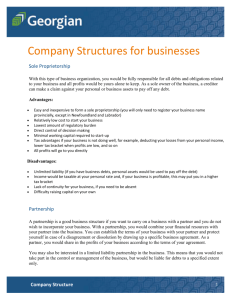

CONCEPT OF BUSINESS Introduction Human activities can be classified into 2 categories i.e. economic activities and non economic activities. Non economic activities are directed towards social services and charitable work. They are influenced by non economic considerations like sympathy, humanity and love. Economic activities include production and distribution of goods and services for the satisfaction of human needs and wants. Economic activities can be classified into the following categories: 1. Profession: These include the services provided from the expertise of people. They rely on the expertise possessed by the people providing the services e.g. artists, lawyers, doctors and accountants 2. Employment: This is an occupation where one works under an agreement with an employer and gets a remuneration/ pay in form of salaries and wages. Professionals also take up employment in government and private enterprises. 3. Business: All other economic activities which result in production and distribution of goods and services and are influenced by economic considerations are treated as business. Definition of Business 1. An organization that provides goods or services for a profit 2. Prof. Owen: Business is an enterprise engaged in production and distribution of goods for sale in the market or rendering of services for a price 3. Prof. Dicksteen: Business is a form of activity pursued with the objective of making profit for the benefit of those on whose behalf the activity is conducted 4. From an activity concept, business refers to an economic activity which is primarily organized and directed to manufacture or produce goods and services at a profit. Features / Characteristics of Business From the above definitions, the following features of business can be derived: 1. Business is an economic activity: Only economic activities which have an economic connotation are considered business 2. Profit motive: The primary objective of business is to earn profits 3. Sale and transfer of goods and services: Business involves sale or transfer of goods and services for value. Any transfer of goods or services not changed for money would not constitute business 4. Regular dealings in goods and services: In business there must be a flow of goods and services with time 5. Risks: In business the entrepreneurs must be willing to take risks. Business always involves elements of risk and uncertainty 6. Customer satisfaction: In order to succeed and thrive, business must satisfy customers. Without customer satisfaction business cannot continue to give rise to profits. Classification of Business Business can be classified as Industry and Commerce. Industry Industry involves production of goods and services. The term industry refers to the production of wealth. The product of an industry maybe used by the final consumer in which case they are referred to as consumer goods or they maybe used by other industries for further production and thus are referred to as capital goods. Industry maybe subdivided into the following: 1. Manufacturing: Industries engaged in converting raw materials into fully finished goods 2. Construction: Industries engaged in construction of buildings, dams and roads 3. Generic: Industries concerned with plant breeding, cattle breeding, poultry, fisheries and other agricultural activities 4. Extractive: Industries involved in deriving resources from nature like mining and quarrying Industries maybe classified according to the following bases: 1. Size and scale of operation: Here we have small scale, medium scale and large scale industries 2. Investment: Here industries are determined by the amount of investment required thus we have heavy and light industries 3. Ownership: Industries in this case are classified by their ownership thus they can be private sector industries, public sector industries and joint sector industries 4. Immediate activities: Thus we have manufacturing, construction, generic and extractive Commerce Commerce refers to the distribution of goods or services. It is a system which delivers the right goods to the right customer at an appropriate time, place and price. Commerce can also be referred as the totality of those processes 1 engaged removing the hindrances or obstacles in exchange of goods or services. Commerce therefore includes trade and all the aids to trade. Trade This is an exchange of goods and services for a price. Trade is basically concerned with purchase of goods and services and their sale. It is the process of directing goods from the place of production to the consumer. Trade is of two types i.e. home trade or internal trade and foreign trade or external trade. Home trade is carried within the borders and it can either be retail or wholesale trade. Foreign trade goes beyond the borders of a country and can either be export or import trade. Aids / Auxiliaries to Trade These are those factors that make trade possible. They are as follows: 1. Transport and Communication: Transport refers to conveyance of goods and passengers from one place to another. Well developed transport facilities are important in the location and growth of industries. Communication is the conveyance of information from one place to another. It is essential for passing information regarding goods or services available. Communication is therefore essential for trade. 