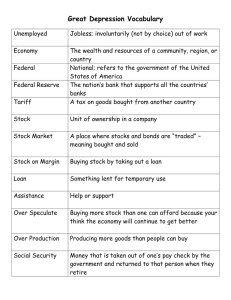

How to Buy Your First Biz 29 WAYS TO GET FUNDING FOR IT Horizontal IncomeYOUR FIRST BIZ HOW TO BUY 29 WAYS TO GET FUNDING FOR IT Congratulations, you’ve taken the first step. Most people don’t. They think small and buying a business may seem daunting. The truth is something altogether different. I am so excited to share this with you, your first deal is a magical time. Here’s what your college professors, boss, partners and most people in finance will never tell you. Most billionaires aren’t made through organic growth, most multi-millionaires aren’t made by working for someone else. Instead, they acquire their income and their businesses. Even the largest companies in the world don’t try to do it all by themselves. Amazon’s acquired 40+ companies, Apple has bought more than 100, KKR (one of the largest PE firms) has bought 88 companies. Here’s where most say, “Wow, I’m not those companies, I don’t have billions on my balance sheet.” The beautiful part is you don’t need to be one of those companies to buy your first business (or multiple). You can (and I have) do deals with OPM (other people’s money), with debt, with seller financing, with rev-share or sweat equity. We’ll break down what all this means later. In this guide, I’m going to teach you some of the first steps you should take to buy your first business. You’ll learn a few different ways to fund the business purchase (ideally using OPM). But there are some expenses you’ll incur, like legal fees, so I’ll also give you 29 different ideas to grow your current income so you can save up for the purchase. Then I’ll tell you my framework for searching for businesses to buy. I also dropped in 130 different ideas that come to mind that fit this framework. And finally, you’re also going to learn the top 5 mistakes to avoid during the business buying process. Consider this guide the starting point of a much longer journey of buying your first business. I know you’ll love it. Codie CEO at Contrarian Thinking THE Table of Contents Why Listen To Me? Chapter #1 Why Buy A Business 1 2 Chapter #2 What Types of Businesses Should You Buy? 6 Chapter #3 How To Buy Your Business for $0 Using OPM 14 Chapter #4 How to Grow Your Investment Income To Buy A Biz 24 Chapter #5 5 Mistakes To Avoid Along The Way Chapter #6 Where Do You Go From Here? 36 44 Horizontal Income WHY LISTEN TO ME? Hi, if we haven’t met yet, I’m Codie. I own 26 small businesses that bring in millions of revenue each year. And I built this portfolio of businesses while working a 9-5 job. Sounds impossible, but I swear it’s not. Prior to owning my own portfolio, I’ve worked as a Partner at a private equity firm. I built up a billion+ business in Latin America and have worked at Vanguard, SSgA and Goldman Sachs closing multi-billions. But I started as a public school kid and child of immigrants, who knew nothing about money. After growing my portfolio, I left my 9-5 job and created Contrarian Thinking. In Wall Street, they have a phrase to “get rich quietly.” I wasn’t a fan of that. I thought it would be better for us to “get rich together.” So I’m on a mission, with the team at Contrarian, to create 100,000 small business owners. I want to help people like you acquire your first business. I wasn’t handed anything, and you won’t need to be either. Let’s get into it. 1 CHAPTER 1: WHY BUY A BUSINESS? 91% of people with a net worth of $5M+ own their own business. It’s the path to wealth that the 1% follow. And now is the best time to jump on the train. There is now an opportunity we haven’t seen previously at the crossroads of baby boomers retiring, pandemic changes, and an opening up of what used to be the elite world of private equity titans only. Here is what is happening in small businesses today: (Although few are still talking about it!) 2.5M+ small businesses for sale in the US. These are profitable businesses with revenue between $1 - $5 million annually. Only 1-10 will sell within a year, maybe fewer in this environment. Baby Boomers are retiring at increasing levels (74MM will retire by 2031). And 4-6% of them own a business. There are desperate sellers who want out because they are tired, the world’s hard, they don’t have a transition plan, they want to retire, and the list goes on The pandemic has even further shifted the power from seller to buyer. 2 You know what that leaves you with? Millions of businesses that are up for sale with sellers who are motivated to sell them to you so they can retire. Other investors are catching on… “The place I bought has a great reputation and runs well already” said Luke, owner of Precizion 509 Gymnastics in Colorado. “Sellers were motivated to retire for the last couple years. I got it at much lower than market value, and no bank involvement. When the economy returns to normal, I’ll have a lot of value here without much debt.” “COVID-19 served as a wake-up call for Baby Boomers. Normally married to their business, these owners have been forced to stay home, as have their friends, and they’re starting to realize it’s okay. They’ve been enjoying spending time with loved ones. Slowly, these owners are understanding that they’re not retiring from something, they’re retiring to something” said Jay Offerdahl, President of Charlotte based VikingMergers & Acquisitions. “We’ve barely scratched the surface of Baby Boomer supply and as new crises arise, any increase in uncertainty will propel these owners into the market” said Andy Kocemba, President & CEO of Calhoun Companies. But how is this better than starting a new business? 