Uploaded by

coolbrud.lfk

SVB Collapse Case Study: Timeline, Risks, and Responsibilities

advertisement

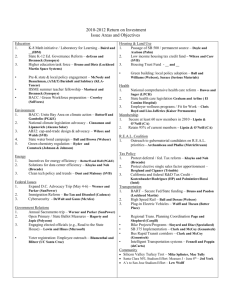

Case - SVB 1. What happened? Make a timeline from the creation up until today and highlight the main events. Highlight both the shining growth (strategy, activities and instruments, stock price) and the dark side (risky decisions, incoherencies, and irregularities) 1983: Silicon Valley Bank (SVB) is founded in Santa Clara, California, specializing in serving the emerging technology industry. 1980s-1990s: SVB grows steadily, catering to the needs of venture capitalists, startups, and technology companies. The bank establishes a reputation for innovation and customer service. 2000s: The dot-com bubble bursts, but SVB navigates the economic turmoil relatively unscathed. The bank's expertise in the technology sector proves to be a valuable asset. 2004: IPO 2010s: SVB continues its expansion, opening new branches and expanding its product offerings. The bank becomes increasingly reliant on risky investments, including collateralized loan obligations (CLOs). 2020: The COVID-19 pandemic sparks a surge in demand for SVB's services, as tech companies seek financial support. The bank's stock price soars to record highs. 2022: Rising interest rates and economic uncertainty begin to weigh on SVB's financial performance. The bank's heavy reliance on CLOs exposes it to losses as interest rates rise. March 8, 2023: SVB announces a $1.8 billion loss after selling off securities, including Treasury and mortgage bonds, which have lost significant value. March 8-9, 2023: Panic breaks out among investors and depositors, following the announcement of SVB's losses. The share price plummets more than 60% on a single day. March 9, 2023: Social media and instant communication online exacerbate the situation, fueling concerns about SVB's solvency. A bank run begins, with depositors rushing to withdraw their money from the bank. March 10, 2023: Trading is halted for SVB Financial Group stock. Amidst the chaos, federal regulators announce their intention to take over SVB to prevent a complete collapse. March 10, 2023: Deposits are moved to a bridge bank created and operated by the Federal Deposit Insurance Corporation (FDIC). The FDIC assures customers that all insured deposits will be available by Monday, March 13. March 12, 2023: In response to the crisis, federal regulators announce emergency measures allowing customers to recover all funds, including those that were uninsured. March 17, 2023: SVB Financial Group, the parent company of SVB, files for bankruptcy. March 26, 2023: First Citizens Bank buys all of Silicon Valley Bridge Bank, the bridge bank established by the FDIC, except for $90 billion of securities and other assets that remained in FDIC receivership. 2. How does Silicon Valley Bank differ from an “ordinary” wholesale bank? What implications could/should it have on the bank’s risk management? What are the key risks to handle? • • • • • • • Different industry focus: Tech companies, startups, VCs, not individuals Since cant lend to customer, like normal banks, Different product offerings: services tailored to the technology industry, such as specialized loans, venture capital financing, and wealth management services Not very differentiated, few big depositors in same sector Implications: Credit risk: SVB extends loans to technology companies that may be more volatile and riskier than traditional loan borrowers. Market risk: SVB's investments in CLOs and other high-yield securities make it vulnerable to changes in market conditions, such as interest rate fluctuations Operational risk: SVB's reliance on technology and complex financial transactions can increase its exposure to operational risk, such as fraud or IT failures. 3. Based on the financial statements what can you identify that could indicate that Silicon Valley Bank could end-up in a collapse? • High Leverage: SVB's heavy reliance on debt made it more vulnerable to economic downturns and interest rate shocks. • Investment in Risky Assets: The bank's portfolio was heavily concentrated in collateralized loan obligations (CLOs), which are sensitive to interest rate changes. • Declining Profitability: SVB's profits were shrinking, putting further strain on its finances. • Volatile Stock Price: The bank's stock price reflected growing investor concerns about its financial stability. • Inadequate Hedging: SVB failed to renew its hedging strategies, leaving it exposed to interest rate risk. The absence of a chief risk officer (CRO) likely contributed to these issues. swaps 4. How is this possible? What are the various responsibilities that you can identify? INTERNALLY by internal control, internal audit, risk management, quality control, conformity and compliance, management, board of directors etc and EXTERNALLY by legal auditors, investors, SEC? How do you analyze the role of social media? What consequences/outcomes do you expect going forward? Internal Responsibilities: • Internal Control: During the pandemic and low interest rates, SVB had to invest in high quality assets, such as CLOs, in order to generate sufficient returns. However, this strategy proved to be ineffective, as the bank was not receiving enough yield and could not offer depositors the returns they were expecting. This led to a loss of depositors and a liquidity crisis. • Risk Management: SVB's risk management team failed to recognize the risks associated with its investment strategy. The bank did not rebalance its portfolio after interest rates increased, which made it more vulnerable to losses. • Quality Control: SVB's quality control measures were inadequate, as they did not detect the deteriorating financial condition of the bank. • Conformity and Compliance: SVB did not comply with applicable laws, regulations, and internal policies. For example, the bank did not have a chief risk officer (CRO) in place. • Management: SVB's senior management failed to adequately oversee the bank's operations and risk management practices. This led to a lack of transparency and accountability, which exacerbated the crisis. • Board of Directors: The board of directors did not effectively oversee the bank's management and failed to act promptly to address the growing financial problems. External Responsibilities: • Legal Auditors: Legal auditors did not conduct thorough reviews of the bank's legal