2. Banking and Finance: Capital is a very crucial element. If a business doesn’t have sufficient capital it cannot survive. In addition businesses need to collect money and disburse money. Bankers and financiers provide businesses with financial services like safekeeping of money, provision of loans and overdrafts, mortgages, collection and disbursement of money and facilitation of foreign trade transactions. In addition banking and financial institutions provide further investment channels for businesses with surplus funds. 3. Insurance: Business involves a lot of risks. Insurance provides businesses with protection against these risks. The insurance field has developed to cover certain risks which were not covered by traditional insurance which further enhances the growth of businesses. 4. Advertising and Publicity: A good product may lack the market if customers are unaware of its existence. Advertising is a service which gives information to potential customers about goods and services. Publicity is an attempt to manage the public’s perception of a given subject. It seeks to enhance the image of a product. Advertising and publicity assist trade by generating demand for goods and services. 5. Warehousing: Goods are sometimes produced at a time when there is no demand for them or more goods are produced than the demand. If the demand is less than supply, prices tend to decline which may lead to losses. To avoid such a situation, businesses sometimes store the goods which are not required immediately. Warehousing preserves goods from the time of production to the time of consumption. 6. Market Research: This involves obtaining information about the market in which a business is operating in. This enables the business understand its customers and their needs and wants. If a business produces goods or services that the market is not interested in, it is bound to fail. Market research therefore is crucial to the business since it gives business information about the customer. Objectives of Business The objectives of a business are the reasons or aims for which the business exists. The objectives of a business undertaking can be understood from the various stakeholders’ viewpoints. Business stakeholders include customers, owners, employees, suppliers, government and the community. For instance owners expect profits, employees require good remuneration, customers require quality goods and services at reasonable prices and the government expects the business to pay taxes. The following are the main business objectives: 1. Profit making: The primary objective of a business is to make profits otherwise the owners would not continue running it. However, business has increasingly been challenged on this goal and therefore profit maximization at the expense of other stakeholders is considered harmful and inappropriate. Therefore business has other secondary objectives. 2. Customer Satisfaction: Business activities are intended to satisfy customers’ needs and wants. Any business which does not satisfy its customers is bound to fail. 3. Innovation: Every business goes through stages i.e. infancy, growth, maturity and decline. When the business reaches maturity, it has to come up with new ideas in order to survive and avoid declining. This is especially crucial in the modern day competitive world where customers have many choices. Without innovation a business has no long term survival prospects. 4. Development of Human Resource: The importance of the human factor in business cannot be underestimated. If the human factor is overlooked the business cannot survive. Human resources exert their willingness, zeal and cooperation on behalf of the business and therefore should be encouraged. Employees should be paid fair remuneration and given proper working conditions. 5. Fulfilling Social Objectives: A business gets all the factors of production from the society. It is therefore expected to produce goods and services for the society in good and sufficient quantities. It should also avoid antisocial behaviour like profiteering and environmental pollution 2 6. Achievement of National Goals, Economic Growth and Development: Every business should operate in such a way that national goals are achieved. It should provide employment, pay taxes and engage in other development projects in a country. FORMS OF BUSINESS UNDERTAKINGS SOLE PROPRIETORSHIPS / SOLE TRADER This is the simplest form of a business organization. It is owned and usually operated by one person who provides all the necessary capital and other resources. He engages in business on his own account. The business has no separate existence from the owner. A sole trader is entitled to all the profits or losses from the business. This implies that business liabilities are also his personal liabilities i.e. there is unlimited liability. Therefore if a business suffers a loss to an extent that the business assets are not enough to cover the debts, the sole trader will be required to pay the debts from his private sources. The sole trader can manage his business alone or employ people to assist him but he remains the final authority. Sole proprietorships are usually localized and are most suitable for small enterprises especially at start up. They are simpler to manage. Features / Characteristics of Sole Proprietorships 1. No legal requirements to be met 2. Involves investment of own or borrowed capital 3. No sharing of profits or losses 4. Management and control is exercised by the owner 5. Not governed by any special legislation Advantages of Sole Proprietorships 1. It is easy to start because there are few legal restrictions 2. Faster decision making since the sole trader makes all the decisions himself. Implementation of decisions is also faster since there are fewer people involved. 