The County Official's Role

advertisement

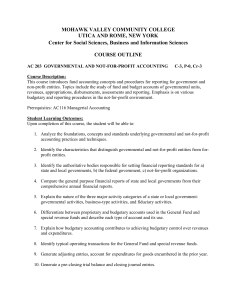

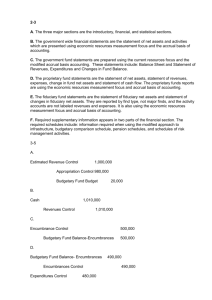

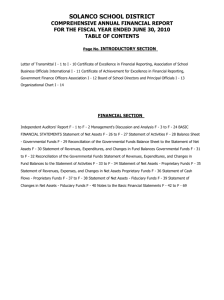

County Financial Statements – The County Official’s Role Wisconsin Counties Association September 22, 2015 Dave Geertsen, Kenosha County David Maccoux, Schenck SC Dawn Gunderson Schiel, Ehlers County Finance Director’ Perspective • What role do County officials play with the financial statements? • What is an audit, and was is not an audit? • What is audit failure? 2 ● schencksc.com Importance of Financial Statements • Financial accounting and financial reporting • Demonstrate stewardship to taxpayers and creditors • Accountability of County officials – Remain financially solvent – Lack of business-like exchange of resources, with taxes levied on taxpayers without necessarily receiving services – Compliance with laws and regulations 3 ● schencksc.com Independent Auditors’ Report • Responsib 4 ● schencksc.com Government-wide Financial Statements 5 ● schencksc.com Statement of Net Position • Illustrates what County owns and how much does it owe. • Assess County’s present financial status and future outlook. • Based on historical cost principles. • Net position components 6 ● schencksc.com Statement of Net Position – Capital Assets • Additions typically represent the purchase or addition to assets owned by the County. • Deletions represent the sale or disposal of assets or, in the case of construction in progress, the classification to asset categories. • Importance – Are you reinvesting in your assets? 7 ● schencksc.com Statement of Net Position – Long-term Obligations • What does changes in your long-term obligations represent? – Bonds and notes payable – Employee obligations 8 ● schencksc.com Statement of Activities • Identify cost to provide services to citizens. • Difference between general and program revenues. • What are the causes in your changes in financial position. 9 ● schencksc.com Fund Financial Statements 10 ● s c h e n c k s c . c o m Balance Sheet – Governmental Funds • More detailed look at your finances, concentrating on short-term view of basic services provided. • Major fund activities reported • Fund balance components and what is important. 11 ● s c h e n c k s c . c o m Statement of Revenues, Expenditures and Changes in Fund Balances • Focus of statement is cash and other financial resources received within or shortly after the year while expenditures represent services and goods received and due to employees and creditors. • Focus on net change in fund balance, and primary reasons. 12 ● s c h e n c k s c . c o m Statement of Revenues, Expenditures and Changes in Fund Balance – Budget and Actual • How did your County’s budget change during the year? • How does your actual results compare to the approved budget? • Understanding your levels of budgetary control. 13 ● s c h e n c k s c . c o m Proprietary Funds • Measurement basis consistent with governmentwide financial statements. • Enterprise and internal service funds. 14 ● s c h e n c k s c . c o m Proprietary Funds • Analysis of operating revenues and expenses. • Non-operating activities 15 ● s c h e n c k s c . c o m Proprietary Funds • Key financial statement to identify sources and uses of cash compared to operations. • Identify future cash needs and ability of operations to meet obligations. 16 ● s c h e n c k s c . c o m Notes to Financial Statements • Notes in complimenting financial statements of County. • Provide additional detail, including key accounting policies 17 ● s c h e n c k s c . c o m Required Supplemental Information • Management’s Discussion and Analysis (MD&A) – Introduction and overview of your financial statements – Increased comprehension by readers of your financial statements – Management’s ability to highlight important issues • Budgetary comparisons • Other Post-employment Benefits (OPEB) • Pension Information (WRS disclosures - FY 2015) 18 ● s c h e n c k s c . c o m Other Information • Supplemental Information – Combining statements of non-major funds – Individual fund financial statements • Statistical Section (CAFR) – Historical trend data – Demographics and other data 19 ● s c h e n c k s c . c o m Thank You David Maccoux, CPA Shareholder 920-455-4114 david.maccoux@schencksc.com 20 ● s c h e n c k s c . c o m Measurement of Financial Viability Beyond the Basic Financial Statements September 22, 2015 Measuring Financial Validity • Finances – Liquidity – Budgetary Performance – Budgetary Flexibility • • • • Economy Management Debt/Pension Institutional Framework 22 Finances • Historical Trends in General Fund Revenues and Expenditures • Trends in Fund Balance (General Fund and Total Governmental) 23 Historical Trends in General Fund Revenues and Expenditures 24 Trends in Fund Balance (General Fund and Total Governmental) 25 Historical Trends in General Fund Revenues and Expenditures 26 Trend in Fund Balance 27 Fund Balance as a % of Revenues 28 Finances • Changes in Cash Balance over 5 years • Liquidity (What makes up fund Balance) • Budgetary Performance (General Fund and Total Governmental Funds) • Budgetary Flexibility 29 Economy • Equalized Value – Total Value of taxable property in the governmental unit’s boundaries. Size of tax base is a reflection on its ability to pay. Composition of tax base (Diverse) • Trends in Equalized value and Assessed Values • Average Annual Growth in tax base – Economic health • Per Capita Equalized Value • Top 10 Tax Payers 30 Diversification of Tax Base 31 Equalized Tax Base Trends 32 Economy • • • • • • • • Largest employers Building permits Housing units Trends in Employment and Unemployment Data Census Population data Average income and age statistics Adjusted Gross Income per tax return Adjusted Gross Income as Percentage of State Average 33 Management (Recommended Practices) • Establish Policies – – – – Fund Balance Policy Debt Policy Budget Policy Investment Policy • Monitor Policies and Live within them • Long Range Planning • Periodic Reporting to Elected Officials 34 Policy Monitoring 35 Policy Monitoring 36 Debt/Pension • Direct Debt Burden • Overall Debt Burden • Payout over Ten Years • Percentage of Expenditures for Debt Service • Pension Liability 37 Institutional Framework • Legal and Practical Environment in which you operate • Predictability of Revenues & Expenses • Statutory Limits • Expenditure Restraints • Levy Limits 38 Issuance of Debt and Credit Rating • Analysis of Credit Quality • Assist the investor in determining the risk of an investment • Rating affects the price and interest rate that will be paid when debt is issued 39 Official Statement for Security Offering • Purpose of the Official Statement (3 Basic functions) – 1. Provide a description of the securities offered and the transaction – 2. Assists with marketing the security – 3. Discloses risks and other material information associated with investment in the securities • Its purpose is to tell potential investors what they need to know in order to decide whether or not to buy the securities 40 Dawn Gunderson Schiel Senior Municipal Advisor 262-796-6166 dgunderson@ehlers-inc.com 41