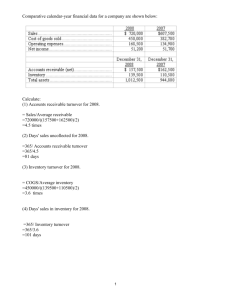

(Pt.2)1 Lecture 7: Sales Rev, Cash, and Receivables SALES: Some forms of sales are offered which help to: 1) attract customers 2) promote faster receipt of cash 3) reduce recordkeeping costs 4) minimize bad debts CREDIT CARD DISCOUNTS: Credit Card Discounts: contra-revenue account, or included as a part of selling expenses. Cash XXX Credit Card Discounts XXX Sales Revenue XXX Customer wants to pay later: Accounts Receivable XXX Sales Revenue XXX SALES DISCOUNTS: Assume that on January 1, a sale on account takes place for $1,000 with terms, 2/10, n/30. Assume the payment is made within the period. Journal Entry: Jan 1. Accounts Receivable 1,000 Sales Revenue Jan 9. 1,000 Cash 980 Sales Discounts 20 Accounts Receivable 1,000 NET SALES: The net sales amount reported on the income statement is usually net of: a. sales returns and allowances (Pt.2)2 b. sales discounts (if treated as a contra-revenue) c. credit card discounts (if treated as a contra-revenue) GROSS SALES = TOTAL SALES WITHOUT DEDUCTIONS (INCLUDE CONTRAVENES, SALES RETURNS AND ALLOWANCE) DELAYED REVENUE RECOGNITION: The earnings process is not nearly complete. Long-Term Construction Contracts: revenue recognition for construction-type contracts: 1. Completed Contract Method: records revenue after contract completed and product is delivered. 2. Percentage-of-Completion Method: records revenue based on the percentage of work completed (Costs incurred during period)*(% of est. total revenue to be recognized) Est. total costs SERVICE CONTRACTS: Similar to accounting for long-term construction contracts. - Completed Performance Method Proportional Performance Method BAD DEBTS EXPENSE: Allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts expected to be paid. Bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible Bad Debt Expense $1,000 Allowance for Bad Debts $1,000 1. Income Statement Viewpoint: Percentage of Sales Method a. Estimate based on credit sales becomes bad debts expense for the period (Pt.2)3 2. Balance Sheet Viewpoint: Aging of Accounts Receivable (or % of A/R) a. Estimate based on accounts receivable becomes balance of Allowance for Bad Debts (contra asset). WRITE OFFS: When specific accounts receivable actually become uncollectible, they must be taken off the books. *No expense is recorded because the expense was recorded when the estimate was made. Allowance for Bad Debts XXX Accounts Receivable XXX REINSTATEMENT: When an A/R that was previously written off is subsequently repaid, the A/R must first be reinstated on the books: Accounts Receivable XXX Allowance for Uncollectible Accounts XXX Then the collection is recorded: Cash XXX Accounts Receivable XXX FINANCIAL ANALYSIS: Gross Profit = Sales – CGS - Depends on how net sales is calculated Receivables Turnover - Sales/Average Accounts Receivable Days Receivable - 365/Receivables Turnover: average collection period of credit sales (Pt.2)4 Common-Size Income Statement - Shows income statement items as a percentage of sales. Aids in comparing companies of different sizes. LECTURE 8:Measuring Inventory and COGS MERCHANDISING OPERATIONS: Merchandise Inventory: Goods held for sale requiring no further processing. MANUFACTURING OPERATIONS: Raw Materials: Items purchased toward the development of a completed product to be held for sale. Work-in-Process: Items in use toward the development of completed products to be held for sale (includes direct labor costs and factory overhead). Finished Goods: Completed goods ready for sale. Purchase of raw material: Raw Materials Inventory XXX Accounts Payable XXX Production: Work in Process Inventory XXX Raw Materials Inventory XXX Work in Process Inventory XXX Wages Payable XXX Accumulated Depreciation XXX (Pt.2)5 Utilities Payable XXX Completion of Production: Finished Goods Inventory XXX Work in Process Inventory XXX TYPES OF INVENTORY SYSTEMS Perpetual Inventory System :A running balance of inventory is maintained after each transaction; more accurate, more costly. Periodic Inventory System: Cost of goods sold and Inventory are updated at the end of the accounting period. CGS = Beg. Inventory + Purchases - Ending Inventory WHY LIFO AND NOT FIFO - Notice that when prices are rising, LIFO produces the highest cost of goods sold. In these circumstances, LIFO is usually preferred for income tax reporting purposes. - Since the physical flow of products has little importance to the financial success of most businesses, the accounting profession allows any of the four methods for calculating cost of goods sold. LIFO EFFECTS - LIFO Layer: Separately identifiable segment of LIFO inventory. (Pt.2)6 - LIFO Liquidation: Sales of inventory may exceed purchases and items from earlier purchases and beginning inventory must be sold. Using LIFO, the cost of these goods sold at times of rising prices may result in usually high net income. LIFO Reserve - Contra-Asset. The difference between inventory valued at FIFO and inventory valued at LIFO. Represents the cumulative gross profit (GP) effect over all prior years due to using LIFO. ∆LIFO Reserve: Beginning LIFO Reserve - Ending LIFO Reserve = Difference in CGS between LIFO and FIFO = (-) Difference in (GP) between LIFO and FIFO = (-) Difference in Pretax Income Diff. in Pretax Income * tax rate = Difference in taxes LECTURE 9: Long-lived assets & depreciation Tangible Assets (PPE, fixed assets) • Land • Buildings, fixtures, equipment • Natural Resources CAPITALIZATION: Asset Value if incurred while it is placed - All costs in acquiring an asset and preparing it for use such as sales taxes, legal fees, delivery