Cost-Volume-Profit Analysis: CVP Course Material

advertisement

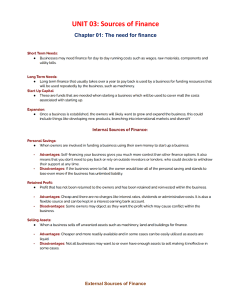

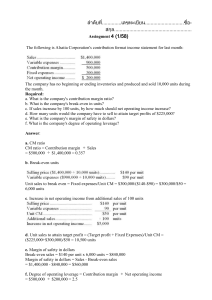

CPAR CPA REVIEW SCHOOL OF THE PHILIPPINES Manila MAS 9202 MANAGEMENT ADVISORY SERVICES COST-VOLUME-PROFIT ANALYSIS COST-VOLUME-PROFIT ANALYSIS (CVP analysis) examines the behavior of total revenues, total costs, and operating income as changes occur in the output level, selling price, variable cost per unit, or fixed costs of a product. USES OF CVP ANALYSIS 1. CVP analysis is used to determine how changes in selling prices, costs, and/or volume affect a company’s operating income and net income. 2. It can be used in preparing flexible budgets showing costs at different levels of production. 3. It can be used to help in evaluating a start-up operation. 4. It can be used to evaluate performance for the purpose of benchmarking and control. 5. It can be used in setting pricing policies by projecting the effect of different price structures on cost and profit. ASSUMPTIONS OF COST-VOLUME-PROFIT ANALYSIS 1. Changes in the level of revenues and costs arise only because of changes in the number of product (or service) units produced and sold. 2. Total costs can be separated into a fixed component that does not vary with the output level and a component that is variable with respect to the output level. 3. When represented graphically, the behavior of total revenues and total costs are linear (represented as a straight line) in relation to output level within a relevant range and time period. 4. The selling price, variable cost per unit, and fixed costs are known and constant. 5. The analysis either covers a single product or assumes that the sales mix, when multiple products are sold, will remain constant as the level of total units sold changes. 6. All revenues and costs can be added and compared without taking into account the time value of money. LIMITATIONS OF COST-VOLUME-PROFIT ANALYSIS 1. Because of the many assumptions, CVP is only an approximation at best. CVP analysis needs estimates and approximation in assembling necessary data and thus lacks accuracy and precision. 2. In CVP analysis, it is assumed that total sales and total costs are linear and can be represented by straight lines. In some cases, this assumption may not be found true. For instance, if a business firm sells more units, the variable costs per unit may decrease due to more operating efficiencies in the factory. 3. CVP analysis is performed within a relevant range of operating activity and it is assumed that productivity and efficiency of operations will remain constant. This assumption may not be valid. 4. CVP analysis assumes that costs can be accurately divided into fixed and variable categories. Such categorization is sometimes difficult in practice. 5. CVP analysis assumes no change in the inventory quantities, during the period. That is, opening inventory units equal the closing inventory units. This also means that units produced during the period are equal to units sold. When changes take place in inventory level, CVP analysis becomes more complex. 6. If prices, unit costs, sales-mix, operating efficiency, or other relevant factors change, then the overall CVP analysis and relationships also must be modified. Because of these assumptions, cost data are of limited significance. MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 2 of 24 BREAK-EVEN SALES – that point of activity level (sales volume) where total revenues equal total costs, i.e., there is neither profit nor loss. Methods of Computing Break-even Point 1. Equation Method or algebraic approach 2. Contribution margin method or formula approach 3. Graphic approach GRAPHS OF CVP RELATIONSHIPS The cost-volume-profit graph depicts the relationships among cost, volume, and profits. Pesos Total Revenue Profit Total Cost Break-Even Point Loss Units Sold The point where the total revenue line and the total cost line intersect is the break-even point. MULTIPLE-PRODUCT ANALYSIS When CVP analysis is used for a multiple-product firm, the product is defined as a package of products. For example, if the sales mix is 3:1 for Products A and B, the package would consist of 3 units of Product A and 1 unit of Product B. Break-even in packages for a multiple-product firm is then calculated as: Break-even packages = Fixed Costs/Weighted average contribution margin SALES MIX - the composition of total sales in terms of various products, i.e., the percentage of each product included in total sales. CVP ANALYSIS AND RISK AND UNCERTAINTY: MARGIN OF SAFETY – indicates the amount by which actual or planned sales may be reduced without incurring a loss. It is the difference between actual or planned sales volume and break-even sales. OPERATING LEVERAGE – a measure of the extent to which fixed costs are being used in an organization. The greater the fixed costs in relation to variable cost, the greater is the operating leverage available and the greater is the sensitivity of income to changes in sales. DEGREE OF OPERATING LEVERAGE (DOL) - a measure of the sensitivity of profit changes to changes in sales volume. DOL measures the percentage of change in profit that results from a percentage of change in sales. Degree of Operating Leverage (DOL) or Operating Leverage Factor (OLF) – a measure, at a given level of sales, of how a percentage change in sales volume will affect profits. DEGREE OF OPERATING LEVERAGE (DOL) OR OPERATING LEVERAGE FACTOR (OLF) = Contribution Margin / Operating income MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 3 of 24 > The higher the degree of operating leverage, the greater the change in profit when sales change. PERCENTAGE CHANGE IN PROFIT = DOL × Percentage change in sales SENSITIVITY ANALYSIS - a “what if” technique that examines the impact of changes on an answer. For example, computer spreadsheets are used to analyze changes in prices, variable costs, and fixed costs on expected profits. Factors Affecting Profit 1. Selling price per unit 2. Variable cost per unit 3. Volume or number of units 4. Fixed cost 5. Sales mix EXERCISES: 1. Jotongol is planning a sales budget for next year and wants to determine the sales volume that will be needed to earn a pre-tax income of P90,000. The tax rate is 40% of income before tax, so the desired profit is P54,000 after tax. Jotongol tells you that his firm makes a type of door closing device that is sold to distributors at P14 per unit. The materials required for each unit can be purchased for P5 per unit. A worker is paid P6 per hour and under normal conditions can produce two units per hour. Supplies, utilities, and other variable items have a total cost per unit of P2. The rent for the building, insurance, depreciation of equipment and other fixed costs amount to P72,000 for the year. REQUIRED: 1. Compute the contribution margin per unit and calculate the break-even point in units. Calculate the contribution margin ratio and the break-even sales revenue. 2. Refer to the original data. a. How much sales must be generated to earn the desired pre-tax profit? b. How many units must be sold to earn the desired after-tax profit? c. If, instead of the desired profit figures given in the first paragraph, the company desires to earn pre-tax profit of 10% of sales. How much should sales be?? d. How much sales must be to earn after tax profit of 7.2% of sales? 3. Refer to the original data. If the cost of materials would increase from P5 to P6 per unit, what effect would this have on the units that must be sold to earn the desired profit? What effect would this have on the break-even point? 