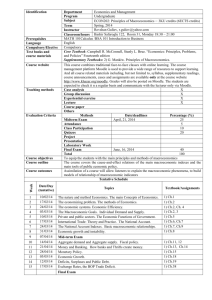

XIM University Bhubaneswar, Odisha, INDIA. Course Outlines- New Format Course Name Managerial Economics – II Programme Bachelor of Business Management (BBM) Batch/AY 2022-2025/2023-24 (Sec. A & B) Term Semester IV Credits 6 (50 Lecture Sessions + 10 Tutorial Sessions of 1 hour each) Course Instructor Prof. (Dr.) D N Panigrahi 1. Course Introduction and Objectives a) What is the course all about? Managerial economics (aka Business economics)-II is the application of economic analysis to managerial decision making and problem solving in business organisations: be it in private, public, and not-for-profit sectors. This course is an introductory course on managerial economics which will provide an overview of macroeconomic issues of the domestic national economy as well as global economy which will impact the business environment of the firms, industries as well as the markets and the society. This course builds on the microeconomic principles studied in the Managerial economics-I course. Macroeconomic events act as fundamental forces and sources of changes for the business environments of firms, industries in which they operate as well as for the markets (goods markets, factor markets and financial markets) and the society. Understanding these changes is a critical success factor for the business managers in formulating appropriate corporate strategies to follow. This course introduces the students to the principles of macroeconomics with a business and managerial perspective. The purpose of this course is to provide students with a thorough understanding of core concepts and methods/models of macroeconomics. Macroeconomics studies the aggregate behaviour of the economy: analysis of the economy as a whole. This course provides an introduction to the economic analysis of key macroeconomic variables such as measurement and determination of aggregate demand and aggregate supply, national income (GDP/GNP), output, inflation, and unemployment/employment, interest rates and exchange rates. Other topics include international trade and capital flows, balance of payment, economic growth, causes and implications of twin deficits, the financial system, short 1|Page term economic fluctuations, unequal distribution of income, business cycles, and fiscal policy and monetary policy etc. b) What position in the academia and practice it has? Managerial Economics is one of the most important and useful courses in the curriculum of business management studies. It will provide the student managers with a foundation for studying other courses in finance, marketing, operations research, and managerial accounting. It will also provide the students with a theoretical framework for tying together courses in the entire curriculum so they can have a cross-functional view of their studies. c) Why is it an important course? Contrary to the beliefs of many, managerial economics differs significantly from pure micro- or macro-economics: the focus of analysis is different. The focus in pure micro- and macro-economics is on theoretical concepts and models in general. In managerial economics, the focus is on business issues, applications and managerial behaviour. Managerial economics prescribes behaviour, whereas pure micro- and macroeconomics describes the environment. This focus on business issues and managerial behaviour provides powerful tools and frameworks to guide managers to better decisions and solutions to problems. These tools allow managers to better identify the consequences of alternative courses of action. d) How is it going to help the managers? Managerial economics plays two important roles in preparing students for managerial life. Concepts we will discuss in this course are found in other functional business courses like accounting, finance, strategy, operations, and marketing. The better student managers understand these concepts we discuss, the easier will be their understanding of them when they arise in other business courses. And because managerial economics recognises the complexity of the managerial world, it is arguably the most integrative of the functional business courses. This helps students learn the integrative mind-set that is essential for good management, and it also gets them to think past the short-term mentality and consider the long-term consequences. 2. Course Content/Structure The course is broken down into 4 learning modules as follows: Module A THE MACROECONOMIC ENVIRONMENT The aim of this module is to provide students with an introduction to macroeconomic environment facing the business firms and industries. At the end of this module students will be able to: • Understand the macroeconomic environment of the business. • Understand what is meant by the balance of payments and how exchange rates are determined. 