Accounting Exam Questions: Financial Reporting & Inventory

advertisement

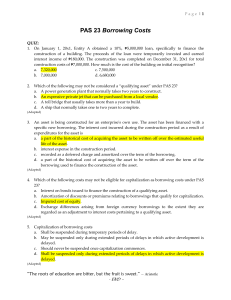

When information about two different entities has been prepared and presented in a similar manner, the information exhibits the characteristic of a. relevance. b. comparability. c. consistency. d. reliability. A soundly developed conceptual framework of concepts and objectives should a. all of these. b. increase financial statement users' understanding of and confidence in financial reporting. c. enhance comparability among companies' financial statements. d. allow new and emerging practical problems to be more quickly soluble. Which of the following is considered a qualitative factor in making materiality judgments? a. the context of an item in relation to the current economic state of the environment where the entity operates. b. 1% of total assets c. 10% of profit or loss, in absolute terms d. 5% of total revenues Information is considered relevant when it a. is understandable by reasonably informed users of accounting information. b. is capable of making a difference in a decision. c. can be depended on to represent the economic conditions and events that it is intended to represent. d. is verifiable and neutral. The overall objective of financial reporting is to provide information a. that allows owners to assess management's performance. b. that is useful to primary users in making economic decisions about providing resources to the entity. c. about an entity's assets, liabilities, and equity. d. about an entity's financial performance during a period. The cost of inventory should not include I. II. III. IV. V. VI. Purchase price. Import duties and other taxes. Abnormal amounts of wasted materials. Administrative overhead. Fixed and variable production overhead. Selling costs. a. II, III, IV, V, VI b. I, II c. None of these d. II, III, IV, V e. III, IV, VI How should trade discounts be dealt with when valuing inventories at the lower of cost and net realizable value (NRV) according to PAS 2? a. Ignored b. Deducted from cost c. Deducted in arriving at NRV d. Added to cost Which of the following costs of conversion cannot be included in cost of inventory? a. Salaries of sales staff (sales department shares the building with factory supervisor). b. Factory overheads based on normal capacity. c. Cost of direct labor. d. Factory rent and utilities. Inventories are measured at a. Lower of cost and net selling price. b. Lower of cost and fair value. c. Lower of cost and net realizable value. d. Lower of cost and nominal value. e. None of these. Which of the following is added to the cost of inventories? a. Storage costs of part-finished goods b. Administrative costs c. Refundable purchase taxes d. Trade discounts An asset is being constructed for an enterprise's own use. The asset has been financed with a specific new borrowing. The interest cost incurred during the construction period as a result of expenditures for the asset is a. a part of the historical cost of acquiring the asset to be written off over the term of the borrowing used to finance the construction of the asset. Incorrect b. interest expense in the construction period. c. recorded as a deferred charge and amortized over the term of the borrowing. d. a part of the historical cost of acquiring the asset to be written off over the estimated useful life of the asset. Which of the following instances does not preclude an entity from recognizing depreciation during a certain period? a. The asset becomes idle or is taken out of active use. b. The asset is being depreciated using the units of production method and there is no production during the period. c. The asset is fully depreciated. d. The asset is classified as held for sale under PFRS 5. Capitalization of borrowing costs a. Shall be suspended during temporary periods of delay. b. Shall be suspended only during extended periods of delays in which active development is delayed. c. May be suspended only during extended periods of delays in which active development is delayed. d. Should never be suspended once capitalization commences. Which of the following costs may not be eligible for capitalization as borrowing costs under PAS 23? a. Imputed cost of equity. b. Exchange differences arising from foreign currency borrowings to the extent they are regarded as an adjustment to interest costs pertaining to a qualifying asset. c. Interest on bonds issued to finance the construction of a qualifying asset. d. Amortization of discounts or premiums relating to borrowings that qualify for capitalization. Which of the following is not one of the essential characteristics of a PPE? a. used in business b. tangible asset c. long-term in nature d. primarily held for sale Under IAS 2, when should the cost of inventories be recognized as an expense in the income statement? a. When the inventories are sold. b. When the inventories are produced. c. When the inventories are purchased. d. When the inventories are disposed of. When should inventories be measured at the lower of cost and net realizable value? a. At the time of acquisition. b. At the end of each reporting period. c. At the time of disposal. d. At the time of sale. Which of the following items should not be classified as inventory under IAS 2? a. Raw materials and supplies used in production. b. Equipment used for manufacturing processes. c. Work in progress. d. Goods held for resale in the ordinary course of business. A VAT-registered entity purchases inventory. The invoice price of the inventory includes payment for VAT. The entity should a. ignore the VAT payment and disclose it only in the notes to the financial statements. b. exclude the VAT paid and record it under the VAT payable account. c. exclude the VAT paid and record it under the Input VAT account. d. include the VAT paid as part of the cost of the inventory. Which of the following costs should be included in the cost of inventories under IAS 2? a. Handling costs. b. Purchase price. c. Transport costs. d. All of these. What is the treatment of repairs and