3 You see…entrepreneurs have a startup problem. Startups fail 90% of the time. Or if they “succeed” they rarely reach $1M in sales and then even more rarely $100-200k in profit to the entrepreneur. While the SBA shows that the average default rate for loans is less than 15% over a 10year period. That means 85% of small businesses survive. Yes, startups are popular and idealized. But they really aren’t that smart if you are optimizing for freedom and financial freedom. Could you imagine if you could skip the phase where you pay all the startup costs and instead make money, real money, on day one? This is what I want to teach you. How to be an entrepreneur through acquisition. I'll teach you how to buy a company, how to use other people’s money to do it, how to avoid the capital raising portion, and outsmart the startup hustle while still achieving the entrepreneurial lifestyle. This isn’t a get-rich-quick scheme. It takes work. 4 This is simply a path traditionally used by those in finance and PE to consistently create wealth, that we are democratizing to the masses. In my opinion given the 90%+ failure rate of startups and the very decreased likelihood of profits on day one, buying and THEN building is the next wave of ownership. I could list a million more reasons why I think buying then building is a better model but let’s go ahead and talk about the actual business buying process. 5 CHAPTER 2: WHAT TYPES OF BUSINESSES SHOULD YOU BUY? Now you know why you should buy a business…but what types of businesses should you consider acquiring? It’s the golden question. I have a video that talks about this topic as well if that’s more of your thing. I also break down specific business acquisitions on my YouTube channel so you can get inspired by those who have gone before you. And here’s the framework I came up with for buying businesses. It’s called SOWS. Like cows. (Stale) = minimal innovation (Old) = longstanding business (Weak) = poor competition (Simple) = simple but needed business model 6 I also call these “boring businesses.” And that’s how I like ‘em. Why? The framework goes like this: the sexier the industry -> the less money you are going to make. Not always true if you’re a brilliant tech founder, but for the rest of us, I’m pretty sure it’s just science. Perhaps that’s why everything in Hollywood pays poorly, marketing & advertising roles are at the bottom of the income tier, as are journalists. Too many people want to be those things, and the credentials needed are not high. However, there are some businesses that get no love, and I am here for them like Onlyfans is for incels. I started calling these “boring” businesses because I am all about misdirection. If you tell people you invest in boring businesses they, first of all, are probably not going to be that interested, and second, want to talk to you about their new AI-powered, social media, Web 3.0 dating app instead. Cool. Yall go hook up to the metaverse while I get paid to clean your house and mow your lawn in the actual sunshine. Because the truth is PE firms and SMB buyers; we aren’t rocket scientists, we aren’t moon shooters, we largely take 7 something that exists and iterate on it. No Elon Musks in here. And that is okay because the world needs small businesses to serve us every day. Step 1: How do you know if a business is stale? The Fax Machine Test I'm looking for businesses that haven't innovated. Less innovation means more potential upside and thus less risk. Let's give a couple of examples, I went into one business and they asked me to fax in an ID. YES. Every time I do a deal and I see a fax machine I grin like the Cheshire cat ate the canary. A great trigger: do they still have a fax machine make you call to place an order mandate written orders All great signs you're onto a stale business model. Step 2: Old & Been Around the Block I'm always nervous about the young hot thing in the business world. I want to operate on the Lindy Effect. I've talked about it before but essentially the longer something has been around the more likely it is to actually persist. So most of the businesses I buy have a 5-10-15 year history in industries that have persisted. 8 Step 3: Weak Competition Typically these industries have a lot of "meh, just ok, not that great, it's all we have" types of competitors. Think about it. How many of you LOVE your landscaper? They're always on time, have automated billing, offer services proactively, never miss a week, and pull weeds without asking. Probably not to most of them. Or how many incredible handymen have you had that proactively check in on things you need fixing, show up on time, don't leave a mess, and do the job right? Uh-huh. Rare. And yet, their lack of focus is your opportunity to charge a premium for better, faster services. Step 4: Simple But Needed Business Model Nothing proprietary here. No biotechnology. No R&D. These are just businesses that typically are in high demand, that have more business than they can handle, that if you can beat on speed or service you can charge 20-50-100% more. Just add billing software, customer service software, outsourced employees, and you're off to the races. If you want my favorite low-cost tools for running businesses, these will get you started. These businesses below are all types I've owned, invested in, or done analysis on. It doesn't mean that every business is great but it means that any business in this could be great. 