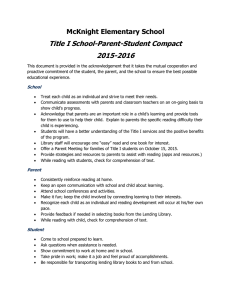

AgroFinance Defi for Farmers Capstone Project Proposal Submitted by: (102115237) Kartik Gupta (102115239) Akhil (102153040) Kanika Chanana (102106054) Rajvir Singh (102165017) Shruti Bansal BE Third YearCPG No. 209 Under the Mentorship of Dr Rohit Ahuja Designation: Associate Professor Computer Science and Engineering Department Thapar Institute of Engineering and Technology, Patiala March 2024 TABLE OF CONTENTS • • • • • • • • • • • • • Mentor Consent Form Project Overview Problem Statement Need Analysis Literature Survey Research Questions Novelty Objectives Methodology Project Outcomes & Individual Roles Work Plan Course Subjects References Page 2 of 11 Page 3 Page 4 Page 4 Page 4 Page 5-6 Page 6 Page 7 Page 7 Page 8 Page 9 Page 10 Page 10 Page 11 Mentor Consent Form I hereby agree to be the mentor of the following Capstone Project Team Project Title: Roll No Name Signatures NAME of Mentor: ……… . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . SIGNATURE of Mentor: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . NAME of Co-Mentor (if any): ……… . . . . . . . . . . . . . . . . . . . . . . . . . . SIGNATURE of Co-Mentor: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Page 3 of 11 Project Overview In today's dynamic economic landscape, Small and Medium-Sized Enterprises (SMEs) play a crucial role in driving innovation and economic growth. However, accessing traditional financing options can be challenging for SMEs due to rigid requirements and extended approval processes imposed by conventional financial institutions. This project proposes the development of a comprehensive Blockchain-Based Lending System tailored to meet the unique financial needs of SMEs. The proposed system leverages blockchain technology to create a secure, transparent, and efficient lending ecosystem, providing SMEs with accessible and flexible financing solutions. The platform integrates with decentralized finance (DeFi) protocols, enabling a seamless connection to liquidity pools, yield farming opportunities, and decentralized exchanges. This integration aims to offer SMEs a range of financial services beyond traditional lending, fostering financial inclusion and empowerment. Problem Statement The conventional collateralized loan system in India places an undue burden on farmers, leading to financial distress, property loss, and an alarming rise in suicides. There is a critical need for a transformative solution that eliminates collateral dependence, prioritizes farmer well-being, and ensures a sustainable financial ecosystem. Need Analysis Traditional lending platforms often do not cater to the specific needs of farmers, such as seasonal income fluctuations, crop cycles, and market uncertainties but our project targets the agricultural sector directly, understanding the challenges faced by farmers in obtaining affordable and flexible credit. Most existing DeFi platforms require collateral, which can be a barrier for farmers, especially small-scale and subsistence farmers with limited assets. . They try to make it easier for the borrowers to take loans, but they still need to submit collateral. Our platform works on the zero-collateral requirement. There is a dire need for a platform that allows farmers to borrow loans without providing collateral. MakerDAO, Aave, and Compound have governance models, but our project's approach of involving stakers in the lending process adds another layer of decentralization. Our project stands out in the DeFi landscape by addressing the specific needs of farmers through innovative under collateralized lending solutions. By offering zero-collateral loans, involving stakers as collateral providers, and focusing on the agricultural sector, your platform can create a significant impact on financial inclusion, rural development, and sustainable farming practices. This unique approach fills a market gap, complementing existing DeFi platforms like MakerDAO, Aave, and Compound, and providing a specialized, communitydriven solution for farmers worldwide. Page 4 of 11 Literature Survey 1. Compound Finance: Compound Finance is a decentralized lending protocol built on the Ethereum block chain. It operates as an algorithmic, autonomous interest rate protocol allowing users to lend and borrow various crypto currencies without the need for traditional intermediaries like banks How it Works: Lenders can supply supported crypt currencies (like Ethereum, DAI, USDC, etc.) to the Compound protocol. By supplying these assets, users earn interest on their deposits. The interest rates are algorithmically set based on the supply and demand of the specific asset. Borrowers can borrow supported assets by providing collateral. Borrowers can choose from a range of supported assets, with the amount they can borrow depending on the value of the collateral they provide. The interest rates for borrowing are also determined algorithmically based on the market dynamics. Compound's interest rates are dynamic and can change frequently based on supply and demand. When more users are supplying an asset than borrowing it, the interest rates for borrowing decrease, incentivizing more borrowing. Challenges faced by Compound Finance is Crypto currency prices can be highly volatile, impacting the value of both supplied assets and collateral. 