Mathematics of

Finance and Investment

Prepared by

Prof. Dr

Omar Abd-Elgwad

Prof. Dr

Prof. Dr

Mohamed Nady Ezzat

Prof. Dr

Hosny Ahmed Elkholy

Eid Ahmed Abu-baker

Mathematics and Insurance department

Faculty of Commerce

Beni-suef university

1

2

Introduction

Praise be to Allah, the Lord of the Worlds, and peace and blessings be upon

the Most Merciful of our Messengers Muhammad bin Abdullah, the faithful and

faithful Prophet, and upon his family and companions.

Mathematics is one of the oldest natural sciences to which mankind has

relied and which has been adopted by most other sciences as an input to the study,

analysis and measurement of many problems. Financial mathematics is one of the

branches of mathematics that contributes to the study and analysis of many

financial and administrative problems.

Capital is one of the main elements of production alongside land, labor and

organization (management), and each element of return or exchange or price for its

use or use. If the rent is the return of land, the reward or reward is the return of

labor, and profit is the return of regulation (management) Interest is the return of

capital, so the financial Mathematics is interested in the element of capital and its

return (interest) on the grounds that all economic and service projects, whether

public or private, whether individual or joint working to provide capital through

borrowing from individuals or entities specialized in the field Finance and

investment such as banks, insurance companies, or by issuing shares and bonds

and selling them on the stock market.

Financial Mathematics offers mathematical methods of financing and

investment through simple interest theory and compound interest theory. Simple

interest theory is used by social institutions and financial institutions such as social

security and social insurance, development and agricultural credit banks and

generally short-term loans. compound interest theory is used by Commercial

financial institutions such as banks and insurance companies.

3

These mathematics methods are used by all interested in finance and

investment Mathematics and their applications in all aspects of life from

depositing, borrowing, buying, selling in installments or in installments.

This book deals with the two sectionsof financial Mathematics:

Section I: Simple Interest:

We consider the basic laws of the simple interest and its various

applications, the interest law and the amount (sum) of one principle and several

amounts of unequal invested or borrowed with one rate of interest , The law of the

present value and the discount (deduction) of one sum and several amounts of

unequal one rate, the discountd of commercial papers and the use of the application

of the laws of the sum and The present value of the settlement and replacement of

short-term debt. We also deal with sum laws and the present value of several equal

amounts paid at equal payments ( annuities) and periodic interest. Finally, we

address the methods of repayment or amortization of short-term loans.

Section II: Compound Interest:

We consider the basic laws of the compound interest and its various

applications, the interest law and the sum of one sum and several amounts invested

or borrowed at compound annual or non-annual compound interest rate, ie ,

interest is paid at less than one year (monthly, quarterly, semi-annual or one-third

annual). And then apply the laws of present value and discount for one or several

amounts. Then we address the application of the sum laws and the present value in

the settlement and replacement of long-term debt. Then we address the sum and

the present value of equal payments ( annuities). And finally the amortization of

long-term loans.

4

Finally, we ask God to help us in presenting this author in an easy way that

serves our students in our institutes, colleges and universities, and our brothers, all

interested in finance and investment.

5

6

Part one:

Simple Interest

7

8

Chapter ( 1 )

Interset and Amount

9

11

Chapter ( 1)

Interset and Amount

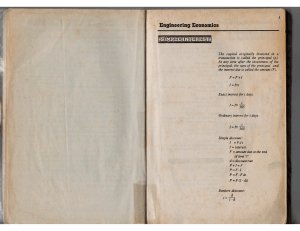

Basic Law for Interest:

Interest is defined as an increase in the capital resulting from its investment

for a certain period at a certain interest rate.

It is also defined as the return or financial compensation resulting from the

investment of funds or the borrowing of funds from others.

From the previous definition of interest it is clear to us that the amount of

interest due for any investment or borrowing depends on three basic elements:

A) The principal :

It is the amount borrowed or the amount deposited, the use of which

involves the performance of a financial compansation (interest) to which the debtor

(the borrower) owes the creditor (the owner of the capital).

B) The Rate of Interest :

The rate of interest - the return on investment of the capital unit at the end of

a one period of time. If the interest payable on the amount of 1000 L.E. at the end

of the year is 70 L.E., it can be said that the annual interest rate is 0.07. or 7%. It is

customary to use the year as a one period of time, as well as the use of 100 units of

money when determining the interest rate unless otherwise stated explicitly.

C) the period of time:

Means it the period after which the amount of the interest is payable. If the

creditor and the debtor agree to pay the interest of the invested capital once a year,

the time period or the unit of time is the year and therefore the rate used for interest

is an annual rate. If the interest is due every month, every quarter or every six

11

months, the period of time becomes one month or three months or six months,

respectively, and the rate is then reported at a rate of one period.

