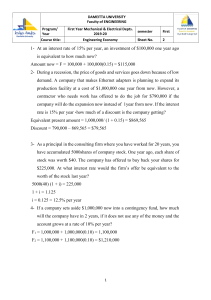

Urban Real Estate Financing and Investment (Mgt 278A) Lecture Modules – Professor Habibi MODULE 1: Real Estate Finance Fundamentals Why Study Real Estate? Tangible products that affect our daily lives in meaningful ways It is easy to relate to real estate, and all of us have experiences living, working, eating, shopping and visiting places. The success of many real estate projects is largely dependent on a concept called placemaking, which strengthens the connections between people and place, and as an industry, real estate is relatively straightforward and easy to understand. That said, the relative simplicity of the industry can sometimes be deceptive, lulling investors into a state of overconfidence and resulting in overly aggressive acquisition/financing strategies Rapid growth through leverage/tax benefits Real estate investors have access to a few powerful tools that enable rapid wealth creation, such as the ability to perform tax-deferred exchanges, syndicate outside capital and make optimum use of financial leverage. While these tools are not without attendant risks, they nevertheless facilitate the growth of equity capital at rates that can potentially outperform many other asset classes. Rewards common sense, wisdom and relationship building Real estate is a very mature industry, with proven rules that determine the success of its participants. As such, those who know what to look for and how to maximize the benefits and exploit inefficiencies in the marketplace tend to outperform those who don’t. Moreover, two of the most formidable hurdles to investment success are access to deals and capital, both of which are heavily dependent on relationships. At the same time, the industry tends to be somewhat slow moving relative to others, and there are still myriad opportunities for technological disruption. We have seen some of these over the past few years, though it is still very early in the innovation lifecycle. Firms like Amazon have led to online sales growth that has been a leading cause of the closure of multiple national and local retailers. Similarly, we are also Urban RE Financing and Investment - Habibi Page 1 seeing the disruption of real estate sales and brokerage through newer entrants such as Zillow/Trulia, Redfin, Opendoor, Knock and OfferPad, to name a few. Even the flow of capital has expanded to individual investors through new laws allowing for the proliferation of crowdfunding. Different types of jobs for all types of people The real estate industry crosses myriad disciplines, and participants vary widely in their backgrounds, skills, and duties. For example, brokers rely heavily on sales and marketing skills to buy and sell property; financial analysts build financial models that predict the returns on capital investments; and, civil engineers may consider the condition of the soils upon which to construct an office tower. There are many more such examples of professions that encompass the industry. Local community knowledge yields competitive advantage; each property is a “minibusiness” Real estate is a local game. Each parcel of property is unique not only in a physical sense, but also with respect to its situation within a country, metropolitan area, city, community and sub-community. Outsiders to a specific geographic area rarely have a grasp of the nuances of local markets in the way that locals do, and typically lack the relationships to source investment opportunities before locals do. Outsiders to a specific market area rarely get the “first look” at choice properties and tend not to have the deep relationships with brokers and sellers that provide an attractive stream of deal flow. Can work virtually anywhere on earth; full-time or hobby The real estate industry allows participation in a variety of capacities, whether you’re planning to grow your nest egg through the purchase of a single-family home, or grow a portfolio of investment properties as part of a large scale corporate structure. There are opportunities at all levels of the industry, from passive to active involvement, as we will discuss in future modules. And of course, since real estate is ubiquitous, you can work anywhere in the world so long as you understand the specific drivers and risks of each market. Real Estate Product Types Residential (single-family) o o o o o o Detached – no shared walls, separated living spaces Attached – shared walls, connected Condo/townhouse – one grant deed per unit, individual ownership interests Co-op – one grant deed for the whole property, undivided ownership interests Modular/pre-fab – increasingly popular with escalation of labor costs Mobile home Urban RE Financing and Investment - Habibi Page 2 Commercial: The 5 ‘Core’ Property Types o Multifamily Types: Duplex/triplex, garden style, podium, high-rise Typically full service gross (FSG) leases – FSG consists of tenant paying a base rental rate, and the landlord paying for operating expenses, such as property taxes, insurance and common area utilities Lowest on risk curve, lowest yields – because multifamily is needs-based, and people always need a place to live o Industrial Types: Warehouse/Distribution, Manufacturing, Flex Simple construction, often tilt-up (“four walls and a roof”), but note that warehouse/distribution facilities are becoming more advanced to suit the growing needs of e-commerce fulfillment Usually triple net (NNN) leases – tenant pays base rent plus operating expenses Typically requires unique considerations: Size, clear heights, column widths, access/loading docks, environmental, technology, roof, HVAC (heating, ventilation, air conditioning), surrounding infrastructure (i.e., access to freeways, ports, etc.) Single-tenant leasing risk, as opposed to multiple tenant diversity Relative ease of management (fewer users per square foot compared to other product types) Success largely driven by functionality and commercial viability, rather than whether properties are appealing to people (unlike the other product types) o Retail Types: Street retail, strip, neighborhood anchor/power centers, regional malls etc. Anchors drive traffic and typically pay lower rents than in-line tenants Combination of location and collection of brands drives traffic Visibility is key Less complicated leases Percentage rent clauses – base rental payment up to a “break point,” usually defined as X% of tenant’s sales revenue Use clauses and radius restrictions “National tenants” and anchors (i.e. Wal-Mart, Bloomingdale’s) tend to have most of the power and pay low rents and obtain higher Tenant Improvement (TI) allowances relative to in-line retailers Urban RE Financing and Investment - Habibi Page 3 o Office Types: office campus, low-rise, high-rise Classifications based on age, amenities and tenant quality (A, B, C) Location is key – near transit corridors and housing Leasing risk high, especially as tenants get larger Stacking/planning tenants can be tough – think of the video game Tetris Modified gross leases get complicated with CAM (common area maintenance) charges and base year expense stops o Hospitality Types: Limited service, full service, extended stay Really an operating/service business Tenants turn rapidly, high vacancy, F&B (food and beverage) is large component of income Very sensitive to economic conditions, typically high along risk curve Commercial: ‘Non-Core’ Property Types Over the past 20 years investors have gradually broadened their scope for what they constitute as ‘real estate’. As of today non-core property types represent roughly half the value of the U.S. publicly listed real estate market. These property types include: o Healthcare o Self Storage o Manufactured Housing o Student Housing o Data Centers o Cell Towers Real Estate Direct Investment Cycle (jobs in parentheses) Deal Sourcing: Listed or off-mkt (Principals, Brokers, Sales/Mktg) Offer and due diligence (Principals, Brokers, Consultants, Market Research, Inspectors) Financing (Equity and debt finance, appraiser, mortgage broker/banker, M&A) Closing: Transaction Support (Escrow, title, legal, insurance, acctg, etc) Asset Management (Property mgmt, leasing, construction/maintenance, tax/acctg, etc) Reversion/Exit (return to top) Urban RE Financing and Investment - Habibi Page 4 The Players: Principals and Agents Seller (Principal), typically represented by Listing Agent (Licensed Broker or Salesperson) Buyer (Principal), typically represented by “Selling Agent” (Licensed Broker or Salesperson) Upon execution of a Listing Agreement between the Seller and Listing Agent, there will be a specified commission that is paid upon close of escrow (completion of sale) by the Seller to the Agents representing the Principals. For residential transactions, this commission is typically about 5-6%. If there are two agents (Listing Agent and Selling Agent) working on the deal, then they typically split the commission. If there is only one Agent representing both sides (called a “dual agency”), then that Agent typically keep the whole commission to himself (more on this below). As you can imagine, dual agency can be very attractive, yet is riddled with conflicts, as it is nearly impossible for an Agent to truly represent and maintain fiduciary duties to both sides of a transaction. For this reason, some states outside California have outlawed dual agency in residential transactions. Types of Listings Public (Marketed) Listing: advertised for sale through one or many of the public networks, accessible by brokers, agents and principals. These public networks include LoopNet (commercial properties) and the Multiple Listing Service, or MLS (residential properties). As you can imagine, these deals gain large exposure and create a bidding war between buyers, which often results in high offers to the seller. It is the listing agent’s responsibility to “qualify” each buyer and ensure that they have the financial capacity to close the deal, as well as the desire to purchase the property and not lead the seller on, only to back out of the deal after tying it up in escrow. Pocket (Off-Market) Listing: not advertised for sale through the public networks. Instead, in a pocket listing, the Listing Agent typically calls upon his network of known buyers and “shops” the deal across this network, telling prospective buyers that they have the opportunity to make an offer on a deal to which the public does not have access. The catch, however, is that the Listing Agent will often times request to act as a Dual Agent, which means he will write the offer on behalf of the buyer, and thus act as the Agent of both the seller and buyer. As such, he will keep all of the commission from sale rather than splitting it with another Agent. The benefit to the buyer is that he can avoid a bidding war, which may otherwise result in an unattractively high purchase price. The benefit to the seller is that the Agent usually knows the buyer well, and can “vouch” for his intent and financial capacity to close the deal. The big downside, however, is that the seller will likely not gain as much exposure to his property and may not yield the highest possible price. Pocket listings work best for the seller who knows the true value of his property and can refuse to accept offers that seem too low. Direct Solicitation: direct transaction between two willing Principals (Buyer and Seller). Usually results from a prospective buyer locating an attractive piece of property and approaching the seller directly and making an offer. These types of deals can be completed using no brokers, or else by bringing brokers or attorneys into the transaction to assist in working through various issues. The idea here is that in a direct solicitation, the deal is never marketed, and the buyer and seller basically find each other and strike a deal between themselves. These types of deals are typically beneficial for both Urban RE Financing and Investment - Habibi Page 5 parties, as commissions are either non-existent or else very low, resulting in higher net proceeds to the seller and a lower net cost to the buyer. Offer and Due Diligence: Terms of a Well-Constructed Purchase Agreement 1. 