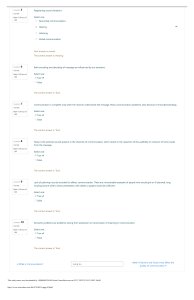

SOLUTIONS MANUAL CASE 12 Appraising Long-term Investments at Kreativ Künste Productions Instructor’s Manual—Guidance for instructors This Instructor’s Manual is prepared for the sole purpose of aiding classroom teaching of the cases found in the Integrated Case Studies for Accounting text. It is strictly not for students or posting. The solutions/points are mostly suggested guides and instructors are therefore advised to use their judgement when analysing and discussing the cases. Instructors are encouraged to consider various alternative views as appropriate. Synopsis Kreativ Künste Productions (KKP) is a private company established in 2012 that produces films, advertisements and stage theatre shows. The company also produces and records music for publication and manages talents for hire. KKP has plans to expand its business both product- and market-wise. KKP has been approached by two television companies with requests to make a series of documentaries for television broadcast for the next five years. According to the finance manager, Ms Jothy, the initial financial outlay for the documentary project is estimated to cost the company RM500,000. Among other things, the CEO has asked Ms Jothy to prepare a five-year cash flow projection for the documentary project and report on the company’s performance for 2018. Teaching objectives In this case, students will be able to: • Evaluate long term decisions using investment appraisal methods • Analyse the firm’s performance using appropriate ratios • Use their business acumen to develop an appropriate mission statement • Apply the Ansoff matrix to identify the product market strategy Audience for the case • Undergraduate students studying for accounting and business-related courses • Postgraduate students studying for accounting and business-related courses This study source was downloaded by 100000866463744 from CourseHero.com on 01-26-2024 18:48:15 GMT -06:00 https://www.coursehero.com/file/157301463/Case12pdf/ Solutions Manual 2 Brief suggestion on how the case may be used in class Opening trigger questions • • • • Explain the different methods of evaluating capital investment projects. How do ratios help determine a firm’s performance? How do you develop a clear mission statement? Explain the Ansoff matrix. Consolidate through self-Learning • Get students to conduct an internet search of a business similar to KKP and analyse the value chain activities of such an industry. Ways in which the class may be conducted • • • • Group discussion Presentation Individual learning Literature review and internet search Suggested answers to application questions 1 Using the information in Appendix 1, evaluate the documentary project using the payback method and the net present value method. Payback period = 4 Year 7 months Net present value Y0 Cost (RM’000) Revenue (RM’000) Production cost (RM’000) Non-production costs (RM’000) NCF (RM’000) Tax payable PY CY Tax credit PY CY NCF after tax DF @ 10% PV Y1 Y2 Y3 Y4 Y5 250 (92.5) 300 (115) 320 (124) 380 (151) 420 (169) (67.5) (72) (80) (95) (115) 113 116 134 136 (17.4) (20.1) (20.1) (20.4) 500 (500) 90 – (13.5) (500) 1 (500) (13.5) (16.95) – 15 15 12 91.5 109.55 0.9091 0.8264 83.18 90.53 Net present value (16.95) (17.4) 12 9.6 103.25 0.7513 77.57 9.6 7.68 113.78 0.6830 77.71 This study source was downloaded by 100000866463744 from CourseHero.com on 01-26-2024 18:48:15 GMT -06:00 https://www.coursehero.com/file/157301463/Case12pdf/ Y6 7.68 29.22 132.4 0.6209 82.21 (20.4) 29.22 8.82 0.5645 4.98 (83.82) Appraising Long-term Investments at Kreativ Künste Productions Tax credit workings Tax credit Initial cost (‘000) Tax depreciation 500 (100) 30 PY = – CY = 15 End of Y1 NBV Tax depreciation 400 (80) 24 PY = 15 CY = 12 End of Y2 NBV Tax depreciation 320 (64) 19.2 PY = 12 CY = 9.6 End of Y3 NBV Tax depreciation 256.0 (51.2) 15.36 PY = 9.6 CY = 7.68 End of Y4 NBV Tax depreciation 204.80 (40.96) 12.288 PY = 7.68 CY = 6.144* End of Y5 NBV Disposal value Balancing charge Y5 163.84 (10.00) 153.84 46.152 CY = 23.076* *Y5 amount PY = 6.144 PY = 23.076 Year 6 • Interpret and discuss the above calculations with the students 2 Evaluate the company’s performance for the year 2018. Profitability ratios Operating profit × 100 *Capital employed *NCA + CA – CL + CE 121 × 100 = 20.2% 585 ROCE = Profit margin = Operating profit Sales Asset turnover = Sales × 100 Capital employed margin = Operating profit Sales × 100 × 100 121 × 100 = 21.8% 556 556 = 0.95 times 585 352 × 100 = 63.3% 556 Liquidity ratios Current ratio = CA:CL 273 : 138 = 1.98: 1 Acid test = (CA – Inventory): CL 223 : 138 = 1.62: 1 This study source was downloaded by 100000866463744 from CourseHero.com on 01-26-2024 18:48:15 GMT -06:00 https://www.coursehero.com/file/157301463/Case12pdf/ 3 Solutions Manual 4 Working capital management Inventory days = Ave. inventrory × 365 COGS 20 × 365 = 35.78 days 204 AR days = Trade debtors × 365 Credit sales AP days = Trade creditors × 365 *Credit sales *or COGS 73 × 365 = 47.92 days 556 13 × 365 = 23.26 days 204 • Interpret and discuss the above calculations with the students. 