Elements of interest:

From the above it becomes clear that the amount of interest due from any

investment or borrowing depends on three elements:

1. Investor's principal ... symbolized by the symbol (a).

2. Period ... (duration or time of investment or borrowing) and symbolized

by the symbol (n).

3. Interest rate... ... denoted by (i).

It should be noted that the amount of interest due increases by increasing any

of the previous three elements with the stability of other racists, meaning that the

interest whether the interest of a loan or investment interest increases by increasing

the principal, time , rate of interest , and so on ... and vice versa .. That is, the

relationship is more positive increse incresing and decrease decreasing. It is

known that the interest of the amount of 1000 L.E. invested for a period of time at

a certain rate less than the interest of the amount of 2000 L.E. invested for the

same period and the same rate. As well as increase the interest of 1000 L.E.

invested for one year at a certain rate for the same interest rate invested at the same

rate and for half a year and the interest owed on the amount at the end of a certain

period at the rate of 9% necessarily exceeds if the user rate of 7%.

period (n)

interest rate (i %)

×

Present value (a)

12

Amount (S)

×

Interest (I)

Simple interest formula (I):

The principal of the investment is that the accrued interest is paid

periodically over the investment period and at the end of each agreed period

between the creditor (the owner of the capital) and the debtor (the borrower), such

as the period of one year, half year or quarter of the year. It may sometimes occur

that the debtor will not be able to pay the accrued interest at the end of each time

period or to agree with the creditor from the outset on the repayment of the

borrowed amount and all the accrued interest at the end of the loan term.

Therefore:

Interest = principal × rate × time

I=a× i× n

Principle amount (a), interest rate (i), period (n). Therefore, one of these

elements can be found if the three elements are known as follows:

1- Find (a)

I

a = ــــــــــــــــــ

i× n

2- Find (i)

I

i = ــــــــــــــــــ

a× n

3- Find ( n)

I

n = ــــــــــــــــــ

a× i

Conclusion amount formula (S):

Amount = principle + interest

S=a+I

Substitute by (I) in the previous equation.

S=a+(a × i× n)

13

S = a (1 + i × n )

In order to use the previous laws of interest and amount , in any law, (n) , (i)

must be of the same time units.

In the sense that:

(i) Yearly

,

(n) years

(i) Half-monthly

(i) Monthly

,

.

(n) in half years

(n) in months

And so on:

In the sense that when applying the interest and amount law in any of the

previous

equations, the period of the rate (unit of interest rate time) must

correspond to the time units on which the period is calculated. If the interest rate is

annual, the period must be calculated in a years. Calculation of rate of interest is a

month , The period must be calculated in months. If the period is in years, either

we convert the rate from a monthly rate to an annual rate or we convert the period

from years to months.

Meaning that the interest rate used corresponds to the periods of time. If the

time period is one year, the interest rate must be annual and in cases where the rate

is stated for a period of time less than one year, the annual rate must be obtained by

multiplying the rate by Period in the number of periods in which a full year is

included.

For example:

- If the interest rate is 5% semiannual.

The annual rate = 5% × 2 = 10%.

- If the quarterly interest rate = 3%

The annual rate = 3% x 4 = 12.

14

The name of the rate varies according to its time unit, if:

- Time unit of time is years, the rate of interest is called annual rate.

- Time unit of time is 6 months, the rate of interest is called semi-annual rate.

- Time unit of time is 3 months, the rate of interest is called quarterly rate.

- The unit of time is 4 months, the rate is called the rate of one-third annual.

- The unit time of time is One month, the rate of interest is called monthly rate.

Problems of period:

1. If the period of investment or borrowing in years, in this case there is no

problem since (n) years.

2. If the period of investment or borrowing is months, it must be converted to

years.by divided 12 . ( n = m /12 )

3. If the period of investment or borrowing is days, it must be converted to

years.divided by (360 , 365 , 366 ).

( n = d /360 ) ,

( n = d /365 )

, ( n = d /366 )

4. If the period is in days and it is not specified whether the year is simple or leap,

the year is considered simple. (number of days = 365)

5. If the period of the investment or borrowing part there of falls in a simple year

and another part falls in a leap year.

{n = (m1 /365) + (m2 /366 )}

6. If the period of the investment or borrow is not explicitly given but gives the

date of depsit (or the date of borrowing) and the date of withdrawal (or the date of

payment), the period shall be calculated as follows:

Period = Number of days remaining in the month of deposit (or month of

borrowing) + Number of days of full months + Number of investment days

(borrowing) in the month of withdrawal (or month of repayment).