2. 3. 4. 5. 6. 7. 8. Identity of Buyer (and/or Assignee clause) Legal Description of Property Purchase Price Earnest Money Deposit Escrow Period Contingency Periods – Physical and Financing Liquidated Damages Provision Disclosures (Various) Elements of the Operating Statement The operating (income) statement for an investment property looks very similar to any other income statement, with some exceptions to reflect the uniqueness of this asset class. The basic premise is that we begin with Gross Potential Rent, and then make adjustments to account for Vacancies and Delinquencies/Concessions to arrive at Effective Gross Income (EGI). After we have EGI, we subtract Operating Expenses to arrive at Net Operating Income (NOI). Operating expense ratios vary by property type, and can range from 20%-50% or more, depending on various factors. Also remember that Operating Expenses are stated as a percentage of Gross Potential Rents due to the fact that even an empty building incurs some operating costs. Thus: Gross Potential Rent (Less: Vacancies) (Less: Delinquencies/Concessions) =Effective Gross Income (Less: Operating Expenses) =Net Operating Income (NOI) Operating expenses include items such as: property taxes, utilities, insurance, management, repairs and maintenance, and other costs associated with operating the property. If the expense is associated with the day-to-day operations of the physical property itself, it’s most likely an operating expense. You may notice that there are certain items missing from this operating statement, namely: depreciation expense, interest expense, and income taxes. These are not part of operating expenses, and are instead referred to as “below the line” items. There reason these are not part of NOI is because these costs are attributable to the investor, not the property. In other words: Depreciation expense changes depending on ownership, as each investor has her own cost basis and annual depreciation charge (if any, as a property could be fully depreciated for tax purposes). Urban RE Financing and Investment - Habibi Page 6 Interest expense depends on how the property is financed (i.e., how much debt is used to buy the property) and thus changes depending on the ownership. Income tax expense rates depend on ownership, as each individual and entity have different tax rates. As you can see, if the expense changes with ownership, it is likely a “below the line” item and not part of NOI. Because of this, NOI is a very useful way to look at the cash flow from a property independent of the ownership and financing structure. And if you’re buying a building, this is exactly what you want to know. A Note on Capital Expenditures (“Cap-Ex”) Although depreciation is intended to reflect the rate at which a building’s improvements decrease over time, there is often a divergence between a standard deprecation schedule and the actual cap-ex costs needed for a building. Cap-ex costs occur infrequently and are ad-hoc in nature, which is why they are “below the line” items. That being said, when underwriting a potential investment opportunity it is important to factor-in the expected cap-ex costs that will be necessary to achieve the projected rents. Cap-ex needs vary by property type, but each cap-ex item is typically grouped into one of three categories: 1. Maintenance Requirements – Costs paid to keep a property competing at the same level (e.g. replacing an old roof, fixing damaged plumbing/electrical, etc.). 2. Tenant Improvements – For office and retail properties, the allowance given by a landlord to tenants to build-out their leased space is amortized over the life of the lease. 3. Leasing Commissions – For office, retail and industrial properties, the cost paid to the leasing broker is typically amortized over the life of the lease. Capitalization Rates (“Cap Rates”) The cap rate is a valuation metric used by real estate investors to apply a measure of value to each dollar of NOI. It is defined as: Cap Rate = Annual NOI / Property Value This is effectively the unlevered yield on a piece of real estate, and very similar to an inverted version of the common Price/Earnings ratio you may have seen in securities analysis. While on the surface it may seem like a very simple metric, it is very powerful, as modest changes to the cap rate can have very large-scale effects on a property’s value. Another useful way to understand the cap rate is to compare it to the Dividend Growth Model, whereby: Price of Stock = c / (r - g) Both “Property Value” and “Price of Stock” signify asset value. Thus: Annual NOI / Cap rate = c / (r – g) Urban RE Financing and Investment - Habibi Page 7 Next, we can equate “Annual NOI” to “c,” or cash flow. Thus: Cap rate = (r – g) The cap rate therefore equates to the discount rate less the NOI growth rate. This relationship is referred to as the Gordon Growth Model. Risk/Return Tradeoffs (Cap Rate Continuum) Source: Ziman Center AREA 101 featuring Professors Paul Habibi and Eric Sussman Leasing 1. Full Service Gross Leases – tenant primarily pays base rent amount (with some potential addons), and operating expenses paid by landlord 2. Triple Net Leases (NNN) – tenant pays base rent plus operating expenses (property tax, insurance, utilities). As such, base rent charged to tenant is usually equal to net operating income to landlord 3. Modified Gross Leases – Somewhere in between the above two configurations, subject to negotiation and can be complex, depending on the situation The Yield Curve and Mortgage Rates Interest rates on loans, also called mortgage rates, are primarily derived from the yield curve, a tool widely used by analysts and forecasters in assessing the state of the economy. Put simply, the yield curve depicts yield-to-maturity (YTM) of risk-free U.S. Treasury securities along different time Urban RE Financing and Investment - Habibi Page 8 horizons. To come up with the mortgage rates, lenders add a risk premium (also called a “spread”) to the YTM to come up with the interest rate on a loan with a specific time horizon. The yield curve: Reflects expectations regarding future rates. It is typically increasing with maturity since long-term bonds have more rate risk and because of expectations for increasing rates Is considered “normal” when it is upward sloping, though it may also slope downwards (“inverted”), implying expectations of economic contraction. Or, it can be flat, implying future uncertainty Is one of the most important metrics to watch as you proceed in your investment careers, regardless of asset class Urban RE Financing and Investment - Habibi Page 9 How does the yield curve tie into Real Estate Asset Valuation? Recall the yield curve is for risk-free investments. Real estate investments are not riskfree, so we need to make adjustments for the risks inherent in owning this type of asset. We must add a “risk premium” (also called the “spread”) to the chart above to adjust for the risks (and thus returns) of owning RE vs. Treasury securities. The spread for real estate debt is naturally lower than that of real estate equities given the higher priority of debt in the capital stack and increased volatility expected with equity cash flows Investors cannot compare two different types of investments without adjusting for the differences in risk profile of each (discount rate is used – more on this later). Within real estate investing, risk premium can differ due to property type, MSA/sub-market, property quality (class A, B, C), and other factors Capitalization rates (referred to as “cap rates” for short) measure the unlevered yield on real estate investments. (Unlevered yield refers to the return on assets generated by the property—in year 1—assuming we buy the property “all cash” and with no borrowed funds) o Cap rate equals the risk-free rate plus the risk premium o Cap rate also equals the expected return to equity holders (r) minus the expected growth rate of net operating income (g). Recall the Gordon Growth Model o Cap rates on various property types can be mapped as a continuum ranging from low to high based on risk levels (see Risk/Return Tradeoffs (Cap Rate Continuum above as example) In an asset bubble, such as the one we experienced leading up to the Great Recession of 2007-2009, risk premiums typically compress to unreasonable, unsustainable levels, causing prices of real estate to rise faster than its underlying cash flows: Urban RE Financing and Investment - Habibi Page 10 Forms of Investment in Real Estate Basic Types of Investment are Debt and Equity, plus their various permutations What is the difference between debt and equity? Well, there are a few differences: Debt holders (lenders) have priority of claims on cash flow of a property. As such, debt holders are paid before equity holders. This makes debt “senior” to equity, and equity “subordinated” to debt. As cash flows from a property are allocated to first to debt holders, this makes equity riskier than debt, and thus the equity holders will require a higher rate of return on money invested to compensate them for their inherently heightened risk or volatility. Within the category of debt, there can be “senior” debt and “subordinated” (also called “junior”) debt. Senior debt has the very highest priority on the cash flows from a property. It is usually secured by a “first trust deed” (more on this later). Because of the security interest, senior debt is sometimes referred to as being in “first place” or in “first position.” Junior debt is usually secured by something called a “second trust deed” (again, more on this later.) Because of this, junior debt is also called “a second.” For the same reasons described above, junior debt will require a higher rate of return than senior debt. Equity and debt are treated differently from a tax perspective. The interest expense on debt is generally tax deductible to the borrower; thus, true cost of debt is lower than stated interest rate. The “actual” cost = Interest rate x (1 – tax rate) Now that we are familiarized with the basic differences between debt and equity, let’s examine the four basic ways to invest in real estate: Active debt – loan origination (making loans), loan purchases on secondary market (also sometimes referred to as “trust deed investing”) Passive debt – pass through certificates, mortgage REITs Active equity – ownership of rental property, development Passive equity – equity REIT, Limited Partnership (LP) shares Who invests in real estate aside from individuals? A. Institutional Investors REITs (Real Estate Investment Trusts) Urban RE Financing and Investment - Habibi Page 11 REITs are tax-advantaged entities that trade like stocks, meaning that they raise equity capital through public share issuances Established by Congress in 1960 to help smaller investors make investments in large-scale income producing real estate 90% of taxable income must be distributed to shareholders as dividends. – because of this REITs function similar to fixed income securities. REITs must distribute this sizable percentage of their income so as not to “hoard” earnings. This ensures that even though REITs are tax advantaged, that they are still paying a healthy tax bill each year The requirement to distribute 90% of earnings means that REITs have to fund new acquisitions primarily through equity and debt offerings Private Equity Funds Pools of capital raised from investors to make debt and equity investments Typically have fixed life span and exit strategy, investments “illiquid” Types of funds include: core, value-add, and opportunity. o “Core” (and “Core-Plus”) assets include properties that are already stabilized, with tenants and steady income streams in place. These are typically fairly lower risk o “Value-add” assets include properties that are in need or repositioning, re-tenanting, or change of use. They are often moderately risky, based on the less-than-certain likelihood of achieving expected results o “Opportunity” assets include ground-up development, distressed deals, and properties that exhibit a high level of risk and uncertainty. These investors require high returns to compensate themselves for the inherently higher level of risk and uncertainty Pension funds ERISA (Employee Retirement Income Security Act) of 1974 required asset diversification for pension funds Pension funds own approximately 1/3 of the real estate equities market Foreign Investment (largest presence are Sovereign Wealth Funds). What factors drive international investment activity? (1) (2) (3) (4) Need for diversification Hedge against political risk Exchange rates – when US dollar is weak, US real estate is less costly Relative interest rates – Higher rates abroad tend to create investment outflows, as prices abroad are depressed and thus more attractive Urban RE Financing and Investment - Habibi Page 12 RE Performance A. Difficult to compare against other asset classes. Why? (1) Sparse, contradictory data (although getting better with institutionalization) Note: Securitization of real estate loans and entrance of Wall Street has created greater demand and liquidity. (2) Fewer reporting periods, quarterly appraisal estimates, smoothing of trends makes RE seem less volatile B. Real Estate Compared to Other Asset Classes: Returns on real estate tend to parallel that of common stocks more closely than most other major asset classes, but usually outperforms the stock market during periods of inflation – thus real estate is commonly thought of as a good hedge against inflation Market Efficiency Market efficiency theory refers to the idea that all relevant information is reflected in market prices, rendering the current price of any asset to reflect its true intrinsic value. As you can imagine, this is a hotly contested area of finance, given the market bubbles and volatility that have persisted in financial markets. In any case, there are two forms of market efficiency, and different people believe in various forms of efficiency in the marketplace, if at all: Semi-strong form: all publicly known info is reflected in market prices Strong form: all publicly and privately known info is reflected in market prices Regardless of what you may believe, there are certain variables that tend to increase market efficiency. That said, real estate markets tend to be much less efficient than other markets, such as the stock, bond and commodities markets. And the greater the inefficiency in a marketplace, the easier it is to purchase assets at a discount to intrinsic value and earn above-market returns So why is the real estate market less efficient? Here are some of the reasons: (1) Fundamental analysis is often times very weak. Many transactions occur at prices that reflect little more info than past prices of similar properties. Whereas investors in other asset classes run complex models to make investment decisions, real estate investors often perform little, if any, financial analysis before making decisions. This creates the opportunity for asset mispricing. (2) Transactions are infrequent in real estate related to other asset classes, typically because larger amounts of capital are required to make an investment. This “lumpiness” factor tends to decrease the frequency of real estate transactions relative to stocks, bonds, commodities and other markets. Urban RE Financing and Investment - Habibi Page 13 (3) There is a substantial lag between the time comparable transactions occur and the time when information is recorded and available for viewing in public records databases. Recall that a typical escrow period can last several months, which means that there can be a substantial time interval between when a deal is consummated and when its details are made available to the public. In contrast, stock transactions on the public exchanges, such as the NYSE and NASDAQ, for example, settle within three days. (4) Transaction costs high compared to securities markets, which inhibits frequent portfolio adjustments and increases time for info to be reflected in market prices. Sales commissions for publicly traded stocks can be as low as $8, but in real estate, they are a few percentage points (typically 2 - 6%) of the purchase price; this can be millions of dollars for sizeable deals. (5) Product is always differentiated. Each parcel unique, so that there is always some monopolistic control. Real estate is not a pure commodity. Building upon the comparison to publicly traded stocks, for example, all common shares of Microsoft and American Airlines are homogenous, whereas every piece of real estate is a unique asset with its own idiosyncrasies. Module 2: Market Cycles and Drivers of Supply and Demand Cyclical Change and Real Estate Activity At a macroeconomic level, the expanding and contracting of economic output over time is referred to as ‘the economic cycle’. The economic cycle is typically categorized into four stages— expansion, peak, contraction, trough. As the economy moves through a full business cycle, similar characteristics occur at each stage. As the economic cycle enters different stages, monetary and fiscal policy changes are enacted by government to counteract the macroeconomic distortions. Government will then enact policies that curb the over/undersupply affecting various parts of the economy. Like the macroeconomy, real estate values also generally move in a cyclical manner, and this is commonly referred to as ‘the real estate cycle’. Although the real estate cycle and the economic cycle follow a similar general pattern, a distinction is made between the two because they do not move through the cycle stages in unison. Further, the real estate cycle typically refers to changes occurring in rents and occupancy, a byproduct of the economic cycle’s expansions and contractions. Urban RE Financing and Investment - Habibi Page 14 Understanding the progression of each phase within the cycle is critical in being able to identify investment opportunities, as different risks become more prevalent when the cycle transitions between stages. There are some important considerations to note when analyzing cycle stage. First, the stages do not necessarily occur over equivalent time periods. Historically there have been recoveries that are brief and quickly transition to expansion, but other cycles where the recovery may drag on for years. It is also difficult to project the duration of phases. Just because there was general consensus that a previous cycle spanned a decade does not imply that the next cycle will approximate the same total duration. A unique aspect of real estate investing is that investors can create a successful allocation strategy for all stages of the cycle. However, understanding whether fundamentals indicate the cycle is entering a new stage can affect how investors approach a number of factors such as: property type allocation and return expectations, hold period/exit strategy, heavier focus on annual income versus property appreciation, appropriate timing of capex improvements. Current Market Conditions Please refer to in-class PowerPoint presentation for color on the current macroeconomic observations of the macroeconomy and U.S. real estate market Module 3: Financial Underwriting and Forecasting Let us start by defining our goal for this module: Forecasting the benefits (cash flows) from a proposed real estate investment. These benefits appear on the property’s operating statement. Recall the Elements of the Operating Statement: Urban RE Financing and Investment - Habibi Page 15 Gross Potential Rent: amount of revenue generated with no vacancies or uncollectibles Effective Gross Income (EGI): potential gross rent adjusted for vacancies and uncollectibles; includes other income (the total is considered actual gross revenues) Operating Expenses (OpEx): expenditures needed to maintain and operate