(1) Should you sell in global markets?

advertisement

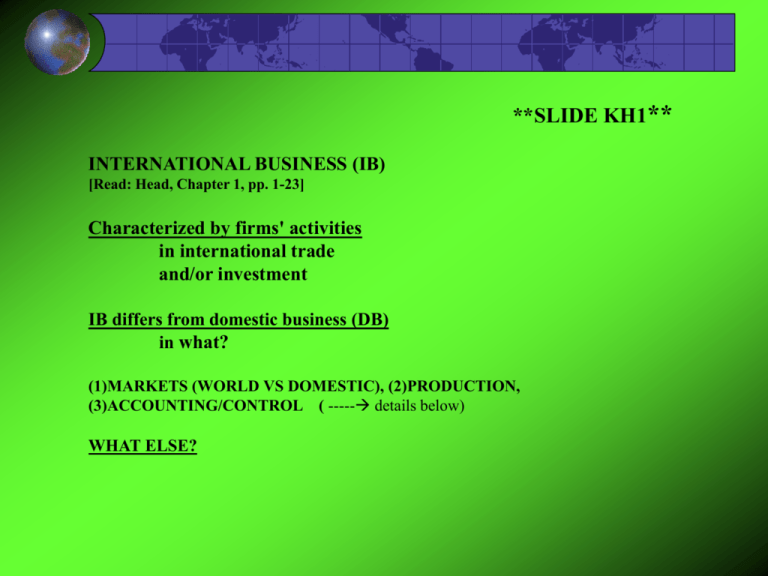

**SLIDE KH1** INTERNATIONAL BUSINESS (IB) [Read: Head, Chapter 1, pp. 1-23] Characterized by firms' activities in international trade and/or investment IB differs from domestic business (DB) in what? (1)MARKETS (WORLD VS DOMESTIC), (2)PRODUCTION, (3)ACCOUNTING/CONTROL ( ----- details below) WHAT ELSE? Broadly speaking, there are at least six factors that separate IB from DB (Head). They are: (1)Political separation, (2)physical separation, (3)relational separation, (4)environmental separation, (5)developmental separation, and (6)cultural separation. In IB, one or more of these separations significantly affect company business. In DB, these are all negligible factors. (Is this always true?) SPECIFIC ISSUES (1) Should you sell in global markets? (Where, why/why not?) GLOBAL MARKETS BRING growth, scale economy, technology, competitiveness, ....... Why?? Thanks to the GATT / WTO(?), world trade has grown massively. GLOBAL MARKETS BRING GROWTH (FIGURE 1.1), SCALE ECONOMY, TECHNOLOGY, COMPETITIVENESS, ... WHY ?? Because of added market size and competition Who sells globally? Who doesn't sell globally? Any correlation with competitiveness? WHAT MATTERS IN SELLING IN FOREIGN MARKETS ? CULTURE? Should you modify your products? What should you modify ? (2) Should you produce / procure globally? - TI has 50 plants in 19 countries. -HP's new product development team: members from JAPAN, the US, the UK, GERMANY work jointly real-time. -Why ? WHICH CAR IS THE MOST "AMERICAN"? (All sold in the U.S. market) MAZDA NAVAJO (sold by Japan’s Mazda Co.) DODGE STEALTH (sold by U.S./German Mercedes Chrysler) MERCURY CAPRI (sold by U.S. Ford) GEO PRIZM (sold by U.S. GM) FORD TAURUS (sold by U.S. Ford) HONDA ACCORD WAGON (sold by Japan’s Honda) "Domestic (American) content index" MN-75, DS-28, MC-18, GP-64, FT-100, HAW-65 What determines domestic content index? THE REASON: where cars (and car parts) are produced Why produce overseas? Market proximity, product modification, foreign technological and production skill, cost, reliability,.. WHERE SHOULD YOU PRODUCE? Where should you procure your parts/services? Should you build your factory overseas? (foreign direct investment) Ability in global networking is a source of firms’ competitiveness Removal of investment (FDI) and trade barriers would allow firms to develop global networks according to firms' strategies. E.G. Shifting marketing/production effort to where growth is globally. DIFFERENCE BETWEEN DB AND IB COUNTRY-SPECIFIC FACTORS: cheap labour, what else? CULTURE, INSTITUTIONS, LANGUAGE, .. --> NOT A SERIOUS FACTOR IN DB IMPLICATIONS -in international marketing, consumer behaviour may differ from DB -in production, HRM may differ from DB -standard of living/cost/wages may differ, but note: NOT ALL FDI GOES TO LOW WAGE COUNTRIES. (Figure below.) -Competent firms are able to take advantage of the above differences by turning them into expanded new opportunities not available from domestic sources. NOT ALL FDI GOES TO LOW WAGE COUNTRIES. -Cheap labour is not always the reason for FDI -Competent firms are able to take advantage of the above country-specific differences by turning them into expanded new opportunities not available from domestic sources. Portfolio investment and foreign direct investment. We'll discuss FDI in depth later in the course. Some stats: Canada 2004. Transaction: Canada (2004) + Money in (Bn$) - Money out (Bn$) Goods (exports+) 429 363 Services (exports+) 62 74 Income (receipts+) 38 63 Portfolio (sales+) 55 19 FDI (sales+) 8 62 (3) INTERNATIONAL ACCOUNTING/TAXATION is problematic. A FIRM MUST HAVE A HOME COUNTRY despite its business activities in other countries. The firm’s home country taxes the firm, but other countries also want to tax it. (Note: Tax treaties between countries may or may not exist. Even if they exist, they often do not completely cancel out double taxation.) TRANSFER PRICING IS ANOTHER ISSUE. Can firms maintain many sets of books for international taxation purposes?