2|Page • • Understand the role of money and interest rates in the economy. Understand what determines the level of business activity and how it affects unemployment and inflation. Following four topics/chapters will be covered. #1. The macroeconomic environment of business #2. The balance of payments and exchange rates #3. The financial system, money and interest rates #4. Business activity, unemployment and inflation Module B MACROECONOMIC POLICY The aim of this module is to equip students with the critical role of the government and the central bank in managing the macroeconomic affairs of a country and how these policies impact business firms and the industries. Specifically, it will cover the demand-side policy covering the fiscal policy and the monetary policy as well as the supply-side problems and policies. At the end of this module students will be able to: • Understand how macroeconomic demand-side policies impact on businesses. • Understand how supply-side policies impact on businesses. Following three topics/chapters will be covered. #5. Demand-side policy #6. Supply-side policy #7. International economic policy Module C BUSINESS IN THE INTERNATIONAL ENVIRONMENT The aim of this module is to give the students an understanding of the globalisation of the business environment in an open economy, the challenges & opportunities of a globalized economy and a feel of the global trading environment including financing of international trade. At the end of this module students will be able to: • Understand globalisation and multinational business. • Understand the importance of international trade ant its financing mechanism. 3|Page Following two topics/chapters will be covered. #8. Globalisation, the multinational business and the global trading environment #9. International trade finance Module D RESEARCH ACTIVITY The aim of this module is to bring all the aspects of the course together. At the end of this module students will be able to: • Apply the knowledge learned during the course to a business or a business issue of their choice. All topics from Module A-C will be included. Students will be able to use the integrative case study provided with every module as a template for their own research. The assessment will be based around this research. 3. Course Learning Outcomes (CLO) CLO 1: Understand and explain the macroeconomic environment of the business. CLO 2: Understand and explain what is meant by the balance of payments and how exchange rates are determined. CLO 3: Understand and explain the role of money and interest rates in the economy. CLO4: Understand and explain what determines the level of business activity and how it affects unemployment and inflation. CLO5: Understand and explain how macroeconomic demand-side policies impact on businesses. CLO6: Understand and explain how supply-side policies impact on businesses. CLO7: Understand globalisation and multinational business. CLO8: Understand and explain the importance of international trade in the economic development of a country and its financing mechanism. 4. COURSE PRE-REQUISITES This course assumes knowledge of basic mathematics like elementary algebra, calculus, graphs and elementary statistics. 4|Page 5. Reading and References 5A. Recommended Textbook: Mankiw, N. Gregory, Principles of Macroeconomics, (2018, 8e), Cengage. 5B. Reference Books: 1. Sloman, John et al, Economics for Business, (2023, 9e), Pearson. 2. Farnham, Paul G., Economics for Managers, (2014, 3e), Pearson. 3. Mankiw, N. Gregory, Principles of Economics, (8e), Cengage. 4. Krugman, Paul et al, Macro Economics, (2014, 3e), Worth Publishers. 5. Samuelson, Paul A. et al, Economics, (2010, 19e), McGraw-Hill. 6. Mishkin, F.S., Macroeconomics: Policy & Practice, (2015, 2e), Pearson. 7. Dornbusch, R., Fischer, S. et al, Macroeconomics, (2011, 11e), McGraw-Hill. Lecture notes will be provided for each topic. 5C. Business Dailies/Journals/E-resources/databases: Apart from the recommended text and further readings and lecture notes, students are advised to read business dailies like Economic Times, Business Standard, Business Line and Financial Express. 6. Pedagogy and Students Workload The pedagogy will include a judicious mix of delivery methods like lectures, business case studies, and projects, etc. We will adopt a “problem-solving oriented pedagogy” for this course rather than a “model-based pedagogy”. Each topic begins with a business problem and then gives students enough inputs to understand the cause of the problem, identify and assess alternative solutions and finally decide the optimal solution. Students are expected to read through the t e x t b o o k a n d s t u d y materials given to them before the lecture session and actively participate in class discussion. Students are expected to devote around four hours of preparations time in a week and a total of about 60 hours of study & preparations time for the subject during the semester apart from the lecture sessions. Students should feel free to ask any doubts inside the class as well as outside. 