. Jason Dean 30 SCHOOLING AS A SIGNAL The Signaling Model • Apart from observing certain indicators (age, experience, education, and personal characteristics) that are correlated to productivity, employers cannot determine the actual productivity of any applicant during the interviewing and hiring process, therefore, they rely on the formal education that workers acquire. • Some see the educational system as a means of finding out who is productive, not of enhancing worker productivity. • Employers can use education as a signaling device, which enables them to sort workers into different levels or categories of productivity rather than assume that all workers/applicants are “average.” Filter of ability Higher education Labour Economics Higher wages So we could observe a positive relationship between wages and education even if the later does not enhance productivity. Professor: Dr. Jason Dean 31 SCHOOLING AS A SIGNAL • Education reveals a level of attainment which signals a worker’s qualifications or innate ability to potential employers. • Information that is used to allocate workers in the labour market is called a signal. • There could be a “separating equilibrium.” – Low-productivity workers choose NOT to obtain X years of education, voluntarily signaling their low productivity. – High-productivity workers choose to get at least X years of schooling and separate themselves from the pack. Labour Economics Professor: Dr. Jason Dean 32 AN ILLUSTRATION OF THE SIGNALING MODEL An Illustration of Signaling • Employers use education to classify workers with less than e* years of education as lower-productivity workers that should be rejected or prevented from any job paying a wage above 1. • Those workers with at least e* or more years of education beyond high school are considered to be the higherproductivity workers who can obtain a wage of 2. BUT - if education is a signaling device which yields a wage of 2, all workers would want to acquire the signal of e* if it were costless for them to do so. Labour Economics Professor: Dr. Jason Dean 33 AN ILLUSTRATION OF THE SIGNALING MODEL But lets further suppose that the costs of education are lower for those with high ability compared to those with low Costs (low ability) ability. Think of the psychic costs – perhaps it takes more able workers less time or that they simply dislike school less. Crucial assumption: education is more costly for low Costs (high ability) ability workers. Now consider the optimal choice of education for each type of worker. Low ability? High ability? Labour Economics Professor: Dr. Jason Dean 34 THE LIFETIME BENEFITS AND COSTS OF EDUCATIONAL SIGNALING • PVE1 and PVE2 are the sums of the discounted lifetime earnings of workers who earn wage of 1 and wage of 2, respectively. • Each year of education costs C for those with lower productivity (lower cognitive ability or distaste for Max e=e* for low prod. learning) and C/2 for those with greater productivity. • Workers choose the level of schooling at which PVE1 – C and PVE2 – C/2 will be maximized. • Low productivity workers: the choice would be A0 with zero years of schooling beyond high school Max e=0 for low prod. because acquiring e* yields BD (< A0). e1 e2 • Higher productivity workers: with cost of C/2 would find it profitable to acquire e* years beyond high school because BF (>A0) exceeds other schooling choices. Labour Economics Professor: Dr. Jason Dean 35 OFFERED WAGE AND SIGNALING COST SCHEDULES Wages W(S), Cost C(S) Cost of education • Low-ability workers’ cost of acquiring CL(S) = S education is given by CL(s). • Their return acquiring s* is given by 2 - W(S) 2 CL(s*) < 1, so they are better off NOT going to school, and accepting the lower wage. CH(S) = S/2 1 • High-ability workers’ cost of acquiring education is given by CH(s). • Their net benefit of education is given by 2 - CH(s*)>1, so they are better off acquiring 1 Labour Economics S* 2 Education the education level s* Professor: Dr. Jason Dean 36 REQUIRING A GREATER SIGNAL MAY HAVE COSTS WITHOUT BENEFITS Some Cautions About Signaling If those with costs along C have higher costs only because of lower family wealth, and that they may be no less productive on the job than those along line C/2, then using e* as signaling would fail. Even when using e* as a useful way to predict future productivity, there is an optimum signal beyond which society would