The self-insurance expense and liabilities are primarily determined

advertisement

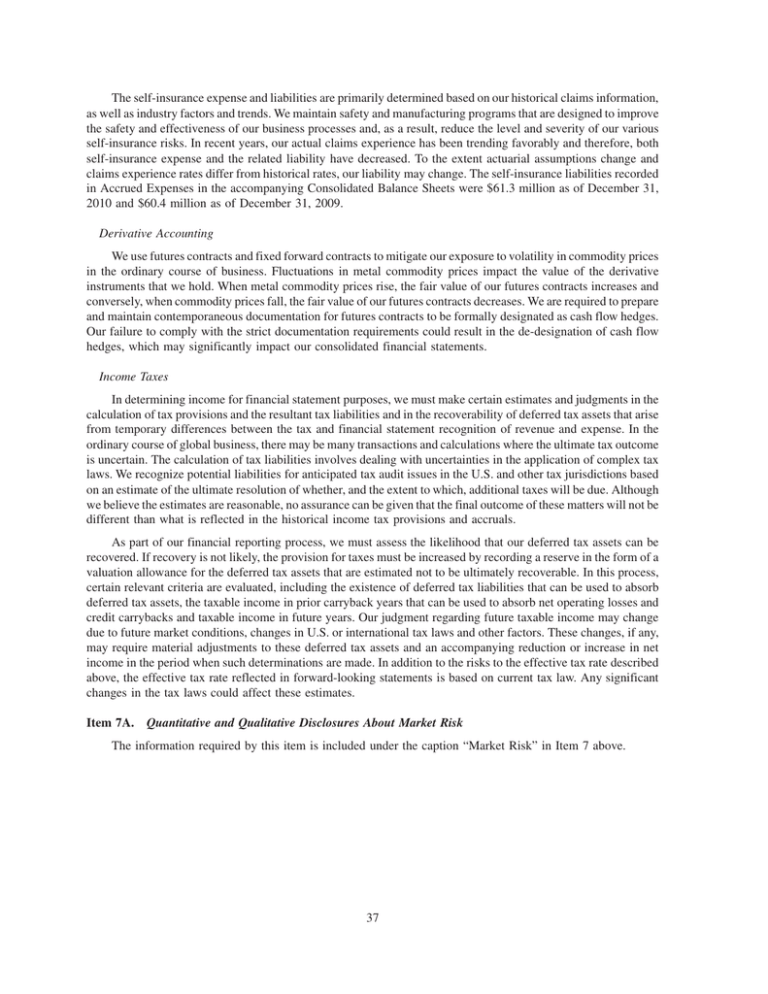

The self-insurance expense and liabilities are primarily determined based on our historical claims information, as well as industry factors and trends. We maintain safety and manufacturing programs that are designed to improve the safety and effectiveness of our business processes and, as a result, reduce the level and severity of our various self-insurance risks. In recent years, our actual claims experience has been trending favorably and therefore, both self-insurance expense and the related liability have decreased. To the extent actuarial assumptions change and claims experience rates differ from historical rates, our liability may change. The self-insurance liabilities recorded in Accrued Expenses in the accompanying Consolidated Balance Sheets were $61.3 million as of December 31, 2010 and $60.4 million as of December 31, 2009. Derivative Accounting We use futures contracts and fixed forward contracts to mitigate our exposure to volatility in commodity prices in the ordinary course of business. Fluctuations in metal commodity prices impact the value of the derivative instruments that we hold. When metal commodity prices rise, the fair value of our futures contracts increases and conversely, when commodity prices fall, the fair value of our futures contracts decreases. We are required to prepare and maintain contemporaneous documentation for futures contracts to be formally designated as cash flow hedges. Our failure to comply with the strict documentation requirements could result in the de-designation of cash flow hedges, which may significantly impact our consolidated financial statements. Income Taxes In determining income for financial statement purposes, we must make certain estimates and judgments in the calculation of tax provisions and the resultant tax liabilities and in the recoverability of deferred tax assets that arise from temporary differences between the tax and financial statement recognition of revenue and expense. In the ordinary course of global business, there may be many transactions and calculations where the ultimate tax outcome is uncertain. The calculation of tax liabilities involves dealing with uncertainties in the application of complex tax laws. We recognize potential liabilities for anticipated tax audit issues in the U.S. and other tax jurisdictions based on an estimate of the ultimate resolution of whether, and the extent to which, additional taxes will be due. Although we believe the estimates are reasonable, no assurance can be given that the final outcome of these matters will not be different than what is reflected in the historical income tax provisions and accruals. As part of our financial reporting process, we must assess the likelihood that our deferred tax assets can be recovered. If recovery is not likely, the provision for taxes must be increased by recording a reserve in the form of a valuation allowance for the deferred tax assets that are estimated not to be ultimately recoverable. In this process, certain relevant criteria are evaluated, including the existence of deferred tax liabilities that can be used to absorb deferred tax assets, the taxable income in prior carryback years that can be used to absorb net operating losses and credit carrybacks and taxable income in future years. Our judgment regarding future taxable income may change due to future market conditions, changes in U.S. or international tax laws and other factors. These changes, if any, may require material adjustments to these deferred tax assets and an accompanying reduction or increase in net income in the period when such determinations are made. In addition to the risks to the effective tax rate described above, the effective tax rate reflected in forward-looking statements is based on current tax law. Any significant changes in the tax laws could affect these estimates. Item 7A. Quantitative and Qualitative Disclosures About Market Risk The information required by this item is included under the caption “Market Risk” in Item 7 above. 37