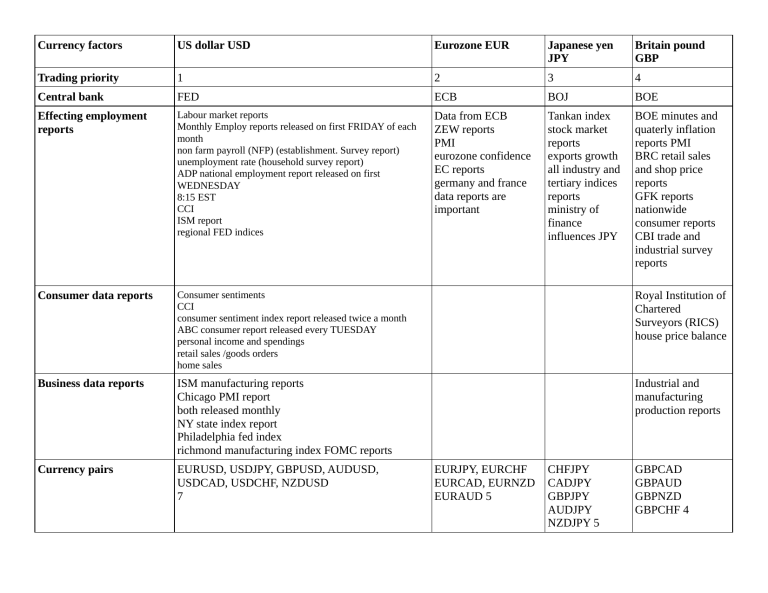

Currency factors US dollar USD Eurozone EUR Japanese yen JPY Britain pound GBP Trading priority 1 2 3 4 Central bank FED ECB BOJ BOE Effecting employment reports Labour market reports Monthly Employ reports released on first FRIDAY of each month non farm payroll (NFP) (establishment. Survey report) unemployment rate (household survey report) ADP national employment report released on first WEDNESDAY 8:15 EST CCI ISM report regional FED indices Data from ECB ZEW reports PMI eurozone confidence EC reports germany and france data reports are important Tankan index stock market reports exports growth all industry and tertiary indices reports ministry of finance influences JPY BOE minutes and quaterly inflation reports PMI BRC retail sales and shop price reports GFK reports nationwide consumer reports CBI trade and industrial survey reports Consumer data reports Consumer sentiments CCI consumer sentiment index report released twice a month ABC consumer report released every TUESDAY personal income and spendings retail sales /goods orders home sales Royal Institution of Chartered Surveyors (RICS) house price balance Business data reports ISM manufacturing reports Chicago PMI report both released monthly NY state index report Philadelphia fed index richmond manufacturing index FOMC reports Industrial and manufacturing production reports Currency pairs EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, USDCHF, NZDUSD 7 EURJPY, EURCHF EURCAD, EURNZD EURAUD 5 CHFJPY CADJPY GBPJPY AUDJPY NZDJPY 5 GBPCAD GBPAUD GBPNZD GBPCHF 4 Currency factors Australia dollar AUD Canadian dollar CAD Swiss franc CHF Newzealand dollar NZD Trading prior 5 6 7 8 Central bank RBA NBC SNB RBNZ Effecting reports RBA minutes and rate decisions westpac consumer confidence NAB consumer confiedence Canadian data mirrors US data IVEY PMI report international securities transaction SNB speeches and rate decision KOF reports retail sales PPI CPI unemployment rates NZ card spending ANZ bank confidence trade balances Currency pairs AUDCAD AUDCHF AUDNZD 3 CADJPY 1 CHFJPY 1 NZDCAD NZDJPY NZDCHF 3 EURUSD USDJPY GBPUSD (cable) USDCHF (swissy) High liqudity liquidity liquidity Less liquidity EUR increase then BUY USD increases then SELL USD increase then BUY JPY increases then SELL USDJPY moves in same direction of USD (check USDX in tradingview) Cable is similar to the EUR/USD in the Swiss are most concerned with that it trades inversely to the overall its level against the EUR as USD. opposed to the USD. US news and data mainly moves the currency pair in short term EUR news also moves the pair Highly influenced by US interest rates this currency pair has traditionally had a close correlation with U.S. Treasuries. When interest rates head higher, Treasury bond prices go down, which lifts the U.S. dollar, strengthening USD/JPY prices. highly politically sensitive If U.S. economic news disappoints, for instance, both sterling and EUR/USD will move higher. But if EUR/USD sees a 60-point rally on the day, cable may see a 100+ point rally. Price action tends to see one-way traffic in highly directional markets. Often see any reversals on the same day trade if directional move is high or low Price action tends to see one-way traffic in highly directional markets. tend to see minimal pullbacks or backing and filling. False breaks of technical levels occur frequently The tendency of Swissy to overshoot in extreme directional moves and to generate false breaks of technical levels means that spike reversals appear frequently on short-term charts. Tick by tick movement slow Strong movements Jumpy movements Often see any reversals on the movement fewer price jumps and smaller price gaps price jumps and technical levels break occur by news/data releases backing and filling is common and substantial directional move is stronger and with interest routine market fluctuations and steady and active trading interest sudden price