5|Page 7. DAILY SESSION PLAN: SESSION No./TOPICS/CLO MAPPED/SESSION COVERAGE & LEARNINGS/PRE-LECTURE READNGS/ ASSIGNMENTS Session 01-02: Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: Macroeconomic Environment of Business Session Coverage/Learnings: Introduction to the macroeconomic environment. The key macroeconomic objectives. Macroeconomics & Economic Statistics, Readings: Chapter 26, Sloman, John et al, Economics for Business. Lecture Notes. Assignment(s): Session 03-06 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: Macroeconomic Environment of Business Session Coverage/Learnings: The Circular Flow of Income. Measuring national income and Output: One Destination and Three Approaches. The Measurement of GDP, The Components of GDP, Real versus Nominal GDP, Is GDP a Good Measure of Economic Well-Being? Readings: Chapter 10, Mankiw, N. Gregory, Principles of Macroeconomics. Module 10 -12, Krugman, Paul et al, Macro Economics. Chapter 26, Sloman, John et al, Economics for Business. Lecture Notes. Assignment(s): Session 07 : TUTORIAL SESSION 1: For Doubt Clearing and Practical Business Case Discussion Session 08-09 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: Macroeconomic Environment of Business Session Coverage/Learnings: Measuring the Cost of Living & Inflation: CPI, WPI, GDP Deflator. Correcting or Adjusting Economic Variables for the Effects of Inflation: Measuring Cashflows (Expenses, Salary etc.): Real and Nominal Cashflows, Indexation, Measuring Interest Rates: Real and Nominal Interest Rates. Measuring Unemployment Readings: Chapter 11, Mankiw, N. Gregory, Principles of Macroeconomics. Chapter 2, Mishkin, F S, Macroeconomics. Lecture Notes. Assignment(s): Session 10-11 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: Macroeconomic Environment of Business Session Coverage/Learnings: Economic volatility and the business cycle. 6|Page Readings: Chapter 26, Sloman, John et al, Economics for Business. Chapter 8, Mishkin, F S, Macroeconomics, Lecture Notes. Assignment(s): Session 12 : TUTORIAL SESSION 2: For Doubt Clearing and Practical Business Case Discussion Session 13-16 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: Macroeconomic Environment of Business Session Coverage/Learnings: Short-Run Economic Fluctuations: Three Key Facts about Economic Fluctuations: Fact 1: Economic Fluctuations Are Irregular and Unpredictable, Fact 2: Most Macroeconomic Quantities Fluctuate Together, Fact 3: As Output Falls, Unemployment Rises. Explaining Short-Run Economic Fluctuations: The Assumptions of Classical Economics, The Reality of Short-Run Fluctuations, The Model of Aggregate Demand and Aggregate Supply. The Aggregate-Demand Curve: Why the Aggregate-Demand Curve Slopes Downward, Why the Aggregate-Demand Curve Might Shift. The Aggregate-Supply Curve: Why the AggregateSupply Curve Is Vertical in the Long Run, Why the Long-Run Aggregate-Supply Curve Might Shift, Using Aggregate Demand and Aggregate Supply to Depict Long-Run Growth and Inflation, Why the Aggregate-Supply Curve Slopes Upward in the Short Run, Why the ShortRun Aggregate-Supply Curve Might Shift. Two Causes of Economic Fluctuations: The Effects of a Shift in Aggregate Demand, The Effects of a Shift in Aggregate Supply. Readings: Chapter 12, Mishkin, F S, Macroeconomics. Chapter 20, Mankiw, N. Gregory, Principles of Macroeconomics. Lecture Notes. Assignment(s): Session 17 : TUTORIAL SESSION 3: For Doubt Clearing and Practical Business Case Discussion Session 18-21 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: Macroeconomic Environment of Business Session Coverage/Learnings: Basic Concepts: Unemployment and Inflation. The Classical Theory of Inflation, The Level of Prices and the Value of Money, Money Supply, Money Demand, and Monetary Equilibrium, The Effects of a Monetary Injection, A Brief Look at the Adjustment Process, The Classical Dichotomy and Monetary Neutrality, Velocity and the Quantity Equation, The Fisher Effect, The Costs of Inflation, A Fall in Purchasing Power? The Inflation Fallacy, A Special Cost of Unexpected Inflation: Arbitrary Redistributions of Wealth, Inflation Is Bad, but Deflation May Be Worse. 