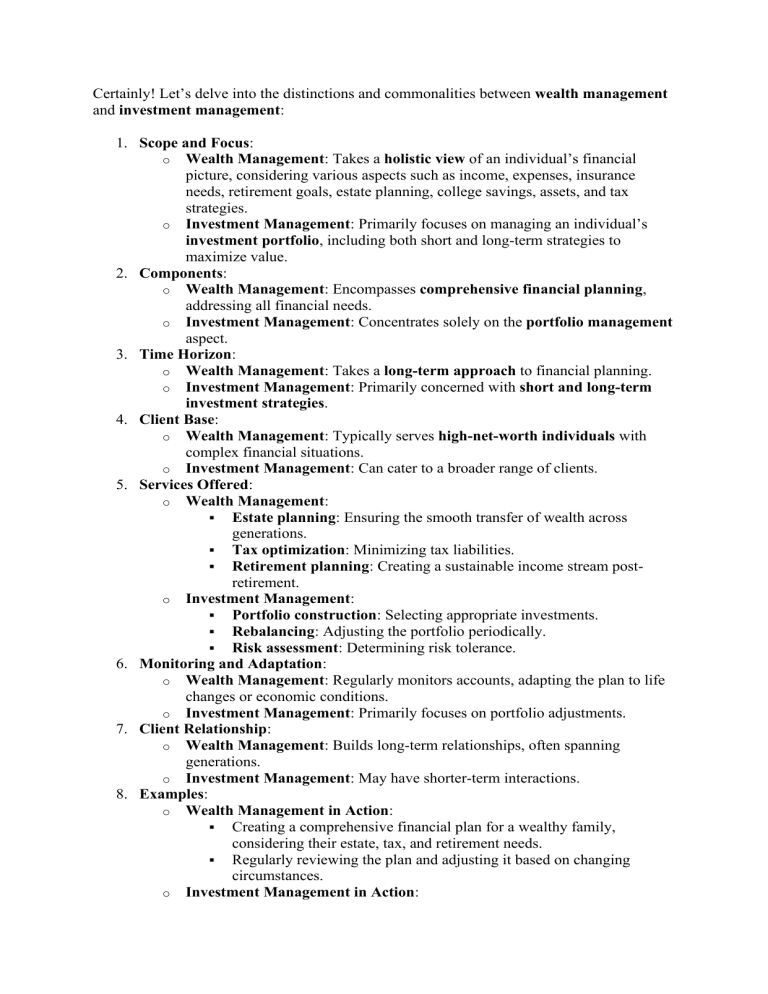

Certainly! Let’s delve into the distinctions and commonalities between wealth management and investment management: 1. Scope and Focus: o Wealth Management: Takes a holistic view of an individual’s financial picture, considering various aspects such as income, expenses, insurance needs, retirement goals, estate planning, college savings, assets, and tax strategies. o Investment Management: Primarily focuses on managing an individual’s investment portfolio, including both short and long-term strategies to maximize value. 2. Components: o Wealth Management: Encompasses comprehensive financial planning, addressing all financial needs. o Investment Management: Concentrates solely on the portfolio management aspect. 3. Time Horizon: o Wealth Management: Takes a long-term approach to financial planning. o Investment Management: Primarily concerned with short and long-term investment strategies. 4. Client Base: o Wealth Management: Typically serves high-net-worth individuals with complex financial situations. o Investment Management: Can cater to a broader range of clients. 5. Services Offered: o Wealth Management: ▪ Estate planning: Ensuring the smooth transfer of wealth across generations. ▪ Tax optimization: Minimizing tax liabilities. ▪ Retirement planning: Creating a sustainable income stream postretirement. o Investment Management: ▪ Portfolio construction: Selecting appropriate investments. ▪ Rebalancing: Adjusting the portfolio periodically. ▪ Risk assessment: Determining risk tolerance. 6. Monitoring and Adaptation: o Wealth Management: Regularly monitors accounts, adapting the plan to life changes or economic conditions. o Investment Management: Primarily focuses on portfolio adjustments. 7. Client Relationship: o Wealth Management: Builds long-term relationships, often spanning generations. o Investment Management: May have shorter-term interactions. 8. Examples: o Wealth Management in Action: ▪ Creating a comprehensive financial plan for a wealthy family, considering their estate, tax, and retirement needs. ▪ Regularly reviewing the plan and adjusting it based on changing circumstances. o Investment Management in Action: ▪ ▪ Constructing a diversified investment portfolio for an individual. Monitoring market trends and adjusting holdings as needed. In summary, while investment management focuses on optimizing investment portfolios, wealth management takes a broader view, considering all financial aspects to create a comprehensive plan for clients’ financial well-being.