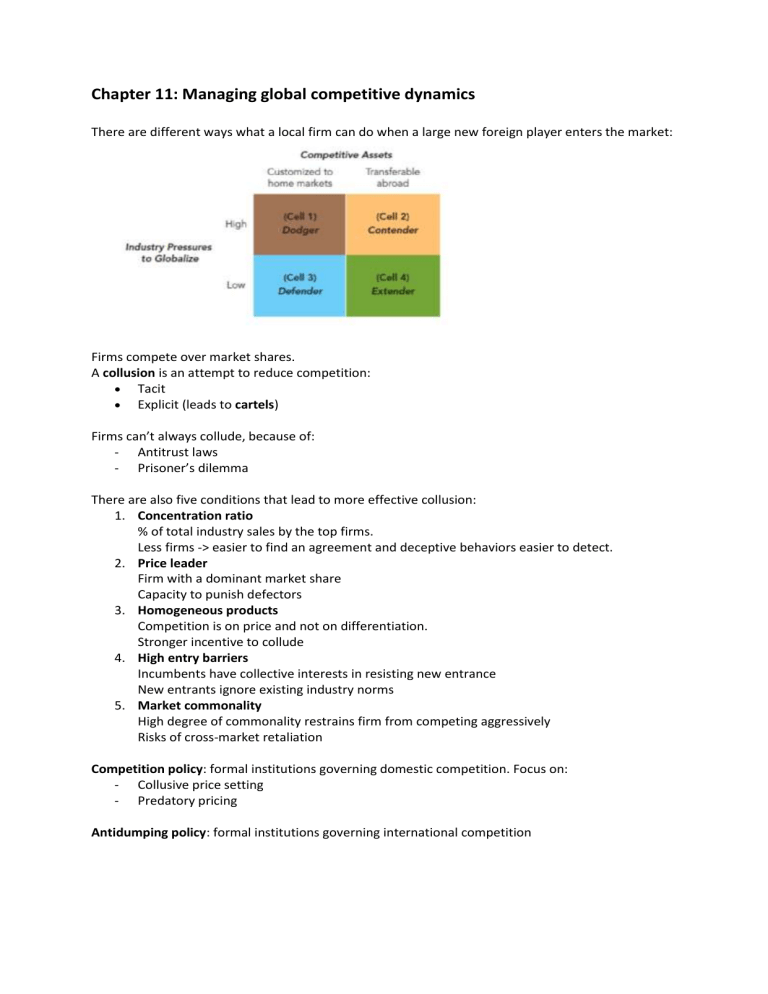

Chapter 11: Managing global competitive dynamics There are different ways what a local firm can do when a large new foreign player enters the market: Firms compete over market shares. A collusion is an attempt to reduce competition: Tacit Explicit (leads to cartels) Firms can’t always collude, because of: - Antitrust laws - Prisoner’s dilemma There are also five conditions that lead to more effective collusion: 1. Concentration ratio % of total industry sales by the top firms. Less firms -> easier to find an agreement and deceptive behaviors easier to detect. 2. Price leader Firm with a dominant market share Capacity to punish defectors 3. Homogeneous products Competition is on price and not on differentiation. Stronger incentive to collude 4. High entry barriers Incumbents have collective interests in resisting new entrance New entrants ignore existing industry norms 5. Market commonality High degree of commonality restrains firm from competing aggressively Risks of cross-market retaliation Competition policy: formal institutions governing domestic competition. Focus on: - Collusive price setting - Predatory pricing Antidumping policy: formal institutions governing international competition Chapter 10: Entering foreign markets Being an international firm is more difficult, because of: - Dealing with different formal and informal institutions - Exchange rate risk - Difficulties with marketing a product/service - Coping with labor and environmental standards Operating internationally requires overcoming the liability of foreignness: the inherent disadvantage that foreign firms experience in host countries because of their non-native status. Entering foreign markets is a complex decision: Where to enter? When to enter? How to enter? Where? Choice of location depends on: - Strategic goals (resource-based view) - Institutional distance (institution-based view) Location benefits: - Cheap labor - Raw materials - Ideas - Facilities/infrastructure - Tax benefits Firm’s strategic goals: - Natural resource seeking - Market seeking - Efficiency seeking - Innovation seeking Distance affect entry decisions: - Institutional distance - Cultural distance - Geographical distance Stage model: 1. Enter in culturally similar or geographically closer countries first 2. Move to culturally or geographically distant countries at later stages When? First-mover advantages: - Establishing entry barriers - Relationships with stakeholders - Technology leadership Last-mover advantages: - Free ride on first mover investments - Less technological and market uncertainties - Less risk to be locked in How? Three dimensions to consider: 1. Scale of entry: amount of resources committed to enter a foreign market. Large scale: + signals commitment and assures customers. - limited strategic flexibility, risk of large losses. Small scale: + less costly, focus on learning by doing. - lack of strong commitment. 2. Speed of entry: speed at which firm expands to foreign markets In the stage model, firms enter culturally/institutionally similar countries and gradually expand with learning. Exceptions are born global firms. 3. Entry mode: method used to enter a foreign market Non-equity: Typically smaller in scale, less control, higher dissemination risk. Equity: Typically larger in scale and harder-to-reverse commitments, more control, lower dissemination risks. Generally transform the firm into an MNE Chapter 6: Foreign Direct Investments (FDI) Foreign direct investment (FDI) is the same as Multinational enterprise (MNE), which is a firm which owns and controls operations in more than one country. Firms have different options to enter in foreign countries: Equity vs non equity modes Some key terms of an FDI: - Foreign Direct Investment (FDI) vs Foreign Portfolio Investment (FPI) - FDI flows vs stocks - Inward vs outward FDI. - Parent firm vs foreign subsidiary/affiliate Why do some firms become MNEs? Decision to engage in FDI associated with three factors, named the OLI theory: 1. Ownership 2. Location 3. Internalization Ownership: they have the possession of