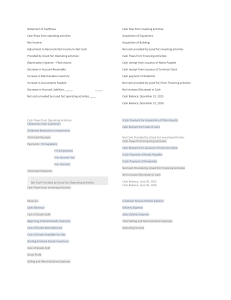

lOMoARcPSD|31311145 ACC1701X Cheat Sheet Accounting for Decision Makers (National University of Singapore) Studocu is not sponsored or endorsed by any college or university Downloaded by Nam Nguyen Dinh (namprice227@gmail.com) lOMoARcPSD|31311145 Chapter 8: Inventory and the Cost of Sales 3 Types of inventories: Raw materials, Work in process, Finished goods COGS: All costs involved in buying the inventory and preparing it for sale. COGAS (Cost of goods available for sale): total cost of inventory avail for sale. Who owns the inventory?: Goods that are being shipped have 2 kinds: 1. Free-on-board (FOB) Destination Only when it reaches the buyer it belongs to them 2. Free-on-board (FOB) Shipping point Once shipped it belongs to buyer already Goods on consignment: Goods owned not physically with owners but with a retailer. Accounting for Inventory Purchases and Sales: Perpetual system: Continually update as and when goods are sold, for items that are of high value or have large costs if stocks run out or overstocked. All journal entries would affect inventory account directly. Purchase of inventory: Inventory Accounts payable Transport cost: Inventory Cash Purchase Discounts: Accounts payable Inventory Cash Sales: Accounts Receivable Sales Revenue Cost of goods sold (Expense) Inventory If goods are missing, do double entry to adjust: COGS Inventory Adjustment for inventory shrinkage Periodic system: Updated periodically, for biz that have a lot of sale. Purchase of inventory: Purchases Accounts payable Transport Cost: Freight in Cash Purchase discounts: Accounts Payable Purchase Discounts Cash Chapter 7: Receivables Chapter 10: PPE and intangible assets Types of Receivables: 1. Account receivables (current assets) Money due for services performed or merchandise sold on credit 2. Note receivable (current assets if due in one year if not noncurrent) Legal claim, stronger than accounts receivable, has interest involved. Calculating and recording Depreciation expense: Undepreciated cost is called carrying amount or book value. Valuing and reporting receivables: Some companies do not pay for items purchased AKA bad debts. Direct write-off method is delete the entire receivable but not the way to go. Allowance method: Create a contra asset account called: ‘Allowance for Expected Credit Loss’ or ‘Loss allowance’ Expected impaired amount is an expense (Expected credit loss). Contra asset (- Dr, + Cr) Sales Revenue At end of period, transfer everything to inventory: Inventory (Net purchases, calculated from balancing this) Purchase Returns Purchase Discounts Freight in Purchases If goods missing, wouldn’t know, all of it would be absorbed into COGS If ending inventory overstate (understate), COGS is understated (overstate), net income is overstated (understated). For next year, beginning inventory is overstated (understated), COGS is overstated (understated). Net income understated (overstated). RE first year is overstated (understated) but by second year it is balanced out. Cost Formula for Inventory: FIFO, LIFO, Weighted average, and specific identification cost formula. LIFO not allowed by IFRS. Inventory should be reported the lower of cost or net realisable value: whichever is smaller of the value. Net realisable value: Cost of inventory can be sold minus any selling cost. To write down to net realisable value: COGS Allowance for inventory write-down (contra-inventory account) Units-of-production method of depreciation: Cost - Salvage value/ total estimated life in miles, hours or units = depreciation per unit, mile, hours used For natural resources its called depletion instead of depreciation. Accelerated Depreciation: Declining-balance method Double-declining-balance depreciation method: 1/Estimated life (years) x 2 = DDB rate Depreciation for the year using DDB = Carrying amount x DDB rate Changes in Depreciation estimates and methods: If change, stop all calculation and use remaining amount as new ‘cost’. When impairment is recognised: Expected Credit Loss (Expense) Loss Allowance Repairing and improving PPE: Two type of expenditures on PPE: 1. Revenue Expenditures 2. Expenses of the current period, maintenance and repairs When have to write-off: Loss Allowance A/C receivable When incurred: Repairs and Maintenance Cash When have to reinstate (cause can collect): A/C Receivable Loss Allowance Then, Cash A/C Receivable Capital Expenditures: Lengthens an assets useful life, increases capacity or changes its use. 3 criterias: Significant amount, should benefit more than one period, increase productive life or capacity of the asset. Net realisable value of A/C receivable is the actual amount the