7|Page Long-term economic growth: Economic Growth around the World, Productivity: Its Role and Determinants, Why Productivity Is So Important, Are You Richer Than the Richest American? How Productivity Is Determined? A Picture Is Worth a Thousand Statistics, FYI: The Production Function, CASE STUDY: Are Natural Resources a Limit to Growth? Economic Growth and Public Policy, Saving and Investment, Diminishing Returns and the Catch-Up Effect, Investment from Abroad, Education, Health and Nutrition, Property Rights and Political Stability, Free Trade, Research and Development, ASK THE EXPERTS: Innovation and Growth, IN THE NEWS: Curmudgeon versus Optimist, Population Growth. Readings: Chapter 26, Sloman, John et al, Economics for Business. Chapter 12, 15 & 17, Mankiw, N. Gregory, Principles of Macroeconomics. Module 13-19, Krugman, Paul et al, Macro Economics. Lecture Notes. Assignment(s): Session 22 : TUTORIAL SESSION 4: For Doubt Clearing and Practical Business Case Discussion Session 23-27 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: The balance of payments and exchange rates Session Coverage/Learnings: The International Flows of Trade/Goods and Capital: The balance of payments account, The exchange rate, Exchange rates and the balance of payments, Fixed versus floating exchange rates, Nominal and real exchange rates, Dealing in foreign exchange, The importance of international financial movements. A Macroeconomic Theory of the Open Economy: Supply and Demand for Loanable Funds and for Foreign-Currency Exchange, The Market for Loanable Funds, The Market for ForeignCurrency Exchange, Purchasing-Power Parity as a Special Case, Equilibrium in the Open Economy, Net Capital Outflow: The Link between the Two Markets, Simultaneous Equilibrium in Two Markets, Disentangling Supply and Demand, How Policies and Events Affect an Open Economy, Government Budget Deficits, Trade Policy, Political Instability and Capital Flight 406 IN THE NEWS: Is a Strong Currency Always in a Nation’s Interest? CASE STUDY: Capital Flows from China, ASK THE EXPERTS: Currency Manipulation. Readings: Chapter 27, Sloman, John et al, Economics for Business. Chapter 18-19, Mankiw, N. Gregory, Principles of Macroeconomics. Lecture Notes. Assignment(s): Session 28 : TUTORIAL SESSION 5: For Doubt Clearing and Practical Business Case Discussion 8|Page Session 29-34 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: The financial system, money and interest rates Session Coverage/Learnings: Saving, Investment, Spending and the Financial System: Saving, Investment and Spending in Closed and Open Economies. The meaning and functions of money, The financial system, The supply of money, The demand for money, Equilibrium, Money, aggregate demand and inflation, Financial intermediation, Growth of banks’ balance sheets, Residential mortgages and securitization, Minsky’s financial instability hypothesis. Saving and Investment in the National Income Accounts, Some Important Identities, The Meaning of Saving and Investment, The Market for Loanable Funds, Supply and Demand for Loanable Funds, Policy 1: Saving Incentives, Policy 2: Investment Incentives, Policy 3: Government Budget Deficits and Surpluses, ASK THE EXPERTS: Fiscal Policy and Saving, CASE STUDY: The History of U.S. Government Debt, FYI: Financial Crises. The Basic Tools of Finance: Present Value: Measuring the Time Value of Money, FYI: The Magic of Compounding and the Rule of 72, Managing Risk, Risk Aversion, The Markets for Insurance, Diversification of Firm-Specific Risk, The Trade-off between Risk and Return, Asset Valuation, Fundamental Analysis, The Efficient Markets Hypothesis, CASE STUDY: Random Walks and Index Funds, ASK THE EXPERTS: Diversification, Market Irrationality, Readings: Chapter 28, Sloman, John et al, Economics for Business. Chapter 13-14, Mankiw, N. Gregory, Principles of Macroeconomics. Chapter 4, Mishkin, F S, Macroeconomics. Module 2023, Krugman, Paul et al, Macro Economics. Lecture Notes. Assignment(s): Session 35 : TUTORIAL SESSION 6: For Doubt Clearing and Practical Business Case Discussion Session 36-39 : Module A THE MACROECONOMIC ENVIRONMENT: CLO X Topic: Business activity, unemployment and inflation Session Coverage/Learnings: The simple Keynesian model of business activity, Alternative perspectives on aggregate supply, Output, unemployment and inflation, Inflation rate targeting and unemployment, The volatility of private-sector spending, Short-run aggregate supply, The accelerationist hypothesis, Confidence and spending. 9|Page The Short-Run Trade-off between Inflation and Unemployment: The Phillips Curve, Origins of the Phillips Curve, Aggregate Demand, Aggregate Supply, and the Phillips Curve, Shifts in the Phillips Curve: The Role of Expectations, The Long-Run Phillips Curve, The Meaning of “Natural”, Reconciling Theory and Evidence, The Short-Run Phillips Curve, The Natural Experiment for the Natural-Rate Hypothesis. Shifts in the Phillips Curve: The Role of Supply Shocks, The Cost of Reducing Inflation, The Sacrifice Ratio, Rational Expectations and the Possibility of Costless Disinflation, The Volcker Disinflation, The Greenspan Era, A Financial Crisis Takes Us for a Ride along the Phillips Curve, Readings: Chapter 29, Sloman, John et al, Economics for Business. Chapter 15, 17 & 22, Mankiw, N. Gregory, Principles