movement a rapid price movement around 14% daily trading volume short term trends respects support & resistance fewer false breakouts price action highly directional (one way traffic) on breaks of support and resistance Technical levels testing and retesting takes long time GBPUSD and USDCHF both pair indicates breakouts and rejections in EURUSD retrace in short term movements GBPJPY breaks important support level short term SELL in USDJPY spike reversal USDJPY and EURJPY have similar trading traits speculative price movements if same day trade if directional move surprisingly strong UK data is is high or low reported, GBP/USD can take off on Jumpy movements a moonshot. tend to see minimal pullbacks or backing and filling. False breaks of technical levels occur frequentlyThe tendency of cable to overshoot in extreme directional moves and to generate false breaks of technical levels means that spike reversals appear frequently on short-term charts. USDCAD (loonie) AUDUSD you’ll need to closely follow Bank of Canada (BOC) monetarypolicy developments, current economic data, inflation readings, and political goings-on trajectory of the Canadian economy is closely linked to the overall direction of the U.S. economy. active currency pair for speculators. the interest-rate outlook is especially critical to the value of the Aussie. No set formula exists to describe the currencies’ relationship, but a general rule is that when it’s a USD-based move, Aussie and Kiwi Aussie trading is also regularly will tend to trade in the same influenced by New Zealand economic direction as each other relative data, but the flow is usually to the USD. more significant in the opposite direction, where Aussie data will Liquidity and market interest are exert a larger pull on NZD lower prices, given the larger size of the Australian economy. Still, when trading Aussie, it helps to be aware of upcoming NZD data, because data surprises in NZ can trigger sharp swings in the AUD/NZD cross rate, with implications for AUD/USD. EUR/JPY is the highest volume of the JPY crosses the low-yielding JPY is sold and higher-yielding currencies are bought When trading in the JPY crosses, you need to keep an eye on USD/JPY in particular, due to its relatively explosive tendencies and its key place as an outlet for overall carry trade buying or selling. Be alert for similar technical levels between USD/JPY and the JPY crosses, as a break in either could spill over into the other. disappointing Aussie data may see AUD/USD move lower, which will tend to drag down NZD/USD Trading the EUR crosses Liquidity and market interest are lower the result can be a negative USD report paired with strong Canadian data, leading to a sharp drop in USD/CAD (selling USD and buying CAD). At the other end, strong U.S. data and weak Canadian numbers can see USD/CAD rally sharply. Mixed readings can see a stalemate, but it always depends on the bigger picture. Price action is highly event drivenThe relatively lower level of liquidity and market interest in these currency pairs makes for sometimes-difficult technical trading conditions NZDUSD disappointing Aussie data may see AUD/USD move lower, which will tend to drag down NZD/USD Liquidity and market interest are Price action is highly event driven lower The relatively lower level of Price action is highly event driven liquidity and market interest in these The relatively lower level of liquidity currency pairs makes for sometimesand market interest in these currency difficult technical trading conditions pairs makes for sometimes-difficult technical trading conditions Trading the JPY crosses Reactions to Eurozone and Swiss news or data are most likely to be felt in the EUR crosses as opposed to EUR/USD or USD/CHF, whereas UK news/data.is going to explode all over GBP/USD and EUR/GBP sharp move higher in the USD will tend to see a higher EUR/CHF and EUR/GBP, while a rapid USD move lower will tend to see lower EUR/CHF and EUR/GBP