4. Assume that the sales needed to earn the desired income of P90,000 is realized, what is the margin of safety expressed in units, pesos, and percentage form? 5. Assume that the sales needed to earn the desired income of P90,000 is realized, what is the degree of operating leverage at that sales level? If sales revenues are 30 percent greater than expected, what is the percentage increase in profits? 2. SENSITIVITY ANALYSIS. The Vice-President of sales, Redge Guerrero, estimates that the variable cost per product unit will increase from P80 to P95. The selling price is expected to remain at P120. The fixed costs for the year amount to P340,000. Last year, the company sold 30,000 units of products and expects to sell the same quantity this year. Guerrero is concerned about the loss in profitability because of increased costs. He asks you to prepare an evaluation of what changes are taking place. MAS 9202 a. b. c. d. e. 3. COST-VOLUME-PROFIT ANALYSIS Page 4 of 24 What is the contribution margin ratio for this year and last year? What is the break-even point in sales pesos for this year and last year? Calculate the margin of safety for last year and this year. Compute the operating leverage for this year and last year. Explain what would happen to profits this year if the sales volume could be increased by 15%. Indifference Point. Pao Company has decided to introduce a new product. The new product can be manufactured by either a capital-intensive method or a labor-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: CapitalLaborIntensive Intensive Direct materials P5 per unit P5.50 per unit Direct labor 6 per unit 7.20 per unit Variable overhead 3 per unit 4.80 per unit Fixed manufacturing costs P2,440,000 P1,390,000 Pao’s market research department has recommended an introductory unit sales price of P30. The incremental selling expenses are estimated to be P500,000 annually plus P2 for each unit sold, regardless of manufacturing method. Required: 1. Calculate the estimated break-even point in annual unit sales of the new product if Pao Company uses the (a) capital-intensive manufacturing method and (b) the laborintensive manufacturing method. 2. Determine the annual unit sales volume at which Pao Company would be indifferent between the two manufacturing methods. 4. The Zapatos Company produces its famous shoe, the Walker, that sells for P3,000 per pair. Operating income for this year is as follows: Sales revenue Variable cost (P1,200 per pair) Contribution margin Fixed cost Operating income P6,000,000 2,400,000 P3,600,000 2,000,000 P1,600,000 Zapatos Company would like to increase its profitability over the next year by at least 25%. To do so, the company is considering the following options: 1. Replace a portion of its variable labor with an automated machining process. This would result in a 20% decrease in variable cost per unit, but a 10% increase in fixed costs. Sales would remain the same. 2. Spend P300,000 on a new advertising campaign, which would increase sales by 20%. 3. Increase both selling price by P500 per unit and variable costs by P200 per unit by using a higher quality leather material in the production of its shoes. The higher priced shoe would cause demand to drop by approximately 10%. 4. Add a second manufacturing facility which would double Zapatos’ fixed costs, but would increase sales by 50%. REQUIRED: Evaluate each of the alternatives considered by Zapatos. Do any of the options meet or exceed Zapatos’ targeted increase in income of 25%? 1. Variable costs decrease by 20%; Fixed costs increase by 10% Sales revenues 2,000 x P3,000 Variable costs 2,000 x P1,200 x (1 – 0.20) Contribution margin (P3,000 – P960) = P2,040/unit Fixed costs P2,000,000 x 1.10 Operating income P6,000,000 1,920,000 4,080,000 2,200,000 P1,880,000 MAS 9202 COST-VOLUME-PROFIT ANALYSIS OR: New CM (P2,040/unit x 2,000 units) New fixed cost New profit Page 5 of 24 P4,080,000 2,200,000 P1,880,000 OR: Increase in CM (P1,200 x 20%) = P240 x 2,000units P480,000 Increase in fixed costs (P2,000,000 x 10%) 200,000 Increase in profit P280,000 Or (P1,880,000 – P1,600,000) = P280,000 or 280/1600 = 17.5% 2. Increase in CM (P3,600,000 x 20%) Increase in fixed costs Increase in Profit P720,000 300,000 P420,000 P420,000/P1,600,000 = 26.25% 3. Increase selling price by P500; Sales decrease 10%; Variable costs increase by P200 Sales revenues 2,000 x 0.90 x (P3,500) Variable costs 2,000 x 0.90 x (P1,200 + P200) Contribution margin Fixed costs Operating income P6,300,000 2,520,000 3,780,000 2,000,000 P1,780,000 180,000/1,600,000 = 11.25% 4. Double fixed costs; Increase sales by 50% Sales revenues 6,000,000 X 1.5 Variable costs P2,400,000 X 1.5 Contribution margin Fixed costs P100,000 x 2 Operating income P9,000,000 3,600,000 5,400,000 4,000,000 P1.400,000 Decrease in profit = P1,600,000 – P1,400,000 = P200,000 or 12.5% 5. Sales MIx Ongpin Dimsum Factory specializes in making dimsum products, two of which are siopao and siomai that are frozen and shipped to Chinese Restaurants. The budget data for siopao and siomai for the coming period are: Selling price per box Variable costs per box Number of boxes Siopao P60 36 25,000 Siomai P80 40 12,500 The items are prepared in the same factory, delivered in the same trucks, and so forth. Therefore, the fixed costs of P1,320,000 are unaffected by the specific products. REQUIRED: 1. How much revenue is needed to break-even? How many boxes of Siopao and Siomai does it represent? 2. How much revenue is needed to earn pre-tax profit of P880,000? 3. If the company earns the revenue determined in (2), but in doing so, sells 1 box of Siopao for every two boxes of Siomai, what would the pre-tax profit or loss be? 6. Dackers Company, a wholesaler of jeans, had the following income statement for last year: Sales (40,000 pairs at P35) Cost of sales Gross margin Selling expenses Administrative expenses Income P350,000 190,000 P1,400,000 800,000 P 600,000 P 540,000 60,000 MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 6 of 24 Mr. Dackers informs you that the only variables costs are cost of sales and P2 per unit selling costs. All administrative expenses are fixed. In planning for the coming year, Mr. Dackers expects his selling price to remain constant, with unit volume increasing by 20%. He also forecasts the following changes in costs and is concerned about how they will affect profitability. Variable costs: Cost of goods sold Selling costs Fixed costs: Selling costs Administrative costs up P1.50 per unit up P0.10 per unit up P40,000 up P30,000 REQUIRED: 1. Compute the expected income for the coming year, assuming that all forecasts are met. P17,200 2. Determine the number of units that Dackers will have to sell in the coming year to earn the same profit as the current year. 51,754 units 3. Mr. Dackers is disturbed at the results of requirements 1 and 2. He asks you by how much he must raise his selling price to earn P60,000 selling 48,000 units. P35.89 – P35 = P0.89 The following preliminary calculations will be helpful. Selling price Cost of goods sold: Cost of sales Divided by number of units sold Equals unit cost of sales Plus increase expected Equals new unit cost of sales in Selling costs: Selling costs, per unit Plus expected increase Equals new unit selling cost Total variable cost per unit Contribution margin per unit 1. P35.00 P800,000 40,000 P20.00 1.50 21.50 P2.00 0.10 2.10 23.60 P11.40 Dackers Company Income Statement Sales, 48,000 (40,000 units x 120%) x P35 Variable costs: Cost of goods sold (48,000 x P21.50) Selling costs (48,000 x P2.10) Contribution margin (48,000 x P11.40) Fixed costs: Selling* Administrative (P190,000 + P30,000) Income *Fixed costs Expected increase Fixed costs, new P350,000 - (40,000 x P2) P1,680,000 P1,032,000 100,800 P310,000 220,000 1,132,800 547,200 530,000 P 17,200 P270,000 40,000 P310,000 2. 