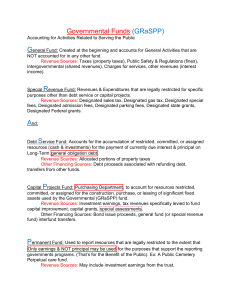

Essentials-of-Accounting-for-Governmental-and-Not-for-Profit-Organizations-by-Paul-A.-Copley-10th-Edition copy

advertisement