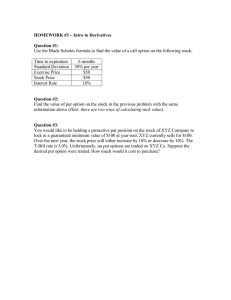

CHAPTER-TWO FINANCIAL ANALYSES AND PLANNING Mulugeta A. Mulugeta.ak@wldu.edu.et 02-DEC-2023 1 Chapter Outline 2.1. Financial Analysis • The Need or purpose of financial Analysis • Source of financial data • Financial Analysis Steps • Approaches to financial analysis and interpretation 2.2. Financial planning (forecasting) • The planning process • The procedures and importance of sales forecasting • Methods of determining external financial requirements. Chapter Two: Financial Analysis and Planning 2 2.1. Financial Analysis • Financial analysis refers to analysis of financial statements and it is a process of evaluating the relationships among component parts of financial statements. • It is the assessment of firm’s past, present and anticipated future financial condition. • The focus of financial analysis is on key figure in the financial statements and the significant relationships that exist between them. • Its objectives are to determine the firm’s financial strength and identify it’s weaknesses. • It helps users obtain a better understanding of the firm’s financial conditions and performance • Users of Financial Analysis are Lenders, Investors, Management, Suppliers, Employees, and Government bodies. Chapter Two: Financial Analysis and Planning 3 The Need/ Purposes of Financial Analysis • To evaluate an organisation’s; – Financial performance – Financial position. • To have a means of comparative analysis across time in terms of: – Intracompany basis (within the company itself) – Intercompany basis (between companies) – Industry Averages (against that particular industry’s averages) • to obtain useful information to aid decision making by applying analytical tools and techniques to financial statements. Chapter Two: Financial Analysis and Planning 4 Source of financial data • Financial data are the base for financial analysis and financial decision making of a firm • Among these financial statements, Balance Sheet, Income Statements,, Cash flow and Retained Earnings statements are the core components. • The financial manager, investor or any responsible financial analyst could get the financial data from these component parts of the financial statements of the firm Chapter Two: Financial Analysis and Planning 5 Financial Analysis Steps 1. Identify the economic characteristics 2. Identify the corporate strategies 3. Understand the financial statements 4. Assess the profitability and risk 5. Value the particular firm Benchmarks for evaluation • To answers the question as; it too high or too low, is good or bad? A meaningful standard or basis is needed. • There are three approaches; – Rule of thumb – Cross sectional analysis or industry average – Time series analysis Chapter Two: Financial Analysis and Planning 6 Approaches to financial analysis and interpretation • According to users of financial information, there are two techniques of financial analysis. These are Internal Analysis, and External Analysis • The most frequently used tools/techniques in analyzing financial statements are:- I. Financial Ratio Analysis/ Ratio analysis II. Common size analysis/ Component Percentages III. Horizontal Analysis analysis/Trend Vertical analysis/ analysis/ Index 7 6 Chapter Two: Financial Analysis and Planning Illustration: Financial statement analysis • The following financial statements of XYZ Ltd were prepared in accordance with Ethiopian GAAPs. XYZ Ltd is a diversified enterprise with its main interests in the manufacture and retail of alcoholic products. • The financial statements of XYZ Ltd need to be analysed. An investor is considering purchasing shares in the company. Relevant ratios need to be selected and calculated and a report needs to be written for the investor. The report should evaluate the company’s performance and position. • See the XYZ Ltd.'s Financial Statements on the given Sheet! Chapter Two: Financial Analysis and Planning 8 I. Financial Ratio Analysis • There are several key ratios that reveal about the financial strengths and weaknesses of a firm • We will look at five categories of ratios, each measuring about a particular aspect of the firm’s financial condition and performance. • A. Liquidity Ratios • Liquidity ratios measure the ability of a firm to meet its immediate obligations and reflect the short – term