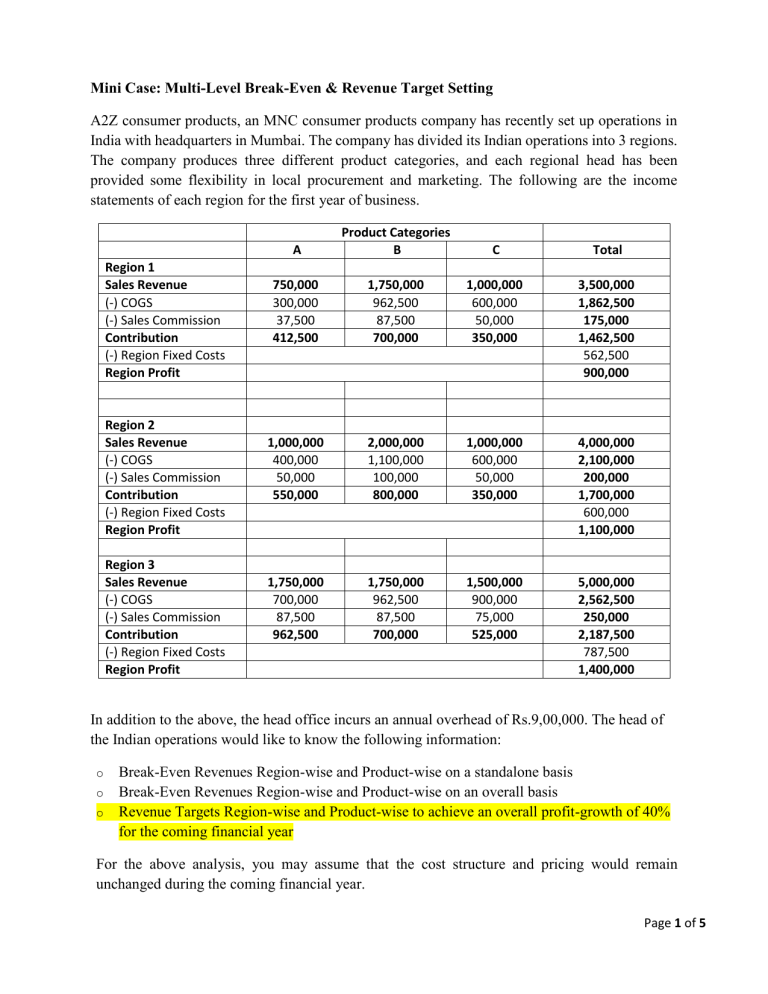

Mini Case: Multi-Level Break-Even & Revenue Target Setting A2Z consumer products, an MNC consumer products company has recently set up operations in India with headquarters in Mumbai. The company has divided its Indian operations into 3 regions. The company produces three different product categories, and each regional head has been provided some flexibility in local procurement and marketing. The following are the income statements of each region for the first year of business. Region 1 Sales Revenue (-) COGS (-) Sales Commission Contribution (-) Region Fixed Costs Region Profit Region 2 Sales Revenue (-) COGS (-) Sales Commission Contribution (-) Region Fixed Costs Region Profit Region 3 Sales Revenue (-) COGS (-) Sales Commission Contribution (-) Region Fixed Costs Region Profit A Product Categories B C Total 750,000 300,000 37,500 412,500 1,750,000 962,500 87,500 700,000 1,000,000 600,000 50,000 350,000 3,500,000 1,862,500 175,000 1,462,500 562,500 900,000 1,000,000 400,000 50,000 550,000 2,000,000 1,100,000 100,000 800,000 1,000,000 600,000 50,000 350,000 4,000,000 2,100,000 200,000 1,700,000 600,000 1,100,000 1,750,000 700,000 87,500 962,500 1,750,000 962,500 87,500 700,000 1,500,000 900,000 75,000 525,000 5,000,000 2,562,500 250,000 2,187,500 787,500 1,400,000 In addition to the above, the head office incurs an annual overhead of Rs.9,00,000. The head of the Indian operations would like to know the following information: o o o Break-Even Revenues Region-wise and Product-wise on a standalone basis Break-Even Revenues Region-wise and Product-wise on an overall basis Revenue Targets Region-wise and Product-wise to achieve an overall profit-growth of 40% for the coming financial year For the above analysis, you may assume that the cost structure and pricing would remain unchanged during the coming financial year. Page 1 of 5 Page 2 of 5 Page 3 of 5 Page 4 of 5 The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the most recent quarter are given below Item Total Dirt Bikes Mountain Bikes Racing Bikes Sales 300,000 90,000 150,000 60,000 Variable Manufacturing & Selling Expenses 120,000 27,000 60,000 33,000 Contribution 180,000 63,000 90,000 27,000 Advertising 30,000 10,000 14,000 6,000 Depreciation of special equipment 23,000 6,000 9,000 8,000 Salaries of product-line managers 35,000 12,000 13,000 10,000 Allocated Common Fixed Costs 60,000 18,000 30,000 12,000 Total Fixed Costs 148,000 46,000 66,000 36,000 Net Operating Income (Loss) 32,000 17,000 24,000 (9,000) Fixed Costs Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. The Product Line Manager will be absorbed in the other product segments. Advertising is done on a productspecific basis. Required: 1. Should production and sale of the racing bikes be discontinued? Explain. Show computations to support your answer. 2. Recast the above data in a format that would be more usable to management in assessing the long-run profitability of the various product lines. Page 5 of 5