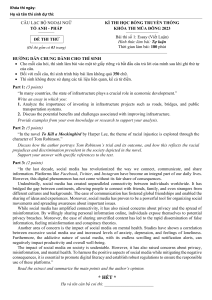

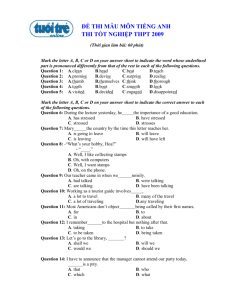

TRƯỜNG ĐH KINH TẾ QUỐC DÂN ĐỀ THI HỌC PHẦN: Quản lý tài chính cá nhân và gia đình Hệ: CQ- TT Ngày thi: 13/11/2021 Ca thi: 3 Thời gian làm bài: 90 phút Bộ môn: Chương trình Tiên tiến ĐỀ SỐ: 305 Câu 1: True or False and Explain shortly (0.5 mark per each) 1. Because of the potential effect of inflation, individuals should underestimate the amount of money needed for retirement 2. The financial activities for a young, single person will probably be the same as those for an older couple with no dependent children at home. 3. Money management refers to annual financial activities necessary to manage personal economic resources 4. Closed-end credit consists of loans made on a continuous basis with periodic bills for at least partial payment 5. Insurance is protection against possible all loss. 6. If you are unable to make your credit card payments, you should not contact your credit card company Câu 2: Exercise (1mark per each) 1. Gwendolyn Francis is interested in buying a bond that pays $70 annually. The current price of the bond is $900. What is her current yield? 2. Marianne and Roger are in good health and have reasonably secure careers. Each earns $45,000 annually. They own a home with a $125,000 mortgage; they owe $25,000 for their car loans and have $22,000 in student loans. If one should die, they think that funeral expenses would be $12,000. What is their total insurance need using the DINK method? Câu 3: Mini-case study (5marks) Consider Gretchen’s budget worksheet for June, and then answer the questions 1. 2. 3. 4. How much was Gretchen able to save in June? Which sources of her income may not be the same from month to month? Which types of spending might not be the same from month to month? Why would a series of short-term budget worksheets be needed to develop a long-term budget? Date Income Source Amount Spending Purpose Date Amount 7/6 Wages 423.52 3/6 New sweater 33.86 9/6 Birthday gift 50.00 12/6 Car insurance 48.29 21/6 Wages 423.52 15/6 Rent 350.00 23/6 Babysitting job 25.00 23/6 Credit card bill 296.04 30/6 Savings interest 8.92 25/6 Telephone bill 53.41 26/6 Grocerries 69.30 29/6 Doctor’s visit 50.00 Ghi chú: Cán bộ coi thi không giải thích gì thêm. Đề thi được được sử dụng tài liệu.