9 130 BORING BUSINESS IDEAS I’D LOVE TO INVEST IN GATEWAY BUSINESSES: Easier to Start - Starter Businesses I call these the gateway businesses to SMB ownership. These aren't always the best companies to own as you scale and want bigger total profits but they can be an interesting way to dip your toe in. Vending Machines Ice vending machines Laundromats Mailbox Pack & Ship Centers Franchise businesses Adventure/Outdoors: Camping sites Hunting guides Hiking tours Biking tours Food tours Surfboard & equipment rentals Niche class-based gyms 10 Professional Services: ADU& Container homes Home pressure washing Podcast production - I Property management own this one Airbnb/VRBO Videography Window cleaning Outsourced Customer Tree trimming service On-demand holiday Bookkeeping & decorations accounting Pool / hot tub services Garbage pickup Deckbuilding & staining Junk removal Gutter cleaning Commercial cleaning Home cleaning Window cleaning Laundry services Scaffolding Carpet Porta-potty rentals cleaning/steaming Dumpster rentals Deep kitchen cleaning Liquidation services HVAC installation and Machine servicing cleaning Commercial power Mold, fire & water washing & striping damage remediation Equipment rental Interior design Home office build-out Home services: Epoxy flooring Handyman Landscaping and Custom wallpaper another installation Garage door Lighting Seasonal & service/installation Evergreen Pet grooming Pest control Pet care boarding & House painting services 11 Yard contracting, Specialty food trucks - designing Mobile wine business Home garage buildout Catering Solar panel installation Event DJ Irrigation system Event management installation Photography Awning installation Videography Foundation repair Photobooth, snapshot & Septic service/pumping accessory rental Porta- Boat repair/maintenance Potty rental RV services Tents/Party rental Home appliance repair On-demand cleanup crews Real Estate Heavy Businesses: Entertainment: Mobile Home Parks Event management RV parks & another Party rentals Storage Centers Sneaker resale Mini-mailbox centers Supercar rental Car-washes & another Farmland Online Education & Tiny home rentals Training: Auto Services: Almost any type of online education Oil change centers business Mobile tire sales/service Online communities Mobile glass repair Real estate transactions: Trucking & logistics Realtor Used carlots 12 Home inspection / thermal General Contractor imaging (utility analysis) Government contractor Moving services Heating and air HVAC Appraiser Insulation installation Loan officer (spray and standard) Property manager Masonry Vacation rental Painting House staging Pipe fitting Plumbing Industrial, Trades & Roofing Construction: Septic tank installation and service Asbestos removal Siding Asphalt Surveying Concrete Tree Removal Carpenter Warehouse storage rack Carpet/Tile/Flooring installation installation Welding Door/Window installation Electrical Elevator installation and service Epoxy flooring/countertops Equipment operation Excavation Fence installation Fire sprinkler system installer/detector installation 13 It’s crazy, right? Money is all around you…if you know where to look. CHAPTER 3: HOW TO BUY YOUR BUSINESS FOR $0 USING OPM The second best thing to having a ton of money is knowing someone else who does and will give it to you. And that’s what you’re about to learn. How to use OPM, other people’s money, to buy businesses for the least amount of money possible. Does that sound good to you? No matter how much wealth you’ve accumulated there is a saying in investing, “I like to use cash, just not mine.” As we look at the market I see a horizon coming full of deals to be had, but many humans don’t know how to fund them. Let’s close the gap, shall we? Why People Sell Profitable Businesses To understand how to use OPM, you first have to understand why people sell their businesses. Initially, most people think that no one would sell a profitable business. I’m always getting comments & DMs from people saying “CODIE WHY WOULD SOMEONE SELL A BUSINESS THAT IS MAKING $200,000 IN PROFIT? YOU LIAR.” Sigh. Because you nincompoop, does anyone want to do anything forever? 14 Let me tell you a story… He’d put the key in the lock, flipped on the lights, opened the doors, and put out his sign just like this for the last 25 years. It was just another Tuesday. But today, the key wouldn’t turn as fast, the sign was a little heavier, and the door harder to open. He was tired. He’d run this coffee shop in his small town for his whole adult life. It’d put his kids through college, it’d sent them on vacations and bought them a new house or two. He knew the names of his neighbors and sometimes, even got their “I’ll have my regular” right. Thousands and thousands of coffees later and the smell wasn’t quite as sweet. So many years ago when he’d put up the sign, “Roaster & Sons” he’d thought his kids would carry on the mantle. They’d replaced aprons with ties. And yet, proud. He was so proud of them. There was one rather large problem. Despite the money, he made each year, and the profits they stacked, if he had to look at one more f-ing coffee, he might have to take a baseball bat to it. This, my friends, is often why people sell their businesses. I call this the 7 horsemen of the great sell-off. 15 Here are the 7 main reasons why a business owner wants to sell their profitable business: Death – Seems to speak for itself. Death of a partner or an owner. Divorce – 50% of partnerships end in divorce. It is a triggering event that can lead to asset sell-offs or moving. Disease – Without your health, running a business is tough enough. Now add health issues. Disagreement – Partnerships fail, operators quit, landlords evict, all of these can be a reason why a business sells. Distress – Business is hard, 20% fail in the first year, 90% over time. Dullness – The average length of someone running a small business is 8.5 years. Attention is a tough commodity. Departure – Over 50% of all business owners are 55+, they are preparing for retirement or perhaps their second or third inning. Not to mention look at what happened during the pandemic. Over 60% of businesses closed their doors forever. I’ve always thought it’s a tragedy that any business closes its doors for $0, there are always some assets to repurpose. 