not find desirable to go. If employers now require e* years of schooling beyond HS for their entry level jobs paying wage of 2, and if they raised their hiring standards to e′ years, then those with costs along C would still find it in their best interests to remain at zero years and retain A0 since A0 > B′D′. Those with costs along C/2 would still find it profitable to invest in the newly required signal of e′ years because B′F′ still exceeds other schooling choices (since B′F′ > A0). Labour Economics Professor: Dr. Jason Dean 37 IMPLICATIONS OF SCHOOLING AS A SIGNAL • For schooling to act as a signal: – Schooling must be more “costly” for low-ability workers compared to highability workers. • Social return to schooling (percentage increase in national income) is likely to be positive even if a particular worker’s human capital is not increased. – Due to matching • Although education may incorporate a signaling aspect, it is well-accepted that education is more than a signal. – Education is at least partially an investment in human capital. Labour Economics Professor: Dr. Jason Dean 38 EMPIRICAL EVIDENCE: EDUCATION AND EARNINGS Figure 9.4 Earnings by Age and Education, Canadian Males, 2015 • This graph shows the average earnings by age group for different levels of education. • For example, the lowest line shows the relationship between age and earnings for those men who have not completed their high school education. Their earnings generally increase with age, as they accumulate on-the-job experience. • The age-earnings profiles are higher on average for those men with more education, being highest for university graduates. Labour Economics Professor: Dr. Jason Dean 39 EMPIRICAL EVIDENCE: EDUCATION AND EARNINGS Figure 9.4 Earnings by Age and Education, Canadian Males, 2015 1. Earnings increase with age experience 2. Increase is most rapid to age 40 or 44 for individuals with the most education 3. Differential is wider between groups at age 50 than 20–30 Labour Economics Professor: Dr. Jason Dean 40 In the U.S. ECON 33: Labour Economics Professor: Dr. Jason Dean 41 IMPORTANT PROPERTIES OF AGE-EARNINGS PROFILES • Important properties of age-earnings profiles: 1. Highly educated workers earn more than less educated workers. 2. Earnings rise over time at a decreasing rate. 3. The age-earnings profiles of different education cohorts diverge over time (they “fan outward”). – Earnings increase faster for more educated workers. Labour Economics Professor: Dr. Jason Dean 42 HUMAN CAPITAL EARNINGS FUNCTION • Estimates the rate of return to education. • Controls for other factors that may affect earnings such as ability and experience Where: 𝐥𝐧 𝒀 = 𝜶 + 𝒓𝑺 + 𝜷𝟏 𝑬𝑿𝑷 + 𝜷𝟐 𝑬𝑿𝑷𝟐 + 𝜺 Y = Earning; α = Fixed component of wage with no schooling; r = i = internal rate of return; S = Years of schooling; EXP = Age as a proxy for Experience – Potential experience (Age – Schooling – 5) ε = Random variable (motivation, luck, etc.) Labour Economics Professor: Dr. Jason Dean 43 ESTIMATES: HUMAN CAPITAL EARNINGS FUNCTION • This scatter plot shows the relationship between education and earnings for a sample of 35- to 39- Log Earnings by Years of Schooling, Women aged 35 to 39 Years, 2005 year- old women in 2005. • Each point represents a particular woman, with her level of education and annual earnings. • Also shown is the estimated regression line, which shows the level of predicted earnings for women with a given number of years of schooling. • While most observations lie close to the regression line, there are obviously some women whose earnings are higher than predicted, and some whose earnings are lower er than predicted. Labour Economics Professor: Dr. Jason Dean 44 EMPIRICAL EVIDENCE: HUMAN CAPITAL EARNINGS FUNCTION Table 9.2 Estimated Returns to Schooling and Experience, 2015 (dependent variable: log annual earnings) • Men Women Intercept 9.232 (714.15) 8.605 (628.29) Years of schooling 0.080 (105.31) 0.114 (140.77) Experience 0.054 (75.96) 0.041 (62.51) Experience squared − 0.0009 (60.14) − 0.0006 (43.85) R-squared 0.136 0.204 Sample size 121,947 99,398 NOTES: The regressions are estimated over the full samples of full-year (49 or more weeks worked in 2005), mostly fulltime men and women, respectively. • Absolute t-values are indicated in parentheses, with t-values greater than 2 generally regarded as indicating that the relationship is statistically