15

7. The date of deposit (date of borrowing) and the date of withdrawal (date of

payment) may occur from the beginning, middle or end of the month, in which

case the period between the two dates is calculated in months, For example:

- If the date of deposit is the first of January and the date of withdrawal is the

last month of August, the investment period in this case is eight months as

follows: (January, February, March, April, May, June, July, August).

From 1/1 / ..... to 31/8

the period = 8 months

- If the borrowing date is 15/3/2020 and the repayment date is 15/8/2020 , the

borrowing period in this case is 5 months.

8. The financial year may be a simple year or leap year. The leap year is the year in

which February is 29 days and the number of days is 366 days. While the simple

year is the year in which February is 28 days and the number of days is 365 days,

determine the kind of the leap year , the year number is divided by 4 and is

outside the integer without fractions. However, the century year (100 multiples)

must divide the year number by 400 and be outside the integer without fractions

the leap year, while the simple years is outside the integer with fractions of 0.25 or

0.5 or 0.75.

The years of 1996 , 2000 , 2004 , 2008

,

2012 , 20016 , 2020 is a

leap year, wheale the years 2010 , 2011 , 2013 , 2014 , 2015 , 2017 , 2018 ,

2019 is a simple year

Example: Ahmed borrowed L.E. 20000 from the Bank of Alexandria, which

calculates a simple interest rate of 12% per annum and agreed with the bank to

repay it after 10 years.

Required: Calculate the interest payable on it and calculate the total amount paid

by the end of the period.

16

Sulotion:

a = 20000

, i = 12% annually

,

n = 10 years

I=a× i × n

I = 20000 × 0.12 × 10 = 24000

S=a+ I

S = 20000 + 24000 = 44000

S = a (1+ i × n)

Or:

S = 20000( 1+ 0.12 × 10) = 44000

Example: A person borrowed 5000 L.E. from a bank at an interest rate of 12% per

annum for 10 months.

Required: Calculate the amount payable.

Sulotion:

a = 5000

,

i = 12% annually , n = 10 months = 10/12 year

I=a× i × n

I = a × i × ( m /12)

I = 5000 × 0.12 × (10/12) = 500

S= a+I

S = 5000 + 500 = 5500

Or :

S = a {1+ i × ( m /12 )}

S = 5000 { 1+ 0.12 × (10 /12 ) } = 5500

Example: A person invested 10000 L.E. at a simple interest rate of 12% per

annum for 9 years, 9 months and 10 days.

Required: Calculate of the amount at the end of the period.

17

Sulotion:

a = 10000

,

i = 12% annually

months + 10 days = 9 + (9/12) + (10/360)

= 9 + 0.75 + 0.028 = 9.778

years

I=a× i × n

I = 10000 × 0.12 × 9.778 = 11733.6

S= a+I

S = 10000 + 11733.6 = 21733.6

Or:

S = a (1+ i × n )

S = 5000( 1+ 0.12 × 9.778 ) = 21733.6

Or

Interest for years

I1 = 10000 × 0.12 × 9= 10800

Interest for months

I2 = 10000 × 0.12 × (9 /12) = 900

Interest for days

I3 = 10000 × 0.12 × (10 /360) = 33.33

Total interest

I = I1 + I2 + I3

I = 10800 + 900 + 33.33 = 11733.33

S= a+I

S = 10000 + 11733.6 = 21733.6

18

n = 9 years + 10

How to calculate the period between two dates:

To calculate the period between two dates, the following considerations must be

taken into account:

1. Ignore the day of depoists ( or borrowing) or the day of withdrawal (or payment)

and often neglects the day of depoists.

2. Note that the number of days of the month varies, some months have 30 days

and others have 31 days. This is unlike the month of February, which is 28 days in

the simple year, which is 29 days in the leap year, as follows:

January

February

March

April

May

June

31days

28 or 29 day

31 days

30 days

31 days

30 days

July

August

September

October

November

December

31 days

31 days

30 days

31 days

30 days

31 days

According to the previous two considerations, the period of the days is determined

between two dates.

Period = Number of days remaining in the month of deposit (or borrowing) +

Number of days of full months between the month of deposit (borrowing) and the

month of withdrawal (repayment). + Number of days in the month of withdrawal

(payment)

The following identify each of these elements:

1. The number of days remaining in the month of deposit (borrowing):

This number is determined by subtracting the date of the deposit day from

the number of days of the deposit month, so we have neglected the day of deposit

and therefore when calculating the number of days in the month of withdrawal (or

payment) do not neglect the day of withdrawal or payment.

19

For example, if the deposit date is March 17, the number of days remaining

of the deposit month = the number of days in March (31) - the day of deposit (17)

= 14 days.

For example, if the day of borrowing is 25 June, The remaining days of the

borrowing month = 30 - 25 = 5 days.

2. Number of days of full months between the month of deposit and the month of

withdrawal:

This number is calculated by adding the number of days of those months.