of Macroeconomics. Lecture Notes. Assignment(s): Session 40 : TUTORIAL SESSION 7: For Doubt Clearing and Practical Business Case Discussion Session 41-44 : Module B MACROECONOMIC POLICY: CLO X Topic: Demand-side Policy Session Coverage/Learnings: Fiscal policy and the public finances, The use of fiscal policy, Monetary policy, Attitudes towards demand management, The fiscal impulse, The evolving fiscal frameworks in INDIA, The evolving monetary policy framework in INDIA. Quantitative easing, Fiscal & Monetary stimulus during recession, How Monetary Policy Influences Aggregate Demand, The Theory of Liquidity Preference, The Downward Slope of the Aggregate-Demand Curve, FYI: Interest Rates in the Long Run and the Short Run, Changes in the Money Supply, The Role of Interest-Rate Targets in Fed Policy, CASE STUDY: Why the Fed Watches the Stock Market (and Vice Versa), The Zero Lower Bound, How Fiscal Policy Influences Aggregate Demand, Changes in Government Purchases, The Multiplier Effect, A Formula for the Spending Multiplier, Other Applications of the Multiplier Effect, The Crowding-Out Effect, Changes in Taxes, FYI: How Fiscal Policy Might Affect Aggregate Supply. Using Policy to Stabilise the Economy, The Case for Active Stabilisation Policy, IN THE NEWS: How Large Is the Fiscal Policy Multiplier? CASE STUDY: Keynesians in the White House, ASK THE EXPERTS: Economic Stimulus, The Case against Active Stabilisation Policy, Automatic Stabilizers, Readings: Chapter 30, Sloman, John et al, Economics for Business. Chapter 21, Mankiw, N. Gregory, Principles of Macroeconomics. Lecture Notes. Assignment(s): 10 | P a g e Session 45 : TUTORIAL SESSION 8: For Doubt Clearing and Practical Business Case Discussion Session 46-47 : Module B MACROECONOMIC POLICY: CLO X Topic: Supply-side Policy Session Coverage/Learnings: Supply-side problems, Market-orientated supply-side policies, Interventionist supply-side policies, Regional policy, Measuring labour productivity, Getting intensive with capital, Apprenticeships and the economic arguments for intervention Readings: Chapter 31, Sloman, John et al, Economics for Business. Chapter 13, Mankiw, N. Gregory, Principles of Microeconomics. Chapter 9 & 11, Mankiw, N. Gregory, Business Economics. Lecture Notes. Assignment(s): Session 48 : Module B MACROECONOMIC POLICY: CLO X Topic: International economic policy Session Coverage/Learnings: Global interdependence, International harmonisation of economic policies, European economic and monetary union, Alternative policies for achieving currency stability, Trade imbalances in the USA and China, Optimal currency areas, The Tobin tax. Readings: Chapter 32, Sloman, John et al, Economics for Business. Lecture Notes. Assignment(s): Session 49-52 : Module C BUSINESS IN THE INTERNATIONAL ENVIRONMENT Topic: Globalisation, the multinational business and the global trading environment Session Coverage/Learnings: Globalisation and multinational business: Globalisation: setting the scene, What is a multinational corporation? Trends in multinational investment, Why do businesses go multinational? The advantages of MNC investment for the host state, The disadvantages of MNC investment for the host state, Multinational corporations and developing economies, M&As and greenfield FDI, Attracting foreign investment. The global trading environment: International trade, Trading patterns, The advantages of trade, Trade restrictions and Arguments for restricting trade, The world trading system and the WTO, The European Union and the single market, Brexit, The changing face of comparative advantage. Strategic trade theory, Giving trade a bad name, Beyond bananas, Preferential trading, In or out? Readings: Chapter 23 & 24, Sloman, John et al, Economics for Business. Lecture Notes. Assignment(s): 11 | P a g e Session 53 : TUTORIAL SESSION 9: For Doubt Clearing and Practical Business Case Discussion Session 54-57 : Module C BUSINESS IN THE INTERNATIONAL ENVIRONMENT Topic: International Trade Finance Session Coverage/Learnings: Risks and Rewards of International Trade, Financing Mechanism and Instruments of International Trade Finance, Bank Guarantee & Letter of Credit: Life Blood of International Commerce. Readings: Chapter 7, Sloman, John et al, Economics for Business. Chapter 8, Mankiw, N. Gregory, Business Economics. Lecture Notes. Assignment(s): (1) HBS/IVEY Case Study on Risks of International Trade (2) HBS/IVEY Case Study on Letter of Credit Session 58 : TUTORIAL SESSION 10: For Doubt Clearing and Practical Business Case Discussion Session 59-60 : Group Project Presentations Session XX-XX : RESEARCH ACTIVITY: CLO X Session Coverage/Learnings: Students should apply the knowledge learned during the course to a business of their choice. All topics learned from the course will be included. Students will be able to use the integrative case study provided with every module as a template for their own research. The assessment will be based around this research. 