Engineering Economy Problems Sheet for First Year Students

advertisement

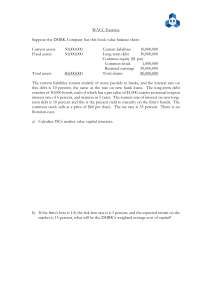

DAMEITTA UNIVERSITY Faculty of ENGINEERING Program/ Year First Year Mechanical & Electrical Depts. 2019-20 semester First Course title: Engineering Economy Sheet No. 2 1- At an interest rate of 15% per year, an investment of $100,000 one year ago is equivalent to how much now? Amount now = F = 100,000 + 100,000(0.15) = $115,000 2- During a recession, the price of goods and services goes down because of low demand. A company that makes Ethernet adapters is planning to expand its production facility at a cost of $1,000,000 one year from now. However, a contractor who needs work has offered to do the job for $790,000 if the company will do the expansion now instead of 1year from now. If the interest rate is 15% per year ،how much of a discount is the company getting? Equivalent present amount = 1,000,000/ (1 + 0.15) = $869,565 Discount = 790,000 – 869,565 = $79,565 3- As a principal in the consulting firm where you have worked for 20 years, you have accumulated 5000shares of company stock. One year ago, each share of stock was worth $40. The company has offered to buy back your shares for $225,000. At what interest rate would the firm’s offer be equivalent to the worth of the stock last year? 5000(40) (1 + i) = 225,000 1 + i = 1.125 i = 0.125 = 12.5% per year 4- If a company sets aside $1,000,000 now into a contingency fund, how much will the company have in 2 years, if it does not use any of the money and the account grows at a rate of 10% per year? F1 = 1,000,000 + 1,000,000(0.10) = 1,100,000 F2 = 1,100,000 + 1,100,000(0.10) = $1,210,000 1 5- Iselt Welding has extra funds to invest for future capital expansion. If the selected investment pays simple interest, what interest rate would be required for the amount to grow from $60,000 to $90,000 in 5 years? 90,000 = 60,000 + 60,000(5)(i) 300,000 i = 30,000 i = 0.10 (10% per year) 6- To finance a new product line, a company that makes high-temperature ball bearings borrowed $1.8 million at 10% per year interest. If the com company repaid the loan in a lump sum amount after 2 years, what was (a) the amount of the payment and (b) the amount of interest? (a) F = 1,800,000(1 + 0.10) (1 + 0.10) = $2,178,000 (b) Interest = 2,178,000 – 1,800,000 = $378,000 7- Because market interest rates were near all-time lows at 4% per year, a hand tool company decided to call (i.e., pay off) the high-interest bonds that it issued 3 years ago. If the interest rate on the bonds was 9% per year, how much does the company have to pay the bond holders? The face value (principal) of the bonds is $6,000,000. F = 6,000,000(1 + 0.09) (1 + 0.09) (1 + 0.09) = $7,770,174 8- A solid waste disposal company borrowed money at 10% per year interest to purchase new haulers and other equipment needed at the company owned landfill site. If the company got the loan 2 years ago and paid it off with a single payment of $4,600,000, what was the principal amount P of the loan? 4,600,000 = P(1 + 0.10)(1 + 0.10) P = $3,801,653 9- If interest is compounded at 20% per year, how long will it take for $50,000 to accumulate to $86,400? 86,400 = 50,000(1 + 0.20)n log (86,400/50,000) = n(log 1.20) 0.23754 = 0.07918n n = 3 years 2 10-To make CDs look more attractive than they really are, some banks advertise that their rates are higher than their competitors’ rates; however, the fine print says that the rate is a simple interest rate. If a person deposits $10,000 at 10% per year simple interest, what compound interest rate would yield the same amount of money in 3 years? Simple: F = 10,000 + 10,000(3)(0.10) = $13,000 Compound: 13,000 = 10,000(1 + i) (1 + i) (1 + i) (1 + i)3 = 1.3000 3log(1 + i) = log 1.3 3log (1 + i) = 0.1139 log(1 + i) = 0.03798 1 + i = 1.091 i = 9.1% per year 11-What is the weighted average cost of capital for a corporation that finances an expansion project using 30% retained earnings and 70% venture capital? Assume the interest rates are 8% for the equity financing and 13% for the debt financing. WACC = 0.30(8%) + 0.70(13%) = 11.5% 12-Managers from different departments in Zenith Trading, a large multinational corporation, have offered six projects for consideration by the corporate office. A staff member for the chief financial officer used key words to identify the projects and then listed them in order of projected rate of return as shown below. If the company wants to grow rapidly through high leverage and uses only 10% equity financing that has a cost of equity capital of 9% and 90% debt financing with a cost of debt capital of 16%, which projects should the company undertake? 3 WACC = 10%(0.09) + 90%(0.16) = 15.3% The company should undertake the inventory, technology, and warehouse projects. 4