financial strength or solvency of a firm. • In other words, liquidity ratios measure a firm’s ability to pay its current liabilities as they mature by using current assets • We will perform the necessary ratio analyses using them, and then evaluate and interpret each analysis Chapter Two: Financial Analysis and Planning 9 I. Current ratio – measures the ability of a firm to satisfy or cover the claims of short-term creditors by using only current assets. Current ratio = Current assets/ Current liabilities • XYZ’s current ratio (for 2002) = Br. 57,600/ Br. 38,100 = 1.51 times • Interpretation: XYZ has Br. 1.51 in current assets available for every 1 Br. in current liabilities. N.B: Relatively high current ratio is interpreted as an indication that the firm is liquid and in good position to meet its current obligations; the reverse is true. A very high current ratio, however, may indicate excessive inventories and accounts receivable, or a firm is not making full use of its current borrowing capacity. II. Quick ratio (Acid – test ratio)- measures the short-term liquidity by removing the least liquid current assets such as inventories. Quick ratio = Current assets – Inventory/Current liabilities XYZ’s quick ratio (for 2002) = Br. 57,600 – Br. 24,900/ Br. 38,100 = 0.86 times • Interpretation: XYZ has Br. 0.86 in quick assets available for every one birr in current liabilities. Chapter Two: Financial Analysis and Planning 10 B. Activity Ratios/Asset Management Ratios/ asset utilization ratios, or efficiency ratios • Efficiency of asset usage – How well assets are used to generate revenues (income) will impact on the overall profitability of the business. – How the firm efficiently or intensively use its assets to generate sales. – These ratios measure the degree to which assets are efficiently employed in the firm. • For Example:1. Accounts Receivable Turnover – measures how efficiently a firm’s accounts receivable is being managed. • Accounts receivable turnover = Net sales/ Accounts receivable • XYZ’s A/R turnover (for 2002) = Br. 196,200/ Br. 20,700 = 9.48 times • Interpretation: XYZ’s accounts receivable get converted into cash 9.48 times a year. • In general, a reasonably higher accounts receivable turnover ratio is preferable. Chapter Two: Financial Analysis and Planning 11 2. Days sales outstanding (DSO) • also called average collection period. • It seeks to measure the average number of days it takes for a firm to collect its accounts receivable. • In other words, it indicates how many days a firm’s sales are outstanding in accounts receivable. Days sales outstanding = 365 days/Accounts receivable turnover XYZ’s days sales outstanding = 365 days/ 9.48 = 39 days • Interpretation: XYZ’s credit customers on the average are paying their bills in almost 39 days. If XYZ’s credit period is less than 39 days, some corrective actions should be taken to improve the collection period. • The average collection period of a firm is directly affected by the accounts receivable turnover ratio. • Generally, a reasonably short-collection period is preferable. Chapter Two: Financial Analysis and Planning 12 3. Inventory turnovermeasures how many times per year the inventory level is sold (turned over). Inventory turnover = Cost of goods sold/ Inventory For XYZ Company (2002) = Br. 159,600/ Br. 24,900 = 6.41times Interpretation: XYZ’s inventory is on the average sold out 6.41 times per year. In general, a relative high inventory turnover is better than a low turnover. 4. Fixed assets turnover – measures how efficiently a firm uses its fixed assets. It shows how many birrs of sales are generated from one birr of fixed assets Fixed assets turnover = XYZ’s fixed assets turnover = Net sales/ Net fixed assets Br. 196,200/ Br. 96,300 = 2.04X Interpretation: XYZ generated Br. 2.04 in net sales for every birr invested in fixed assets. • A fixed assets turnover ratio substantially lower than other similar firms indicates underutilization of fixed assets Chapter Two: Financial Analysis and Planning 13 5. Total assets turnover • indicates the amount of net sales generated from each birr of total tangible assets. It is a measure of the firm’s management efficiency in managing its assets. • Total assets turnover = Net Sales/Total assets • XYZ’s total assets turnover = Br. 196,200/ Br. 153, 900 = 