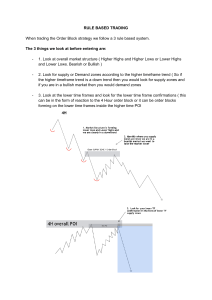

Table of Contents Complete Mastery in Trend identification Valid BOS/CHoCH identification Mastery in Order Block / FVG / IMB / IFC Retail / SMC / Banks - Institutional Types of Liquidity / Advance Liquidity High Probability Entries / Ping Pong / Sniper Entry/ Multiple Entries Scale / Single Candle Mitigation Entry Multiple Time Frame Analysis Trade Management Psychology WHAT IS TREND ? English dictionary defined TREND as a general direction in which something is developing or changing. In Forex, TREND is a tendency for prices to move in a particular direction over a period. Trends can be long term, short term, upward, downward and even sideways. Success with forex market investments is tied to the TRADERS ability to identify trends and position themselves for profitable entry and exit points. when the market goes up it is called Bullish market and going to Down is called Bearish market. Buy it when it goes up while making it Higher High and sell it when the market Make Lower Lows . On the other hand, market can be RANGING, meaning NOT UPTREND NOR DOWNTREND,But just Ranging. Bullish Trend Uptrend[bullish trend] is identify when a low break a previous high, and continue upwardly as the recent low making upward movement breaking the previous. Printing lower highs and higher high. Bearish Trend Downtrend[bearish trend] is identify when a High break a previous low, and movement continue downward,recent Highs breaking previous lows. Printing lower highs and lower low . Major Trend vs Minor Trend[Understanding time frame] To fully understand MAJOR and MINOR trend, you have to understand HIGHER AND LOWER TIME FRAME, MOVE AND STRUCTURE. A major trend is considered the main trend over a longer period of time. This is the dominant direction of a market movement. Within the major trend we can also have a secondary trend. Smaller movements which tend to last for very short periods of time are referred to as minor trends. In the chart given below, you can see how HTF and LTF structures are marked and this is a simple method. But many people also find it difficult that how do we mark the original high and low A large time frame depends on your trading style whether you are an intraday trader or a swing trader or positional trader. The H1 time frame can be a higher time frame for the day trader and the same time frame can be shorter for the H1 swing or position. This is not a fix, it has to be managed according to your trading style. Which we will tell you further which time frame is right for you and how to apply. HOW TO MAP AND IDENTIFY VALID STRUCTURE This is a very important part of SMC and I can say this with certainty that Max people are not able to mark the structure properly. The reason for that is not you, it is your education system, which tells us the same things that everyone does, but if it was so, then why not everyone is able to make money. And everyone knows that the trend is your friend, yet people continue to do as we have been taught, and Banks Intuitions takes advantage of this. But now there is nothing to worry about, now you will be able to improve things to a great extent and your angle of view of the market will change at once BEARISH STRUTURE Small structures make up a main leg. when Price breaks the Recent high of the previous minor[internal high] structure, then our HTF Low is confirmed. The chart above is about Bearish Market only, for your understanding. In the next page we make it a little more easy . You can understand the examples given below. Now you must have understood how we have to mark the structure. And what are the things to keep in mind. These are all referring to the bearish structure and all bearish examples. Even in bullish market the concept works Same , just your trend will be bullish. Excersise 01 Study and map out the valid structure. Submit the answer to my dm @ OdogwuFx BULLISH STRUCTURE In summary, The same rules apply here regarding mapping valid LOW & HIGH as we just studied the bearish structure Above . You can understand from the example given below. BOS & CHoCH In this session, you will be able to identify real BOS and CHoCH. BOS[Break Of Structure] Break of structure is full name of BOS. When the market breaks its Previous swing low, then that condition is called BOS. And when the market goes up and it breaks high, then it is also called BOS, it is also called BMS by some traders (Break Market Structure). BMS occurs when the price closes above / below a swing high/low, in summary. NOTES:AFTER BMS[BOS] ALWAYS WAIT FOR RETRACEMENT/PULLBACK. IN MAPPING BOS[BREAK OF STRUCTURE]: You firstly must understand the market trend, put it in mind and also before start mapping your bos from higher time , 1hour +. try not a forget a true break of structure must have taken a recent internal lows or highs. You can understand the example given below. The examples above are for bearish market, same concept is applicable for bullish price action. Just focus and follow through… You have to practice on tradingview and check for more CHoCH [Change of Character]