16 So now we get to step in. White knights saving someone’s legacy from irrelevancy, keeping employees employed, allowing another small coffee shop to stand up to a Starbucks, and continuing your customer’s favorite product. Buying a company for $0 doesn’t mean that you’re predatory, it means a continuation of something beautiful when done right. 7 WAYS TO BUY A BUSINESS OR DO A DEAL WITH $0 #1 Customer Acquisition for $0 Let’s say a business is closing in your area, what if you reached out to the owner and repurposed their clients to your business? You propose a deal to refer their clients to you, they get a % of the revenue of clients who sign up and you help the owner craft a ‘Goodbye or transition plan.’ In one fell swoop, you’ve allowed the owner to get an annuity, given those clients a new home, and cut yourself into a revenue stream or a new business line. 17 Here’s how I’d do it: First, reach out to all of the owners of the businesses in your sector who have closed or are closing. Tell them you want to help them recoup some of their costs. Why don’t they do a deal where you give the owner 50% of all the revenue from the client, and they transfer over to your business for 6 months or even a year of them being a member? (Look at your individual COGS to figure out what you could afford here). Bring in the closed owner to your studio/business to do a final farewell class/evening, or a week of classes and handhold their clients over. Help the owner draft up an email/social/marketing etc for all their clients to explain how they didn’t want to leave them without a home, so they found them one. Give the owner a lifetime membership to come to your business, and welcome them to the family. Create an email and marketing sequence that drips on the new customers for a few weeks to close them. What we just did is acquire all of this business’s customers for nothing. We gave them a home. We gave the dejected owner a win. Hell, the owner could even say they sold their business instead of closing it. Those ego blows help. 18 #2 Referral Fee for Customer Acquisition What if you don’t own a business? Same idea but a case study. I had a UA’er (a member of our mastermind) reach out to a local restaurant owner who was going out of business. We asked if they would send their client email list a final goodbye email with a discount code that was good for a year at a restaurant nearby we loved that was staying open. Anytime their clients bought with that code for 25% off, the old owner made some money, and the clients were taken care of. That restaurant owner had a list of 15k clients, he made $2,250 in 2 weeks following his sending that code out. Our UA’er has now made $1k off that email sent and continues to make $100+ a week from that affiliate code. As for the new restaurant owner – that client list he essentially bought into for $0 has netted him more than $20k. Once he realized that this strategy would be useful, he switched his list over to being a recommendation email list with the “best of” picks by the owner. So that is almost $23k from a business that previously was going to evaporate with $0 worth. The email was very moving, hearing an entrepreneur’s story of closing moves us, and it moved their customers to the tune of $20k. 19 #3 Employee Acquisition for $0 Does anyone think it’s easy to hire right now? Ok ya, us either. Well, how about this...closing business refers employees to you. You pay a finder fee for all employees who stay over x period OR owner & employee get a % rev share of profits for clients brought over. In VC land this is pretty normal, it’s called Aqui-hiring. We did this with instructors at a popular gym and added 100+ clients. Do the same process with employees of the other gym owners/your sector biz. Ask the owner to help with transferring their best employees or contractors AND THEIR ROLODEX OF CLIENTS. You give the owner and the employee a % rev share of profits for any of their clients that come over. You give them off hours that you currently don’t have filled to do their classes. You bring them in to co-teach a class with one of your other instructors. By acquiring employees through revenue or profit share you are growing inorganically with ZERO dollars out of pocket. Those who don’t work out to offset their costs you don’t keep. Contrarian crew, if you run a business and you aren’t out there trying to buy up your competitor’s closing, YOU ARE MISSING A HUGE OPPORTUNITY. 20 #4 Seller Financing Now this one isn’t $0 but it can be amounts of all levels. Seller financing means simply that you buy a business or an asset of any kind, and the seller finances your purchase through the profits of the business over a period of time. We’ve written often on this practice and how to negotiate these types of deals. But I thought I’d give you a new story... Brandon of Investment Joy did this exact process: Total deal size = $675k, but 94% was seller financed: Brandon put in $40k for his own money for the down payment and the other $635k was negotiated as seller financing with 3% interest. Of his 3 main businesses, they are more than 90% sellerfinanced #5 Revenue OR Profit Share Acquisition What if you could buy into a company using your ability to bring on clients as your equity and cash flow? We teach students every day how to turn their sales and marketing ability into ownership in a company. Here’s an example in real life: I spend $2-6k a month on video production So I thought why not buy the company I pay now I put down $10k+ and new revenue milestones (aka helped them increase sales by 30%) for 40% of