company expects to collect. When incurred: PPE Cash 2 methods of estimating: 1. % of total receivables Calculate by taking X% from outstanding A/C receivables Recording Impairments of asset value: If there is an impairment: 2. Aging A/C receivables % differs based on how old debts have been. % usually provided. Impairment Loss (Expense) Accumulated Impairment losses, XXX How ECL and Loss allowance is presented on income statement and balance sheet respectively Notes Receivables: A written promise that includes interest. Recoverable amount is either net fair value or value in use, whichever is higher. Impairment loss = Carrying amount - recoverable amount. Represented similar to Accumulated depreciation on sheet When A/C receivable convert into Note receivable: A/C receivable Note receivable Disposal of PPE: If after complete use: Accumulated Depreciation PPE When collecting: Cash If there is a loss: Accumulated Depreciation Loss on disposal of PPE Cash PPE Note receivable Interest revenue (must add this portion) Chapter 9: Completing the Operating Cycle (LO3 and LO4) Provisions and Liabilities: Sales: A/C Receivables Straight line depreciation method: Cost - Salvage value/ Estimated useful life = annual depreciation expense Selling PPE: If sold for a gain: Accumulated Depreciation Cash PPE Gain on sale of PPE Provision should be recognised when: 1. A present obligation as a result of past event 2. It is probable 3. Reliable estimate Recognise the provision (warranty): Product warranty expense Product warranty provision If sold for a loss: Accumulated Depreciation Cash Loss on sale of PPE PPE If provide the warranty: Product warranty provision Supplies Contingent Liabilities: Same like provision just that it is either not probable that it will go through or that the amount needed to be paid cannot be measured properly Capitalise versus expense: R&D - Always to be expensed less if technological feasibility has been established then can be capitalised (IASB) Advertising - Always expensed unless results from it are probable (eg. Targeting loyal customers) Intangible assets: Only goodwill obtained through acquisition is recorded. Amortisation is same, basically depreciation of intangible assets Intangibles must be regularly checked for impairment Chapter 12: Financing: Equity Common stock AKA ordinary share/share capital. right to vote in corporate matters Preemptive right to purchase shares if more shares are issued by company Rights to receive cash dividends if they are paid but not before preferred stocks Right to ownership to all corporate assets once obligations to everyone else has been satisfied Chapter 14: Statement of Cash Flows Preferred Stock AKA preferred share/preference share. no voting rights, Mainly only fixed cash dividends Have priority in being paid cash dividends if any before common stock holders Some convertible preferred stock that can be converted to common stock at special conversation rate Current-dividend preference, basically gets cash payout first Cumulative-dividend preference, every year will have. If last year not paid yet will cumulate CA increase means minus CA decrease means add CL decrease means minus CL increase means add Accounting for Stock: Issuance of stock: Stocks have a par value. When sold above par value it is being sold at a premium Issuing Par-value common stock at a premium: Cash (XXX shares X $a) Common Stock (XXX shares X $par-value) Paid-in capital in excess of par, common stock (XXX shares x $excess) Paid-in capital in excess of par AKA Common Stock premium Issuing No par-value shares: Cash Common Stock Issuing par-value preferred stock at a premium: Cash (XXX shares X $a) Preferred Stock (XXX shares X $parvalue) Paid-in capital in excess of par, preferred stock (XXX shares X $excess) Issuing shares for non cash assets: Land Common stock Paid-in capital in excess of par, common stock Accounting for stock repurchases: Buying back stocks from holders means shares become treasury shares. Treasury stock is accounted for on a cost basis (how much it was bought for). Treasury shares are minus off at the end of equity. Purchasing treasury stock: Treasury stock, common Cash Reissuing treasury stock above cost: Cash Treasury stock, common Paid-in capital, treasury share Reissuing treasury stock below cost: Cash Paid-in capital, treasury stock Treasury stock, common If below cost, paid-in capital, treasury stock account would be debited. If value is 0 or not enough, retained earnings would be deducted. Format on balance sheet Retained earnings: Cash dividends. When declared: Cash dividends, common stock Cash dividends, preferred stock Cash dividends payable, common stock Cash dividends payable, preferred