51,754 units rounded (P60,000 + P530,000)/P11.40 = P590,000/P11.40 3. P35.89 rounded, P1,722,800 total revenue divided by 48,000 units sales = variable costs + fixed costs + profit S = (48,000 x P23.60) + P530,000 + P60,000 S = P1,722,800 MAS 9202 7. COST-VOLUME-PROFIT ANALYSIS Page 7 of 24 Gosnell Company produces two products: squares and circles. The projected income for the coming year, segmented by product line, follows: Squares Sales P300,000 Less: Variable expenses 100,000 Contribution margin P200,000 Less: Direct fixed expenses 28,000 Product margin P172,000 Less: Common fixed expenses Operating income Circles P2,500,000 500,000 P2,000,000 1,500,000 P 500,000 Total P2,800,000 600,000 P2,200,000 1,528,000 P 672,000 100,000 P 572,000 The selling prices are P30 for squares and P50 for circles. REQUIRED: 1. Compute the number of units of each product that must be sold for Gosnell Company to break even. 7,400; 37,000 2. Compute the revenue that must be earned to produce an operating income of 10 percent of sales revenues. P2,374,216 3. Assume that the marketing manager changes the sales mix of the two products so that the ratio is three squares to five circles. Repeat Requirements 1 and 2. 18,786; 31,310; P2,449,225 4. Refer to the original data. Suppose that Gosnell can increase the sales of squares with increased advertising. The extra advertising would cost an additional P45,000, and some of the potential purchasers of circles would switch to squares. In total, sales of squares would increase by 15,000 units, and sales of circles would decrease by 5,000 units. Would Gosnell be better off with this strategy? P55,000 increase in profit. This is a good strategy 8. Hay! Co. produces a single product. Sales have been very erratic, with irregular monthly operating results. The company’s income statement for the most recent month is given below: Sales (15,000 units ) Less variable expenses Contribution Margin Less fixed expenses Net Loss P450,000 _315,000 135,000 150,000 P(15,000) REQUIRED: 1. Compute the company’s CM ratio and its break-even point in both units and pesos. 30%; 16,666.67; P500,000 2. The sales manager feels that a P20,000 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will result in a P100,000 increase in monthly sales. If the sales manager is right, what will be the effect on the company’s monthly net income or loss? ↑P10,000 3. The president is convinced that a 10% reduction in the selling price, combined with a P50,000 increase in the monthly advertising budget, will cause unit sales to double. What will the new income statement look like if these changes are adopted? P20,000 loss 4. Refer to the original data. The company’s advertising agency thinks that a new package for the company’s product would help sales. The new package being proposed would increase packaging costs by P3 per unit. Assuming no other changes in cost behavior, how many units would have to be sold each month to earn a profit of P9,000? 26,500 5. Refer to the original data. By automating certain operations, the company could slash its variable expenses to half. However, fixed costs would increase to P250,000 per month. a. Compute the new CM ratio and the new break-even point in both units and pesos. 65%; 12,820.5 units; P384,615 b. Assume that the company expects to sell 20,000 units next month. Prepare two income statements, one assuming that operations are not automated and one showing that they are. Not, P30,000; Auto: P140,000 MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 8 of 24 c. Would you recommend that the company automate its operations? Explain. Automate 9. Great Wall Ski Company recently expanded its manufacturing capacity, which will allow it to produce up to 15,000 pairs of cross-country skis of the mountaineering model or the touring model. The Sales Department assures management that it can sell between 9,000 pairs and 13,000 pairs of either product this year. Because the models are very similar, Great Wall will produce only one of the two models. The following information was compiled by the Accounting Department. Selling price Variable costs Per-Unit (Pair) Data Mountaineering Touring P88.00 P80.00 52.80 52.80 Fixed costs will total P369,600 if the mountaineering model is produced but will be only P316,800 if the touring model is produced. Great Wall Ski is subject to a 40 percent income tax rate. REQUIRED: a. Compute the contribution margin for each product line. 35.20 or 40%; 27.20 or 34% b. If Great Wall desires an after-tax net income of P22,080, how many pairs of touring skis will the company have to sell? 13,000 c. How much would the variable cost per unit of the touring model have to change before it had the same break-even point in units as the mountaineering model? dec. 2.97 d. Suppose the variable cost per unit of touring skis decreases by 10 percent, and the total fixed cost of touring skis increases by 10 percent. Compute the new break-even point. 10,729.06 e. Suppose management decided to produce both products. If the two models are sold in equal proportions, and total fixed costs amount to P343,200, what is the firm’s breakeven point in units? 11,000 f. Suppose that Great Wall decided to produce only one model of ski. What is the total sales revenue at which Great Wall would make the same profit or loss regardless of the ski model it decided to produce? P880,000 g. If the Great Wall sales department could guarantee the annual sale of 12,000 pairs of either model, which model would the company produce and why? M=52,800; T=9,600 10. Popoy Company and Basha Company both make wall clocks. They have the same production capacity, but Popoy is more automated than Basha. At an output of 2,000 wall clocks per year, the two companies have the following data: Popoy Basha Fixed costs P500,000 P300,000 Selling price 400 400 Variable cost per unit 100 200 REQUIRED: By how much would each company’s income change if production and sales level increase by 500 units per year? Increase by P150,000; P100,000 MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 9 of 24 11. Following are data taken from the most recent income statement of Whitney Company: Sales (45,000 units at P10 per unit) Less cost of goods sold: Direct materials Direct labor Manufacturing overhead Gross margin Less operating expenses: Selling expenses Variable: Sales commissions Shipping Fixed (advertising, salaries) Administrative: Variable (billing and other) Fixed (salaries and other) Net operating loss P450,000 P90,000 78,300 98,500 P27,000 5,400 1,800 48,000 P266,800 183,200 32,400 120,000 202,200 P(19,000) All variable expenses in the company vary in terms of unit sold, except for sales commissions which are based on peso sales. Variable manufacturing overhead is P0.30 per unit. There were no beginning or ending inventories. Whitney Company’s plant has a capacity of 75,000 units per year. The company has been at a loss for several years. Management is studying several possible courses of action to determine what should be done to make next year profitable. REQUIRED: 1. The president is considering two proposals prepared by his staff: a. For next year, the vice president would like to reduce the unit selling price by 20%. She is certain that this would fill the plant to capacity. (4,000) b. For next year, the sales manager would like to reduce the unit selling price by 20%, increase the sales commission to 9% of sales, and increase advertising by P100,000. Based on marketing studies, he is confident this would increase unit sales by onethird. Compute the amounts of income, one under the vice president’s proposal and the other one under the sales manager’s proposal. (168,200) 2. Refer to the original data. The president believes it would be a mistake to change the unit selling price. Instead, he wants to use less costly raw materials, thereby reducing unit costs by P0.70. How many units would have to be sold next year to earn a target profit of P30,200? 