8. Assessment Scheme Component Weightage (%) Assessment of Course Learning Outcome(s) (CLO) Quizzes (4 Nos.: 2 Pre-Mid term and 2 Post-Mid term) – Simple average of 4 quizzes will be computed Mid-term Examination (MT) 20% CLO 1 to 8 20% CLO 1 to 4 Group Project (GP) 10% Class Activity & Participation 10% (CAP) End-Term Examination (ET) 40% CLO 1 to 8 CLO 1 to 8 12 | P a g e CLO 1 to 8 9. Group Projects The students will form 12-14 groups. Each group will conduct a group research project on one topic allotted by the faculty. In all these group research projects, students are expected to apply the concepts learned in the course. They should define/develop the research problem, research questions and present their findings from the study. The last date for submission of project report is March-01-2024. Each group has to make a power point presentation of the project report (max 15 slides in 15 minutes) to the class in the presence of the faculty. 10. Academic Discipline and Integrity Academic integrity and honesty are critical values in upholding XIM University's reputation as a community of scholars and its claim to the "intellectual property" created by faculty and students. As a student of XIM University, you are committed to the Academic Honour Code. Cheating, dishonesty and plagiarism will not be tolerated in any part of their academic work including projects, presentations, assignments etc. You will face strict disciplinary action if you risk yourself in such attempts. 11A. Exams: The exam questions will normally consist of MCQs, objective questions [concept checking questions (CCQs)] requiring answers in not exceeding 2 sentences, shortanswer questions [critical thinking questions (CTQs)] requiring answers in not exceeding 5 sentences by providing arguments/equations/graphs etc. and numerical (computational) questions. The midterm will cover only materials taught in class up to that point in the term, while the final exam will ask questions on the entire course materials with more emphasis on topics covered after the midterm exam. All the exams excluding quizzes (class tests) are closed-book – pen and paper based. 11B. Class Participation: The emphasis in this course is on the application of concepts and analytical techniques to real life situations in bank lending, with the expectation to bring a new level of analytical depth to this fast-growing and challenging field. Class participation includes such aspects as your ability to answer specific questions in class, your willingness to initiate discussion and your ability to identify, initiate, sustain, contribute to critique, analyse and discuss the issues raised in the cases/papers. Quality and quantity both counts towards “Class participation” with the former being weighted more. Class participation, admittedly, is subjective and is based entirely on the faculty’s assessment only. 13 | P a g e 12. EXPECTATIONS FROM STUDENTS Students must go through the pre-class preparations/reading materials, complete the assignments, if any and come well prepared for the class. Anyone who has not read the article/case/assigned chapters beforehand will find it difficult to participate in the discussion and so will Not be allowed to sit in the class. For this reason, class time is critical. Class room sessions should be used for discussion on real life examples/cases/applications rather than for explanation of basic theory. Post-reading assigned materials or otherwise specific queries/doubts can be raised. Students are supposed to read/access materials beyond those of books, through online mode, print and electronic media. Students are expected to display professional conduct in the class and be punctual and sincere in all the activities. ✓ Late comers are not permitted to enter the class. 13. Mapping Course Leaning Outcomes (CLO) with the Program Learning Goals (PLG) PLG# PLG1 PLG2 PLG3 PLG4 PLG5 Program Learning Goal Trait Addressed by Course Yes No The students will demonstrate Yes Functional and understanding of elements of all functional areas Business Skills The students will use analytical yes techniques to identify a business problem, and suggest a solution Analytical Skills Collaboration and The students will exhibit voluntary No teamwork cooperation and effective teamwork attributes in a group setting The students will understand the Yes ethical complexities of conducting business. The students will adopt techniques in scenarios involving ethical dilemma and offer Ethical resolution responsibility Communication The students will produce No reasonably good quality business documents. The students will become effective and confident communicators &&&&&&&&&&&&&& The End &&&&&&&&&&&&&&& 14 | P a g e