2. Maker DAO: Maker DAO is a decentralized autonomous organization (DAO) built on the Ethereum block chain. It operates the Maker Protocol, which enables users to generate the stable coin DAI by collateralizing assets. How it Works: Users lock up collateral assets, such as Ethereum (ETH), in Maker Dao’s smart contracts. Based on the value of the collateral, users can generate DAI, a stable coin soft-pegged to the US Dollar. MakerDAO maintains stability through various mechanisms, including the Dai Savings Rate (DSR) and the Stability Fee. The DSR allows DAI holders to earn interest by locking their DAI into a savings contract. The Stability Fee is a variable interest rate that borrowers pay on the DAI they generate. Collateralized assets are held in MakerDAO's "Vaults." If the value of the collateral falls below a certain threshold, the Vault is at risk of liquidation. Keepers, automated agents, can bid on and liquidate under collateralized Vaults, maintaining the stability of the system. MakerDAO is governed by its native token, MKR. MKR holders have voting rights on proposals, including changes to stability fees, collateral types, and system upgrades. In times of system debt, MKR tokens can be minted and sold to cover the debt, helping to keep DAI stable. MakerDAO operates autonomously through its smart contracts, without the need for intermediaries. All transactions and decisions are transparent and recorded on the Ethereum blockchain. Challenges faced by MakerDAO users must monitor their Vault collateralization ratios to avoid liquidation risks. Changes in the value of collateral assets can impact the stability of the system and the fees users pay. Page 5 of 11 3. Aave Protocol Aave is a decentralized non-custodial money market protocol on Ethereum that allows users to lend and borrow a wide variety of cryptocurrencies. It operates similarly to a traditional bank's lending system but in a decentralized and automated manner. How it Works: Lenders can deposit supported cryptocurrencies into the Aave protocol. These deposited funds are then supplied to a liquidity pool, from which borrowers can borrow. Borrowers who want to borrow cryptocurrency can do so by providing collateral in the form of other supported assets. The amount that users can borrow is determined by the value of the collateral they provide. Aave supports a wide range of cryptocurrencies and tokens for both lending and borrowing. Aave is known for introducing the concept of "flash loans," which are uncollateralized loans that must be borrowed and repaid within the same transaction. These flash loans have been used for various purposes such as arbitrage, liquidation protection, and more. Borrowers must maintain a certain level of collateralization to secure their loans. If the value of their collateral falls below a specified threshold, it can be liquidated to repay the borrowed amount. Aave operates using its native governance token, AAVE. AAVE token holders can participate in the governance of the protocol, voting on proposals and changes. Users can also stake their AAVE tokens to earn staking rewards and participate in the protocol's governance. Challenges faced by this is cryptocurrency prices can be volatile, impacting the value of both deposited assets and collateral. Research Questions 1. What is the optimal design for a blockchain-based lending system tailored to the specific needs of farmers? 2. How can we integrate DeFi protocols like Compound, MakerDAO, and Aave to provide a wider range of financial services beyond traditional lending for farmers? 3. How canwe implement a zero-collateral lending system for farmers while maintaining financial stability and mitigating risk? 4. How can we involve stakers in the lending process, creating a decentralized and communitydriven system? 5. How can a blockchain-based lending system for farmers contribute to financial inclusion and empowerment in rural communities? 6. How can this system promote sustainable farming practices by providing access to financing for eco-friendly technologies and initiatives? Page 6 of 11 Novelty • • • • • This project eliminates the need for collateral entirely for farmers. This significant departure from traditional lending practices opens up access to capital for small-scale farmers who might not have substantial assets to offer as collateral. The project introduces a unique model where stakers take on the responsibility of providing collateral for loans. Stakers participate in the platform by staking cryptocurrency or tokens, gaining voting rights and earning rewards. This innovative approach not only supports farmers in accessing funds but also creates a new incentive structure and role for participants in the lending ecosystem. Incentivized System for Borrowers, Lenders, and Stakers Borrowers benefit from the platform by gaining access to loans without the burden of providing collateral. Lenders contribute liquidity to the pool and earn trading fees, creating a source of passive income. Stakers play a crucial role in the approval