The Price in Time - A Powerful High Profitability Day Trading Method

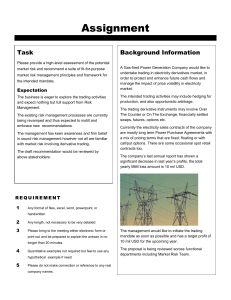

advertisement