48,000 3. Refer to the original data. Whitney Company’s board of directors believes that the company’s problem lies in inadequate promotion. By how much can advertising be increased and still allow the company to earn a target profit of 4.5% on sale of 60,000 units? 32,000 4. Refer to the original data. The company has been approached by an overseas distributor who wants to purchase 9,500 units on a special price basis. There would be no sales commission on these units. However, shipping costs would be increased by 50% and variable administrative cost would be reduced by 25%. In addition, a P5,700 special insurance fee would have to be paid by Whitney Company to protect the goods in transit. What unit price would have to be quoted on the 9,500 units by Whitney Company to allow the company to earn a profit of P14,250 on total operations? Regular business would not be affected by this special order. 8.35 12. Pittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies completely on independent sales agents to market its products. These agents are paid a commission of 15% of selling price for all items sold. MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 10 of 24 Barbara Cruz, Pittman’s controller, has just prepared the company’s budgeted income statement for next year. The statement shows the following: Sales Manufacturing costs: Variable Fixed overhead Gross margin Commissions to agents Fixed marketing costs Fixed administrative costs Net operating income Less fixed interest cost Income before income taxes Less income taxes (30%) Net income *Primarily depreciation on storage facilities. P16,000,000 P7,200,000 2,340,000 2,400,000 120,000* 1,800,000 9,540,000 6,460,000 4,320,000 2,140,000 540,000 1,600,000 480,000 P1,120,000 As Barbara handed the statement to Karl Vega, Pittman’s president, she commented, “I went ahead and used the agents 15% commission rate in completing these statements, but we’ve just learned that they refuse to handle our products next year unless we increase the commission rate to 20%.” “That’s the last straw,” Karl replied angrily. “Those agents have been demanding more and more, and this time they’ve gone too far. How can they possibly defend a 20% commission rate?” “They claim that after paying for advertising, travel, and the other costs of promotion, there’s nothing left over for profit,” replied Barbara. “I say it’s just plain robbery,” retorted Karl. “ And I also say it’s time we dumped those guys and got our own sales force. Can you get your people to work up some cost figures for us to look at?” “We’ve already worked hem up,” said Karl. Several companies we know about pay a 7.5% commission to their own salespeople, along with a small salary. Of course, we would have to handle all promotion costs, too. We figure our fixed costs would increase by P2,400,000 per year, but that would be more than offset by the P3,200,000 (20% x P16,000,000) that we would avoid on agents’ commissions.” The breakdown of the P2,400,000 cost follows: Salaries: Sales Manager Salespersons Travel and entertainment Advertising Total P 100,000 600,000 400,000 1,300,000 P2,400,000 “Super,” replied Karl. “And I noticed that the P2,400,000 is just what we’re paying the agents under the old 15% commission rate.” It’s even better than that,” explained Barbara. “We can actually save P75,000 a year because that’s what we’re having to pay the auditing firm now to check out the agent’s reports. So our overall administrative costs would be less.” Pull all of these numbers together and we’ll show them to the executive committee tomorrow,” said Karl. “With the approval of the committee, we can move on the matter immediately.” REQUIRED: 1. Compute Pittman Company’s break-even point in peso sales for next year assuming: a. That the agent’s commission rate remains unchanged at 15%. 12M MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 11 of 24 b. That the agents’ commission rate is increased to 20%. 13,714,286 c. That the company employs its own sales force 15M 2. Assume that Pittman Company decides to continue selling through agents and pays the 20% commission rate. Determine the volume of sales that would be required to generate the same net income as contained in the budgeted income statement for next year. 18,285,714 3. Determine the volume of sales at which net income would be equal regardless of whether Pittman Company sells through agents ( at a 20% commission rate) or employs its own sales force. 18,600,000 4. Compute the degree of leverage that the company would expect to have on December 31 at the end of next year assuming: a. That the agents’ commission rate remains unchanged at 15%. 6,400/1600=4 b. That the agents’ commission rate is increased to 20%. 5,600/800=7 c. That the company employs its own sales force. 7,600/475=16 13. Athena Company has fixed expenses of P400,000, a contribution margin ratio of 40% and a break-even sales ratio of 80% for a quarter’s operations. REQUIRED: Compute the company’s profit for the quarter. 14. The accountant of Alexander Company is trying to prepare comparative income statements for the last two months of the year. However, he obtained only the following information: Sales Variable cost ratio Break-even sales ratio November P1,200,000 40% 85% December 75% 70% Changes in the given ratios are due to the decrease in sales price and fixed costs. REQUIRED: 1. Decrease in sales 2. Decrease in fixed costs 3. Compute the break-even point for December. Sales VC CM FxC Profit January 1,200,000 480,000 720,000 612,000 108,000 February 640,000 480,000 160,000 112,000 48,000 15. Goljes Company has annual fixed costs of P195,000. In the year 20B, sales increased by 20% from the 20A level of P1,500,000. Profit for the year 20B was P90,000 higher than in 20A. REQUIRED: 1. If there is no need to expand the company’s capacity, how much should profit be in the year 20C if the budgeted sales volume is P2,700,000? 