the business Now I MAKE $5-8k on the biz a month I continue to help them grow the company while cash flowing and having equity if we sell 21 #6 Cost Decrease Acquisition Perhaps you are not the salesman type. There is no marketer in you capable of increasing revenue and sales. Well, my friend, what is the other way to pocket more cash? Decrease expenses. Most private equity firms of scale do not just grow businesses they cut costs. How will Elon Musk come in and right-size Twitter? He’ll cut 75% of the workforce. How can you get equity without money to invest or revenue to bring in? Cut what is not crucial. Track exactly where money is currently deployed Actively manage working capital Zero-base the capital budget (every expense needs to be justified) Free fixed capital (real estate, big cap-ex) Employ alternative ownership models Create systems to prevent “capital creep” (increasing costs) This is the single most undervalued skill set by founders and business owners because it feels awful. Close a new sale – CELEBRATE. Cut underperforming team members – FEEL BAD. We are giant emotive machines. But the truth is that most businesses in the world of low-interest rate glut are overstaffed and overfat. Learn to cut the cancer without killing the patient and you’ll get paid like a surgeon. 22 #7 Loans Let’s say you have zero money to utilize, no friends to ask for it, and no skills to negotiate for it. What do you have left? Access to money through debt. If I could plead with you one thing, it’d be to learn about intelligent debt use. We did a whole video on one type. But add SBA loans, grants, and debt through lines of credit or equipment loans and you’ll quickly realize you don’t just need “money” you need to understand finance. THETRUTH... If you read the above and say, “That won’t work for me,” it probably won’t. If you read the above and think, “How could that work for me?” It just might. I’ve built broke. I’ve built scared. I’ve built alone. It’s never the right time to build something. It’s never the right time to buy something. But it’s also always the right time. You can’t deposit excuses. 23 CHAPTER 4: HOW TO GROW YOUR INVESTMENT INCOME TO BUY A BIZ As you probably noticed in the seller financing example, sometimes you’re going to need to come up with some amount of cash for the deal. And if not for the deal itself, you’ll need some cash to pay for your team, like your lawyers and accountants who are helping you close the deal. This is where most people get stuck. They immediately think they don’t have enough money to buy a business. And there’s money all around, you just have to know where to look. So I added this chapter because I want you to be the master of your own fate by taking control of your income. These ideas can be used to save up to buy your first business. And remember, just like you wouldn’t put all your money in one stock (or at least I hope you don’t), you shouldn’t rely on your income coming from one source. 24 CHAPTER 4: No one will ever care about your financial freedom as much as you do. So own it. 25 CHAPTER 4: 29 CREATIVE INVESTMENT INCOME IDEAS I hate the term passive income. It’s a myth. There’s always going to be some work involved. So I call it investment income instead. And that’s true with all the ideas on this list. They are all going to require some work. But this isn’t your typical dog-walking and Uber-driving list. They may make money, but they don’t make you smarter. And they are the opposite of passive. They require your time. The list below is full of things I would do or have actually done. These are unconventional ways to make money on day one, that actually scale, are fun, and can create a horizontal income flywheel. CHAPTER 4: 1. RULE NUMBER #1 - THERE ARE NO RULES. TAKE THIS LIST AND GET CREATIVE. 26 2. WRITE A GUIDE Write a guide on a subject you are an expert in and sell it on Gumroad like mine: Get Hired, Get Hired In Cannabis. Gumroad is free and so idiot proof I did it myself as opposed to hiring someone! I donate to charity out of this and here’s a screenshot from one of the products I sell. 3. WRITE A BOOK Turn that guide into a book you sell on Amazon as I did here: ooh la la now I’m an “author.” This falls under the model of “create something once, and sell it over and over again.” That’s one of my favorite models. 4. SELL ON FIVERR Sell Your Services on Fiverr. I’ve used this site for graphic design, video editing, copywriting, virtual assistant, research, and the list goes on. 27 5. HOST A VIRTUAL SUMMIT We do this at Arcview Group on cannabis investing and you can charge $100’s of dollars to get a group of humans to listen to whatever you know about. Real estate, comic book collecting, cannabis, cooking... literally google virtual events they are on every summit. My friend started his $10MM+ revenue company The Hustle/Trends with a conference where he made $50k in the first event. 6. START A PODCAST I am with Strike Fire Productions, producer of Green Entrepreneur. You can sell sponsorships, do affiliate deals with guests, and sell your own product. 7. CREATE YOUR OWN JOURNAL The amount of things you can do online is ASTOUNDING. You can create, upload, sell, package, and ship a custom-made journal on Blurb for nothing except a royalty on journals sold. They do all the work you collect the check. 8. LAUNCH AN ONLINE COURSE Udemy or Coursera allows you to easily do your own course and are the most used. I prefer Thinkific which is where we did a course on How to Buy a Small Biz and it garnered about $10k in the 1st two weeks. 