Advanced Microeconomics

Final Examination

Sunday, January 8, 2023.

9:00 am-11:00 am

㎫㵀㵍㔋 11:05 㺐㍰⯿ㅩ㈈㷹☨▖≦㔋║㺣㫓㥠㟜

㐯ⶌ⫊ⓁⰏⴋ⭝⼯➶

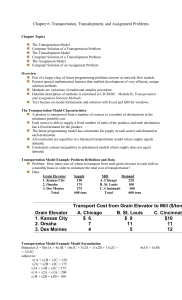

1. (25’) The following figure shows the production set of a technology. Please answer

the following questions and explain your answer.

y2

Y

y1

(a) Does the production set satisfy possibility of inaction (i.e., 0 ∈ Y )?

(b) Does the production set satisfy no free lunch (i.e., Y ∩ RL+ ⊆ {0} )?

(c) Does the production set satisfy irreversibility (i.e., 0 ̸= y ∈ Y ⇒ −y ∈

/ Y )?

(d) Does the production set satisfy DRS (i.e., y ∈ Y ⇒ αy ∈ Y, ∀α ∈ [0, 1])?

(e) Does the input requirement set V (y2 ) = {y1 : (−y1 , y2 ) ∈ Y } satisfy convexity?

2. (25’) Consider a production economy with two consumers and one firm. Consumption sets are given by X1 = X2 = R2+ . Utility functions are

u1 (x11 , x21 ) = ln(x11 ) + ln(x21 ) + 8

u2 (x12 , x22 ) = ex2 ·x2 − 6

1

2

The firm uses good 1 to produce good 2, and the production set is

}

{

√

Y = (−y 1 , y 2 ) : y 2 ≦ y 1 , y 1 ≧ 0, y 2 ≧ 0 .

Suppose the firm is fully owned by consumer 1. Endowments w1 = (w11 , w12 ) > 0,

w2 = (w21 , w22 ) > 0. It is clear that zero prices cannot be a CE price. So, let

p = (p1 , p2 ) = (1, p) > 0.

√

(a) Determine the returns to scale of the production function y 2 = y 1 .

Hint: ∀t > 1, CRS: f (tx) = tf (x); DRS: f (tx) < tf (x); IRS: f (tx) > tf (x).

(b) Solve the firm’s profit maximization problem.

(c) Solve consumer 1’s utility maximization problem.

1

(d) Solve consumer 2’s utility maximization problem.

(e) Write down the equations that determine the CE price. (You are not required

to solve for the CE price)

3. (20’) Consider a pure exchange economy with two consumers (A and B) and two

goods (good 1 and good 2). Initial endowments are given by

wA = (5, 5), wB = (5, 15).

Utility functions are

UA (x1A , x2A ) = ln (x1A ) + x2A , UB (x1B , x2B ) = (x1B )3 (x2B )2 .

Suppose consumers always consume strictly positive quantities of each good.

(a) Draw the Edgeworth box with initial endowment w and indifference curves

passing through w.

(b) Find the equation of the interior Pareto efficient allocations.

(c) At the prices given by p1 = p2 = 1, does market clearing condition hold?

(d) Solve for the competitive equilibrium prices (p∗1 , p∗2 ).

4. (30’) Consider a pure exchange economy with two consumers (A and B) and two

goods (good 1 and good 2). Initial endowments are given by

wA = wB = (1, 1).

Utility functions are

UA (x1A , x2A ) = x1A + x2A , UB (x1B , x2B ) = max{x1B , x2B }.

(a) Draw the Edgeworth box with initial endowment w and indifference curves

passing through w.

(b) Find the contract curve in the Edgeworth box.

(c) Find the set of core allocations in the Edgeworth box.

(d) At the prices given by p = (p1 , p2 ) > 0, find the demand functions.

(e) Solve for the competitive equilibrium allocation and equilibrium prices (p∗1 , p∗2 ).

(f) Is the equilibrium allocation Pareto efficient? Justify your answer.

2