Cambridge International AS & A Level accounting COURSEBOOK 2022

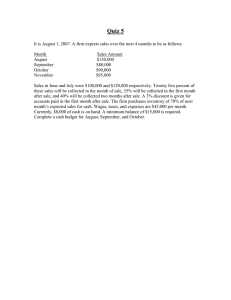

advertisement