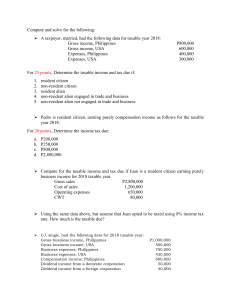

pdfcoffee.com quiz-compensation-income-pension-and-retirement-benefit-pdf-free (1)

advertisement