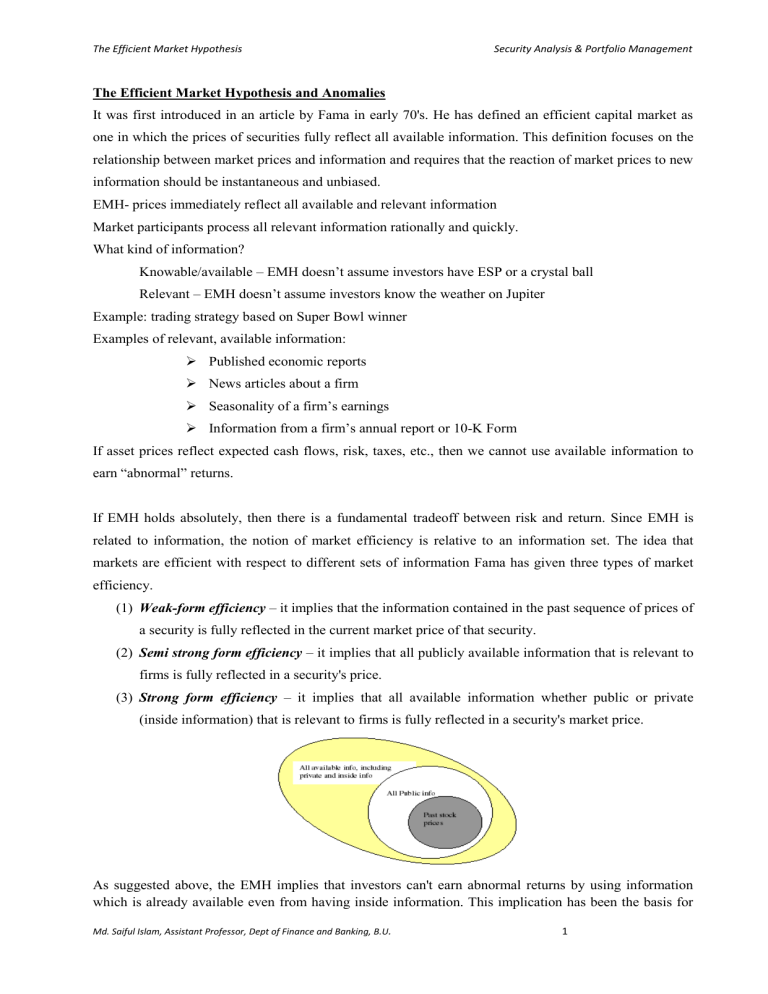

The Efficient Market Hypothesis Security Analysis & Portfolio Management The Efficient Market Hypothesis and Anomalies It was first introduced in an article by Fama in early 70's. He has defined an efficient capital market as one in which the prices of securities fully reflect all available information. This definition focuses on the relationship between market prices and information and requires that the reaction of market prices to new information should be instantaneous and unbiased. EMH- prices immediately reflect all available and relevant information Market participants process all relevant information rationally and quickly. What kind of information? Knowable/available – EMH doesn’t assume investors have ESP or a crystal ball Relevant – EMH doesn’t assume investors know the weather on Jupiter Example: trading strategy based on Super Bowl winner Examples of relevant, available information: Published economic reports News articles about a firm Seasonality of a firm’s earnings Information from a firm’s annual report or 10-K Form If asset prices reflect expected cash flows, risk, taxes, etc., then we cannot use available information to earn “abnormal” returns. If EMH holds absolutely, then there is a fundamental tradeoff between risk and return. Since EMH is related to information, the notion of market efficiency is relative to an information set. The idea that markets are efficient with respect to different sets of information Fama has given three types of market efficiency. (1) Weak-form efficiency – it implies that the information contained in the past sequence of prices of a security is fully reflected in the current market price of that security. (2) Semi strong form efficiency – it implies that all publicly available information that is relevant to firms is fully reflected in a security's price. (3) Strong form efficiency – it implies that all available information whether public or private (inside information) that is relevant to firms is fully reflected in a security's market price. As suggested above, the EMH implies that investors can't earn abnormal returns by using information which is already available even from having inside information. This implication has been the basis for Md. Saiful Islam, Assistant Professor, Dept of Finance and Banking, B.U. 1 The Efficient Market Hypothesis Security Analysis & Portfolio Management most empirical tests of the hypothesis. So market efficiency is not a binary concept but is instead a relative concept. When does information become embedded in today’s prices? Investors are trying to make profits (buy low, sell high). If they find a stock that is selling today at $20 and they think its price will be $30 in a week, they will buy the stock today. When many investors do this, the high demand for the stock will drive up its price to $30 today. So “good news” about a stock is reflected immediately. Empirical implications of EMH 1. Prices should react quickly and accurately to new information 2. Price changes should be random and unpredictable (prices follow a random walk; prices have no memory) Cov(rt, rt-j) = 0 for any fixed j 3. Impossible to find profitable trading strategies on a risk-adjusted basis (fundamental tradeoff between risk and return). All prices are “correct.” 4. “Knowledgeable” investors should do no better than average investors. 5. We should never see speculative asset pricing bubbles. Other implications An efficient market yields an optimal allocation of resources. The famous $100 bill story An efficient market protects a fool from himself! The only way to make abnormal returns is to have (1) superior information (2) superior information processors – maybe Peter Lynch Prices convey information If market is very efficient, what should an investor do? 1) Forget technical analysis 2) Forget fundamental analysis 3) Use passive investment strategy (avoid high expenses, trading costs, research costs, etc.) Md. Saiful Islam, Assistant Professor, Dept of Finance and Banking, B.U. 2 The Efficient Market Hypothesis Security Analysis & Portfolio Management 4) Still