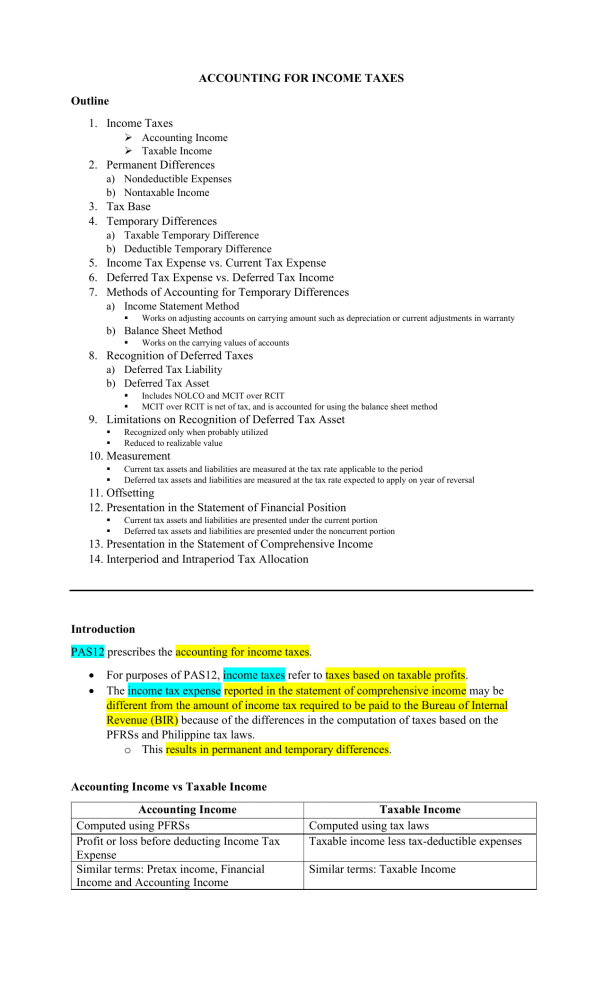

ACCOUNTING FOR INCOME TAXES Outline 1. Income Taxes Accounting Income Taxable Income 2. Permanent Differences a) Nondeductible Expenses b) Nontaxable Income 3. Tax Base 4. Temporary Differences a) Taxable Temporary Difference b) Deductible Temporary Difference 5. Income Tax Expense vs. Current Tax Expense 6. Deferred Tax Expense vs. Deferred Tax Income 7. Methods of Accounting for Temporary Differences a) Income Statement Method Works on adjusting accounts on carrying amount such as depreciation or current adjustments in warranty b) Balance Sheet Method Works on the carrying values of accounts 8. Recognition of Deferred Taxes a) Deferred Tax Liability b) Deferred Tax Asset Includes NOLCO and MCIT over RCIT MCIT over RCIT is net of tax, and is accounted for using the balance sheet method 9. Limitations on Recognition of Deferred Tax Asset Recognized only when probably utilized Reduced to realizable value 10. Measurement Current tax assets and liabilities are measured at the tax rate applicable to the period Deferred tax assets and liabilities are measured at the tax rate expected to apply on year of reversal 11. Offsetting 12. Presentation in the Statement of Financial Position Current tax assets and liabilities are presented under the current portion Deferred tax assets and liabilities are presented under the noncurrent portion 13. Presentation in the Statement of Comprehensive Income 14. Interperiod and Intraperiod Tax Allocation Introduction PAS12 prescribes the accounting for income taxes. For purposes of PAS12, income taxes refer to taxes based on taxable profits. The income tax expense reported in the statement of comprehensive income may be different from the amount of income tax required to be paid to the Bureau of Internal Revenue (BIR) because of the differences in the computation of taxes based on the PFRSs and Philippine tax laws. o This results in permanent and temporary differences. Accounting Income vs Taxable Income Accounting Income Computed using PFRSs Profit or loss before deducting Income Tax Expense Similar terms: Pretax income, Financial Income and Accounting Income Taxable Income Computed using tax laws Taxable income less tax-deductible expenses Similar terms: Taxable Income Permanent Differences Arise when income and expenses enter in the computation of either accounting profit or taxable profit but not both. Usually arises from non-taxable income and non-deductible expenses and those that have already been subjected to final taxes. o These items are excluded from the income tax return. Permanent differences don’t have future tax consequences, so they don’t give rise to deferred tax assets and liabilities. Examples of permanent differences are: 1. Interest income on government bonds and treasury bills 2. Interest income on bank deposits 3. Dividend income 4. Fines, surcharges, and penalties arising from violation of law 5. Life insurance premium on employees where the entity is the irrevocable beneficiary. 6. Goodwill arising from business combinations. Nondeductible Expenses Added back to Pre-tax Accounting Income to solve for Income Subject to Tax Examples: Life Insurance Premium Tax Penalties, Fines, and Surcharges Impairment Loss from Goodwill Nontaxable Income Deducted from Pre-tax Accounting Income to solve for Income Subject to Tax Examples: Dividend Income Interest Income on Deposits, Government Bonds, Treasury Bills Definition of Tax Base Amount of the asset or liability recognized or allowed for tax purposes. Amount deductible for tax purposes against future income. Temporary Differences Includes timing differences that arises when income and expenses are recognized for accounting in one period but are recognized for taxation in another period (vice versa). Temporary differences have future tax consequences and hence give rise to either deferred tax assets or deferred tax liabilities. Either taxable temporary differences or deductible temporary differences. Taxable vs. Deductible Temporary Difference Taxable Temporary Difference Deductible Temporary Difference Accounting Income > Taxable Income Accounting Income < Taxable Income Carrying Amount Assets > Tax Base Carrying Amount Assets < Tax Base Carrying Amount Liabilities < Tax Base Carrying Amount Liabilities < Tax Base Results to deferred tax liability if Results to deferred tax asset if multiplied multiplied by tax rate. by tax rate. Example: Example: 1. Installment Sales 1. Rent received in advance 2. Accelerated Depreciation (tax 2. Advances from customers purpose) and Straight-Line 3. Accelerated Depreciation Depreciation (accounting purpose) (accounting purpose) and Straight3. Prepaid Expense Line Depreciation (tax purpose) 4. Accrued Income 4. Doubtful accounts 5. Upward revaluation of an asset 5. 6. 7. 