significant, and unlikely due to chance. • SOURCE: Data from Statistics Canada, Individual Public Use Microdata Files, 2006 Census of Population. © 2021 MCGRAW-HILL EDUCATION LTD. Labour Economics Professor: Dr. Jason Dean 9 - 45 EMPIRICAL EVIDENCE: EDUCATION AND EARNINGS Table 9.1 Estimates of the Private Returns1 to Schooling in Canada, 2000 • NOTES: • Rates of return by level of schooling are Level of Schooling Males Females Bachelor’s degree2 12 14 Master’s degree 3 5 Ph.D. nc2 4 Medicine 21 22 Males Females Education 9 14 Humanities and fine arts nc 10 dentistry, optometry, veterinary) and law Social sciences3 11 14 degrees. Commerce 9 19 Natural sciences 9 8 Engineering and applied science 9 14 Health sciences 18 18 Bachelor’s Degree by Field of Study calculated relative to the next-lowest level. For example, the return to a bachelor’s degree is relative to completed secondary school, and the return to a master’s degree is relative to a bachelor’s degree. • • “nc” indicates “not calculated” because that estimated returns were not significantly different from zero, statistically. • © 2021 MCGRAW-HILL EDUCATION LTD. Labour Economics Bachelor’s degree includes health (medicine, Social sciences includes law degrees. Professor: Dr. Jason Dean 9 - 46 SIGNALING, SCREENING, AND ABILITY • If there are systematic differences between low and high educated people that affect earnings and schooling then the estimate is biased. • Determinants difficult to control – innate ability, motivation, perseverance, tolerance, etc. • Education as Signaling/Screening – If true than education itself has no effect on earnings – it is only a screening mechanism for highly able workers. Labour Economics Professor: Dr. Jason Dean 47 SCHOOLING AND EARNINGS WHEN WORKERS HAVE DIFFERENT ABILITIES Rate of Interest Dollars • Ace and Bob have the same discount rate (r) Z Bob wHS but each worker faces a different wageschooling locus. Ace wACE wDROP r • Ace drops out of high school and Bob gets a PACE high school diploma. IRRBOB • The wage differential between Bob and Ace IRRACE 11 12 Years of Schooling 11 12 Years of Schooling • As a result, this wage differential (11 vs. 12 years) does not tells (wHS - wDROP) arises both because Bob goes to school for one more year and because Bob is more able. us by how much Ace’s earnings would increase if he were to complete high school (wACE - wDROP). Labour Economics Professor: Dr. Jason Dean 48 ADDRESSING ABILITY BIAS • Optimal situation – random assignment (randomized controlled trial) – Not possible • Natural experiments – Another approach is to try to mimic an experiment by finding a mechanism that affects (“assigns”) education levels to groups of individuals in some way independent of the individual’s expected returns to schooling. – Isolate the influence of education from unobserved ability factors Labour Economics Professor: Dr. Jason Dean 49 ADDRESSING ABILITY BIAS • Research on twins – Princeton University labour economists collected data on a large sample of identical twins attending the annual “Twins Festival” in Twinsburg, Ohio.⁵ – Using the conventional approach- the OLS return to education of about 11 percent, slightly higher than most other datasets. – Exploiting the twins feature of the data to control for innate ability, the return to education fell to 7 percent, suggesting considerable ability bias. – However, once they accounted for the possibility of measurement error, the estimated returns rose to 9 percent, which was still lower than the conventional OLS results. – Their results confirm that omitted-variables bias is a problem, but not large one. Labour Economics Professor: Dr. Jason Dean 50 ADDRESSING ABILITY BIAS – Compulsory school attendance laws – Law requiring students to remain in school until 16th or 17th birthday – Because children born in different months start school at different ages, these laws imply that some children are required to remain in school longer than others. – Month of birth is unlikely to be correlated with ability – Proximity to college findings – Card (1995) – 7.5% Labour Economics Professor: Dr. Jason Dean 51 EMPIRICAL ESTIMATES Labour Economics Professor: Dr. Jason Dean 52 TRAINING: WHO PAYS? GENERAL TRAINING • Skills used in various firms SPECIFIC TRAINING • provides the training • Firms will offer higher wages for this training • for these skills Trainee is unwilling to bear