2. What is the company’s break-even point? MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 12 of 24 SELF TEST: COSTS AND COST CONCEPTS/COST-VOLUME-PROFIT/BREAK-EVEN ANALYSIS 1. Tierra Company prepared the following preliminary forecast concerning Product X for 20B assuming no expenditure for advertising: Selling price per unit P10 Unit sales 100,000 Variable costs P600,000 Fixed costs P300,000 Based on a market study in December 20A, Tierra estimated that it could increase the unit selling price by 15% and increase the unit sales volume by 10% if P100,000 was spent in advertising. Assuming that Tierra incorporated these changes in its 20B forecast, what should be the operating income from Product X? a. P175,000 c. P205,000 b. P190,000 d. P365,000 2. Darigold, Inc., sells Product M for P5 per unit. The fixed cost is P210,000 and the variable cost is 60% of the selling price. What would be the amount of sales if Darigold is to realize a profit of 10% of sales? a. P700,000 c. P472,500 b. P525,000 d. P420,000 3. Dukha Company is considering a proposal to replace existing machinery used for the manufacture of Product E. The new machines are expected to cause increased annual fixed cost of P120,000; however, variable cost should decrease by 20% due to a reduction in direct-labor hours and more efficient usage of direct materials. Before this change was under consideration, Dukha had budgeted Product E sales and costs for 20B as follows: Sales Variable cost Fixed cost P2,000,000 70% of sales P400,000 Assuming that Dukha implemented the above proposal by January 1, 20B, what would be the increase in budgeted operating profit for Product E for 20B? a. P160,000 b. P280,000 4. c. P360,000 d. P380,000 Remar, Inc. reported the following results from sales of 5,000 units of Product C for the month of June 20A: Sales P200,000 Variable cost 120,000 Fixed cost 60,000 Operating income 20,000 Assume that Remar, Inc. increases the selling price of Product C by 10% on July 1, 20A. How many units of Product C would have to be sold in July 20A in order to generate an operating income of P20,000? a. 4,000 c. 4,500 b. 4,300 d. 5,000 5. Araw Corporation is planning its advertising campaign for 20B and has prepared the following budget data based on a zero advertising expenditure: Normal plant capacity Sales Selling price Variable manufacturing cost 200,000 units 150,000 units P25 per unit P15 per unit MAS 9202 COST-VOLUME-PROFIT ANALYSIS Fixed cost: Manufacturing Selling & administrative Page 13 of 24 P800,000 P700,000 An advertising agency claims that an aggressive advertising campaign would enable Araw to increase its unit sales by 20%. What is the maximum amount that Araw can pay for advertising and obtain an operating profit of P200,000? a. P100,000 c. P300,000 b. P200,000 d. P550,000 6. In planning its operations for 20B based on a sales forecast of P6,000,000, Thone, Inc., prepared the following estimated data: Direct materials Direct labor Factory overhead Selling expenses Administrative expenses COST AND EXPENSES Variable Fixed P1,600,000 1,400,000 600,000 240,000 60,000 P3,900,000 P 900,000 360,000 140,000 P1,400,000 What would be the amount of sales in pesos at the break-even point? a. P2,250,000 c. P4,000,000 b. P3,500,000 d. P5,300,000 7. Merissa Company is planning to sell 100,000 units of Product Y for P12 a unit. The fixed cost is P280,000. In order to realize a profit of P200,000, what would the variable cost be? a. P480,000 c. P300,000 b. P720,000 d. P220,000 8. Bibot Company has projected cost of goods sold of P4,000,000, including fixed cost of P800,000. Variable cost is expected to be 75% of net sales. What will be the projected net sales? a. P4,266,667 c. P3,333,333 b. P4,800,000 d. P4,400,000 9. The Little Star Company is planning to sell 200,000 units of Product M. The fixed cost is P400,000 and the variable cost is 60% of the selling price. In order to realize a profit of P100,000, the selling price per unit would have to be a. P3.75 c. P6.00 b. P4.17 d. P6.25 ITEMS 10 and 11 ARE BASED ON THE FOLLOWING INFORMATION. Bruto, Inc. produces only two products, Popeye and Olive. These account for 60% and 40% of the total sales in pesos of Bruto, respectively. Variable costs (as a percentage of sales) in pesos are 60% for Popeye and 85% for Olive. Total fixed cost is P150,000. There are no other costs. 10. What is Bruto’s break-even point in sales (in pesos)? a. P150,000 c. P300,000 b. P214,286 d. P500,000 11. Assuming that the total fixed cost of Bruto increases by 30%, what amount of sales in pesos would be necessary to generate a net income of P9,000? a. P204,000 c. P650,000 b. P434,000 d. P680,000 12. The Riverwild Company sells Chitty for P6 per unit. Variable cost is P2 per unit. Fixed cost is P37,500. How many Chittys must be sold to realize a profit before income taxes of 15% of sales? a. 9,375 units c. 12,029 units MAS 9202 COST-VOLUME-PROFIT ANALYSIS b. 9,740 units Page 14 of 24 d. 12,097 units 13. At a break-even point of 400 units sold, the variable cost is P400 and the fixed cost is P200. What will the 401st unit sold contribute to profit before income taxes? a. P0 c. P1.00 b. P0.50 d. P1.50 14. How may the following be used in calculating the break-even point in units? Fixed costs a. Denominator b. Denominator CM per unit Numerator Not used Fixed costs c. Numerator d. Numerator CM per unit Not used Denominator 15. Within the relevant range, the amount of variable cost per unit a. differs at each production level. b. remains constant at each production level. c. increases as production increases. d. decreases as production increases. 16. If the fixed cost attendant to a product increases, while variable cost and sales price remain constant, what will happen to (1) contribution margin and (2) break-even point? Contribution Margin a. b. c. d. Increase Decrease Unchanged Unchanged Break-even Point Decrease Increase Increase Unchanged 17. Miiller, Inc. sells Products X, Y, and Z. Miller sells three units of X for each unit of Z and two units of Y for each unit of X. The contribution margins are P1 per unit of X, P1.50 per unit of Y, and P3 per unit of Z. Fixed costs are P600,000. How many units of X would Miller sell at the break-even point? a. 40,000 c. 360,000 b. 120,000 d. 400,000 18. The Vetron Company is planning to produce two products, Tig and Lam. Vetron is planning to sell 100,000 units of Tig at P4 a unit and 200,000 units of Lam at P3 a unit. Variable cost is 70% of sales for Tig and 80% of sales for Lam. In order to realize a total profit of P160,000, what must the total fixed cost be? a. P80,000 c. P240,000 b. P90,000 d. P600,000 19. The contribution margin increases when sales volume remains the same and a. variable cost per unit decreases c. fixed cost decreases b. variable cost per unit increases d. fixed cost increases 20. Wacky Company is a medium-sized manufacturer of lamps. During 20A, a new line called “Daylights” was made available to Wacky customers. The break-even point for sales of Daylight is P400,000 with a contribution margin of 40%. Assuming that the operating profit for the Daylight line for 20A amounted to P200,000, total sales for 20A would amount to a. P600,000 c. P900,000 b. P840,000 d. P950,000 ITEMS 21 TO 23 ARE BASED ON THE FOLLOWING INFORMATION: Preview Company sold 100,000 units of its product at P20 per unit. Variable cost is P14 per unit (manufacturing cost of P11 and selling cost of P3). Fixed cost is incurred uniformly throughout the year and amounts to P792,000 (manufacturing cost of P500,000 and selling cost of P292,000). There are no beginning inventories. MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 15 of 24 21. The break-even point for this product is a. P2,640,000 or 132,000 units b. P2,600,000 or 130,000 units 22. The number of units that must be sold to earn a net income of P60,000 for the year before income taxes would be a. 142,000 c. 100,000 b. 132,000 d. 88,000 23. If labor cost is 50% of variable cost and 20% of fixed cost, a 10% increase in wages and salaries would increase the number of units required to break-even (in fraction form) to a. 807,840/5.3 c. 807,840/14.7 b. 831,600/5.178 d. 831,600/14.28 24. The Cor Company plans to market a new product. Based on its market studies, Cor estimates that it can sell 5,500 units in 20B. The selling price will be P2 per unit. Variable cost is estimated to be 40% of the selling price. Fixed cost is estimated