stock Continued from Chapter 12: When distributed: Stock dividends distributable Common Stock When paid: Cash dividends payable, common stock Cash dividends payable, preferred stock Cash Stock dividends account will close to retained earnings: Retained earnings Stock dividends At end of year, cash dividends is closed into RE: Retained Earnings Cash dividends, common stock Cash dividends, preferred stock Large stock dividends: Stock dividends Stock dividends distributable Small Stock dividend: When declared: Stock dividends Stock dividends distributable Paid-in capital in excess of par Downloaded by Nam Nguyen Dinh (namprice227@gmail.com) Indirect method for operating activities: - Start with net income before tax - Remove depreciation and gains and loss of disposals - Adjust according to increase or decrease in current assets and current liabilities - Remove interest expense and revenue - Find how much actually collected and paid for interest - Find out how much paid for income tax Cash flow from financing and investing activities: Investing is just from PPE sale and purchase Financing is loans Chapter 15: Analysing Financial Statements Vertical analysis AKA common-size financial statements. Provides a view on how a company has allocated its economic resources across periods Balance Sheet is % of Total assets. Income statement is % of Net sales. Horizontal Analysis Use earlier year as base amount. Percentage of change = Current period amount - Base period amount/ Base period amount X 100% Trend percent = Current period amount/Base period amount X 100% Reflect amount change, % change and trend percent. Financial Ratios: Liquidity - Current ratio and Acid-test (quick ratio) Efficiency - A/C TO and average collection period, Inventory TO and number of days’ sales in inventory, fixed asset TO Solvency (ability to pay debts when its due) - Debt ratio (how much of assets is from borrowed money), Debt-to-equity ratio (reflects mix of sources of financing for a company), Times interest earned ratio (income that is available for interest payments to annual interest expense) Profitability - Profit margin (Return on sales), Return on assets, Asset TO, Return on equity for common shares, Earnings per share, Price-earnings ratio Cash Flow - Cash flow-to-net income ratio, Cash flow adequacy DuPont Framework: Return on equity = Net income - preference dividends/Average total equity DuPont: ROE = profitability X Efficiency X Leverage Profitability = Return on sales (profit margin) Efficiency = Asset TO Leverage = Assets-to-equity ratio lOMoARcPSD|31311145 Accounting Equation: Assets = Liabilities + Equity 3. Statement of Changes in Equity (SOCE) 4 Types of Financial Statements: 1. Statement of Financial Position (Balance Sheet) 2. Statement of (Comprehensive) Income 3. Statement of Changes in Equity (SOCE) 4. Statement of Cash Flows (SOCF) Chapter 4: Completing the Accounting Cycle Chapter 5: Internal Controls: Ensuring the integrity of Financial Information Accrual Accounting: recording expenses and revenues when incurred and recognised instead of when cash is received Types of problems that occur: 1. Errors - Genuine entry errors 2. Disagreements - Judgements made of certain decisions when preparing financial statements 3. Frauds - Deliberate falsifying of data Cash-Basis Accounting: Recording expenses and revenue when cash is received or paid. Not accepted Internal control structure aims to safeguard and ensure financial reports are accurate. Periodic Reporting: Fiscal year (1 year but starting month depends on individual biz, usually Jan) Adjusting entries: a. Unrecorded Receivables (Accrued Revenue) Work/Criteria met but yet to receive cash When incurred: A/C Receivable 1. Statement of Financial Position (Balance Sheet) Assets (Current and Non-Current) Liabilities (Current and Non-Current) Equity XX Revenue When collected: Cash 2. Risk assessment 3. Control activities (Procedures) a. Segregation of duties No one desperate not or individual should be responsible for handling all or conflicting phases of a transaction. b. Authorisation of transactions (Proper procedures for authorisation) A/C Receivable 4. Statement of Cash Flows (SOCF) Operating: From operations (normal biz of company) Investing: PPE (purchase and sale) Financing: Long term loans (payment and taking up of loans) and also dividends distributed Split into 5 basic categories: 1. The control environment Consists of actions, policies and procedures that reflect the overall attitude of top management about control and its importance to the company. Clear organisational structure. Subset of directors form an audit committee. c. Record keeping of transactions (Adequate documents