3 Despite having a clear set of strategic objectives the company does not have a mission statement. The CEO feels that this should be remedied as a matter of urgency. Discuss the issues which KKP should consider when creating an appropriate mission statement. Your mission statement should reflect your business’s special niche. Studying other companies’ statements can fuel your creativity. Points that can be considered in the discussion are available online in the article ‘10 questions to answer when writing your mission statement’ (Entrepreneur, February 2015): www.entrepreneur.com/article/241954. Ten questions to help you create an appropriate business mission: 1 Why are you in business? Think about the spark that ignited your decision to start a business. 2 Who are your customers? What can you do for to satisfy customer needs? 3 What image of your business do you want to convey? To customers, suppliers, employees and the public? 4 What is the nature of your products and services? What factors determine pricing and quality? 5 What level of service do you provide? Don’t be vague; define what makes your service so extraordinary. 6 What roles do you and your employees play? What type of leadership style that organizes, challenges and recognizes employees. 7 What kind of relationships will you maintain with suppliers? To ensure effective supply chain management. 8 How do you differ from competitors? What do you do better, cheaper or faster than competitors? 9 How will you use technology, capital, processes, products and services to reach your goals? You need to identify your strategy which will keep goals focused. 10 What underlying philosophies or values guided your responses to the previous questions? Writing them down clarifies the ‘why’ behind your mission. This study source was downloaded by 100000866463744 from CourseHero.com on 01-26-2024 18:48:15 GMT -06:00 https://www.coursehero.com/file/157301463/Case12pdf/ Appraising Long-term Investments at Kreativ Künste Productions 5 4 Discuss where the proposal to make documentaries for television would feature in Ansoff ’s product–market matrix. EXISTING NEW MARKET PENETRATION MARKET DEVELOPMENT LOW RISK EXISTING MARKET NEW RELATED PRODUCT DEVELOPMENT DIVERSIFICATION UNRELATED HIGH Source: www.business-to-you.com/ansoff-matrix-grow-business/ • • • • • The Ansoff matrix consists of four strategies for growth. The matrix (also known as the product–market expansion grid) allows managers to quickly summarize these potential growth strategies and compare them to the risk associated with each one. Market penetration is about selling more of the company’s existing products to existing markets. To penetrate and grow the customer base in the existing market, a company may cut prices, improve its distribution network, invest more in marketing and increase existing production capacity. Product development is about developing and selling new products to existing markets. Companies could, for example, make some modifications in the existing products to give increased value to the customers for their purchase or develop and launch new products alongside a company’s existing product offering. Market development is about selling more of the company’s existing products to new markets. This strategy is about reaching new customer segments or expanding internationally by targeting new geographic areas. Diversification strategies are about entering new markets with new products that are either related or completely unrelated to a company’s existing offering. In the case of KKP, the development of documentaries for television represent a product development strategy. However, if the rights of these documentaries are sold to television industries in other countries, it will also be part of the market development strategy. This study source was downloaded by 100000866463744 from CourseHero.com on 01-26-2024 18:48:15 GMT -06:00 https://www.coursehero.com/file/157301463/Case12pdf/ Powered by TCPDF (www.tcpdf.org)