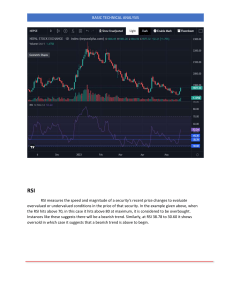

BASIC TECHNICAL ANALYSIS RSI RSI measures the speed and magnitude of a security's recent price changes to evaluate overvalued or undervalued conditions in the price of that security. In the example given above, when the RSI hits above 70, in this case it hits above 80 at maximum, it is considered to be overbought. Instances like these suggests there will be a bearish trend. Similarly, at RSI 38.78 to 30.60 it shows oversold in which case it suggests that a bearish trend is above to begin. BASIC TECHNICAL ANALYSIS MACD When the blue line crosses orange line from below at point -7.83, it suggest that bullish trend is about to begin and when the red line crosses orange line again at point 63.91 it suggests that the bearish trend is about to begin. BASIC TECHNICAL ANALYSIS EMA As the pint intersects each other at point 1899.23, it signals for a bullish trend to begin. Bollinger Bands As bands get narrower from point 1877.32 to 1979.29, it shows the market is going to see changes soon which may either be a bullish trend or a bearish one. BASIC TECHNICAL ANALYSIS Engulfing Bearish Pattern As the illustration above depicts when a bullish candle is overshadowed by a bigger bearish candle it begins the bearish trend as shown above. This is known as engulfing bearish pattern as the bear engulfs the bull in the market. BASIC TECHNICAL ANALYSIS Advance Block Pattern As the above figure shows there are three bullish candles in the range of 433 and 471. It depicts the day demand is high in the market and the confidence of the public in that stock. It also shows the undecisivesness of the public in that stock with lower lows each days. Which suggests a correction in the near days which will lead to the fall of the stock price and downward trend.