Financial Accounting Principles: Journal Entries & Trial Balance

advertisement

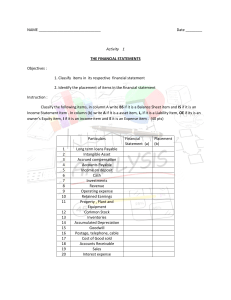

[DR. NABIL ABD ELRAOUF] Principles of Financial Accounting Principles of Financial Accounting Dr. Nabil Abd Elraouf Section 6 TA: Ahmed Sa'eed The Second Chapter Understand the Accounting Framework General Journal and Accounting Equation: 1- Journalizing Transactions and Events: Ex. No. 2 P. 34 (Accounting Principles – Kieso – P1-4A) Gordon Beckham started his own delivery service, Beckham Deliveries, on June 1, 2012. The Following occurred during the month of June. June 1 2 3 5 9 12 15 17 20 23 26 29 30 Page 1 Gordon invested $10,000 cash in the business. Purchased a used van for deliveries for $12,000. Gordon Paid $2,000 cash and signed a note payable for the remaining balance. Paid $500 for office rent for the month. Performed $4,400 of services on account. Withdrew $200 cash for personal use. Purchased supplies for $150 on account. Received a cash payment of $1,250 for services provided on June 5. Purchased gasoline for $200 on account. Received a cash payment of $1,300 for services provided. Made cash payment of $600 on the note payable. Paid $250 for utilities. Paid for the gasoline purchased on account in June 17. Paid $1,000 for employee salaries. TA: Ahmed Sa'eed [DR. NABIL ABD ELRAOUF] Principles of Financial Accounting Beckham Deliveries General Journal Date June. 23 June. 26 June. 29 June. 30 Account & Explanation Notes Payable Cash Made a cash payment on the note payable Utilities Expense Cash Paid cash for utilities Accounts Payable Cash Paid for the gasoline purchased on account on June. 17 Salaries Expense Cash Paid for employees salaries Debits (Dr.) Credits (Cr.) $600 $600 $250 $250 $200 $200 $1,000 $1,000 2- How the Transactions affect the Accounting Equation: Transaction 10: Basic Analysis: Gordon paid cash on the note payable (from transaction 2) so that means cash will be decreased and since cash is an Asset so it will be credited, and on the other side note payable is debited as it has decreased and it is a liability. Transaction 11: Basic Analysis: He then paid cash for utilities, so it will be credited as it's an Asset, and utilities expense will be debited as it is an expense account. Transaction 12: Basic Analysis: Gordon pays cash for gasoline purchased on account on June 17, which will be credited as it is an Asset, and accounts payable will be debited as it has decreased. Transaction 13: Basic Analysis: Gordon paid cash for Employees Salaries, so it will be credited as it's an Asset, and utilities expense will be debited as it is an expense. Page 2 TA: Ahmed Sa'eed [DR. NABIL ABD ELRAOUF] Principles of Financial Accounting Beckham Deliveries Trial Balance 30, June 2012 Accounts Cash Cars Supplies Accounts Receivable Accounts Payable Notes Payable Owner's Capital Owner's Drawing's Services Revenue Rent Expense Gasoline Expense Utilities Expense Salaries Expense Page 3 Debits 7,800 12,000 150 1850 200 500 200 250 1,000 23,950 Credits 150 9,400 10,000 4,400 23,950 TA: Ahmed Sa'eed Equation Analysis: Assets Cash 1 2 + +10,00 0 -2,000 3 4 5 6 -500 7 8 +1,250 9 10 11 12 13 +1,300 -600 -250 -200 -1,000 7,800 Cars = + Supplies + Accounts Receivable = Liabilities Accounts + Payable Notes Payable + + Owner's Equity Owner's Capital + Owner's Drawings + Revenues - +10,000 +12,000 +10,000 -500 +4,400 +4,400 -200 -200 +150 +150 -1,250 +200 -200 -1,300 -600 -250 -200 + 12,000 + 21,800 Page 4 Expenses 150 + 1,850 = = 150 + 9,400 + 10,000 - 200 + 4,400 - -1,000 1,950 21,800 TA: Ahmed Sa'eed