1.27X • Interpretation: XYZ Share Company generated Br. 1.27 in net sales for every one birr invested in total assets. • A high total assets turnover is supposed to indicate efficient asset management; and vis versa. Chapter Two: Financial Analysis and Planning 14 C. Leverage Ratios • Also called debt management or utilization ratios, Long term funds management • measure the extent to which a firm is financed with debt, or the firm’s ability to generate sufficient income to meet its debt obligations. • The types of debt measurement tools are:I. Financial Leverage Ratio: These ratios examine balance sheet ratios and determine the extent to which borrowed funds have been used to finance the firm. 1. Debt to total assets (Debt) Ratio – measures the percentage of total funds provided by debt. Debt ratio = Total liabilities/Total asset XYZ’s debt ratio = Br. 98,100/ Br. 153,900 = 64% Interpretation: At the end of 2002, 64% of XYZ’s total assets were financed by debt and 36% (100% - 64%) was financed by equity sources. The higher the debt ratio is the more the firm’s financial risk. Chapter Two: Financial Analysis and Planning 15 II. Coverage Ratios These ratios measure the risk of debt and calculated by income statement ratios designed to determine the number of times fixed charges are covered by operating profits. 1. Times – interest earned – measures a firm’s ability to pay its interest obligations. Times interest earned = Earnings before interest and taxes (EBIT) / Interest expense XYZ’s times interest earned = Br. 10,500Br. 3,000 = 3.50X Interpretation: XYZ has operating income 3.5 times larger than the interest expense. Chapter Two: Financial Analysis and Planning 16 2. Fixed charges coverage • Measures the ability of firms to meet all fixed obligations rather than interest payments alone. • Fixed payment obligations include Interest on debt, Principal repayment on debt, Lease payment, and Preferred-share dividend payments. • Fixed charges coverage = Income before fixed charges and taxes/ Fixed charges • For XYZ Company, the other fixed charge payment in addition to interest is lease payment. Therefore, • XYZ’s FCC = Br. 10,500 + Br. 2,700 / Br. 3,000 + Br. 2,700 = 2.32X • Interpretation: the fixed charges (interest and lease payments) of XYZ Share Company are safely covered 2.32 times. Chapter Two: Financial Analysis and Planning 17 3. Cash Coverage Ratio Cash Coverage Ratio= EBIT + Depreciation/ Interest XYZ’s cash coverage ratio = Br. 10,500+ Br. 6,000/ Br. 3,000 = 5.5x Interpretation: the cash coverage ratio of XYZ Share Company are safely covered 5.5 times. Chapter Two: Financial Analysis and Planning 18 D. Profitability Ratios Profitability is the ability of an entity to earn profits. This ability to earn profits depends on the effectiveness and efficiency of operations as well as resources available. Profitability analysis focuses primarily on the relationship between operating results reported in the income statement and resources reported in the balance sheet. • 1. Profit Margin – shows the percentage of each birr of net sales remaining after deducting all expenses. • Profit margin = Net income/Net Sale • XYZ’s profit margin = Br. 3,900/ Br. 196,200 = 2% • Interpretation: XYZ generated 2 cents in profits for every one birr in net sales. Chapter Two: Financial Analysis and Planning 19 2. Return on Investment (Assets) Measures how profitably a firm has used its investment in total assets. Return on investment = Net income / Total assets XYZ’s return on investment = Br. 3,900 / Br. 153,900 = 2.53 % Interpretation: XYZ earned more than 2 cents of profits for each birr in assets. Generally, a high return on investment is sought by firms Chapter Two: Financial Analysis and Planning 20 3. Return on equity indicates the rate of return earned by a firm’s stockholders on investments made by them selves. Return on equity = Net income/ Stockholders’ equity XYZ’s return on equity = Br. 3,900/ Br. 55,800 = 6.99% • Interpretation: XYZ earned almost 7 cents of profit for each birr in owner’s equity. • We can also use the following alternative way to calculate return on equity. Return on equity = ROI / 1 – Debt ratio Chapter Two: Financial Analysis and Planning 21 E. DuPont System of Analysis • Is an approach to assess that a firm’s return on assets and return on equity show not