unique resources that allow to overcome the liability of foreignness. Also defined as firm-specific advantages (FSA). Location: use of resources/assets that are tied to a specific location, example: cheap labor, ideas, etc. Also defined as location-specific advantages (LSA). Internalization: produce in-house rather than using market. International transaction costs are higher -> more opportunism. However, there are risks of market transactions: - Dissemination risk - Less control over production/strategy - More difficult to transfer tacit (implicit) knowledge Benefits of FDI for receiving countries: - Technology spillovers - Direct and indirect employment - Capital inflows improve BoP Costs of FDI for receiving countries: - Loss of sovereignty - Increased competition - Capital outflow (profits) Benefits of FDI for sending countries: - Learning from operations abroad - Increased exports of components/parts - Capital inflows (profits) Costs of FDI for sending countries: - Employment losses - Capital outflow In sense of political ideology and FDI, there are three main views on FDI: 1. Radical view 2. Free market view 3. Pragmatic nationalism Governments can influence a firms’ decision to invest in a country. Policies to stimulate outward FDI: government loans, insurances, tax benefits. Policies to stimulate inward FDI: tax concessions, low interest loans, special economic zones. Governments can also impose restrictions on FDI. Policies to limit outward FDI: prohibit firms to invest in certain countries Policies to limit inward FDI: forbid MNEs to invest in strategic industries, local content requirements. MNEs react to policies by bargaining with host governments. Outcome is dependent on the bargaining power of both sides (which then changes after FDI decision). Aims of the two parties are conflicting: Governments: maximize control and minimize benefits for MNE MNEs: minimize state intervention and maximize profits Chapter 9: Growing and internationalizing the entrepreneurial firm Small and Medium Enterprises (SMEs) are important in the global economy -> 95% of the total number of firms, 50% of the value added. Criteria to be defined as a SME: less than 500 employees (US), less than 250 employees (EU). An entrepreneur is an individual who discover, evaluate, and exploit previously unexplored opportunities. Entrepreneurship is mainly associated with SMEs and therefore, entrepreneurs are founders and managers of SMEs. Entrepreneurship is influenced by institutional environment: Formal institutions How easy it is to start a new entrepreneurial firm. Rules, regulations, etc. Informal institutions Values and norms To be successful, SMEs need to achieve 3 goals: 1. Growth SMEs can’t compete with larger and more established rivals. Need to fully exploit underutilized resources and capabilities. 2. Innovation Sustainable basis for competitive advantage How to innovate: - Radical vs incremental innovation - Product vs process innovation 3. Financing More difficult for SMEs to get capital Alternative sources of financing: - Venture capitalists - Angel investors - Family and friends - Microfinance To be successful, SMEs also need to internationalize. SMEs face a number of barriers associated with: - Limited access to credit - Limited resources - Limited bargaining power with stakeholders How can SMEs enter in foreign markets? 1. Direct modes Exports, licensing, FDI, etc. 2. Indirect modes Indirect exports, supplier/franchisee/licensee of foreign firm, harvest and exit Chapter 12: Making alliances and acquisitions work Strategic alliances: voluntary agreements of cooperation between firms Contractual (non-equity) alliances: association between firms based on contracts. Licensing/franchising, turnkey projects, co-marketing Equity based alliances: association based on ownership or financial interest between partners. Strategic investment, cross-shareholding, joint ventures Turnkey projects work like this: - One of the parties (the contractor) handles every detail of the project for a foreign client - Client is given the key to the plant at completion - Common in