the cost because there are no higher earnings • Trainee is willing to bear the cost since higher wages are offered Training useful to the firm that • Firm does not have to pay higher wages because other firms are not competing for such trainees Labour Economics Professor: Dr. Jason Dean 53 COSTS, BENEFITS, AND FINANCING OF TRAINING Value of worker after training Cost and Benefit of Training (general skills) Wages VMP VMP* Wage in absence of training benefits Wa = VMPa costs If the benefits exceed the costs than it is worthwhile to make the investment. VMPt Value of worker during training 0 Labour Economics training t* But who should make the investment? Worker because the firm has no incentive. The employee could leave and still get a wage of VMP*. Time Professor: Dr. Jason Dean 54 COSTS, BENEFITS, AND FINANCING OF TRAINING Cost and Benefit of Training (specific skills) Value of worker after training (Only valuable to specific firm) Wages VMP VMP* Wage during and after training benefits Wa = VMPa costs If the benefits exceed the costs than it is worthwhile to make the investment. VMPt Value of worker during training 0 Labour Economics training t* But who should make the investment? The Firm would provide the training and pay Wa. There is no market for this skill so the worker has no incentive to pay. If the worker leaves still only be able to getTime a wage of VMPa. Professor: Dr. Jason Dean 55 COSTS, BENEFITS, AND FINANCING OF TRAINING Specific training as a shared investment VMP* Wages VMP Employer’s benefits W* Employee’s benefits Wa = VMPa Employee’s costs Wt Employer’s costs VMPt 0 Training Labour Economics Given the uncertainly that the worker could quit – it could make sense to share the costs of training. t* Time Professor: Dr. Jason Dean 56 TRAINING: APPROPRIATE ROLE OF GOVERNMENT • Private markets may not provide socially optimal amounts of training: – Imperfect information – Regulatory restrictions • Training subsidies to disadvantaged could: – Increase working hours – Raise wages above the poverty line © 2021 MCGRAW-HILL EDUCATION LTD. Labour Economics Professor: Dr. Jason Dean 9 - 57 HOMEWORK QUESTION • The costs of obtaining a university degree for high-productivity and low-productivity-type workers are as follows: • High productivity: CH= $20,000y • Low productivity: CL= $40,000y • where y is years in university. In an economy, workers with a university degree are paid a lifetime income of $600,000, and workers without a university degree are paid a lifetime income of $450,000. • For low-productivity workers, the net benefit of four years of university is ______, while the net benefit of not going to university is ______. • For high-productivity workers, the net benefit of four years of university is ______, while the net benefit of not going to university is ______. Labour Economics Professor: Dr. Jason Dean 58 HOMEWORK QUESTION - SOLUTION • a) Low-ability – Uni: 600,000 - 40,000(4) = $440,000 – No Uni: 450,000 – 40,000(0) = $450,000 • b) High-ability – Uni: 600,000 - 20,000(4) = $520,000 – No Uni: 450,000 – 20,000(0) = $450,000 Labour Economics Professor: Dr. Jason Dean 59 HOMEWORK QUESTION • The costs of obtaining a university degree for high-productivity and low-productivity-type workers are as follows: • High productivity: CH= $25,000y • Low productivity: CL= $41,000y • where y is years in university. In an economy, workers with a university degree are paid a lifetime income of $600,000, and workers without a university degree are paid a lifetime income of $430,000. • Will the earnings paid above result in an effective screening device? Why? • What is the pay range for university graduates that would result in a separating equilibrium? Labour Economics Professor: Dr. Jason Dean 60 HOMEWORK QUESTION - SOLUTION a) Low-ability Uni: 610,000 - 41,000(4) = $446,000 No Uni: 430,000 – 41,000(0) = $430,000 High-ability Uni: 610,000 - 25,000(4) = $510,000 No Uni: 430,000 – 25,000(0) = $430,000 There is no separating equilibrium. b) x-41,000(4) < 430,000 so x < 594,000 for low ability to chose no University. x-25000(4) > 430,000 so x > 530,000 for high ability to choose University. 530,000 < x < 594,000 Labour Economics Professor: Dr. Jason Dean 61 END OF LECTURE • Socrative Quiz – https://b.socrative.com/login/student/ – Room: DEAN200 • Next Class: • Chapter 10 – The Wage Structure Labour Economics Professor: Dr. Jason Dean 62