28 This was pre-launch and I’ll break down in another post on Contrarian Thinking how to succeed in a launch. Other ideas I’ve been thinking about for courses below: How to train for a Spartan race How to invest in cannabis How to angel invest How to create the best startup pitch deck Venture capital and fundraising masterclass Negotiation to make more money Sales, how to win at the sales game The possibilities are endless. If you want to teach a course, simply pick your area of expertise and package it. 9. WRITE FANTASY SHORT STORIES Using wattpad you can connect w/ 80 million readers and find ways to monetize your short stories. 29 10. CONSULT FOR OTHERS Consult on a subject you are intrigued by a la GLG which has 700k+ experts. I did this for a while but given how busy I am I found it annoying that I had to “apply” for every job back in the day, so I stopped. But if you have the time, apply away. The only part I don’t love about this one is it’s not passive and you can do lots of free work without pay, so be cautious. 11. START A NEWSLETTER I’m obviously obsessed with this one, because we did it, and if you want to learn EXACTLY how, you can here. Essentially you create a newsletter on a niche you are curious about and put it behind a firewall. I subscribe to the Dispatch and a slew of other pay-walled newsletters that are all on Substack. The Dispatch has tens of thousands of subscribers at $10 a month aka if they only have 10k subscribers that equals $100k in revenue a month. Not bad eh? 30 12. ASK FOR A JOB Everyone knows a business owner or two, or a wealthy person or two. Reach out to them and ask them if they have tasks they need done, problems they need solved, projects they don’t have time for, give them some ideas, and have them create you a job. My husband did this for a family office, a big influencer, and a slew of nonprofits. He starts out being very helpful and letting them know he’s looking for project work and it usually takes off from there. 13. GET YOUR OWN WEBSITE I prefer Wordpress, I think everyone should have a website in their name. Use it to do consulting services, speak on your area of expertise, e-commerce, sell your finger paintings. Whatever. 14. CREATE AFFILIATE CONTENT I do affiliate deals on brands I love and for EEC, and we make a commission on them. It’s hard to get scale here so you either need a targeted audience that will buy with larger dollar items or a big audience on some platform. It’s great to just add to your blog to set and forget. 31 15. E-COMMERCE COMPANY Get a website setup with BigCommerce and follow SumoMe’s step-by-step guide to starting an e-commerce company. My agent has one called Bontempsbands that sells watch bands with customizations. 16. SELL MERCH ON AMAZON Amazon has a service called Merch by Amazon where you upload your designs and they do all the printing, packaging, and shipping of whatever you design for clothing. They take a cut and you pay no upfront. I’m thinking of doing a graphic tee, too easy not to. 17. GET PAID TO TRAVEL TrustedHousesitters USA, House Sitters America, HouseCarers, Nomador, and MindMyHouse. All sites where you can live for free and often get paid to house sit. On particularly long days I fantasize about going to work on an organic farm in a European clime and getting lodging for labor. Then I snap out of it, maybe you should snap into it. 18. BECOME A SALES REP Reach out to Your Favorite Small Businesses. If you’re obsessed with a t-shirt brand, your gym equipment, a candle company, whatever is small enough to respond to 32 you, reach out and ask if you can be an affiliate for them. Push sales to them in exchange for a cut. 19. DROPSHIPPING BUSINESS Think of this like you playing the middleman. You set up an e-commerce site and sell other people’s wares and inventory, when your store sells a product, you purchase the item from a third party and have it shipped directly to the customer. No warehouse is needed. 20. HAVE AN AIRBNB? I do, so I contract out services and get a commission on anything my renters do with my guests. These are things like yoga, cooking class, hiking, bar hopping, whiskey making, wine tasting, dinner suggestions. It’s a three-sided win. The renter says my code and gets a discount, the small business makes a new sale and I get a cut. If I am not seeing any revenue from a place I cut it and try a new one. I make sure to tell the business proprietor that so they won’t cut me out of the deal. 21. PASSIVE INVESMENT INCOME I use sites like Fundrise (an online small dollar amount real estate investment platform), to invest and set up recurring revenue through monthly dividends. 33 22. CREATE AN AFFILIATE PROGRAM Instead of being an affiliate, offer the service of setting them up for your product or for another company’s and ask for a cut. Ambassador is by far my favorite program to use for affiliates and brand ambassadors who can take a cut on the product too. 23. UPSELL THE PLACE YOU FREQUENT Every time I walk into a business I obsess about all the ways they are leaving money on the table. For example, our MMA gym literally just swipes your cc and gives you a membership and that’s it. If I was less lazy I’d go to my gym and say I’ll create a nutrition guide, a website and email campaign for new members linking product they need to start (gloves, wraps, shin pads), a 30 day workout plan, etc etc I’ll brand it all as the company and create a system for new members to get upsold on everything. You can either pay me a lump sum for it or I’m happy to do a revenue share on what sales we bring in. Win-win. 24. POP-UP EVENT I love the idea of pop-up events. My friend Alex does popup dance events using space at gyms and studios when not in use. She gets the space for free and splits whatever she makes. You could do this for any in-person event. 