to be P6,000. What is the break-even point? a. 3,750 units c. 5,500 units b. 5,000 units d. 7,500 units 25. The Pad Company sells Pajax for P6 per unit. Variable cost is P2 per unit. Fixed cost is P37,500. How many Pajax must be sold to realize a profit before income taxes of 15% of sales? a. 9,375 units c. 11,029 units b. 9,740 units d. 12,097units 26. Information concerning Siko Corporation’s Product X is as follows: c. P1,800,000 or 90,000 units d. P1,700,000 or 88,000 units Sales P300,000 Variable costs P240,000 Fixed costs P 40,000 Assuming that Siko increases sales of Product X by 20%. What should the net income from Product X be? a. P20,000 c. P32,000 b. P24,000 d. P80,000 27. The Manilad Corporation sells each unit of output for P75. For output up to 40,000 units, fixed cost is P225,000. Variable cost is P30 per unit. What is the firm’s gain or loss at a sales level of 10,000 units? a. P450,000 gain c. P225,000 loss b. P450,000 loss d. P225,000 gain 28. The Ines Corporation produces and sells bolts. The selling price is P10 per bolt. Fixed cost is P4,000. Variable is cost P6 per bolt. What is the break-even point in units? a. 10,000 c. 5,000 b. 1,000 d. 4,000 29. MACE Company is a medium-sized producer of lamps. During the year a new line called “Torolin” was made available to MACE’s customers. The break-even point for sales of Torolin is P200,000 with a contribution margin of 40%. Assuming that the profit for the Torolin line during the year amounted to P100,000, total sales during the year would have amounted to a. P300,000 c. P475,000 b. P450,000 d. P485,000 30. The PUBS Company is planning to sell 200,000 units of Product B. The fixed cost is P400,000 and the variable cost is 60% of the selling price. In order to realize a profit of P100,000, the selling price per unit would have to be a. P3.75 c. P5.00 b. P4.17 d. P6.25 MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 16 of 24 ITEMS 31 to 35 ARE BASED ON THE FOLLOWING INFORMATION: The management of Riviera Corporation is evaluating the profitability of the company’s present product mix. Several proposals are being reviewed. A partial income statement and other information follows: ABC Sales P24,000 Cost of Sales 10,000 Gross profit P14,000 Operating costs 5,000 Income before tax P9,000 Units sold Selling price/unit Variable cost of sales/unit Variable operating cost/unit DEF Products GHI JKL P35,000 20,000 P15,000 8,125 P6,875 P24,000 25,000 (P 1,000) 8,000 (P9,000) P30,000 25,000 P 5,000 6,000 (P1,000) 2,000 P12.00 2,500 P14.00 3,000 P8.00 4,000 P7.50 P3.00 P5.00 P6.50 P5.00 P1.50 P1.25 P2.00 P1.00 TOTAL P113,000 80,000 P 33,000 27,125 (P5,875) The various proposals shall be treated as separate and independent of the other proposals. Consider only the product changes stated in each proposal, the activity of other products remain the same. Disregard effects of income taxes. Based on the above information: 31. If the production of GHI is stopped, the effect on income will be a. P1,000 increase c. P9,000 decrease b. P1,500 increase d. P1,000 decrease 32. If the production of GHI is stopped and an accompanying loss of the customers results in a decrease of 500 units in sales of product DEF, the total effect on income will be a. P1,500 increase c. P2,375 decrease b. P3,875 increase d. P3,875 decrease 33. If the selling price of GHI is increased by P1.25 per unit with a reduction in the number of units sold to 2,000, the effect on income will be a. P1,500 increase c. P1,500 decrease b. P3,000 increase d. P3,000 decrease 34. The factory in which GHI is produced can be used to manufacture another product, MNO. The total variable cost and expenses per unit of this new product is P9.50 and 2,500 units can be sold at P10.75 each. If MNO is introduced and GHI is discontinued, the total effect on income will be a. P4,625 increase c. P4,625 decrease b. P3,125 increase d. P3,125 decrease 35. Production of ABC can be increased by 100% by adding a second shift. Variable cost of sales, however, will increase by P2 for each of the additional unit of ABC. If the 2,000 additional units of ABC can be sold at the same selling price of P12 each, the total effect on income will be a. P24,000 increase c. P11,000 increase b. P17,000 increase d. P14,000 decrease MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 17 of 24 ITEMS 36 to 37 ARE BASED ON THE FOLLOWING INFORMATION: Isa Manufacturing Company’s budget for the coming year revealed the following unit data: Budgeted net income for the year ------------------------------- P875,000 Unit Costs: Variable Fixed Manufacturing cost P14.00 P12.00 Selling cost 2.50 5.50 General cost 0.25 7.00 Unit selling price ----------------------------------------------------- P50.00 36. Based on the above data, the budgeted sales volume in units is a. 36,400 c. 87,500 b. 55,000 d. 100,000 37. Based on the same data above, the margin of safety amounts to a. between P1.3 million to P1.5 million c. between P2.9 million to P3.1 million b. between P1.8 million to P2.0 million d. between P3.5 million to P3.7 million ITEMS 38 to 39 ARE BASED ON THE FOLLOWING INFORMATION: Aratex, Inc. proposes to increase its sales volume and realize bigger profits. Previous year, the company sold 22,000 units of Product 101-A for P11 per unit. The profits were modest because of the small difference between the selling price and the variable cost per unit and the relatively low sales volume. The fixed cost is equal to P20,000 per annum. The cost per unit is P10. The company feels that by reducing the selling price to P10.80, the sales can be increased to 27,000 units a year and thereby increase, too, its profits. 38. How much profit before tax did Aratex, Inc. earn in the previous year? a. P2,000 c. P22,950 b. P2,950 d. P32,950 39. What profit before tax can be generated with the reduced selling price and the increase of sales volume? a. P2,000 c. P22,950 b. P2,950 d. P1,600 ITEMS 40 to 41 ARE BASED ON THE FOLLOWING INFORMATION: The present break-even sale of Siratone Company is P550,000 per year. It is computed that if fixed expense will go up by P60,000, the sales volume required to break-even will also increase to P700,000, without any change in the selling price per unit and on the variable expenses. 40. Based on the information above, the variable expense ratio of the company is: a. 30% c. 60% b. 40% d. 70% 41. Before the increase of P60,000, the total fixed expense of Siratone Co. is: a. P200,000 c. P280,000 b. P220,950 d. P330,000 MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 18 of 24 ITEMS 42 to 43 ARE BASED ON THE FOLLOWING INFORMATION: Yakal Company shows the following budgeted data for the year 20B: Estimated sales Direct labor Materials Fixed overhead Administrative expenses 18,000 units Amount P54,000 8,100 13,500 16,200 P91,800 Per unit P3.00 0.45 0.75 0.90 P5.10 Selling expenses are expected to be 20% of sales and profit before tax is to amount to P1.50/unit. 42. In order to attain the company’s goal for 20B, the selling price per unit must be set at: a. P5.10 c. P8.25 b. P6.00 d. P9.75 43. The company’s break-even point in units assuming that overhead and administrative expenses are fixed but that other expenses are fully variable, is equal to: a. 4,286 units c. 9,428 units b. 5,143 units d. 18,000 units ITEMS 44 and 45 ARE BASED ON THE FOLLOWING INFORMATION: Sta. Rosa Appliances Company presents its budgeted data for the year 20B. It is estimated that the company will sell 240 refrigerators for the year 20B. The estimated costs of these sales are as follows: Direct