the property; costs required in order to generate rent; these include any costs specific to the property. Measured as a percentage of Gross Potential Rent, as this best captures the fixed costs of real estate operations. NOI = difference between EGI and Op Ex Due Diligence (Some Basic Steps – there are many more) Legal, title and survey Preliminary title report Zoning restrictions Easements, property lines, topography, etc Physical inspection Land, environmental, soil, seismic Structural, foundation, grading/drainage issues Roof, water heater, laundry, mechanical/electrical/plumbing (MEP) systems Tenancy and leases Review rent rolls (collections, delinquencies, vacancies) Review leases for rates and concessions Review Certificate of Occupancy Review building permits Financial and operational Model expected operating results Develop an exit strategy Assess optimal operational, capital and tax structures Collect data from the subject property: Review past Statements of Operations Audit past operating expenses (utility bills, invoices, check copies, contracts, etc.) Market research Compare with peer group properties Look for substitutability and comparability, same segments Equally desirable, similar amenities Establish the market area Urban RE Financing and Investment - Habibi Page 16 7th Street Santa Monica Apartments Case Study: Multi-Family Financial Forecast Subject property: 1809 - 1833 7th Street, Santa Monica, CA Refer to Lee & Associates Marketing Brochure Construction of operating statements Revenues Confirmation of rents Inspect rent rolls Review leases Estoppels: confirms to tenants Adjust for vacancies, uncollectibles, concessions, write-offs and delinquencies Vacancy factor in strong markets is typically low, say 3% Vacancy factor in weaker markets is higher, say 10% Write off/delinquency factor is typically about 0.5% Vacancies represent units that are unoccupied, whereas write-offs/delinquencies represent occupied units with non-paying tenants who do not pay rent and must be evicted. Expenses Property taxes and Insurance Property tax: Proposition 13 (1978) placed property tax cap of 1% of assessed value, with value to be reassessed only upon legal transfer of title Unless a property is reassessed through transfer of title or other such trigger, tax increases are capped at 2% annually to keep up with inflation; counties have some discretion to add additional assessments to property taxes to cover local services. (typical City of LA tax is around 1.125%) Insurance: The lender requires insurance to protect its interest in the underlying loan collateral. If the borrower does not maintain adequate insurance, the lender will purchase a “force policy” and charge the borrower for insurance premiums that are often several times higher than traditional coverage. Fees and Commissions Property management fee: this is added by the lender to account for the costs it would have to incur if they foreclosed on the property. Covers the costs of offsite management, and is typically about 4% Urban RE Financing and Investment - Habibi Page 17 Payroll Resident manager compensation per door per month; resident manager is required by California state law if building contains 16 or more units Payroll tax of 12% of the payroll Workers compensation of 9% of the payroll Maintenance/repairs: this is a wildcard, depends largely on the condition of the property, as well as the type of property (e.g., hotel, office, apartment, etc.) Repairs and maintenance covers plumbers and electricians (1099 employees) Painting and decoration covers painting of common areas only; painting expense doesn’t include “clean and show” costs as they wash out against security deposits retained. Deposits that are kept cover cleaning, painting and getting unit ready. If tenant has been there more than 3 years you cannot deduct for painting the units. Refer to specific landlord/tenant laws for the state in which you plan to operate Utilities Gas bill is typically for water heater only, unless property is master metered (meaning landlord pays for tenants’ gas) Electricity is for common areas and hallways, unless property is master metered (meaning landlord pays for tenants’ electricity); total cost depends largely on whether common areas and hallways are open or enclosed, as enclosed common areas require 24-hour lighting; typically less for open common areas, and more for enclosed Water and sewer typically incurred by landlord Other expenses Legal fees are based on one Unlawful Detainer action per year Unlawful Detainer (UD) Action: If rent is not submitted by due date, landlord can give three-day notice, in which case tenant has three days to pay, not counting Sundays and holidays. At the end of three days, owner can refuse to accept rent and file UD. Once UD is filed and served to tenant, tenant has Urban RE Financing and Investment - Habibi Page 18 five days to respond. If tenant responds, they have to go pay a fee to the court and a hearing date is then set for three weeks from then. If the tenant does not respond, lawyer can take a “default” and get a judgment. Judgment goes to the Sheriff’s office and Sheriff posts a note, giving the tenant five days to vacate. If at the end of this time the tenant has not moved out, Sheriff comes to give possession of unit to owner. At this time, owner should have a locksmith present in case locks need to be opened or changed. Construction of Operating Forecast and Valuation Every analysis requires an exit strategy, whether it is operation of the property into perpetuity or obsolescence, or a quick flip. In this analysis we will assume three years of operations prior to a sale, or “reversion.” Some new terms used in the forecast and valuation Exit cap: cap rate to be used in the year of sale or exit; a future estimation using all available macroeconomic and other data NOI growth: compounded annual rate of growth in NOI, to be forecasted based on revenue and expense trends Reversion value (sale price): what we will sell the property for at the end of the holding period; calculated by dividing the final year’s NOI by the exit cap Adjusted basis: the depreciated value of the property, used to calculate the taxes payable upon sale of the property Cash flow to equity holders: cash they receive as residual claimants on the property’s cash flows; they are paid after debt holders are paid Cash on cash return: cash generated divided by cash invested in property (although widely used, this measure does not properly account for the time value of money and risk of the investment) Equity Multiple: Measure of money returned to equity investors versus money contributed by those investors = (total profit + equity invested) / equity invested Debt yield: NOI divided by Loan Amount. Higher yield implies less risk to lender, as there is more NOI available to service debt. In a volatile market, lenders will seek higher debt yields (i.e., will lend less relative to the underlying income) Financing: Calculating the Maximum Loan Amount Income approach/NOI margin method: NOI/Margin = Maximum annual loan payment Loan-to-Value (LTV) method: Urban RE Financing and Investment - Habibi Page 19 Take percentage of value of property, typically somewhere between 50-90%, but this depends on property type and other factors For adjustable rate loans, interest rate is priced with a spread above the T-Bill rate, and thus fluctuates over time. As a rise in interest rates may adversely affect a borrower’s ability to service the debt, most adjustable rate loan programs provide for a lower LTV ratio and thus protect both the borrower as well as the lender. After all this is done, use the LTV test and compare how much you can borrow under this cap. Compare what you can borrow under both the income approach and the LTV approach, and use the prevailing (lesser, more restrictive) loan amount. MODULE 4: Financial Leverage and the Capital Stack Let’s begin this module with a little review of how interest rates work. Compounding Intervals: Thus far when referring to interest rates, we have made the basic assumption that we are dealing with “nominal” or “stated” rates in our calculations. When compounding on a periodic basis, we need to change our general formula: From FV = PV (1+r)n To FV = PV [1 + (r/m)]nm, where m=intervals per year Effective Annual Yield Illustration Let’s examine the following scenarios and see how the effective interest rate is altered by compounding frequency: FV of $10k, annual rate of 6% compounded annually for one year = $10,600 EAY = (FV-PV)/PV = 6% FV of $10k, annual rate of 6%, compounded monthly for one year = $10,616.78 EAY = 6.1678% FV of $10k, annual rate of 6%, compounded daily for one year = $10,618.31 EAY = 6.1831% Urban RE Financing and Investment - Habibi Page 20 More frequent compounding gives higher EAY. However, even with infinitesimal compounding intervals, the EAY will reach a limit, expressed as en. Thus, using r=6%, the limit is 6.1877%. Now, we’re ready to tackle financial leverage… In this module, we will: Introduce the concept of leverage Show why it can be valuable and also dangerous Show how lenders price loans via the interest rate and illustrate the risks they incur every time they underwrite a loan Illustrate types of loans and ways lenders charge interest Run through some basic calculations for each type of loan Lenders make loans in exchange for compensation. What’s their compensation? Interest – compensation for the use of funds; driven by market and risk What are they being compensated for? What are their risks? Default risk – borrower defaults on the loan Interest rate risk – unanticipated inflation Prepayment risk – risk that loan will be prepaid when rates fall below contract rate o Prepayment penalties Stepdown Yield maintenance Defeasance Liquidity risk – risk that loan cannot be sold in secondary market Legislative risk – tax status of mortgages, rent controls, etc. Interest rate must provide for fair and adequate compensation for these risks. Positive vs. negative leverage: ROA must exceed debt constant (debt service/loan amount) ROA less this borrowing cost is the “spread” Urban RE Financing and Investment - Habibi Page 21 Financial leverage also effectively increases the depreciation deduction. Recall that you depreciate real property using some portion of total cost basis, not just the equity invested. As such, financial leverage allows the investor to benefit from a depreciable basis that can be much larger than the total amount of equity in the deal. Similarly, financial leverage amplifies tax benefits derived via favorable capital gains rates Assume loans below are 9% interest, compounded monthly, with 