chemical, pharmaceutical, petroleum refining, metal refining industries Licensing: right to use a specific intangible asset in exchange of a fee. Franchising: similar to licensing, often used by service firms. + less need of capital to develop operations overseas - lack of control, dissemination risk Requirements for a franchise: - Minimum of $500.000 non-borrowed funds - 12-18 months training program Joint venture: establishing a firm that is jointly owned by two or more otherwise independent firms International Joint Ventures require FDI. + local partner’s knowledge of host country’s competitive conditions, cost/risk sharing - dissemination risk, no tight control, conflicts The challenges of strategic alliance: 1. Finding the right partner Strategic fit: matching of complementary strategic capabilities Organizational fit: similarity in cultures, systems, and structures 2. Designed to maximize benefits and minimize risks Opportunism damage alliances How to prevent opportunism? Swapping critical capabilities or wall off critical skills. 3. To be successful, alliances require hard to find tangible and intangible capabilities Rational capabilities: ability to manage inter-firm relationships. An acquisition is an alternative to alliance. Main drivers of acquisitions: - Synergistic - Hubristic - Managerial How to perform an acquisition: 1. Acquire firm shareholders 2. Target firm shareholders Advantage of alliances: - Reducing costs, risks, uncertainties - Use as real options Advantage of acquisitions: - Quickly acquire sizable presence in the market - No opportunism Risk of alliances: - Choosing wrong partners - Opportunism - Competitors nurturing Risks of acquisitions: - Higher costs and commitment - Resistance from local stakeholders Decision whether to choice alliances or acquisitions are driven by institutional factors. Antitrust authorities more favorable to alliances. Acquisitions can be restricted in strategic sectors. Chapter 13: Strategizing, structuring, and learning around the world How can MNEs succeed in foreign markets? - Configuring the internal network effectively - Managing the external network of relationships Managing MNEs internal network: Two set of pressures influence MNEs strategies: 1. Cost reduction -> global integration Global competition increased Need to standardize products and integrate activities 2. Local responsiveness -> local adaption Adapt products/services to local tastes Regulations, norms are different among countries Four strategic choices: 1. Home replication (international division) Pressure for Local Responsiveness: low. Pressure for Global Integration: low. - Centralized knowledge and expertise - Leverage home country advantages - Easy to implement - Little adaptation to local needs 2. Localization (geographic area) Pressure for Local Responsiveness: high. Pressure for Global Integration: low. - Subsidiaries develop/retain knowledge - High adaption to local needs - Too much local autonomy - Duplication of efforts – high costs 3. Global standardization (global product division) Pressure for Local Responsiveness: low. Pressure for Global Integration: high. - Leverage low-cost advantages - Centers of excellence - Lack of local responsiveness - Too much centralized control 4. Transnational (global matrix) Pressure for Local Responsiveness: high. Pressure for Global Integration: high. - Cost efficient and locally responsive - Global learning/diffusion of innovations - Organizationally complex - Difficult to implement Each strategic choice requires a specific organization structure: - International division - Geographic area structure - Global product division structure - Global matrix The best organizational structure depends on stage of product life cycle and other factors. Strategic choices influence knowledge management: developing, utilizing, and transferring knowledge. Two types of knowledge: 1. Explicit = codifiable; transmittable by IT. 2. Tacit = not codifiable; needs learning-by-doing. MNEs prefer to manage knowledge internally. However, R&D offers diminishing returns. Emergence of open innovation model: - Collaborative research