labor Materials Fixed overhead Administrative expenses Amount P40,800 240,000 98,400 100,800 P480,000 Per unit P 170 1,000 410 420 P2,000 Selling expenses are expected to be 20% of sales. Profit before tax is to amount to P500 per unit. 44. In order to attain the company’s goal for 20B, the selling price per unit must be set at: a. P2,000 c. P2,625 b. P2,500 d. P3,125 45. The company’s break-even point in units assuming that overhead and administrative expenses are fixed but that other expenses are fully variable, is equal to: a. 74 units c. 188 units b. 150 units d. 240 units ITEMS 46 and 47 ARE BASED ON THE FOLLOWING INFORMATION: The production specialists of Won Corporation are considering the purchase of a new manufacturing equipment with a higher production capacity. Analysis shows that with the increased production, sales volume can be increased by as much as 50%. However, fixed manufacturing costs will increase by 60%. Variable manufacturing costs, on the other hand, is expected to drop from P2.00 to P1.80 per unit. There will be no change in the total fixed selling and administrative expenses and in the variable selling and administrative expenses per unit. The selling price per unit, likewise, will remain the same. Presented below are the results of the operations of Won Corporation for the previous year: (Note: Won has since been operating at full capacity) MAS 9202 COST-VOLUME-PROFIT ANALYSIS Sales (200,000 units) Manufacturing cost of goods sold: Fixed Variable Selling and administrative expense Fixed Variable Page 19 of 24 P1,000,000 P200,000 400,000 P49,750 60,000 (600,000) (109,750) P 290,250 46. Should Wilson decide to purchase the equipment, what would be the break-even point in terms of units? a. 86,120 c. 150,200 b. 127,500 d. 150,000 47. What is the maximum income (before taxes) that Won can earn after the purchase of equipment? a. P210,250 c. P500,250 b. P550,000 d. P502,500 48. The contribution margin ratio always increases when: a. break-even point decreases b. break-even point increases c. variable cost as a percentage of net sales increases d. variable cost as a percentage of net sales decreases 49. Merchants, Inc. sells Product X to retailers for P200. The unit variable cost is P40 with a selling commission of 10%. Fixed manufacturing cost totals P1,000,000 per month, while fixed selling and administrative cost equals P420,000. The income tax rate is 30%. The target sales if after tax income is P123,200 would be: a. 19,950 units c. 18,750 units b. 15,640 units d. 11,400 units 50. Sari-sari Corporation is a multiple-product firm. In their review of operations, they decided to shift the sales mix from less profitable products to more profitable products, accounting for 35% of gross sales. This will cause the company’s break-even point to: a. decrease c. increase b. change by 15% d. not change 51. Unico, Inc. formulates and sells three chemicals: B1, B2, and B3. It sells to industrial users who use and buy these chemicals in the following ratio: three (3) measures of B1 for one (1) measure of B3, two (2) of B2 per one (1) measure of B1. The company makes the following contribution margin per measure: B1 B2 B3 P30 45 90 Fixed cost amounted to P1.8 million. At break-even point, the volume of B3 to be sold would be: a. 12,000 c. 24,000 b. 36,000 d. 4,000 52. Assuming that the flexible budget is in use, when production level is expected to increase within a relevant range, the expected effect on fixed cost per unit (FCU) and variable cost per unit (VCU) would be: a. FCU, to decrease and VCU, to decrease b. FCU, to decrease and VCU, no change MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 20 of 24 c. FCU, no change and VCU, no change d. FCU, no change and VCU, to decrease 53. Neth and Company has sales of P400,000 with variable cost of P300,000, fixed cost of P120,000, and an operating loss of P20,000. By how much would Neth need to increase its sales in order to achieve a target operating income of 10% of sales? a. P400,000 c. P500,000 b. P462,000 d. P800,000 54. When using the graph method, if unit output exceeds the break-even point, a. expenses are extremely high relative to revenues. b. there is loss because the total cost line exceeds the total revenue line. c. total sales exceeds total cost. d. there is profit since the total cost line exceeds the total revenue line. 55. The most important use of the cost-volume-profit graph is to show a. the break-even point b. the cost/margin ratio at various levels of sale activity c. the relationships among volume, costs, revenues over wide ranges of activity d. the determination of cross-over point 56. Which of the following formulas is used to determine the break-even point when using the contribution margin method? a. Revenues less operating income equals variable cost plus fixed cost b. Unit contribution margin times the break-even number of units equals fixed cost. c. Selling price less unit fixed cost equals contribution margin d. Total fixed cost equals total revenues 57. Ipo-ipo Corporation would like to market a new product at a selling price of P15 per unit. Fixed cost for this product is P1,000,000 for less than 50,000 units of output and P1,500,000 for 500,000 or more units of output. The contribution margin percentage is 20%. How many units of this product must be sold to earn a target operating income of P1 million? a. 754,900 c. 825,530 b. 833,334 d. 785,320 58. The following data refer to cost-volume-profit relationship of K Co. Break-even point in units 1,000 Variable cost per unit P250 Total fixed cost P75,000 How much will be contributed to operating income by the 1,001st unit sold? a. P250 c. P75 b. P325 d. zero 59. Which of the following statements is true? a. A shift in sales mix toward less profitable products will cause the over-all break-even point to fall. b. One way to compute break-even point is to divide total sales by the cost margin ratio. c. Once the break-even point has been reached, net income will increase by the unit contribution margin for each additional unit sold. d. As sales exceed the break-even point, a high contribution margin ratio will result in lower profit, rather than a low contribution margin ratio. 60. When used in cost-volume-profit analysis. Sensitivity analysis a. determines the most profitable mix of products to be sold. b. allows the decision makers to introduce probabilities in the evaluation of decision alternatives. c. computes profit per unit of production and determines the optimum production of the company. MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 21 of 24 d. is done through various possible scenarios and computes the impact on profits of various predictions of future events. 