need to select appropriate risk/return profile If the market is very inefficient, then an investor should search for profitable trading strategies/undervalued stocks to get positive abnormal returns. Which of these two scenarios do stock brokers believe? Rex Sinquefield: “There are three classes of people who don’t think markets work: the Cubans, the North Koreans, and active money managers.” Grossman-Stiglitz Paradox: If markets are efficient, (and everybody knows this), then nobody will engage in costly research to find undervalued stocks. But if no one does research, markets will not be efficient. So there’s no way to have an efficient market where all investors believe the market is efficient. Brokers and active money managers believe the market is inefficient. But the harder they work to find undervalued stocks, the more efficient the market becomes. As the brokerage industry does its job better and better, the less useful their services will be to individual investors. If the market was efficient, would it mean that all brokers and money managers would be fired? So is the stock market efficient (or how efficient is it)? Are the implications of EMH true? How can we set up a test of market efficiency? 1. Pick a piece of information that can be used to “beat the market.” 2. Insiders buying activity, length of the 10-Q form, etc. 3. Set up a trading strategy based on this information Example: - buy stocks when an insider buys – hold for 6 months 4. Determine an appropriate “benchmark” for strategy to compute abnormal returns Example: CAPM benchmark (β of insider stocks = 1.1) Suppose you find a statistically significant abnormal return. It could mean that 1. The market is inefficient (and/or) 2. Your benchmark is incorrect So a test of market efficiency is actually a joint test that 1. The market is efficient 2. Your selected asset pricing model is correct FINANCE IS FUN, but it’s HARD too! 1. If you find significant abnormal returns, people who believe market efficiency say that your asset-pricing model is wrong. 2. If you don’t find significant abnormal returns, people who don’t believe markets are efficient say Md. Saiful Islam, Assistant Professor, Dept of Finance and Banking, B.U. 3 The Efficient Market Hypothesis Security Analysis & Portfolio Management the test isn’t conclusive. Why doesn’t a zero abnormal return prove that markets are efficient? Bottom Line – it is very difficult to conduct a definitive test of the EMH To a large degree, people’s beliefs about market efficiency are similar to their beliefs about religion. Evidence in favor of EMH 1. In general, prices appear to react quickly to new information. 2. Fama (1965) - found no serial correlation in stock returns (price changes are random) –daily returns 3. Most money managers do not outperform the market, and those that do outperform in one period do not appear to consistently do so in the next period. 4. Even the strongest anomalies do not produce dependable returns over all time periods (e.g. small stocks have done poorly relative to large stocks since 1983) Evidence against the EMH 1. Crash of 1929, 1987 2. Anomalies – profitable trading strategies 3. In the real world, “arbitrage” is risky (e.g. even if you know a stock is overpriced, shorting it can lead to huge losses if it becomes even more mispriced) Before we look at a list of anomalies, we need to be careful in how we interpret them. 1. Selection bias issue – if you’ve found a profitable trading strategy, why are you telling me? (If somebody really did find one, they’d keep their mouth shut.) “The smart players are not talking, and the talkers are not smart players.” 2. Lucky event issue/data snooping (data mining) – if you try enough trading strategies or have enough money managers, a few of them are bound to do well just by luck. Can you repeat the profitable result in the future? (Correlation does not imply causation.) 3. Is the trading strategy implementable? Trading costs Taxes Can you really sell certain stocks short, or invest in certain stocks? 