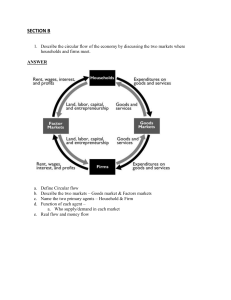

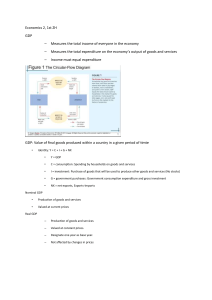

MACRO ECONOMICS: Macro comes from a Greek word meaning large and macro economics is the study of whole economic units which is concerned with aggregates, such as national income, consumption, and investment. Or; The study of whole economic systems aggregating over the functioning of individual economic units. It is primarily concerned with variables which follow systematic and predictable paths of behaviour and can be analysed independently of the decisions of the many agents who determine their level. More specifically, it is a study of national economies and the determination of national income." CIRCULAR FLOW OF NATIONAL INCOME: Society is divided in two broad sectors Households Firms or Producers. The circular flow of income is a simple model of the economy showing flows of goods and services and factors of production between firms and households. In the absence of government and international trade this simple model shows that households provide the factors of production for firms who produce goods and services. In return the factors of production receive factor payments, such as wages, which in turn are spent on the output of firms. This basic flow is shown in the diagram below. CLOSE ECONOMY INJECTIONS o Investments WITHDRAWALS o Savings In reality the households do not spend all their current income. Some is saved. This represents a withdrawal/leakage from the circular flow. In addition to the consumer spending, firms also carry out investment spending. This is an injection to the circular flow of income, as it does not originate from consumers' current income. Withdrawals/Leakages: These are the non-consumption uses of income, including; o Savings (S): It is the part of the income which is not consumed. o Taxes (T): Households must pay some of their income to the government is called tax. o Imports (M): Expenditure incurred by the local buyers on the goods produced by foreign producers. Injections: expenditures that are the additions to the circular flow, including o Investments (I): Expenditures on new capital goods o Government Spending (G): Expenditure incurred by the government on goods and services. o Exports (X): Expenditure incurred by the foreign buyers on the goods produced by home producers. In the real world the government and international trade sectors must also be included. Economic systems are in reality three sector open economies. Consequently there will be additional leakages and injections. Government spending will be injected into the circular flow and taxation will leak from it. Export flows will be injected and imports flows leaked. A full circular flow with withdrawals and injections is shown below. OPEN ECONOMY INJECTIONS o o o Investments Government Spending Exports WITHDRAWALS o o o Savings Taxes Imports This model of the economy demonstrates that economic activity is a flow. In actual fact it can be considered two flows, one of goods and services and a flow of money. The size of these flows is an indicator of the amount of economic activity. The circular nature of the flows means that there will be a number of different ways of measuring the size of the flow. Economists maintain that there are three possible ways of measuring this flow with each way looking at a different part of the circular flow of income. However all should give the same answer: The output method: the total amount of goods and service produced in one year. The expenditure method: the total amount of domestic spending by consumers, firms, government and foreigners. The income method: the total incomes earned by the factors of production involved in the production of goods and services in one year. NATIONAL INCOME (N. I.) National Income is the money value of all the final goods and services produced in a country throughout the year. These goods and services are produced by the four factors of production which command rewards for the production. These rewards are awarded in the form of rent, wages, interest and profits. Therefore, the aggregate of these rewards in a year amounts to National Income. Alternatively the expenditures through these rewards also amount to National Income. DIFFERENT CONCEPTS OF NATIONAL INCOME Gross Domestic Product / Gross Domestic Income (GDP) / (GDI) Gross National Product / Gross National Income (GNP) / (GNI) Net Domestic Product (NDP) Net National Product (NNP) Personal Income (PI) Disposable Income (DI) Per Capita Income. (PCI) Gross Domestic Product / Gross Domestic Income (GDP) / (GDI): It is a basic measure of a country's overall economic output. It is the market value of all final goods and services made within the borders of a country. Or; It is the aggregate of incomes earned in a country. Or; It is the aggregate expenditures incurred in a country in a given period which is usually a year. Therefore, there are three approaches to the GDP. o Product Approach o Income Approach o Expenditure Approach Product Approach: o Usually in this approach the economy is broken down into classes of enterprise: agriculture, construction, manufacturing, etc. o Their outputs are estimated largely on the basis of surveys which businesses fill out. o To avoid "double-counting" in cases where the output of one enterprise is not a final good, but serves as input into another enterprise, either only final goods outputs must be counted, or a "value-added" approach must be taken, where what is counted is not the total value output by an