maintenance expenses according to IAS 16? a. They are expensed as incurred. b. They are recorded as revaluation adjustments. c. They are treated as revenue. d. They are capitalized as part of the cost of the asset. Which of the following items should be classified as property, plant, and equipment under IAS 16? a. Land held for investment purposes. b. Machinery used in the production process. c. Stocks of finished goods held for resale. d. Office supplies used by employees. What is the primary objective of IAS 16? a. Define accounting treatment for intangible assets b. Prescribe the accounting treatment for property, plant, and equipment c. Establish principles for financial statement presentation d. Provide guidance on revenue recognition According to IAS 16, which cost formula can be used to measure the cost of property, plant, and equipment? a. Cost model or revaluation model. b. Last-in, first-out (LIFO) method. c. First-in, first-out (FIFO) method. d. Specific identification method. When should property, plant, and equipment be derecognized according to IAS 16? a. When they are sold or disposed of. b. When they are no longer used by the entity. c. When their carrying amount is fully depreciated. d. When there is a change in fair value. According to IAS 23, how should the capitalized borrowing costs be treated in the financial statements? a. They should be included as part of the revenue recognition. b. They should be reflected as an expense in the income statement. c. They should be presented as a separate line item on the balance sheet. d. They should be included as part of the cost of the qualifying asset. How should borrowing costs that qualify for capitalization be measured under IAS 23? a. At the actual borrowing rate. b. At the market interest rate. c. At the effective interest rate. d. At the prime lending rate. According to IAS 23, which of the following borrowing costs should be capitalized as part of the cost of qualifying assets? a. Borrowing costs directly attributable to the acquisition, construction, or production of a qualifying asset b. Borrowing costs incurred after the start of production c. All borrowing costs d. Borrowing costs incurred for any purpose How does IAS 23 treat borrowing costs related to assets that are ready for use or sale? a. Capitalize them b. Recognize them as an expense c. Treat them as an extraordinary item d. Amortize them over the useful life of the asset What is a qualifying asset, as per IAS 23? a. An asset that is intended for sale in the ordinary course of business b. Any asset that generates revenue for the entity c. Any asset held for investment purposes d. An asset that necessarily takes a substantial period of time to get ready for its intended use or sale Problem 1. Movements in the inventory of CFAS Corporation during the period are as follows: ● November 1: Beginning Inventory, 100 units at P15 per unit ● November 7: Purchases, 300 units at P18 per unit ● November 12: Sales, 320 units ● November 21: Purchases, 200 units at P21 per unit Compute: 1. How much is the cost of sales under the Weighted Average Method (Periodic Inventory System)? 5,920 2. How much is the cost of sales under the FIFO cost formula? 5,460 3. How much is the cost of sales under the Weighted Average Method (Perpetual Inventory System)? 5,520 4. How much is the ending inventory under the Weighted Average Method (Perpetual Inventory System)? 5,580 5. How much is the ending inventory under the Weighted Average Method (Periodic Inventory System)? 5,180 6. How much is the ending inventory under the FIFO cost formula? 5,640 Problem 2 Materials. P70,000; Storage costs of finished goods, P18,000; Delivery to customers (Freight out), P4,000; Non-recoverable purchase taxes, P6,000. 1. According to PAS 2, at what figure should the item be valued in inventory? 76,000 Problem 3 2BSA-A Corporation purchase equipment on January 1, 20x1. Information on costs are as follows: Purchase price, net of trade discount, P10,000,000; Trade discount available, P100,000; Freight costs, P200,000; Testing costs, P300,000; Net disposal proceeds of samples generated during testing, P50,000; Present value of estimated costs of dismantling the equipment at the end of its useful life, P62,090. The equipment has an estimated useful life of 10 years and a residual value of ₱2,000,000. Entity A uses the straight line method of depreciation. 1. How much is the monthly depreciation expense? 70,934 2. According to PAS 16, how much is the initial cost of the equipment? 10,562,090 3. 2BSA-A sells the equipment for ₱8,700,000 on January 1, 20x5. It incurs selling costs of ₱200,000 on the sale. How much is the gain (loss) on the sale? 1,362,746 4. How much is the carrying amount of the equipment on December 31, 20x3? 7,993,463 Problem 4 On January 1, 20x1, ACC108 Corporation obtained a 10%, ₱5,000,000 loan, specifically to finance the construction of a building. The proceeds of the loan were temporarily invested and earned interest income of ₱180,000. The construction was completed on December 31, 20x1 for total construction costs of ₱7,000,000. 1. How much is the cost of the building on initial recognition? 7,320,000 2. How much is the capitalizable borrowing costs? 320,000 Problem 5 PNC Corporation is constructing a building for its own use. The following expenditures relating to the construction were made during 2023: January 1, P1,500,000; June 1, P600,000; November 30, P300,000. PNC Corporation's current outstanding general borrowings are as follows: 1. Bank loan in BDO obtained prior to the construction of the building, 10% for 10 years, P3,000,000 2. Bank loan in BPI obtained prior to the construction of the building, 8% for 8 years, P1,000,000 PNC Corporation's estimated cost of equity capital is 13%. 1. 2. 3. 4. 5. Calculate the total cost of building as of December 31, 2023. 2,578,125 Calculate the actual borrowing costs incurred. 380,000 Calculate the average expenditures of constructing the building. 1,875,000 Calculate the capitalization rate. 9.5% Calculate the capitalizable borrowing costs. 178,125