3. The sole trader enjoys all the profits himself which encourages hard work. He is also keen to avoid losses. 4. Sole trades have direct contact with their customers, employers and suppliers which is likely to lead to better services and therefore better returns. 5. The sole trader is in a better position to keep business secrets than in any other business form 6. The sole trader enjoys freedom and flexibility which fosters an entrepreneurial spirit. He can try anything within the legal boundaries to make his business succeed. Disadvantages 1. Unlimited liability therefore personal property can be called upon to settle business debts 2. Sole traders are often unable to raise sufficient capital since they rely on their own ability to raise cash 3. Sole traders may not be able to attract and maintain highly qualified employees due to the inability to provide them with attractive terms and conditions 4. Lack of continuity since the life of the business is pegged on the owner’s presence 5. Sole traders suffer from lack of training and specialization. Since they also have to put in long hours they do not have time for self development. PARTNERSHIPS It is a relationship existing between two or more persons jointly carrying out a business with the objective of making a profit. Each person is referred to as a partner and the business is called a firm. In a partnership a number of people work together and there is no separate identity of the firm from the individual partners. Each partner contributes money, property and labour and in turn the partners share in the profits and losses of the business. A partnership can be formed by agreement between the partners when they want to use their personal names to constitute the name of the firm. If they want to use a different name, the firm’s name must be registered at the Registrar General’s office. A partnership can either be permanent or temporary. A permanent partnership is expected to continue indefinitely i.e. the date of termination is unknown at the time of formation. A temporary partnership is formed for either a specific period or purpose. At the expiry of the period or fulfillment of the purpose, the partnership is automatically dissolved. Characteristics of Partnerships 3 1. 2. 3. 4. 5. 6. 7. Membership: A partnership is formed by two or more persons and the membership should not exceed 20 persons in general business, 10 persons in banking business and 50 persons for professional services provided every member is a professionally qualified person. If membership exceeds this, the operations of the firm can be deemed illegal Contractual Relationship: The partnership arises from a contract. It is created by mutual and voluntary agreement. Implied Authority: The partners are authorized to act on behalf of the firm. The firm is bound by the acts of any of the partners. Principal and agent relationship: In a partnership every partner is a principal and an agent. All the partners need not take part in the day to day running of the firm, therefore each partner is authorized to act on behalf of the firm. Unlimited liability: Each partner is jointly and severally liable for the debts of the firm. If the firm’s assets are insufficient to settle business debts, the partners’ personal property can be attached to settle the debt. Restriction on transfer of interests: A partner cannot transfer his interest in the partnership without the consent of the core partners. No legal or separate existence of the partnership from the partners. Types of Partnerships Partnerships are of two types: 1. General Partnerships: In this type all the partners are general partners that is they share in the financial liabilities of the business and have unlimited liability in the business. 2. Limited Partnerships: These types of partnerships allow for limited partners who invest money and are also liable for debts only to the extent of their investments. Limited partnerships must have at least one general partner for liability purposes. Types of Partners 1. General partner: This partner has unlimited liability for the firm’s debts 2. Limited partner: Has limited liability equal to his investment in the firm 3. Active partner: Partner who shares in every way including capital contribution, management, profits and losses. He may have a fixed area of responsibility and is usually disclosed to the public as a partner. In ordinary partnership practice there must be one active partner 4. Dormant / Sleeping / Silent partner: He contributes capital but does not take part in the day to day activities of the firm. He is also disclosed to members of the public as a partner 5. Nominal partner: He is not one of the partners but allows his name to be associated with the firm. He does not take part in management or contribute to capital but has unlimited liability. He will usually lend his name to the firm for a fee and mostly is a well known person who can enhance the firm’s prestige and reputation. 