costs, installation costs, renovation costs, and repair costs. - Renovation and repair costs incurred after an asset is placed in use are normal operating expenses when incurred. Finance Expense: Not in the Asset and are interest expenses - (Pt.2)7 APPRAISAL VALUE: Land and Building - cost apportioned in proportion to their appraised values. EFFECT OF DEPRECIATION ON TAXES “Least and latest rule”: - Taxpayers should want to pay the lowest possible amount of income taxes at the latest possible date. Modified Accelerated Cost Recovery System (MACRS) - Adopted in 1986. Required if an accelerated method is to be used. - Similar to the declining-balance method, but allocates cost over shorter time periods. Not allowed for financial reporting purposes. CASH FLOW EFFECTS OF DEPRECIATION: - The cash flow effects of depreciation are in the form of taxes only. Depreciation expense itself has no direct effect on cash flow. EXPENDITURES: CAPITALIZATION vs. EXPENSING Expenditures: the purchase of goods or services •If they are expected to benefit more than the current accounting period they are capitalized (recognized as assets) and are expensed over the periods benefited. ·Ordinary repairs and maintenance are costs incurred for the ordinary upkeep of operational assets during the current period. These costs are expensed when incurred. ·Extraordinary repairs increase the economic usefulness of an asset. These costs are added to the related asset account (capitalized) and depreciated over the remaining life of the asset. (Pt.2)8 ·Additions are extensions to an existing asset. These costs are added to the related asset account and depreciated over the remaining life of the asset (over the remaining life of the addition if shorter) DISPOSAL OF LONG-LIVED ASSETS: •Depreciation expense on the asset must be recorded from the beginning of the accounting period to the date of sale. •The asset, reported at acquisition cost, must be taken off the books. •Accumulated depreciation related to the asset is also taken off the books. •Any gain or loss is recognized for the difference between the sales price and the book value of the asset at the date of sale. •(The gain is often included in “other income” on the income statement.) Financial Analysis Gross Profit Percentage = Gross Profit/Sales Inventory Turnover = CGS/Average Inventory - Measures the liquidity of inventory and the efficiency of the company’s use of inventory. (Pt.2)9 Gross Profit = Sales – CGS (Depends on how net sales is calculated) Receivables Turnover: Sales/Average Accounts Receivable Days Receivable: 365/Receivables Turnover - average collection period of credit sales Common-Size Income Statement: Shows income statement items as a percentage of sales. Aids in comparing companies of different sizes. Cost of Goods Available for Sale = Cost of Goods Produced During the Year + Cost of Finished Goods Inventory at the beginning of the Year Liquidity - measures the ability to pay liabilities as they become due and to meet other unexpected needs for cash. - Working Capital = Cur. Assets – Cur. Liabilities Current Ratio = Current Assets/Current Liabilities Leverage - Measures a company's mixing of finances ● Debt to EquityL shows the proportion of the company financed by creditors in comparison to that financed by owners\ shareholder ○ A debt-to-equity ratio of 1.0 means that total liabilities equal stockholders’ equity and that one-half of the company’s assets are financed by creditors. A ratio of 0.5 means that one-third of the assets are financed by creditors. Profitability - measures the ability to generate greater revenues than the costs. •Gross Margin = Gross Profit/Sales Shows the percentage of each sales dollar that results in gross profit •Profit Margin = Net Income/Sales Shows the percentage of each sales dollar that results in net income (not to be confused with gross profit percentage, or gross margin percentage = gross profit/sales) (Pt.2)10 Efficiency - measures utilization of co. resources - Asset Turnover = Net Sales / Avg. Total Assets - Measures effectiveness of a firm’s utilization of assets. Receivables Turnover = Net Sales / Avg. A/R - Measures time between sales and receipts. Day’s Receivable = 365 / Receivables Turnover Inventory Turnover = CGS / Avg. Inventory - - Measures the relationship between CGS and the flow of inventory. Determines # of times inventory is sold during the year which provides information about the ability to convert inventories to cash Day’s Inventory = 365 / Inventory Turnover Return on Investment ● Return-on-Assets (ROA) ○ = Net income (before interest and taxes)/AVGTA ○ Measures how efficiently a company is using all of its assets, or the income-generating strength of a company’s resources. ● Return-on-Equity (ROE) ○ = Net income/average stockholders’ equity ○ Measures how much investors earned on their investment in the company. (Pt.2)11 Market and Dividend Ratios - Price/Earnings Ratio (PE multiple) = Stock price per share / Earnings per share Stock price is typically a reflection of expected future performance. A high P/E multiple may suggest high expected future performance. - Book Value per Share = S/E (common shares) / Common shares outstanding - Price/Book (P/B) = Price per share / BV per share Measures the growth potential of a firm. Dividend Yield (D/P) –For existing stockholders: = Dividends per share / Original Price per share –For potential stockholders: = Dividends per share / Current Market Price Dividend Payout Ratio Measures the proportion of income paid in dividends (or not retained by the firm) = Dividends / Net Income Growth Rate = 1- Dividend Payout Ratio (Pt.2)12