61. Sats & Co. sells three products: Sim, Plu, and Cop. Sim is the most profitable product while Cop is the least profitable. Which one of the following events will definitely decrease the firm’s over-all break-even point for the upcoming accounting period? a. An increase in the over-all market for Plu. b. A decrease in Cop’s selling price. c. An increase in anticipated sales of Sim relative to the sales of Plu and Cop. d. An increase in Sim’s raw material cost. 62. A new product, DVD, will be marketed for the first time by Tunog, Ltd. during the next year. Although the Sales Department estimates that 35,000 units could be sold at P72 per unit, the management has allocated only enough manufacturing capacity to produce a maximum of 25,000 units of the new product annually. The fixed cost associated with the new product is budgeted at P900,000 for the year, which includes P120,000 for depreciation on the new manufacturing equipment. Each unit of product costing is presented below. The company is subject to a 40% income tax rate. Direct materials Direct labor Manufacturing overhead Total variable manufacturing overhead cost Selling expenses TOTAL VARIABLE COST Variable Cost P14.00 7.00 8.00 P29,00 3.00 P32.00 The management ruled that it will not allow the commercial production of the product after the next fiscal year unless the after-tax profit is at least P150,000 during the first year. The unit selling price to achieve this required profit must be at least: a. P75.00 c. P83.00 b. P78.00 d. P74.00 63. Cost-volume-profit analysis is a key factor in many decisions including choice of product lines, pricing of product, marketing strategy, and utilization of productive facilities. A calculation used in a CVP analysis is the break-even point. Once the break-even point has been reached, operating income will increase by the: a. sales price per unit for each additional unit sold. b. contribution margin per unit for each additional unit sold. c. fixed cost per unit for each additional unit sold. d. gross margin per unit for each additional unit sold. 64. To reduce the break-even point, the company may a. decrease both fixed cost and the contribution margin. b. increase both fixed cost and the contribution margin. c. decrease the fixed cost and increase the contribution margin. d. increase the fixed cost and decrease the contribution margin. 65. For a profitable company, the amount by which sales can decline before losses occur is known as the: a. Variable sales ratio c. Sales volume variance b. Margin of safety d. Marginal income tax MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 22 of 24 66. The following revenue and cost budgets for the two products that Baggs, Inc. sells are made available: Sales price Direct materials Direct labor Fixed overhead Net income per unit Budgeted unit sales Plastic bags Leather bags 150,000 300,000 P 50.00 (10.00) (15.00) (15.00) 10.00 P 75.00 (15.00) (25.00) (20.00) 15.00 The budgeted unit sales equal the current unit demand and total fixed overhead for the year is budgeted at P4,875,000. Assume that the company plans to maintain the same proportional mix. In numerical calculations, the company rounds to the nearest centavo and unit. The total number of units Baggs, Inc. needs to produce and sell to break-even is: a. 102,632 units c. 171,958 units b. 153,947 units d. 418,455 units 67. Games Corp. expected to sell 150,000 board games in July. Its master budget related to the sale and production of these items is presented below: Revenue Cost of goods sold: Direct materials Direct labor Variable overhead Total cost of goods sold Contribution margin Fixed overhead Fixed selling/administrative costs Operating income IN THOUSAND PESOS 480 135 60 90 285 195 50 100 150 45 July’s sales registered at 180,000 board games. Using a flexible budget, the company expects the operating income for July to be: a. P102,000 c. P84,000 b. P270,000 d. P45,000 68. For the period just ended, Chanda, Inc. generated the following results in percentages: Revenues Cost of sales: Variable Fixed Total Gross profit Operating expenses: Variable Fixed Total Operating income 100% 50% 10 20% 15 60 40% 35 5% Total sales amounted to P3 million. At what level is break-even sales? a. P3,750,000 c. P1,875,000 b. P2,500,000 d. P2,850,000 69. In a multi-product company, as the mix of the products being sold changes, the over-all contribution margin ratio will also change. If the shift in mix is toward less profitable products, then the contribution margin ratio will MAS 9202 COST-VOLUME-PROFIT ANALYSIS a. rise b. change in direct proportion to break-even point Page 23 of 24 c. not change d. fall 70. Rings, Etc., Inc. manufactures and sells key rings embossed with college names and slogans. Last year, the key rings sold for P75 each, and the variable cost to manufacture them was P22.50 per unit. The company needed to sell 20,000 key rings to break-even. The net income last year was P50,400. The company expects the following for the coming year: 1. The selling price of the key rings will be P90. 2. Variable manufacturing cost per unit will increase by one third. 3. Fixed cost will increase by 10%. 4. The income tax rate will remain unchanged. For the company to break-even for the coming year, the company should sell a. 22,600 units c. 19,250 units b. 21,250 units d. 21,600 units 71. The rate or amount that sales may decline before losses are incurred is called: a. residual income rate c. sensitive level of income b. variable sales ratio d. margin of safety 72. The following data pertain to the two products manufactured by Dipa, Inc. Product U P PER UNIT Selling price Variable cost P 240 1,000 P140 400 Fixed cost totals P600,000 annually. The expected sales mix in units is 60% for Product U and 40% for Product P. How many units of the two products together must Dipa sell to break-even? a. 857 c. 2,000 b. 2,459 d. 1,111 73. Total unit cost is a. needed for determining product contribution b. irrelevant in marginal analysis c. independent of the cost system d. relevant for cost-volume-profit analysis ITEMS 74 to 76 ARE BASED ON THE FOLLOWING INFORMATION: Chuchay Manufacturing Company produces two products for which the following data have been tabulated. Fixed manufacturing cost is applied at a rate of P1.00 per machine hour. Per unit Selling price Variable manufacturing cost Fixed manufacturing cost Variable selling cost Chu P4.00 2.00 0.75 1.00 Chay P3.00 1.50 0.20 1.00 The sales manager has had a P160,000 increase in the budget allotment for advertising and wants to apply the money to the most profitable product. The products are not substitutes for one another in the eyes of the company’s customers. MAS 9202 COST-VOLUME-PROFIT ANALYSIS Page 24 of 24 74. Suppose the sales manager chooses to devote the entire P160,000 to increased advertising for Chu. The minimum increase in sales units of Chu required to offset the increased advertising is a. 640,000 units c. 128,000 units b. 160,000 units d. 80,000 units 75. Suppose the sales manager chooses to devote the entire P160,000 to increased advertising for Chay. The minimum increase in revenues of Chay required to offset the increased advertising would be a. P160,000 c. P 960,000 b. P320,000 d. P1,600,000 76. Suppose Chuchay has only 100,000 machine hours that can be made available to produce additional units of Chu and Chay. If the potential increase in sales units for either product resulting from advertising is far in excess of this production capacity, which product should be advertised and what is the estimated increase in contribution margin earned? a. Product Chu should be produced, yielding a contribution margin of P75,000. b. Product Chu should be produced, yielding a contribution margin of P133,333. c. Product Chay should be produced, yielding a contribution margin of P187,500. d. Product Chay should be produced, yielding a contribution margin of P250,000. COST VOLUME PROFIT/BREAK-EVEN ANALYSIS 1. C 11. D 21. A 31. B 41. B 51. D 61. C 71. D 2. A 12. D 22. A 32. C 42. C 52. B 62. B 72. C 3. A 13. B 23. A 33. B 43. C 53. A 63. B 73. B 4. A 14. D 24. B 34. A 44. D 54. C 64. C 74. B 5. A 15. B 25. D 35. C 45. B 55. C 65. B 75. C 6. C 16. C 26. C 36. D 46. B 56. B 66. B 76. D 7. B 17. B 27. D 37. A 47. C 57. B 67. C 8. A 18. A 28. B 38. A 48. D 58. C 68. B 9. D 19. A 29. B 39. D 49. D 59. C 69. D 10. D 20. C 30. D 40. C 50. A 60. D 70. C -- end --