34 25. SELL ON INSTAGRAM Still hurts my heart that a Kardashian was the youngest female billionaire, but don’t hate the player, hate the game right? In that vein – selling on Instagram is so easy you have a veritable army of moms selling everything from essential oils to beauty products, to yes even wireless services. Check us out and see exactly how we do it. 26. BUY AN ACCOUNT & SELL PRODUCTS INTO IT This one blew my mind. My high school age cousin Wyatt buys Instagram accounts with tens of thousands of followers and then sells other people’s products to them. There are dozens of marketplaces that do this, you can buy an account with 14k followers for $350 or an account with 154k followers for $2k, then turn around and use affiliate links to sell products to them. Wild. 27. BUY AN ONLINE BUSINESS On Flippa you can buy actual profitable businesses and then take over the business for “passive” income or try to grow them. The whole transaction is set up similar to eBay and Amazon for businesses online. 34 28. SOCIAL MEDIA MANAGEMENT I lost my mind. One of our portfolio companies was paying $1,500 for a person to post 2-4 photos a month on their Instagram and manage the account. The photos were terrible and the account wasn’t growing. But I digress. $1500 for 4 photos. I’d put myself on Upwork and reach out to underperforming brands and offer that service. My friend Maria does this for local businesses in Chicago and crushes it. PS - If you’ve made it this far, you will love our Investor Operating System course. You’ll learn the money mindset that I used to acquire multiple businesses and income streams. 35 CHAPTER 5: 5 MISTAKES TO AVOID ALONG THE WAY After doing over 30 deals, I’ve made a bunch of mistakes along the way. And I’m a strong believer in learning from other people’s mistakes so you don’t have to. And it only seemed fit for me to share some of the red flags to look out for as you start your first deal. 1. They Use All Cash & Their Own Cash Rule #1, Don’t Buy with Cash Rule #2, Don’t Forget Rule #1. The beautiful thing about buying a business right now is there is a huge demand/supply imbalance. There is more supply than demand. Because of this, you can get leverage. You can literally get the seller to help you finance the deal. Buying a business is all about leverage. The ability for you to leverage the businesses assets to get your deal done and keep your cash to grow the business. I like to try to shoot for a similar model as a mortgage, i.e. 1020% down in cash and the rest “seller financed”. Then if you really want no money in the game, layer over it with an equipment loan. 36 34 I’ve personally never done a deal that didn’t include some aspect of leverage or seller financing. EVEN if I have the money to do the deal in cash I never do. Why? Cash is king. I’d rather have it on hand for anything to go wrong. This is a very high-level example of how this works with seller financing. Essentially your purchase price is $394,000 in this example 1. Instead of paying cash, you put $50,000 down in cash. The rest, you payout in thirds over three years. 2. Then you go to the SBA and get a loan for up to 90% of the purchase price and can add on a loan based on the value of the equipment. Aka – if you have a laundromat you get a loan against the laundromat 3. At the end of it you subtract the $50,000 you gave the seller and you take the $334,000 and put it in your bank account.You use that cash to grow the business, pay down the interest and live off the profits of the business. 37 34 PAUSE FOR A SECOND. You buy a business and DAY ONE, you make $334,000. This is a real-life example. It happens every day. Just no one teaches us these things. At Unconventional Acquisition, THIS is what we teach you. You just got a mini-lesson right here. Using other people’s money to earn is what we do in finance all day. 2. They Overpay The second mistake is about the purchase price. There is a mountain of complex modeling techniques for small businesses to figure out what they are worth. Let me save you some headaches and time. Small businesses are worth 2-3x their profits on average. We can cite study after study on this and you can also do a Google search for companies below $10M in revenue. The rule of thumb is usually the bigger the business the higher the profit multiple. Why do we simplify this? Because as long as you have done your due diligence right, have the right processes in place, and the determination to continue the business, 2-3x purchase price means you can turn around and sell the business for the same amount, or higher. 38 34 In tandem, remember in businesses it’s different from real estate. You have MANY ways to grow the value. It’s better to KISS. Keep It Simple Stupid, on your first deals. You don’t need to model out complex returns because you are looking for businesses at 2-3x their profit. Period. 3. They Don’t Use Milestones & Earnouts When negotiating a purchase you have two big levers: Price & Terms. You can focus exclusively on price or you can also manipulate terms. My saying is your price, my terms, or my price and your terms. Often when buying a business I talk about using milestones and earnings to protect you on the downside when you buy. For example one of our members buys Financial Firms. His name is Toby and he said: “What’s smarter, the guy growing by selling door to door, or the guy who buys all the clients once they’re collected door to door and then sells them more things? The door-to-door salesman does all the hard work now I just layer options over his work.” 39 34 Deal Example: The first deal he did was buying a financial advisor’s book of business. This happens a LOT in finance. He bought the business for 1.8x the profits of the business. How this works out in this industry is called a trailer So Toby bought