only the firm’s earning power but also efficiency and leverage. • This analysis breaks down these two ratios as follows: ROA= Profit margin X Total assets turnover XYZ’s ROA (2002) = 0.02 X1.27 = 0.0254 ≈ 0.03 ROE= PM X Total assets turnover X Total assets/equity = PM X Total assets turnover X Equity Multiplier* XYZ’s Equity Multiplier (2002) = 153,900/55,800 = 2.76X XYZ’s ROE (2002) = 0.02X1.27X2.76* ≈ 0.07 Chapter Two: Financial Analysis and Planning 22 F. Marketability Ratios • Marketability ratios are used primarily for investment decisions and long range planning. They include: 1. Earnings per share (EPS)- expresses the profits earned on each share of a firm’s common stock outstanding. Earnings per share = Net income – Preferred stock dividend Number of common shares outstanding • XYZ’s Eps for 2002 = Br. 3,900 – Br. 300 / Br. 33,000 Br. 10 = Br. 1.09 2. Dividends Per Share (DPS)- represents the amount of cash dividends a firm paid on each share of its common stock outstanding. Dividends per Share = Total cash dividends on common shares Number of common shares outstanding • XYZ’s DPs for 2002 = Br. 3,300 / Br. 33,000 Br. 10 = Br. 1.00 • Interpretation: XYZ distributed Br. 1 per share in dividends. Chapter Two: Financial Analysis and Planning 23 3. Dividend pay-out (pay-out) ratio Shows the percentage of earnings paid to stockholders. • Dividends pay-out = Dividends per share Earnings per share = Total dividends to common stockholders Total earnings to common stockholders XYZ’s pay-out ratio = Br. 1.00 Br. 1.09 = Br. 3,300 = 92% Br. 3,600 Interpretation: XYZ paid nearly 92% of its earnings in cash dividends. Chapter Two: Financial Analysis and Planning 24 Comparing Financial Ratios • Cross – sectional analysis: The comparison of a firm’s ratios to those other firms in the same industry at the same point in time • Time – series analysis: an evaluation of a firm’s financial ratios over time. The purpose is to determine whether the firm is progressing or deteriorating. Chapter Two: Financial Analysis and Planning 25 Limitation of Ratio Analysis • Even though ratio analysis can provide useful information about a firm’s financial conditions and operations, it has the following problems and limitations. Any single financial ratio does not provide sufficient information by itself. Sometimes a comparison of ratios between different firms is difficult due to the following two reasons A single firm may have different divisions operating in different industries. The financial statements may not be dated at the same point in time. Chapter Two: Financial Analysis and Planning 26 Con… The financial statements of firms are not always reliable, particularly, when they are not audited. Different accounting principles and methods employed by different companies can distort comparisons. Inflation badly distorts comparison of ratios of a firm over time. Seasonal factors inherent in a business can also lead us to deceptive conclusion. For example, the inventory turnover ratio for a stationery materials selling company will be different at different time periods of a year. Chapter Two: Financial Analysis and Planning 27 2.2. Financial planning (Forecasting) • It is the process of estimating the capital required and determining it's competition. • Financial planning is the process of assessing the current financial situation of a business to identify future financial goals and how to achieve them. • It indicates a firm’s growth, performance, investments and requirements of funds during a given period of time, usually three to five years. • It is generally a planning process which involves forecasting of sales, assets, and financial requirements • Financial forecasting is an integral part of financial planning. It uses past data to estimate the future financial requirements. • It is a process which involves: evaluation of a firm’s need for increased or reduced productive capacity and evaluation of the firm’s need for additional finance Chapter Two: Financial Analysis and Planning 28 Con… • Financing planning process involves the following facets: – Evaluating the current financial condition of the firm. – Analysing the future growth prospects and options. – Appraising the investment options to achieve the stated growth objective. – Projecting the future growth and profitability. – Estimating