20-year amortization: Illustration: Cash Flow Consequences of Financing Alternatives Net Operating Income Less: Annual Debt Service Before Tax Cash Flow No Loan $ 210,000 $ $ 210,000 $1,000,000 Loan $ 210,000 $ 107,964 $ 102,036 $1,200,000 Loan $ 210,000 $ 129,564 $ 80,436 Purchase Price Less: Loan Amount Equity Invested $ $ $ $ $ $ $ $ $ Ratios: Debt Service / Loan Amount Net Operating Income / Cost Return on Equity 1,500,000 1,500,000 N/A 14% 14% 1,500,000 1,000,000 500,000 1,500,000 1,200,000 300,000 11% 14% 20% 11% 14% 27% Net Operating Income Less: Annual Debt Service Before Tax Cash Flow No Loan $ 150,000 $ $ 150,000 $1,000,000 Loan $ 150,000 $ 107,964 $ 42,036 $1,200,000 Loan $ 150,000 $ 129,564 $ 20,436 Purchase Price Less: Loan Amount Equity Invested $ $ $ $ $ $ $ $ $ Less-Than-Expected NOI Ratios: Debt Service / Loan Amount Net Operating Income / Cost Return on Equity Urban RE Financing and Investment - Habibi 1,500,000 1,500,000 N/A 10% 10% 1,500,000 1,000,000 500,000 11% 10% 8% 1,500,000 1,200,000 300,000 11% 10% 7% Page 22 Key points: Yield to equity increases w/ positive operating leverage Spread affects whether leverage is positive or negative Debt cheaper than equity b/c senior, less risk, and interest is tax deductible o “True” cost of debt =[interest rate x (1-tax rate)] Too much debt squeezes NOI, which is static; this can amplify bankruptcy risk Capital structure refers to debt/equity mix; balance low cost of capital with tolerable bankruptcy risk (decreasing cost of capital vs. increasing bankruptcy risk). Keep in mind that both senior and subordinated debt are included in this calculation. Debt of any type will increase the debt/equity ratio and will increase bankruptcy risk. Banks implement measures to protect us from over-leveraging: NOI cushion (Debt Service Coverage Ratio), LTV maximums, debt yield (NOI/loan amount), et al. Additional Benefits of Leverage Amplify tax shelter - even when properties purchased w/ borrowed funds, while equity outlay is reduced, you can deduct full depreciation Amplify gain on disposal - realize appreciation benefit on less cash. To the extent that you can take depreciation deductions, they offset ordinary income, but when you reduce your tax basis, you only pay unrecaptured depreciation rate (25%) on those basis reductions. Gain is also amplified when appreciation rate on property exceeds borrowing costs Illustration: A parcel of land that is well situated to benefit from rapid urban growth can be acquired for $600,000. A prospective investor expects that the land will double in value during the next five years, after which she plans to sell. During the interim, the land can be leased to a turnip farmer for an annual rental that just covers the property tax liability, so there will be zero annual cash flow before debt service and income taxes (because there are no improvements on or to the land – just raw farm land – there is no cost recover allowance to consider. The land can be purchased for $600,000 cash, or the present owner will agree to accept a $150,000 down payment accompanied by a note and purchase-money mortgage for $450,000. Both the principal and the accumulated interest on the note will be due and payable at the end of the fifth year, with interest accumulating at a compound annual rate of 9 percent (9%). Urban RE Financing and Investment - Habibi Page 23 Calculation of CAGR/IRR Proceeds from Sale after 5 Years Less: Balance due on loan Net Sales prodeeds, before tax $ $ $ Initial Cash Outlay Approximate annual pretax rate of return $ With Leverage 1,200,000 692,381 507,619 Without Leverage $ 1,200,000 $ $ 1,200,000 150,000 $ 27.60% 600,000 14.90% FV of $450k loan ($450k*(1.09)^5) = $692,381 Terminology Note: A note is a contract that says “I owe you money.” For a commercial real estate loan, the note typically will include a more complicated version of the following language: “Bank of America (the “Lender”) agrees to provide a $1,000,000 loan to Cornell, LLC (the “Borrower”). Borrower agrees to make payments to Lender on the first of the month, every month, in the amount of $5,995.51 (calculated as follows: 6% interest rate, 30 year amortization.) Borrower agrees to pay the loan back in full to Lender by January 1, 2015 (the “Maturity”). Deed of Trust: A deed of trust is a security instrument that secures the note to the real property. If the Borrower does not pay back the debt, the Lender has the legal ability to foreclose on the property, sell the property, and use the proceeds to pay back the debt. Loans that are not secured by a deed of trust do not have this ability and hence are called unsecured loans. The deed of trust is a deed wherein legal title to the property gets transferred to an independent third party (a trustee), which holds it as security between the borrower and the lender. The borrower is the trustor, and the lender is the beneficiary. If the debt is paid off as indicated in the note, the trustee transfers title back to the trustor in what is known as a reconveyance. If, however, the debt is not paid off according to the specifications in the note, the trustee has the power to foreclose on the property by a clause in the deed of trust known as the power of sale clause. Deeds of trust can be secured by a 1st priority lien, a 2nd priority lien, a 3rd priority lien, etc. (See next section.) Mortgage: A mortgage is another kind of document that pledges real estate as collateral for a loan, much like a deed of trust does. The main difference between a mortgage and a Urban RE Financing and Investment - Habibi Page 24 deed of trust has to do with the foreclosure process. A foreclosure under a deed of trust can take place outside of the court system in a process known as “non-judicial foreclosure”. A foreclosure under a mortgage can only take place via the court system in a process known as “judicial foreclosure”. Mortgages are not used frequently in California. Seniority of Loan Instruments Senior loan – also called a first deed of trust, or first mortgage, or sometimes just a “first” for short. This is the highest “rung on the ladder” of debt, and first in line as compared to other loans. As a result, these loans usually have the lowest interest rate, and comprise the largest piece of a property’s capitalization. Junior loan – also called subordinated debt, or a second mortgage, or sometimes just a “second” for short. These instruments are lower (junior) to in collection priority. Because of this, they have a higher rate. No one wants to be behind a big first mortgage unless it is priced accordingly. Here is why: Say you have an apartment building worth $1,000,000. There is a senior loan in first place for $750,000 and a 2nd for $100,000. That means that there is $150,000 of equity in the building. Now let’s assume that the owner of the building stops paying his mortgage for whatever reason. The first has the right to accelerate the loan (call all $750,000 due at once, not just the missing interest payments) and foreclose on the property. This means that the second will get totally wiped out, unless it comes up with the $750,000 of fresh cash out of pocket to cure the first. (This is in addition to the $100,000 that they already loaned.) This is not a happy day for the holder of the 2nd mortgage! Keep in mind that there was (and still is) equity in the property when they made their loan in 2nd place. Therefore, one important aspect of being a lender in second position is your ability to come out of pocket with fresh cash to cure the first. This is necessary in order to protect your security interest as we saw in the example above. This situation is made even more precarious if we consider a scenario in which values are declining. Let’s assume that due to the recent “Great Recession”, the apartment building is now only worth $800,000. Therefore, the second lender now can only hope to recover $50,000 of the $100,000 loan he originally made. Because they are higher up in the capital stack that the first, they will only achieve a partial recovery. Amortization Alternatives Interest only Fully-amortizing (amortization = maturity) Partially amortizing – balloon payment (amortization > maturity) Urban RE Financing and Investment - Habibi Page 25 Sample Calculations (Calculator and Tables) Ex: 1810 Cherokee apartment building: $2.4M @ 6.1% annual interest rate, monthly payments and monthly compounding intervals Interest only – simple monthly calculations; principal paid at end. Fully amortizing – constant payments calculated such that monthly interest is paid yet principal paydown is big enough such that the loan reaches zero balance at end of term. The amortization period is the length of time it takes for the principal balance to reach zero. Partially amortizing – same as above, but maturity hits a wall; value of the balloon payment can be calculated at any point in time; it’s the PV of all the remaining annuities discounted at the note rate. Alternative Interest Rate Provisions Fixed rate loans – lock and pay for longer term (recall yield curve) Adjustable rate loans (ARM) – Index rate + spread based on Yield-to-Maturity (YTM) on Treasuries, average cost of funds, average mortgage rates, or LIBOR; adjustment period frequency determines risk to lender Negative ARM – limits interest payment, but interest unpaid gets added to principal balance; these loans are no longer common as they can tend to create problems for borrowers who only make minimum payments. Usually, these loans get “recast” every 5 years, meaning payments are recalculated using remaining term and prevailing rate. Some banks will recast anytime principal balance reaches 110% of initial balance. Thus, this type of loan only protects you in the short term until you are recast. Additional topics Recordation: Deeds of trust and mortgages are recorded on real property. Recordation is a process of filing a document at the county recorder’s office so it becomes “of record” and allows the public notice that a claim on the property exists. Although unrecorded documents are fully effective and binding under common law, as a best-practice, all deeds are always recorded. Here’s why: The law assumes that once something is recorded, it provides constructive notice to the public that such a claim exists on the property at a certain point in time. For example, let’s assume that A sells a property to B, and B does not record the sale. One year later, A turns around and sells the same property to C, who immediately records the sale. The law says Urban RE Financing and Investment - Habibi Page 26 that C now owns the property. (C would have had no way to know that B had a claim on the property, since