4. Survivorship bias - Are you looking at the “winners” or survivors in your data set? e.g. Siegel: stocks have higher returns than bonds AND are less risky 5. Are you using the correct asset-pricing model? In particular, is there a risk of a very lowprobability event occurring that did not occur in your data set? 6. Why doesn’t this profit-making opportunity go away once people start to learn about it? – potential role for behavioral finance Md. Saiful Islam, Assistant Professor, Dept of Finance and Banking, B.U. 4 The Efficient Market Hypothesis Security Analysis & Portfolio Management Is a profitable trading strategy the same as an arbitrage opportunity? Does arbitrage opportunity Does profitable trading strategy profitable trading strategy? arbitrage opportunity? If you find that one person (or some people) invests in an irrational manner, does that imply that markets are inefficient? Now what we’ve all been waiting for: Anomalies (or how to make money in the stock market)? 1. January effect (turn-of –the-year effect) Not that the market does best in January Small stocks outperform large stock by an average of 3% over the last 50 years ¾ of this outperformance comes in first 5 trading days in January Also holds in many other countries 2. End-of-the month effect stocks tend to have large returns on the last trading day of the month 3. Weekend effect (day-of-the week effect) Stocks tend to have large negative returns on Mondays 4. Time-of-day effect stocks tend to go up at the beginning (first 45 minutes) and end (last 15minutes) of the trading day 5. Holiday effect stocks tend to go up the trading day before a holiday 6. Size effect (small firm effect) small stocks outperform large stocks on average over time more than CAPM would predict (small stocks have higher β than large stocks) 7. Low beta firm effect low beta stocks outperform high beta stocks on average over time on a riskadjusted basis 8. Neglected firm effect stocks with a relatively small analyst following have higher risk-adjusted returns on average than stocks with many analysts 9. Book-to-market effect stocks with high book-to-market rations (value stocks) outperform stocks with low B/M ratios (glamour stocks, also called growth stocks) on average over time 10. Price-to-earnings effect stocks with low P/E ratios outperform stocks with high P/E rations on average over time Md. Saiful Islam, Assistant Professor, Dept of Finance and Banking, B.U. 5 The Efficient Market Hypothesis Security Analysis & Portfolio Management 11. Dividend yield effect stocks with high dividend yields outperform stocks with low dividend yields on average over time 12. Short-term price reversals stocks with low returns in the past month (short-term losers) outperform stocks with high returns in the past month (short-term winners) on average during the following month. 13. Intermediate-term price momentum stocks with high returns in the past 6 months (intermediate-term winners) outperform stocks with low returns in the past 6 months (intermediate term losers) on average during the following year 14. Long-term price reversals stocks with low returns in the past 60 months (long-term losers) outperform stocks with high returns in the past 60 months (long-term winners) on average during the following 5 years. 15. Value Line effect following Value Line’s trading strategy yields positive abnormal returns (momentum strategy) 16. Inside information effect stock prices tend to rise after insiders bought shares. There is evidence that firms have the ability to take advantage of their stock being under- or over-valued. 17. Long-run performance of IPOs stocks that have just done an IPO do worse than stocks that haven’t over a 3-year period 18. Long-run performance of SEOs stocks that have just done an SEO do worse than stocks that haven’t over a 3-year period 19. Long-run performance of share repurchases stocks that have just announced a share repurchase do better than stocks that haven’t over a 3-year period. There is significant overlap between some of these anomalies. People come up with new, supposedly profitable trading strategies every day! Md. Saiful Islam, Assistant Professor, Dept of Finance and Banking, B.U. 6