funds requirement and considering alternative financing options. – Comparing and choosing from alternative growth plans and financing options. – Measuring actual performance with the planned performance Chapter Two: Financial Analysis and Planning 29 The procedures and importance of sales forecasting • The financial forecasting process generally involves the following procedures: I) Forecasting of sales for the future period ii) Determining the assets required to meet the sales targets, and iii) Deciding on how to finance the required assets. Determining how much money (finance) the firm will need during the forecasted period. This will be done based on sales and assets forecast. Determining how much of the total required finance, the firm will be able to generate internally during the same period. Determining the additional external financial requirements Chapter Two: Financial Analysis and Planning 30 The planning process 1)Preparation- Includes establishing the objectives of the analysis and assembling the financial statements and other pertinent financial data 2) Computation- an application of various tools and techniques to gain a better understanding of the firm’s financial condition and performance. 3) Evaluation and InterpretationDeveloping conclusions, inferences and recommendations about the firm’s performance and financial condition. Chapter Two: Financial Analysis and Planning 31 Methods of determining external financial requirements (Additional funds needed (AFN)) 1) The pro-forma financial statements method 2) The formula method Chapter Two: Financial Analysis and Planning 32 1) The Pro-Forma Financial Statements Method • is also called the projected financial statements method • The pro-forma financial statements method is simply a method of forecasting financial requirements based on forecasted financial statements • It involves the following steps i. Developing the Pro Forma Income statement • The pro-forma income statement provides a projection of the firm’s net income for the forecasted period. • This enables the firm to estimate the amount of retained earnings it will generate during the period. • In developing the projected income statement, first, a forecast of sales should be established. Chapter Two: Financial Analysis and Planning 33 ii. Constructing the Pro Forma Balance Sheet • Some of the assets increase can be financed by retained earnings, and spontaneous finance • The remaining balance must be financed from external sources • In the forecast of the firm’s balance sheet, first, those balance sheet items that are expected to increase directly with sales are forecasted Example Blue Nile Share Company is a medium sized firm engaged in manufacturing of various household utensils. The financial manager is preparing the financial forecast of the following year. At the end of the year just completed, the condensed balance sheet of the company has contained the following items. Chapter Two: Financial Analysis and Planning 34 Blue Nile Share Company Comparative Balance Sheet August 30, 2015 Assets Liabilities and Equity Cash ----------------------------Br. 10,000 A/payable --------------------------Br. 90,000 A/receivable -----------------------70,000 Accruals --------------------------------40,000 Inventories -----------------------150,000 Current liabilities -------------Br. 130,000 Current assets -------------Br. 230,000 Long-term debt -----------------------200,000 Net fixed assets -----------------370,000 Common stock ------------------------120,000 _________ Total assets -------------Br. 600,000 Chapter Two: Financial Analysis and Planning Retained earnings --------------------150,000 Total liabilities and equity ------Br. 600,000 35 Con… • During the year just completed the firm had sales of Br. 1,800,000. In the following year, due to increased demand to the firm’s products the financial manager estimates that sales will grow at 10%. There is no preferred stock outstanding during the year. The firm’s dividend pay-out ratio is 60%. It is also known that the firm’s assets have been operating at full capacity. During the same year, Blue Nile’s operating costs were Br. 1,620,000 and are estimated to increase proportionately with sales. Assume the company’s interest expense will be Br. 40,000 during the next year and its tax rate is 40%. • Required: Determine the additional funds needed (AFN) of Blue Nile Share Company for the next year using the pro-forma financial statements method and Formula Method. Chapter Two: Financial Analysis and Planning 36 Solution 1st . Develop Pro Forma Income Statement Sales (Br. 1,800,000 x 1.10) ----------------------------------------------------------------Br. 1,980,000 Operating costs (Br. 1,620,000 x 1.10) --------------------------------------------------------1,782,000 Earnings before interest and taxes (EBIT) -----------------------------------------------------Br. 198,000 Interest expense -----------------------------------------------------------------------------------------40,000 Earnings before taxes (EBT) ------------------------------------------------------------------------Br. 158,000 Taxes (Br. 158,000 x 40%) -------------------------------------------------------------------------------63,200 Net income -----------------------------------------------------------------------------------------------Br. 94,800 Dividends to common stock (Br. 94,800 x 60%) ---------------------------------------------------Br. 56,880 Addition to retained earnings (Br. 94,800 – Br. 56,880) ----------------------------------------Br. 37,920 Chapter Two: Financial Analysis and Planning 37 Con… 2. Then, construct the Pro Forma Balance Sheet Assets Liabilities and Equity Cash (Br. 10,000 x 1.10) ----------------Br. 11,000 A/Payable (Br. 90,000 x 1.10) -------------Br. 99,000 A./receivable (Br. 70,000 x 1.10) ----------77,000 Accruals (Br. 40,000 x 1.10) --------------------44,000 Inventories (Br. 150,000 x 1.10) ----------165,000 Current liabilities ----------------------------Br. 143,000 Current assets ---------------------------Br. 253,000 Long-term debt (the increase is unknown)----200,000 Net fixed assets (Br. 370,000 x 1.10) ----407,000 _______ Total assets -----------------------Br. 660,000 Chapter Two: Financial Analysis and Planning Common stock (as long-term debt) ------------120,000 Retained earnings (Br. 150,000 + Br. 37,920) 187,920 Total liabilities and equity -------------Br. 650,920 38 Con… Blue Nile’s forecasted total assets as shown above are Br. 660,000. However, the forecasted total liabilities and equity amount to only Br. 650,920. Since the balance sheet must balance, i.e. A = L + OE, the difference must be covered by additional funds. Therefore, AFN = Br. 660,000 – Br. 650,920 = Br. 9,080. Or AFN = increase in Assets Increase in normally – generated funds = [Br. 660,000 – Br. 600,000] – [(Br. 99,000 – Br. 90,000) + (Br. 44,000 – Br. 40,000) + Br. 37,920] = Br. 60,000 – Br. 50,920 = Br. 9,080 Chapter Two: Financial Analysis and Planning 39 2. The Formula Method • is a much easier method of determining additional financial requirements than the pro forma method; and it’s a shortcut to financial forecasting. Assumption of the formula method. Each asset maintains a direct proportionate relationship with sales Accounts payable and accruals increase in direct proportion to sales increase. The profit margin and the dividend pay-out ratios are constant. • The formula that can be used as a shortcut to determine external capital requirements is given as: • Additional • funds • needed Required = increase Spontaneous – in assets increase in liabilities Increase in – retained earnings • AFN = (A/S) S – (L/S) S – MS1 (1 – d) Chapter Two: Financial Analysis and Planning 40 Con… To illustrate the formula method, consider the example given for the previous method. But assume that Blue Nile’s net profit margin is 5%. AFN = Br.600,000 Br.130,000 Br.180,000* Br.1,800,000 Br.1,800,000 (Br. 180,000) – 5% x Br 1,980,000** (1 – 60%) = Br. 60,000 – Br. 13,000 – Br. 39,600 = Br. 7,400 To increase sales by 10% (Br. 180,000), the formula suggests that Blue Nile must increase its assets by 60,000. In other words, the firm will require a Br. 60,000 more fund for the forecasted year. Out of this, Br. 13,000 will come from spontaneous increase in liabilities. Another Br. 39,600 will be obtained from retained earnings. The remaining Br. 7,400 must be raised from external sources like by issuing new shares of stocks or by borrowing. * S = S1 – S0 = S0 x sales growth rate (g) = Br. 1,800,000 x 10% = Br. 180,000 ** S1 = S0 + S0g = S0 (1 +g) = Br. 1,800,000 (1 + 0.10) = Br. 1,980,000. 41 The End! 42