8. Accrued retirement benefits Warranty obligation Research costs Downward revaluation of an asset Income Tax Expense vs. Current Tax Expense Income Tax Expense Current Tax Expense Computed using PFRSs Computed using tax laws Reported in the Statement of Reported in the Income Tax Return Comprehensive Income The total amount included in profit or loss The amount of income taxes payable and comprises current tax expense (recoverable) in respect of the taxable (current tax income) and deferred tax profit (tax loss). expense (deferred tax income). Current Tax Liabilities and Assets Current tax expense is the amount of tax that is required to be paid to the BIR. When businesses fall short of payment, a current tax liability arises. When business exceeds payment, a current tax asset arises. Formula The arrows (↑) describe the item to have increased for the functions “add” or “less” to be valid (vice versa). Deferred Tax Expense vs. Deferred Tax Income Income tax expense comprise both current tax expense (income) and deferred tax expense (income). Deferred tax expense is the sum of the net changes in deferred tax assets and deferred tax liabilities. Deferred Tax Assets and Deferred Tax Liabilities The following T-Account analyses may be used: The ending balances of DTL and DTA are presented as noncurrent asset and noncurrent liability, respectively. Methods of Accounting for Temporary Differences 1. Income Statement Method Focuses on timing differences. 2. Balance Sheet Method Considers all temporary differences. Determined by getting the differences between the carrying amount of assets and liabilities and their respective tax bases. Required by IAS12. Recognition of Deferred Taxes An entity shall recognize a deferred tax liability (asset) whenever recovery or settlement of the carrying amount of an asset or liability would make future tax payments larger (smaller) than they would be if such recovery or settlement were to have no tax consequences. Deferred Tax Liability “The amount of income taxes payable in future periods in respect of taxable temporary differences”. Doesn’t arise from the following: 1. Initial recognition of goodwill 2. Initial recognition of an asset or liability in a transaction neither affecting accounting profit nor taxable profit 3. Investments in subsidiaries, branches, and associates, and interests in joint arrangements. Deferred Tax Asset “The amounts of income taxes recoverable in future periods in respect of deductible temporary differences; the carryforward of unused tax lasses; and the carryforward of unused tax credits”. Net Operating Loss Carry-Over (NOLCO) Under the National Internal Revenue Code of the Philippines (NIRC), operating loss can be carried over a maximum of 3 years and can be treated as reduction in taxable profits. Corporate Income Tax Regular Corporate Income Tax (RCIT) is 25% of Taxable Income. Minimum Corporate Income Tax (MCIT) is 2% of Gross Income. Use higher between the 2 if both are given. National Internal Revenue Code MCIT of 2% of the gross taxable income is hereby imposed upon any domestic corporation beginning the 4th taxable year immediately following the taxable year in which such corporation commenced its business operations. The MCIT shall be imposed whenever such corporation has zero or negative taxable income or whenever the amount of MCIT is greater than the RCIT due from such corporation. Carry Forward of Excess MCIT Any excess of the MCIT over the RCIT shall be carried forward on an annual basis and credited against the normal income tax. Limitation on the Recognition of Deferred Tax Asset An entity can only benefit from the reversal of a deferred tax asset if it earns enough taxable profit. A deferred tax asset is recognized only when it is probable that a reduction on future tax payments will be utilized. o If this is not the case, DTA won’t be recognized or reduced to its realizable value. The allowance for deferred tax asset is a valuation account (deduction) to the deferred tax asset account. o DTA is reassessed for recoverability every year-end, and any further decline or increase in the recoverable amount is recognized prospectively by adjusting the allowance account. Measurement Current tax assets and liabilities are measured at the tax rate applicable to the period. Deferred tax assets and liabilities are measured at the tax rates expected to apply to the period of their reversal. Different Tax Rates apply to Different Levels of Taxable Income When different tax rates apply to different levels of taxable income, DTA and DTL are measured using the average rates applicable in the periods the differences are expected to reverse. Different Tax Rates apply to Different Transactions or Events When different tax rates apply to different transactions or events, DTA and DTL are measured using the tax rate that reflects the tax consequences resulting from the manner in which the carrying amount of an asset or liability is recovered or settled. Presentation in the Statement of Financial Position Current Tax Assets and Current Tax Liabilities are presented separately as current assets and current liabilities, respectively. Deferred Tax Assets and Deferred Tax Liabilities are presented separately as noncurrent assets and noncurrent liabilities, respectively. Offsetting Offsetting of current tax assets and current tax liabilities is permitted only if the entity has: a. A legally enforceable right to offset the recognized amounts; and b. An intention to settle/realize the recognized amounts on a net basis or simultaneously. Presentation in Statement of Comprehensive Income Tax consequences are accounted for in the same way as the related transactions or events. Thus, if a transaction is recognized in profit or loss, its tax effect is also recognized in profit or loss. Interperiod and Intraperiod Tax Allocation Interperiod Tax Allocation relates to the recognition of DTA and DTL. Intraperiod Tax Allocation relates to the allocation of income tax expense.