B did not record.) California has what is known as the race-notice recording statute, which states that the first party to record without notice of conflicting claims has priority. “Race” refers to the idea of a “race” between two parties to the recorder’s office. (Each wants to be first to record.) Senior loans are “senior” to junior loans because they were recorded first in time. Chain of Title: The term chain of title refers to a chronological history of all documents affecting title to a certain property. To be included in the chain of title, a document must be properly recorded so that it may be discovered in a search of the property records at the county recorder’s office. (In practice, this is all done electronically via a title company. Title companies have digital copies of each document in a chain of title.) Title Insurance: As you can imagine, there are massive amounts of records in a chain of title, dating back to the first person who originally owned a piece of land. Because the risk of missing a record could be catastrophic, title companies will offer insurance policies stating that they guarantee a particular claim (for example, a loan) is in a given position in the chain of title. No lender will make a loan without a title insurance policy insuring that the lender is in (for example) first position. Foreclosure: Foreclosure refers to the process by which a trustee conveys the title of a property to a lender due to non-performance of a secured debt. For example, let’s assume you get a loan on your house for $500,000 from Bank of America, and your monthly payment is $3,000 per month. Let’s further assume that you lose your job and can’t pay your monthly mortgage. Three months go by (and so, therefore, you are behind $9,000 in your mortgage payments.) Bank of America will likely begin foreclosure proceedings. Here are the steps that this entails: First, the lender files a Notice of Default (also called an “NOD”.) This is a formal document that gets recorded by Bank of America that says that you’ve missed several payments on your loan, and therefore are in default under the terms of the note. (Remember, the note is not recorded, but the deed of trust is recorded.) The NOD basically says if you don’t cure the default immediately, BofA will sell your house at a public auction. Sometimes, but not always, the NOD also includes a clause whereby the debt is accelerated, meaning that not only do you have to pay off the $9,000 immediately, but you also have to pay off all $500,000 immediately. (If you have lost your job and can’t pay off the $9,000, the likelihood of you being able to pay off the $500,000 is zero.) Second, the lender files a Notice of Sale (also called a “NOS”). This is another formal document that gets recorded by Bank of America. It basically says that if you don’t pay off the entire loan ($500,000), it will instruct the trustee to conduct a public auction of your deed of trust securing the house. The notice of sale always gives the location and date of the auction (called a trustee’s auction.) Urban RE Financing and Investment - Habibi Page 27 Third, the trustee conducts the auction. Assuming the auction does not get delayed (which can happen for a variety of reasons), the trustee will auction off the deed of trust. If the deed of trust is in first position, the buyer of the deed will get the house. If the deed of trust is in second position, the buyer of the deed will get the house subject to the loan which is in first place (i.e., senior to him.) There are a variety of other conditions and idiosyncrasies of trustee auctions which are beyond the scope of this module. The important part is understanding that a secured lender has the power to foreclose on a deed of trust and wind up owning the property. Trust Deed Investing: This is a type of real estate investing that involves purchasing loans and holding them for interest. It is analogous to somebody who purchases a corporate bond, only in this case you are getting the additional protection of a security interest. Although as individuals we don’t usually think of being a real estate lender (typically individuals are borrowers and banks are lenders), trust deed investing allows individuals to be lenders. Like anything else in life, there are certain trust deed investments which are excellent investments and others which are not. The trick is figuring out (a) what position the loan is in, (b) what the value of the property is, and (c) who your borrower is and why they have procured a loan in this fashion, and (d) if the interest rate being offered if adequate to compensate you for the risk you’re taking on. Nominal Rate vs. APR vs. Effective Annual Yield Differences: (1) Nominal rate is simply the stated note rate (2) Building on the nominal rate, APR also includes points/origination fees that deduct from proceeds and makes APR > nominal rate (3) Building on APR, EAY includes compounding frequency, which makes EAY > APR Example: A borrower signs a $100,000 mortgage note payable in equal monthly installments over 25 years, with interest at 9 percent per annum on the unpaid balance. The lender charges a loan origination fee equal to 2 percent (2%) the face amount of the loan. Loan proceeds = Face ofofnote – Origination fee Loan proceeds = Face value less origination fee = $100,000 – (.02 x $100,000) = $98,000 But… Loan PMT is based on the full $100k, so loan PMT is: $839.20/month HP12C: 9 Enter 12 Divide =i; 300=n; 100,000=PV; PMT Urban RE Financing and Investment - Habibi Page 28 Now, if we want to find out the effective interest that is charged based on the actual $98,000 received… HP12C: 839.20(CHS)=PMT; 98,000=PV; 300=n; I This is monthly rate. Multiply by 12 to get the effective annual rate. Comparing Effective Rates Exercise An investor is offered three alternative $1 million loan proposals. All the loans are fully amortizing and require monthly payments. a. There is a 2.5% origination fee for Loan A. The interest rate is 7.5% per annum. The amortization period is 20 years, and there is no prepayment penalty. b. Loan B requires a one-half percent loan origination fee. The contract interest rate is 8% and the amortization period is 25 years. There is no prepayment penalty. c. Loan C requires no loan origination fee. The interest rate is 8% and the amortization period is 25 years. There is a prepayment penalty of 2% of the prepaid amount. Effective Interest Rate with Three Borrowing Alernatives When Loan Runs Full Term Face Amount of Note Less: Front-End Charges Loan Proceeds $ $ $ Monthly Payment Effective Pre-tax Rate $ A 1,000,000 25,000 975,000 8,055.93 7.84% Loan Proposal B $ 1,000,000 $ 5,000 $ 995,000 $ $ $ $ C 1,000,000 1,000,000 7,718.16 8.06% $ 7,718.16 8.00% 922,739 922,739 $ $ $ 922,739 18,455 941,194 Prepayment After Five Years Remaining Balance after Five Years Add: Prepayment Penalty Payoff amount Effective Pre-Tax Rate $ $ $ 869,021 869,021 8.15% $ $ $ 8.13% 8.31% Refer to the 3 alternatives presented above. Goal is to find best possible EAY available. To do this, find the EAY of each given the payoff assumptions (i.e., loan outstanding for whole term vs. 5-year prepay) Find EAY for each alternative, assuming loan held for entire term. Alternative “A” looks best. However, assuming a 5-year prepay, things change. Look at annuity plus balloon plus prepay penalty (if any) to determine EAY of alternatives. Alternative “B” is now most appealing. Urban RE Financing and Investment - Habibi Page 29 You really need a computer to perform these calculations, but two points to note: (1) Front-end fees give us higher EAY over short term because fee must be amortized over short period. Thus, opt to pay points only if you’re holding the loan over the long haul. (Lenders assume 3-4 year hold nowadays and add about 0.25 to the rate if you don’t pay points; thus, this time period is the breakeven point to make this decision). (2) Prepayment penalties (and yield maintenance) can radically affect an otherwise appealing loan, so if you’re going to sell in the short-term or refinance, avoid these situations. Incremental Cost of Borrowing Say we can take a loan of: (A) (B) $80k for 25 years, compounded monthly @ 12% or $90k for 25 years, compounded monthly @ 13% At first glance you may think that the incremental cost of extra $10k is 13%. To get the extra $10k you must pay an additional 1% on the first $80k also. Increases the cost of the additional $10k considerably. But how much? (A) (B) Payment $842.58 Payment $1,015.05 Difference of PMT is $172.47 Want to find the annual rate of interest, compounded monthly, that makes the PV of the differences in the payments ($172.47) equal to $10,000 Calculator solution: n=300 PV=(10,000) PMT=172.47 FV=0 Solve for I =20.57% ANNUAL (must multiply by 12) Proof: [($80k/$90k) x 12%] + [($10k/$90k) x 20.57%] = 13% Key Takeaway: Unless you can earn more than this with an investment of equal risk, you are better off using your $10k as down payment. Urban RE Financing and Investment - Habibi Page 30 Other Important Considerations Aside from the effective interest rate or cost of borrowing, we must consider other factors that differentiate various loan alternatives. These include factors that have both quantitative and qualitative implications. Here are a few additional things to consider: Recourse: allows the lender to pursue assets of individual guarantors in the event of a loan default. Full recourse allows for a full guaranty of the loan amount, 50% allows for half, and so forth. Nonrecourse loans are also available from certain lenders; however these are priced slightly higher (typically about half a point) to reflect the additional cost to the lender. In a non-recourse loan, the lender can only pursue the assets of the borrowing entity with few exceptions. Covenants: requirements placed on the borrower for the loan to remain in good standing. Often times, a violation or non-performance of a covenant can lead to acceleration of the loan, requiring immediate payoff. Common examples of loan covenants include: Compliance with certain debt coverage ratios during the life of the loan Periodic submission of borrower financial statements showing compliance with minimum liquidity requirements Requirements for no secondary financing to be placed on property (i.e., second mortgages) Requirements to maintain adequate levels of insurance on the property Requirements to remain current on property tax payments and any special assessments Partitioning the IRR When assessing the total returns on a project, it is useful to know how much of the total return is dependent on cash flows from operations and how much is dependent on