and records. Easily interpreted and understood. Pre-numbered for easy ID and tracking. Formatted for easy access.) b. Unrecorded Liabilities (Accrued Liabilities) Expenses already incurred but have yet to pay d. Custody of assets, physical possession of assets (Physical safeguards to protect resources). When incurred: XX Expense e. Independent Checks. Internal and external checks. XX Payable 4.Information and communication 5. Monitoring When paid: XX Payable Cash c. Prepaid Expenses An asset. Pay early for expenses When paid: Prepaid Expense Cash When expense is incurred: XX Expense Prepaid Expense Supplies is same as prepaid expense: Supplies Reasons for Earnings Management: 1. Meet internal targets Manipulate earnings to hit targets 2. Meet external expectations Manipulate earnings to hit investors’ expectations 3. Income Smoothing Making income graph smooth instead of erratic, helps with investors’ confidence. 4. Window dressing for IPO (initial public offering) Making company look more attractive leading up to IPO. Bank Reconciliation: Chapter 6: Cash 3 Types of cash flow: Operating activities Investing activities Financing activities Cash Supplies Expense Supplies d. Unearned Revenue A liability (obligation). Cash is received but work has yet to be done. When receive cash: Cash Unearned Revenue Fundamental Concepts and Assumptions: 2. Statement of (Comprehensive) Income Revenue Expenses Income a. The Separate Entity Concept Biz entity separate from its individual owners b. The Time-Period Assumption Artificial time periods must be used to report results of biz entities. Eg. Fiscal year c. The Assumption of Arm's-Length Transactions Every transaction would be rational and unbiased, both parties trying to achieve the best deal possible d. The Cost Principle Record transactions at historical cost. Assumed to represent the fair market value. e. The Fair Value Principle Assets and Liabilities to be recorded at fair value so relevance can be improved. f. The Monetary Measurement Concept Only record things that can be measured in monetary terms. g. The Going Concern Assumption Assumes that biz will continue in the foreseeable future. h. The Matching Principle All costs and expenses incurred to generate revenue must be recognised in the same accounting period as related revenues. When work is done: Unearned Revenue XX Revenue Closing books: Close nominal accounts, do not last more than one period (eg. Income statement - Expenses, Revenues) Real accounts last more than one period, are permanent (eg. Asset, Liability and Equity). Closing entries: Sales revenue Other operating income Financial income Expenses Taxes Retained Earnings (might be Dr or Cr depending on performance of company) *Dividends are not expense so they are deducted from RE accounts not during closing entries. Retained Earnings Dividends Summary of Accounting Cycle: 1. Analyse transactions 2. Record effects of transactions 3. Summaries effects of transactions - Journal entries - Trial balance 4. Prepare reports - Adjusting entries - Financial statements - Closing the books (Post-closing trial balance) Downloaded by Nam Nguyen Dinh (namprice227@gmail.com) Internal Control of Cash: 1. Separating duties in handling of cash and accounting for cash 2. Cash receipts are deposited in banks 3. Except for small payments, payments are made with prenumbered checks 4. Prepare bank reconciliation frequently Purchase discounts: Eg. 2/10, n/30 2% discount if customer paid within 10 days if not net amount is due in 30 days. Purchase on credit: Inventory Accounts payable Discount: Accounts payable Cash Inventory Petty Cash Funds: Establish/increase the fund: Petty Cash Cash To refill the fund: Expense Expense Cash Short and Over (Dr if missing cash or Cr if got extra cash) Cash (money to match all expense to top up back to original amount) Adjustments made to company bank account that may not be in journal: a. NSF (not sufficient funds) Cheque cashed in bounce back cause payer’s account not enough balance b. ATM transactions (eg. Direct deposits) c. Withdrawals for debit card transactions paid directly from accounts Owner pay through debit card, direct payment d. MS (miscellaneous) e. Time period difference Bank statement may not be as updated as accounts f. Deposits in transit Still processing cheques g. Outstanding checks Cheques written but have not be cashed in by company whom owner paid h. Bank debits Bank charges etc i. Bank credits Interest earned from bank j. Accounting errors Numerical errors made by either company or bank. Must do adjusting entries to relevant accounts to make sure cash account tallies with bank statement. Adjusting entries taken from Book side of bank recon.