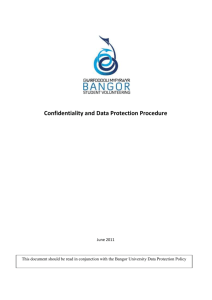

LIQUIDITY LEVERAGE Restricts Control Truncates Duration "Margin Calls" BLEEDING INVESTORS PERSPECTIVE DURATION Provides Control Lengthens Duration "Dry Powder" FEEDING How long will you own the stock? Investors must allow TIME to let it BREATHE You must believe your THESIS will become the REALITY LIQUIDITY COMPANY PERSPECTIVE LEVERAGE SIVB Forced Into Capital Raise To Fill The Hole From Selling Treasuries At A Loss SIVB Clients Pull Some Deposits To Meet Liquidity Needs SIVB Forced To Sell Treasuries At A Loss SIVB Clients Pull All Deposits BLEEDING DURATION SIVB Clients Could Not Raise Capital Due To Higher Rates = RISK OFF = VC Window Shut SIVB Shareholders Concerned About Dilution, Hammer Stock FEEDING STARVING FOMO PHILOSOPHICAL PERSPECTIVE GOMO "I fully understand the statistical certainty that I will miss almost every one of the very best stocks. I will not regret this. I know that if I can deliver reasonable stock picking with just a few big winners over long periods of time and avoid permanent capital impairment, I will be in the top quintile of performance. I will be able to justify my existence - and fees!” "I am aware of everything. I comprehend none of it. I am a tail-chaser" BLEEDING DURATION FEEDING Due Diligence Is The Vaccine For Short Termism -------LEVERAGE------- LIQUIDITY 1985 - Billy Sullivan 1988 - Victor Kiam 1988 - Stadium fell into Bankruptcy 1993 - Team fell into Bankruptcy BLEEDING 1993 - James Orthwein Trapped by Kraft's operating lease on Stadium DURATION Robert Kraft Receives all stadium concession and advertising cash flow FEEDING Robert Kraft 1985 - Buys the muddy parking lots around Patriot's stadium 1988 - Buys the stadium and operating lease with Patriots 1994 -Buys the Patriots after fight with Goldman Sachs SOME SILICON VALLEY BANK CLIENTS FACE CASH CRUNCH (source: Reuters, March 10 2023) As higher interest rates caused the market for initial public offerings to shut down for many startups and made private fundraising more costly, some Silicon Valley Bank clients started pulling money out to meet their liquidity needs. This culminated in Silicon Valley Bank looking for ways this week to meet its customers' withdrawals. To fund the redemptions, Silicon Valley Bank sold on Wednesday a $21 billion bond portfolio consisting mostly of U.S. Treasuries. The portfolio was yielding it an average 1.79%, far below the current 10-year Treasury yield of around 3.9%. This forced SVB to recognize a $1.8 billion loss, which it needed to fill through a capital raise. Latest Updates SVB ANNOUNCES STOCK SALE SVB announced on Thursday it would sell $2.25 billion in common equity and preferred convertible stock to fill its funding hole. Its shares ended trading on the day down 60%, as investors fretted that the deposit withdrawals may push it to raise even more capital. STOCK SALE COLLAPSES Some SVB clients pulled their money from the bank on the advice of venture capital firms such as Peter Thiel's Future Fund, Reuters reported. This spooked investors such as General Atlantic that SVB had lined up for the stock sale, and the capital raising effort collapsed late on Thursday. SVB GOES INTO RECEIVERSHIP SVB scrambled on Friday to find alternative funding, including through a sale of the company. Later in the day, however, the Federal Deposit Insurance Corporation (FDIC) then announced that SVB was shut down and placed under its receivership. The FDIC added that it would seek to sell SVB's assets and that future dividend payments may be made to uninsured depositors.