contracts, agreements, and regulatory filings. This allowed SVB to hide the extent of its financial problems. • Investors: Investors failed to do their due diligence and made uninformed investment decisions. They did not thoroughly evaluate the bank's financial statements, risk profile, and management team before investing. • SEC: The SEC did not adequately monitor SVB's activities and failed to identify the risks posed by the bank's investment strategy. Role of Social Media: Social media played a significant role in SVB's collapse. The rapid spread of rumors and speculation on social media fueled investor anxiety and exacerbated the bank run. The lack of transparency from the bank and its management further contributed to the panic and loss of confidence. Consequences and Outcomes: The collapse of SVB had far-reaching consequences, including: • Losses for Investors: Investors who held SVB stock or deposits suffered significant losses. • Damage to Reputation: SVB's reputation was severely damaged, making it difficult for the bank to attract new customers and investors. • Impact on the Economy: The collapse of SVB rippled through the financial system, causing uncertainty and instability. • Regulatory Changes: The collapse led to calls for stricter regulation of financial institutions and enhanced oversight of risk management practices. Going Forward: To prevent similar collapses in the future, banks and regulators need to take a number of steps, including: • Strengthening Internal Controls: Banks should implement robust internal control systems to monitor and manage risks effectively. • Improving Risk Management: Banks need to develop sophisticated risk management models that can accurately assess and mitigate emerging risks. • Enhancing Communication: Banks should communicate openly and transparently with investors, regulators, and the public to address concerns and avoid rumors and speculation. • Promoting Accountability: Regulatory bodies should hold banks and their executives accountable Eget: • The reporting on SVB played a large role in producing this contagion. Major news outlets, like The New York Times, highlighted the plight of business owners who they said would be unable to meet their payrolls because their money was tied up with SVB. • Not true, the FDIC announced that it would issue an advance payment the following week. This was likely to be worth well over half of the money in the accounts, and quite possibly as much as 70% to 80%. And then thy would get a marketable certificate for the rest (which easily could be sold if the depositor needed the money) • This reality was rarely conveyed in news stories, most of which implied that depositors stood to lose the full amount over the $250,000 insurance cap. This was a huge factor in feeding bank runs across the country. • Pandemic and all time low interest rated – tech boom – more deposits than ever, had to invest in high quality assets • Too low interest rated, were not receiving enough yield – could then not offer depositors the yield they were expecting so they put their money elsewhere and SVB started to lose money quickly • No CRO • And all time low interest rated, followed by an inflation shock where rated increased very quickly • They did not rebalance their portfolio • SVB positioned themselves just below the cap of having to comply with regulations such as basel 3 and other regulations • But under basel 3 – high quality assets are as good as cash so that might not be the solution, and it might not have showed up on any stress tests depending how you design it • The Silvergate bank stopped operations on thursday, so the customers thought that this was related to SVB • Causes the VCs to instruct all the portfolio companies to pull out funds 5. What are the lessons of the collapse for the different types of investors (stocks and bonds) and customers. What are the lessons for the other stakeholders? For Investors: • Diversify your investments to mitigate risk. • Conduct thorough research before investing in any bank. • Stay informed about regulatory changes. • Avoid making investment decisions based on rumors or speculation. For Customers: • Choose a reliable bank with a strong reputation and financial standing. • Keep an eye on your bank's financial health and news coverage. • Be prepared to withdraw your deposits promptly if you suspect a bank run. For Other Stakeholders: • Strengthen internal controls to manage risks effectively. • Embrace transparency and open communication with stakeholders. • Enforce regulations and hold banks accountable for their actions. 6. What do you think of the role of supervision and regulation regarding the banking and Fintech industries and recent evolutions? • SVB's lack of a chief risk officer (CRO) contributed to the bank's downfall. A CRO would have been responsible for identifying and mitigating risks, but SVB did not have this role in place. • SVB's investment in risky assets, such as collateralized loan obligations (CLOs), also played a role in its collapse. These assets are sensitive to interest rate changes, and SVB did not adequately hedge against these risks. • SVB's lack of transparency with investors and regulators exacerbated the bank's problems. If the bank had been more open about its financial condition, it may have been able to avoid a bank run. In light of the SVB collapse, regulators are now looking at ways to strengthen supervision and regulation of banks. This includes requiring banks to have a CRO, limiting their exposure to risky assets, and improving their transparency. Here are some specific recommendations for improving supervision and regulation in the wake of the SVB collapse: • Require banks to have a CRO. This would help to ensure that banks have a dedicated individual responsible for identifying and mitigating risks. • Limit banks' exposure to risky assets. This would reduce the likelihood that banks will experience losses that could threaten their stability. • Improve banks' transparency. This would help to build trust between banks, investors, and regulators. • Increase scrutiny of fintech companies. Fintech companies are operating in a rapidly evolving space, and regulators need to be vigilant to ensure that they are operating in a safe and sound manner. By taking these steps, regulators can help to prevent another SVB-type collapse and ensure that the banking and fintech industries remain stable and resilient.