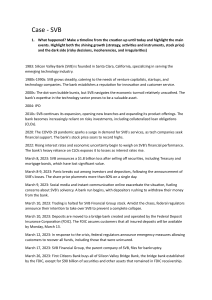

CASE STUDY: THE COLLAPSE OF SILICON VALLEY BANK TCHE303.3 Group 5 Group members Đào Mai An Ngô Trúc Anh Phạm T. Vân Anh Ngô Ngọc Hà Lò Khánh Huyền Nguyễn Minh Huyền Ngô Mai Linh Ng. Ngọc Phương Trang 2212340002 2114410073 2212340007 2112340602 2212340010 2111410073 2212340029 2114410190 Case study: The collapse of SVB CONTENTS 01. Overview: Silicon Valley Bank 02. The collapse of SVB 03. Causes of the collapse 04. Consequences of the collapse 05. Related cases & Lessons TCHE303.3 Group 5 OVERVIEW: SILICON VALLEY BANK Founded in 1983 16th largest U.S. bank Insured by the Federal Deposit Insurance Corporation (FDIC) OVERVIEW: SILICON VALLEY BANK OVERVIEW: SILICON VALLEY BANK The collapse of SVB: The timeline 1983 - 2019 The growth of SVB since establisment 2020 - 2022 The substantial growth in SVB deposits during the pandemic the events leading up to SVB’s collapse March 2023 The collapse of SVB Silicon Valley Bank: The 2020 - 2022 period SVBFG and banking industry total assets growth index Silicon Valley Bank: The 2020 - 2022 period SVB Deposit Silicon Valley Bank: The 2020 - 2022 period Composition of SVBFG assets Silicon Valley Bank: March 2023 Estimated unrealized gains (losses) on SVBFG's investment portfolio securities Silicon Valley Bank: March 2023 After-tax loss: $1.8 Billion dollar Silicon Valley Bank: March 2023 Silicon Valley Bank: March 2023 Silicon Valley Bank: March 2023 The California Department of Financial Protection and Innovation (CDFPI) closed SVB on the morning of March 10 and appointed the FDIC as receiver. Causes of the collapse Rising interest rates FED raised interest rates, causing bonds to loose value Investors and depositors's panic Investors and depositors panicked at the news of the bank’s loss, causing a bank run and a fall in stock price Declining deposits The company had to sold its held-to-maturity securities before maturity Others SVB internal management Trump 2018 rollbacks Cause of the collapse: Rising interest rates FED raised interest rates to control inflation US Treasury Bonds loose its value SVB Investment were worth $17 Billion less than its fair value Cause of the collapse: Declining deposits As interest rates rose, new deposits into SVB shrank The company had to sold its held-to-maturity securities before maturity, resulting in a loss, to help cover the decline in deposits Cause of the collapse: Investors & depositors’ panic “The first Twitter-fueled bank run” Cause of the collapse: Internal management Lack of diversification Cause of the collapse: Others Trump 2018 rollback Consequences: On the stock market Consequences: On SVB’s clients Current situation Related cases Recommendation for banks Diversification Communication Recommendation for regulators monitoring and supervising Balance Thank You TCHE303.3 Group 5