6. Quasi partner: Is a person who is presented to the public as a partner although he contributes no capital and does not participate in the management of the firm. He has unlimited liability in the debts of the firm 7. Minor partner: A partner who is under the statutory majority age of 18 years. Since he is a minor his liability is limited to his capital. However on attaining the majority age he ranks as an active partner with unlimited liability Partnerships are governed by a Deed of Agreement or the Partnership Act (Cap 29). Where the Deed exists it operates instead of the provisions of the Act since a partnership operates under mutual understanding. The Deed is the evidence of partnership and is used incase of dispute. It can be registered in a court of law however this is not compulsory. The Deed defines the following terms and conditions regarding the internal management of the partnership. 1. Name, duration and purpose of the business 2. Location of the business and commencing date 3. Name, address and occupation of each partner 4. Status or type of each partner 5. Capital contributed and in what ratios 6. Interest rates to be paid on capital if any 7. Duties, responsibilities, rights and remuneration of the partners 8. How profits and losses will be shared 9. Drawings allowable and interest on drawings if any 10. Admission, withdrawal and expulsion of partners In the absence of a Partnership Deed or incase of ambiguity the following major provisions of the Partnership Act will apply: 4 1. 2. 3. 4. 5. 6. 7. 8. 9. Capital must be contributed equally and no interest should be paid on capital No interest should be charged on drawings Profits or losses should be shared equally Each partner should take an active part in the management of the firm and no salaries are payable to them All decisions should be made on the basis of majority of opinions Major changes such as change of purpose or introduction of new partners should be on agreement of all partners Books of account must be kept at the principal place of business and all the partners have a right to inspect them The partners cannot carry out competing business On dissolution, settlement should start with loan repayment then capital repayment and incase of any surplus, it should be distributed on equal sharing basis Advantages of Partnerships 1. Ease of formation: All that is needed is an agreement between partners and there are no legal formalities. 2. Additional sources of capital: Since it has more people they are likely to raise more capital by contribution and it is more creditworthy than a sole trader 3. Broader management base: Each partner may have expertise in different functions which they can be responsible for in the firm leading to better performance 4. Ease of expansion: Expansion can be done by increasing the size of partnership including addition of specialist skills 5. Sharing of losses and liabilities: Liabilities are better spread to a number of people reducing the burden on any one person 6. Duration: Partnerships have a longer life span since the death of one partner does not imply the end of the firm especially where there are more than 2 partners or there is a provision to perpetuate the partnership Disadvantages 1. Unlimited liability: Partners maybe obliged to pay the firm’s debts from personal resources 2. Difficulty in decision making: Since partners have to be consulted in decision making, decisions maybe harder to reach and may take time which may result in lost opportunities 3. Lack of continuity: Partnerships can be terminated easily especially if partners disagree or one dies or is incapacitated 4. Sharing of profits: Due to profit sharing benefits accruing from personal efforts of individual partners reduces which can lead to reduced efforts especially where some partners perceive the others to be doing less 5. Frozen investment: It is often difficult for a partner to withdraw his investment leading to dissatisfaction and lack of commitment to the firm. Buying out a partner may also be difficult unless specifically provided for in the agreement 6. Limited access to capital: Partners may have difficulties in raising large sums of money especially in the long term Dissolution of Partnerships A partnership may be dissolved in the event of the following: 1. If the partners agree among themselves to wind it up. This is referred to as voluntary dissolution 2. If it is a temporary partnership, at the completion of the purpose of the firm or at the expiry of the specified period 3. If a partner notifies the other partners of his intention to dissolve the partnership in writing 4. If a partner suffers mental ailment, is declared bankrupt or dies 5. If the partnership business becomes unlawful usually due to a change in the law 6. A court may dissolve the partnership on application from a partner or any other interested party in case of the following: a. If a partner acts in contravention to the provisions of the Partnership Deed and damages the interests of the firm b. Where the partnership cannot run at a profit c. Where the prevailing circumstances make it only fair and just to dissolve the partnership 5