process, conducting due diligence on borrowers and earning a percentage of interest when loans are repaid successfully. This three-tiered system creates a symbiotic relationship where each participant is incentivized to contribute to the platform's success. This project targets a specific industry with unique needs, aiming to address the challenges farmers face in accessing affordable credit. The project stands out in the decentralized finance (DeFi) space by offering a more inclusive and sustainable lending model. By democratizing access to loans and shifting the risk from farmers to stakers, it aligns with the ethos of DeFi while addressing realworld challenges in the agricultural sector. Objectives • • • • To break the barriers for farmers with access to undercollateralized loans, consistent and beneficial return for long-term liquidity providers with a stable yield generating instrument, and an open-sourced financial derivative for stakers. A working UI for farmers to register for loans, lenders to supply liquidity, and stakers to stake, evaluate and approve loans. Conditional logic deployed on a set of smart contracts for the protocol deployed on an EVM-based test net for the proof of concept. Make the platform user and developer-friendly (for any future ecosystem around) with it being blockchain agnostic. Page 7 of 11 Methodology 1. Registration and KYC Process Farmers need to register on the platform providing essential details like PAN number, Aadhaar number, annual income, occupation (type of crop grown), etc. These details are stored securely on the blockchain, ensuring immutability and transparency. 2. Verification Process The platform sends an identification approval request to a government entity (off-chain). The government entity verifies the submitted KYC details for legitimacy. Approval or denial is communicated back to the blockchain platform. 3. Staking Mechanism Stakers participate by staking a certain amount of cryptocurrency or tokens in the protocol. Stakers gain voting rights based on the amount they stake. They conduct due diligence on the farmer's profile and can approve or deny the borrowing request. 4. Borrowing Process Upon approval, farmers receive capital from the lending pool. • • • Farmers receive loans without the need for traditional collateral. This reduces the barriers to entry for small-scale farmers who might not have significant assets for collateral. Farmers repay the loan with interest based on the agreed terms. Stakers receive a good percentage of interest if the farmer repays successfully. If the farmer fails to repay, the stakers' stakes are liquidated and added back to the lending pool. A lender or long-term investor contributes funds to the lending pool. In return, they earn trading fees from transactions within the pool, proportional to their share of total liquidity. 5. Blockchain Implementation: • • • • Smart Contracts: The heart of this system, smart contracts automate the lending process, execute loan terms, and manage repayments. Immutable Ledger: Blockchain ensures all transactions are recorded transparently and cannot be altered. Decentralization: No central authority controls the lending process. Instead, it's governed by the consensus of stakes. Tokenization: Use of tokens (cryptocurrencies or utility tokens) for staking, borrowing, and lending within the ecosystem. . Page 8 of 11 Project Outcomes For Farmers: • • • • Access to zero-collateral loans. Simplified loan request processes. Fair and flexible repayment terms. Reduced dependency on high-interest loan sharks. For Stakers: • • • Risk-weighted rewards through decision-making. Profitable short-term investments. Incentivized due diligence for loan approval. For Lenders: • • • • Stable and sustainable returns from the liquidity pool. Contribution to agricultural development. Enhanced liquidity in the financial ecosystem The individual team member's role must also be specified in this section. Individual Roles S.No. Name Role 1 Kartik Gupta Full Stack Web Development, Testing 2 Kanika Chanana Frontend Development, UI design 3 Shruti Bansal Documentation, Project Management, Integration and testing 4 Akhil Sharma Backend development and integration 5 Rajvir Singh Smart Contract and backend development Page 9 of 11 Work Plan Figure 1.Workflow Gantt Chart Course Subjects The capstone project draws upon a range of disciplines including: • • • • • • Software Engineering (UCS503) Database Management Systems (UCS310) UI/UX Development(UCS542) Blockchain Technology(UEC635) Data Engineering(UCS677) Test Automation(UCS662) Page 10 of 11 REFERENCES [1] Angeris, G., & Chitra, D. (2020) A Multivocal Literature Review of Decentralized Finance: Current Knowledge and Future Research Avenues. Electronic Markets, vol. 30(2), pp. 509-539. [2] Baek, A., & Kum, H.-C. (2021). Decentralized Stablecoins: A Focused Literature Review. Sustainability, vol. 13(24), pp. 14227. [3] Dai, J., Wright, R., & Guttmann, L. (2018). The MakerDAO Decentralized Autonomous Organization. In Title of Published Proceedings. Retrieved from [https://makerdao.com/en/whitepaper/] (https://makerdao.com/en/whitepaper/) (Accessed February 29, 2024). Page 11 of 11