the business for 1.8x or 180% of its profits. But he structured it so he paid 60% of what the financial advisor produced in 1 year and each year another 60% for 3 years. So Toby paid 1.8x for the business (60% x 3 years paid). But he put in a caveat. That the business did $400,000 in revenue when he bought it. So Toby said I’ll pay you 60% of $400k for three years BUT anything I get the business to produce over $400,000 I keep 80% of the profit but I will give you 20%. What’s smart about this is that he incentivizes the owner to transition the business, but he knows that owners are largely a bit tired so they’re not going to be growth engines. They’re just there to make sure the ship doesn’t burn down due to new ownership. He keeps the advisors on for three years to manage the clients he already has, while Toby can focus on generating additional revenue streams, and the advisor he bought out just had to be a relationship manager. 40 34 4. They Build A Business When They Should Buy It This is the single biggest mistake people make in our opinion. Not buying a business when they should. Let me give you a couple of examples. Marketing Business Example: One of my students had a business that was in the marketing space. It was doing about $1.3M in revenue a year with a profit margin of about 20%. So let’s say doing $260k in profit. That business just kept growing by a small 5% a year or $13k in additional profit. But that wasn’t enough to hire the people they needed to really jumpstart growth. SO – they bought another agency. This one was a digital agency as opposed to a PR & marketing agency. This agency was growing like crazy (35%) but really poorly managed with very small profit margins ($1M in revenue w/ about 5% margins). It made about $50,000 a year in profit. The buyers knew it should make between 11-20% margins but the founders were good at growing and marketing but bad at managing the business The founders were tired of growing more just to make the same, they wanted to sell. So, the larger company bought the business for 2x $50,000, or $100,000. 34 41 They optimized costs and immediately got the profits up to 17%. Which means they bought the business for $100k and within the first 12 months they made $170,000 on the deal. Not to mention it is growing at 35% so that $170k this year could be $229,500 the next year. So the acquirers could have maybe hired two employees for $50k each with their money, or buy a business and get an additional $229k out of it. Well done team. 5. They Buy Too Small of A Business (They Buy A Job) Lastly, when I buy a business we strive for it to make at least $100k a year in profit. Why? Then I can hire a decent operator for most small businesses. Ideally, the profit is closer to $200k. Why? Because I don’t want to run these businesses. I want to be what we call an owner-investor (passive-ish), not an owner-operator (actively run the business). As you are looking for a small business to buy, pay attention to what you want. Do you want to buy a job? That is awesome if so, those deals are EVERYWHERE. 42 34 If you want to work for yourself and make $65k running a laundromat, you can close a deal in 30 days. If you want to work for yourself and make $100-200k on a landscaping or accounting, or marketing business you can do that in a few weeks. What takes a bit more looking for is those larger businesses that you can buy with an operator or partner, or hire one for and thus get cash flow without your time. There you have it. The FIVE most common business buying mistakes, and how to avoid them. If you leave with one thing today I hope it is this: Buying is > Building Is it every time? No. Is it most of the time? Yes. How do I know? I've done it. And the numbers, they don’t lie. 43 34 CHAPTER 6: WHERE DO YOU GO FROM HERE? At this point, you’ve learned… Why you should buy a business What types of businesses you should look into buying How you can buy a business using OPM How you can grow your income to fund the rest of the deal Some of the mistakes I’ve made along the way And now what? Well, if you’ve made it this far, you’re probably ready for our mini-MBA course that shows you everything you need to go from “I don’t know how to buy a business” to “I’m about to close on my first deal." I’ve spent years refining our formula for buying businesses, and now I want to share it with you. My goal is to help you build freedom and passive income through acquisitions. So if that’s your goal too, and you know it’s time to get the financial and time freedom you want, and want to do that by acquiring a cash-flowing business, enroll in the course. I’d love to have you. Join the Business Buying Mastermind here. 44 34 Disclaimer – This is the “Be an adult” section. Everything mentioned above isn’t advice, just a recount of what I did. That said: This eBook/article is presented for informational purposes only. The opinions stated here are not intended to recommend any investment or provide tax advice. Neither are they an offer to sell or the solicitation of an offer to purchase an interest in any current or future investment vehicle managed or sponsored by Codie Ventures, LLC or its affiliates. All material presented in this newsletter is not to be regarded as investment advice but for general informational purposes only. Day trading and investing do involve risk, so caution must always be utilized. We cannot guarantee profits or freedom from loss. You assume the entire cost and risk. You are solely responsible for making your own investment decisions. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. By reading/sharing this newsletter or consuming our content on our other channels, you are indicating your consent and agreement to our disclaimer.