property appreciation. Generally speaking, the overall undertaking becomes inherently riskier when a larger part of the return is dependent on appreciation. To determine how the total IRR is distributed, or “partitioned,” we must perform the following steps: (1) (2) (3) (4) Compute the IRR Discount cash flows from operations using the IRR Discount cash flow from sale using the IRR Compute the percentages Urban RE Financing and Investment - Habibi Page 31 Example: Equity invested = $600,000 BTOCF1 = $40,000 BTOCF2 = $42,000 BTOCF3 = $45,000 + $800,000 from sale IRR = 16.48% Where BTOCF = Before-tax operating cash flow PV of BTOCF = $93,773 (using 16.48% as discount rate) PV of BTCF (sale) = $506,229 (discounting $800,000 at 16.48% for 3 years) Percent from Operations = 15.63% ($93,773/$600,000) Percent from Sale = 84.37% ($506,229/$600,000) Usefulness of this Method: This is useful for comparing alternative similar investments For example, an alternative property may have the same IRR, but if the percentage of return from sale relative to percentage of return from operations is higher, there may be significantly higher risk associated with this property (dependence on future leases not yet in place, rent growth, exit cap rate, etc) MODULE 5: Risk/Reward Tradeoffs and Deal Structuring Legal Ownership Entity Types Below is a summary of the various legal ownership entity types used for real estate investing (NOTE: this section only offers a high-level summary of ownership entities and their differences. Please speak with a qualified legal professional before pursuing the establishment of an ownership entity): Sole Proprietorship: Real estate ownership is structured so that it is held by a single individual. There are no formalities to create a sole proprietorship, and all economic gains/losses are reported on the individual’s personal tax return. The sole proprietor has unlimited liability, meaning that real estate losses can both wipe out equity invested and courts could go after the individual’s personal assets to satisfy a judgement. Sole proprietorships are not a common structure used to hold real estate because they do not limit liability. Urban RE Financing and Investment - Habibi Page 32 Partnerships: Ownership entity where two or more entities share ownership. Partnerships are pass through tax entities structured so partners own interest in the partnership, not in the invested property. The two main types of partnerships are General Partnerships and Limited Partnerships: General Partnership is a structure where each partner has unlimited liability, meaning one partner’s dealings with third parties can impact the remaining partners. Because of this liability exposure, general partnerships are used in combination with other legal ownership structures to help limit liability. Limited Partnership (LP) is a legal entity that separates members into two separate classes—general partner(s) and limited partner(s). An LP must have at least one general partner and one limited partner. A partnership agreement outlines LP agreement, explaining how the responsibilities differ between the two classes, and how profits are split between general partners and limited partners. General partners handle the details of asset investment and management decisions and have unlimited liability exposure. The limited partner(s) risk is limited to only their equity invested in the LP, and they do not participate in the day-to-day operations. LP’s have a finite life that is specified in the partnership agreement. Limited Liability Company (LLC): Ownership entity consisting of one or more members where the liability is limited to only the financial stake committed by each member. LLCs are structured so members own interest in the LLC, not in the property itself. LLCs are very flexible in how they can be structured allowing members to distribute managerial and financial responsibilities disproportionately, if desired. The two common types of LLC structures are member-managed and manager-managed: Member-Managed gives all members an equal say in business operations and management decisions Manager-Managed established a two-tier structure where the managers handle all day-to-day operations (and do not necessarily have to be members of the LLC), whereas members are owners who take a more passive role. This structure is similar to a corporation. Corporation: Legal entity owned by one or more shareholders and often managed by directors. They will be registered at a state level via an article of incorporation, which is a costly process. The main benefit offered by corporations is the limit on the liability they give shareholders, who can only lose the equity invested in the corporation. Furthermore, they are fairly liquid ownership entities because they are organized to operate in perpetuity. C Corporations and S Corporations are the two types of corporations used for real estate investment, they key difference between the two is taxation: C-Corporation is a legal taxable entity that is owned by shareholders and managed by directors. A c-corp is that it cannot operate as a pass-through tax entity, so Urban RE Financing and Investment - Habibi Page 33 investment returns will be “double-taxed” first at a corporate level, then at the shareholder income level. S-Corporation can elect to be taxed as a partnership, and thus avoiding “doubletaxation”. To elect s-corp status the shareholders must adhere to the following conditions at the time of incorporation: Less than 100 shareholders, all of which must be individual persons who are residents of the United States. Also, shares must all be a single class of stock. Joint Ventures (JV) JV’s are a form of business agreement commonly used for large real estate investments. JV’s allow parties to jointly pursue an investment, but distribute the economic benefits/burdens unevenly between the parties. Typically a JV will be formed to bring together 1) a party with a high degree of operational skill (e.g., a developer) with 2) a party with access to a deep pool of equity capital (e.g., an institutional investor). The JV structure allows the two parties to share the investment risks accordingly and structure the profits to align with each party’s risk tolerance. JV’s are not a legal ownership entity in themselves, so will be organized as some combination of sole proprietors, partnerships, corporations or trusts. These parties will come together an outline terms using a JV agreement which outline the benefits and burdens of each party involved. Common Deal Structure Terms and Example Refer to in-class PowerPoint presentation MODULE 6: Real Estate Taxation Note: Our discussion of income taxes in intended only as a general overview of how taxes affect real estate investments. Tax laws change very frequently, and many complexities in the Internal Revenue Code area beyond the scope of this class. When considering the impact of taxes in real estate investment, it is a good idea to consult a qualified tax professional. For those of you who wish to learn more about taxation, pick up a copy of the Commerce Clearing House U.S. Master Tax Guide, which is published annually and available through www.amazon.com or www.tax.cchgroup.com Important Distinctions Personal Use Personal residence is not depreciable Gain on sale is tax exempt if primary residence for 2 out of the last 5 years $250k individual; $500k married filing jointly; anything in excess of this exclusion is considered capital gain Loss on sale has no tax consequences Urban RE Financing and Investment - Habibi Page 34 Mortgage interest on the first $750,000 of home loan deductible Property taxes deductible, but when combined with SALT, capped at $10k/year Loan points deductible Closing costs typically capitalized and added to cost basis Investors: property “held for use in a trade or business” Most income producing real estate is included in this category Includes investors holding title as corporations, partnerships, LLCs and trusts Homes held for investment or rental purposes are included in this category, as well as most income property within the various product types. Dealers: those who intend to flip, or immediately resell; includes developers and those who subdivide land for resale; refers to those who hold real estate as inventory available for sale Cannot take depreciation deductions Cannot enter into Section 1031 tax-deferred exchanges Must pay taxes at ordinary income tax rates, not capital gains rates Entity Taxation: treatment of “C” corps (entity is taxed) differs from that of individuals, partnerships, “S” corps and LLCs (entity not taxed; income passes through) Definitions Taxable income = NOI – interest expense – depreciation allowance Depreciation: in theory, investors should only be taxed on income net of an economic allowance for decreases in physical value Historically, Congress has provided for allowances in excess of economic depreciation to stimulate investment activity and increase the supply of available space (e.g., accelerated depreciation) Residential real property depreciated straight-line over 27.5 years. To qualify as residential real property, 80% or more of gross rental income must be from dwelling units; otherwise it’s considered non-residential real property Non-residential real property depreciated straight-line over 39 years Under the Tax Cuts and Jobs Act of 2017, depreciable lives extend to 30 and 40 years for residential and non-residential, respectively, when election is made to deduct all interest expense past the allowable limits. Depreciable basis: the amount that can be depreciated, which is usually equal to acquisition cost plus capital improvements plus costs associated with placing property into service, such as legal work, title insurance, et al. Costs associated with financing or costs incidental to purchase are not included. Land has no depreciable basis, as it is not a depreciable asset Allocating value between land and buildings: there are three generally accepted ways to do this (1) Specify in the purchase and sale agreement Urban RE Financing and Investment - Habibi Page 35 (2) Order an appraisal (3) Use the Tax Assessor’s ratio of land-to-improvements Adjusted basis: depreciable basis less accumulated depreciation Mid-month convention: during the month a property is placed into, or removed from, service, the taxpayer can only claim half of the monthly allowance (e.g., property purchased or sold on November 1st is treated as if sold on November 15th, and half month of depreciation is taken) Disposal of Depreciable Real Property: tax is determined by subtracting adjusted basis from net sales proceeds, which is gross sales