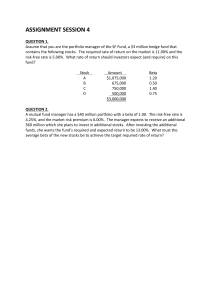

Peter Lynch Investment Strategy: Stock Classification & Portfolio

advertisement