with other firms and university labs. - Role of agglomeration of innovative firms (e.g. clusters). - Internationalization driven by innovation-seeking. Chapter 14: Competing om marketing and supply chain management MNEs should also manage external networks of relationships with local and global actors. Two aspects are relevant: - Global marketing - Supply chain management Successful marketing requires a mix of four factors (the four Ps): Product Product standardization vs. local adaption Market segmentation (between and within countries) Price Total cost of ownership: purchase price vs. after-sales products and services Price-sensitivity (elasticity) of demand Price policies affected by institutional constraints Promotion Standardized vs localized promotion Perception of home-country firms/products (country-of-origin effects) Channel/media: offline (traditional) vs. online Place -Intensive vs. selective distribution Long vs. short distribution channel How to manage the different stages of the production process (supply chain management) Global value chains (GVCs) vs Global Supply Chains (GSCs) Globalization of production: production is more fragmented. New division of labor -> Global Value Chains Triple A in supply chain management: Agility: react speedily to sudden changes in demand or supply. Adaptability: adapt to changes in environment and technology. Alignment: align the interest of all the firms in the supply network. Chapter 16: Financing and governing the corporation globally Financing: how a firm’s money, banking, and investment are managed. Corporate governance: relationships among the main participants of the firm. Cross-listing: firm’s shares on foreign stock exchanges. + lower costs of capital, visibility, and reputation - meeting reporting and compliance requirements, volatility spillover Functional excellence depends also on corporate governance: system of rules, practices, and processes by which a firm is directed and controlled. Relationships between: - Owners - Managers - Board of directors Ownership can be diffused or concentrated: Diffused ownership - Numerous shareholders, no dominant level of control - Ownership and control separated - Popular in the UK Concentrated ownership - Majority of shared held by one or few owners - Little separation between ownership and control - Popular in Continental Europe and Japan Family firms feature concentrated family ownership/control + less conflicts between owners and managers, long-term view - selection of less-qualified managers, less diversity, authoritative leadership State-owned enterprises (SOE) feature concentrated ownership/control by the state. More diffused in developing countries, specific sectors (natural monopolies) + pursue public interest, help stabilizing an industry during crises - lack of incentives, poor performance, political interference Principal-agent problem: Principal-principal problem: Board of directors: intermediary between owners and managers. The board can be led by a separate chairman or by the CEO (CEO duality). Main functions of the board: - Control - Advising - Rewards and penalizes management Corporate governance can be based on internal mechanisms (voice-based) or external mechanisms (exit-based). Chapter 17: Managing corporate social responsibility globally Uneven economic effects of globalization: - Substantial reduction of poverty in certain areas - Increased inequality between and within countries Income gap between rich and poor countries Income disparities within both rich and poor countries Environmental effects of globalization - Climate change, waste, pollution Stakeholders: any group or individual who can affect or is affected by the actions of the firm. Traditional role of firms: maximize shareholders’ value. Corporate Social Responsibility (CSR): focus moved from shareholders to stakeholders. Different approaches to CSR: Stakeholders interaction and CSR promotion have an old paradigm and new paradigm. In the old paradigm there was limited interaction and independent roles. In the new paradigm, there was integration, collaboration and partnerships.