enterprise, but its valueadded: the difference between the value of its output and the value of its input. o Gross Value Added (GVA) = Sales of goods - purchase of intermediate goods to produce the goods sold. o Therefore, GDP = GVA - Subsidies on products Income Approach: o According to this approach GDP of a country is the aggregate of incomes earned by the factors of production in the form of Rent Wages Interest & Profits Within the geographical boundaries of a country in a year. o The formula for GDP by the income method is: GDP = R + I + P + SA + W o Where; R : Rent I : Interest P : Profits SA : statistical adjustments (corporate income taxes, dividends, undistributed corporate profits) W : Wages Expenditure Approach: o According to this approach the GDP of a country is an aggregate of expenditure incurred in a country in year. o These expenditures are; Private Consumption Expenditure. Gross Domestic Private Investments. Gross Domestic Public Investments. Government Expenditure on Goods and Services. Net Exports. o Therefore, GDP = C + I + G + (X − M) o Where; C = Consumption I = Investment G = Government Spending X = Exports M = Imports GDP COMPONENTS UNDER EXPENDITURE METHOD C (consumption) is normally the largest GDP component, consisting of private household expenditures in the economy. These personal expenditures fall under one of the following categories: durable goods, non-durable goods, and services. Examples include food, rent, jewelry, gasoline, and medical expenses but do not include the purchase of new housing. I (investment) includes business investment in plant, equipment, inventory, and structures, and does not include exchanges of existing assets. Examples include construction of a new mine, purchase of [software], or purchase of machinery and equipment for a factory. Spending by households (not government) on new houses is also included in Investment. G (government spending) is the sum of government expenditures on final goods and services. It includes salaries of public servants, purchase of weapons for the military, and any investment expenditure by a government. It does not include any transfer payments, such as social security or unemployment benefits. X (exports) represents gross exports. GDP captures the amount a country produces, including goods and services produced for other nations' consumption, therefore exports are added. M (imports) represents gross imports. Imports are subtracted since imported goods will be included in the terms G, I, or C, and must be deducted to avoid counting foreign supply as domestic. Gross National Product / Gross National Income (GNP) / (GNI): GNP is nothing but an extended form of GDP. The basic difference between GNP and GDP is the Net Factor Income from abroad. Net Factor Income From Abroad consists of the net income receipts from the rest of the world such as; Investment incomes including interest, dividends, and branch profits. Earnings of residents working abroad. Other factor incomes of normal residents. Therefore; GNP = GDP + Net Factor Income from Abroad. Net Domestic Product (NDP): When depreciation allowance is deducted from GDP, it becomes NDP. Depreciation is the reduction in the value of Fixed Assets in a year. Therefore, NDP = GDP – Depreciation. Net National Product (NNP): NNP is the residual of GNP after deducting depreciation allowance. Or It is the sum of GDP and Net Factor Income from Abroad after deducting Depreciation from GDP. Therefore, NNP = GNP – Depreciation NNP = GDP – Depreciation + Net Factor Income from Abroad Personal Income (PI): It is the aggregate of the incomes received by the people in a country in a year. PI is therefore included not only the incomes earned i.e. rent, wages, dividends but also transfer payments. Transfer Payments are those payments which are not the part of National Income but are the Part of PI. There are three types of transfer payments; Government Transfer Payments: Such payments as pensions, unemployment allowances, scholarships etc. Business Transfer Payments: Such payments are in the form of donations by business firm to different organisations. Transfer payments from Abroad: Such payments are the certain portion of the earnings of workers in abroad which is remitted back to their families. Therefore PI is the sum of NI and Transfer Payments after deducting; Undistributed Corporate Profits (Savings) Corporate Income Tax (CIT) Social Security Contribution (SSC) From National Income. Therefore, PI = NI – (UCP + CIT + SSC) + Transfer Payments. Disposable Income (DI): It is the residual of PI after deducting Income Tax or Direct Tax. After the deduction of direct tax income consists of two parts; Personal Consumption Expenditure Personal Savings/ Investments. Therefore, DI = PI – Direct Taxes or; DI = Personal Consumption Expenditure + Personal Savings Per Capita Income. (PCI): It is an Income per head of a country. It is obtained by dividing N.I. over the Population Therefore; PCI = NI / Population. National Income (N.I): Now National Income is calculated by following adjustments in NNP; NI = NNP + Government Subsidies – (Indirect Taxes + Transfer Payments + Statistical Discrepancy) (Now try Q5 of Spring 2001 and 2002 Examination) DIFFICULTIES IN MESUREMENT OF NATIONAL INCOME: A country may have following difficulties while calculating National Income; Shortage of statistical data Lack of trained man power Lack of specialization Free services Demonetized goods Ignorance & Illiteracy Lack of responsibility Price fluctuation.