price (cash or property received in payment for property sold, plus liabilities against the property assumed by the buyer) less selling expenses (e.g., legal, recording, brokerage fees). Tax is paid on the difference between the net sales proceeds and adjusted basis, and divided into two parts: Capital Gains, which represents the “true” appreciation on the property (net sales proceeds less cost basis). The Federal tax rate is currently 15-20% on capital gains and applies only if the property has been held for investment purposes for at least one year. Unrecaptured Depreciation, which represents the total accumulated depreciation taken form acquisition through date of sale. The Federal tax rate is currently 25% on unrecaptured depreciation. Interest expense: generally deductible, principal is not Loan points: deductible ratably over the term of the loan Example: investor secures loan for $1 million to buy a building. The loan is partially amortizing, with a 10-year maturity and 30-year amortization. Two points, or $20k, are paid on the loan. For tax purposes, the $20k is deductible over 10 years, at a rate of $2k per year. If the property is sold before all points are amortized, the balance can be expensed in the year of sale. As such, if the building is sold and the loan is repaid in year 5, the remaining $10k can be immediately expensed Construction period interest and taxes: capitalized if incurred during the time of construction Leasing commissions: capitalized and amortized over life of the lease Income Classifications Arose from 1986 Tax Reform Act Passive income (or loss) is where investor does not materially participate in the management or operation of property. Investment in rental property is considered passive Urban RE Financing and Investment - Habibi Page 36 Material participation requires satisfaction of both of the following criteria: (1) More than half of all services individual performs during the year are for RE trades/businesses; and (2) Individual performs more than 750 hours of service per year on those activities Active income (or loss) is where investor materially participates on a “regular, continuous and substantial basis.” Salaries, wages and fees for service are active income. However, even if taxpayer materially participates, income or loss from rental activity is not considered active income (exceptions for hotels, nursing homes, et al.) Passive Loss Limitations Passive losses can only be used to offset passive income, with unused losses carried forward indefinitely. When an investment producing passive income is sold and capital gain occurs, any unused or suspended losses from that activity are: (1) First used to offset any capital gain from sale; (2) Next, used to offset any other passive income from that year; (3) Next, used to offset any income from that year Any excess is carried forward as a capital loss, not subject to passive loss rules When an investment producing passive income is sold and capital loss occurs, and unused losses from prior years remain, unused losses may be used to offset any sources of income. Of the capital loss portion, $3k of the loss can be used to offset any other source of income for the year. Any excess is carried forward indefinitely as a capital loss, not subject to passive loss rules Special Passive Loss Exceptions Individual rental property owners are allowed to offset active income with up to $25k of passive losses (to the extent that passive losses exceed passive income) from rental activities in which individual actively participates. Active participation is less stringent than material participation. In general, the individual must own 10% or greater interest in the activity and be involved in management decisions. This exception phases out for individuals at Adjusted Gross Income (AGI) levels between $100k and $150k. The phase out reduces the $25k by 50% of every AGI dollar above $100k. Example: If AGI is $130k, limitation is reduced by $15k (50% of the difference between $130k and $100k). The maximum allowable deduction is then $10k ($25k less the $15k reduction) For “material participation,” individuals can deduct unlimited real estate losses (Tax Act of 1993). Section 1031 Tax Deferred Exchanges Urban RE Financing and Investment - Habibi Page 37 Refer to posted handout on course website for definitions and requirements. Urban RE Financing and Investment - Habibi Page 38 In-Class Case Study Curtis Jackson purchased an apartment building in Queens, NY on December 9, 2019, at a cost of $8M. According to the Tax Assessor, the building has an assessed value of $6M and the land has an assessed value of $2M. As of May 31, 2022, the date on which he plans to sell, the property has a value of $12M. Curtis has a loan of $6M on the property and no other liabilities. Question 1: As of May 31, 2022, what was Curtis’ adjusted basis in the property? Monthly dep. = $18,182 [use $6M over 330 per. (27.5 yrs. X 12)] Use ½ month convention for Dec. 2019 and May 2022 (total 29 mos.) Accumulated depreciation = $18,182 x 29 months = $527,278 Adjusted basis = $8M – $527,278 = $7,472,722 Later on that day Curtis decides to enter into a like-kind exchange with Shawn Carter, an unrelated party. The new property, an apartment building in Brooklyn, has a fair market value of $17M, and Curtis is going to assume a loan of $9M on the new property. This transaction requires Curtis to contribute $2M cash for the purchase of the new property. Shawn’s adjusted basis in his property before exchange is $10.5M. New adjusted basis (after exchange) is a function of: (1) Carryover basis (2) Net loan assumption/relief (3) Cash conveyed/received (“boot”) To compute new adjusted basis, we start with carryover basis, then make the following adjustments: (1) If there is net loan assumption and cash conveyed, add the two to old basis to get new basis. There is no taxable gain in this case; (2) If there is net loan relief and cash received, both are considered taxable income and basis doesn’t change; (3) If there is net loan assumption and cash received, the cash received is taxable and the net loan assumption is added to old basis to arrive at new basis; (4) If there is net loan relief that is partially offset by cash conveyed, the excess of net loan relief over cash conveyed is taxable, and the basis does not change (5) If there is net loan relief that is fully offset by cash conveyed, the excess of cash conveyed over net loan relief is added to basis, and there is no taxable gain Urban RE Financing and Investment - Habibi Page 39 Question 2: What are Curtis’s and Shawn’s adjusted bases, realized and recognized gains after the exchange? FMV Loan Equity Adjusted Basis Cash Received (Conveyed) Loan Relief (Assumed) Basis after Exchange Realized Gain Recognized (taxable) gain Shawn (in millions) 17 9 8 10.5 2 3 10.5 6.5 5 Curtis (in millions) 12 6 6 7.47 (2) (3) 7.47 + 2 + 3 = 12.47 12 – 7.47 = 4.53 0 One year later, Sean Combs makes an offer of $20M on the Brooklyn property, resulting in an immediate sale. Curtis must pay a 6% commission on the sale. Question 3: What are the Federal tax consequences to Curtis upon sale, assuming the land allocation is 30%? Curtis’ Brooklyn building depreciation schedule Depreciable basis = [$12,472,722 x 70% (land @ 30%)] = $8,730,905 Depreciation expense/month = $8,730,905/330 periods = $26,457 Accum. dep. for Curtis’ holding per. = $26,457 x 12 mos. (1/2 mo. conv.)= $317,487 Adjusted basis @ sale = $12,472,722 – $317,487 = $12,155,235 Net sales proceeds = $20M x (100% – 6%) = $18.8M Total gain on sale = $18.8M – $12,155,235 = $6,644,765 Unrecaptured dep. = $527,278 + $317,487 = $844,765 Capital gain = total gain – unrecaptured dep. = $5.8M Intuition: The $5.8M makes sense if you consider that we “gained” $4M (or $12M – $8M) from the first transaction and $1.8M (or $18.8M – $17M) from the second transaction Tax liability = (25% x $844,765) + (20% x $5.8M) = $1,371,191 Urban RE Financing and Investment - Habibi Page 40 MODULE 7: Disruption and Structural Shifts in Real Estate Structural Change vs. Cyclical Change Cyclical factors (see Module 2) only partially drive real estate values. Structural changes also drive value. Structural shifts—i.e. technological advances, demographic shifts, political regime changes—fundamentally change the way physical space is utilized. Unlike cyclical changes, where trends usually revert back to the historical mean, structural shifts cause changes that have little resemblance with past performance. Recall that the “fair value” of a property is the present value of all future cash flows, and to establish a baseline understanding an investor typically begins by analyzing past performance. When a property type is in the midst of structural shift, past performance may be a poor indicator of future growth, and may not help with determining future cash flows. Generally structural shifts have dramatic impacts on real estate at a property type level and the timing and magnitude of a their impact can be heavily debated among investors. A current example: There is disagreement among investors regarding the extent to which e-commerce’s growth impacts brick-and-mortar retail sales. Some investors argue we are at the beginning of storefront obsolescence, while other investors believe that storefronts still serve an essential purpose, and are in the process of adapting to digital consumers’ preferences. Regardless of which argument is ultimately true, the future cash flow performance of brick-and-mortar retail will not resemble the past, making the estimate of current “fair value” an extremely difficult exercise. Finally, it is important to note that when a property type is undergoing structural changes, this does not mean it has ceased to be impacted by the cyclical changes as well. Instead an investor must carefully incorporate analysis that overlays both cyclical and structural factors simultaneously impacting future growth expectations when estimating a property’s value. Current Structural Changes Impacting Real Estate Please refer to in-class PowerPoint presentation for observations on current disruptors causing structural shifts impacting various real estate property types. Deal Sourcing: Listed or off-mkt (Principals, Brokers, Sales/Mktg) Offer and due diligence (Principals, Brokers, Consultants, Market Research, Inspectors) Financing (Equity and debt finance, appraiser, mortgage broker/banker, M&A) Closing: Transaction Support (Escrow, title, legal, insurance, acctg, etc) Asset Management (Property mgmt, leasing, construction/maintenance, tax/acctg, etc) Reversion/Exit (return to top) Urban RE Financing and Investment - Habibi Page 41