3. Number of days in the month of withdrawal (or payment):

This number equals the date of the withdrawal day of the month of withdrawal, so

we have taken within the period of the draw day. For example, if the amount is

withdrawn on March 24, the number of days of the withdrawal month = 24 days.

To determine the period between two dates, we use the following formula:

period = Number of days remaining in the month of deposit (month of borrowing)

+ Number of days of full months + Number of days in the month of withdrawal

(month of payment)

Example: Calculate the period in the following cases:

1- The period from 25/3/2017 to 16/8/2017

2- The period from 11/1/2017 to 22/4/2017

3- The period from 22/9/2017 to 13/3/2018

4- The period from 12/2/2018 to 18/5/2018

5- The period from 1/6/2018 to 1/11/2018

6- The period from 15/3/2018 to 15/8/2018

7- The period from 1/7/2018 to 31/12/2018

8- The period from 5/3/2018 to 5/8/2018

21

Solution:

1- The period from 25/3/2017 to 16/8/2017

Period = Mar

Apr May June July Aug

= (31- 25) + 30 + 31 + 30 + 31 + 16 = 144 days

2- The period from 11/1/2017 to 22/4/2017

Period = Jan

Feb

March Apr

= (31- 11) + 28 + 31 + 22 = 101 days

3- The period from 22/9/2017 to 13/3/2018

Period = Sep

Oct Nov Dec Jan Feb March

= (30- 22) + 31 + 30 + 31 + 31 + 28 + 13 = 173days

4- The period from 12/2/2018 to 18/5/2018

Period = Feb March

Apr

May

= (28- 12) + 31 + 30 + 18 = 96 days

5- The period from 1/6/2018 to 1/11/2018

Period = 5 Months

6- The period from 15/3/2018 to 15/8/2018

Period = 5 Months

7- The period from 1/7/2018 to 31/12/2018

Period = 6 Months

8- The period from 5/3/2018 to 5/8/2018

Period = 5 Months

In cases 5, 6, 7 and 8, it is noted that the periods have been calculated in months. If

the date of deposit (borrowing) agreed with the date of withdrawal or repayment,

the period shall be calculated in months.

Note: If the deposits date corresponds to the withdrawal date, so that the same day

of deposit is the same on the day of the withdrawal or the day of deposit and

21

withdrawal from the first or the last or the middle of the month, the period shall be

calculated in months.

The following examples illustrate how to use previous relationships:

Example: On 13/5/2019, a person borrowed a sum of L.E. 30000 from a bank

which calculate a simple interest at the rate of 10% per annum and agreed with the

bank to pay the amount on 13/12/2019.

Required: Calculate the interest and the amount payable.

Solution:

Calculation of the period between two dates from 13/5 to 13/12, since there

is an agreement between the date of borrowing and the date of payment, and

therefore the period is calculated in months.

The period from 13/5/2019 to 13/12/2019

Period = 7 Months

a = 30000

, i = 10% annually

,

n = 7 months

I=a× i × n

I = 30000 × 0.10 × (7/12) = 1750

S=a+I

S = 30000 + 1750 = 31750

Or:

S = a (1+ i × n)

S = 30000 { 1+ 0.12 × (7 /12)} = 31750

Example: a person deposits L.E.5000 in a bank. If the total amount he has at the

end of a specified period is L.E. 5500 . If the bank calculates a simple interest at

the rate of 12% per annum.

22

Required: calculate the period during which the amount was invested (calculate

the period of investment) .

Solution:

a = 5000

, i = 12% annually

,

S = 5500

I=S- a

I = 5500 – 5000 = 500

I=a× i × n

500 = 5000 × 0.12 × n

I

n = ــــــــــــــــــ

a× i

500

n = = ــــــــــــــــــــــــ0.833

5000 × 0.12

converted into the period to months

= 0.833 × 12 = 10 months

Or:

S = a (1+ i × n )

5500 = 5000( 1+ 0.12 × n )

5500 / 5000 = ( 1+ 0.12 × n )

1.1 = ( 1+ 0.12 × n )

1.1 – 1 = 0.12 × n

0.1 = 0.12 × n

23

year

0.1

n = = ــــــــــــــــــ0.833

0.12

converted into the period to months

year

= 0.833 × 12 = 10 months

Example: Find a simple interest and amount of L.E 15000 for 5 years,with a

quarterly interest rate of 3%.(Using two methods).

Solution:

a = 15000

, i = 3% quarterly

,

n = 5 years

Thus, there must be a correlation between the period of time and the period

of rate

Period = Number of years x Number of periods per year

Time = 5 × 4 = 20 periods

I=a× i × n

I = 15000 × 0.03 × 20 = 9000

S= a+I

S = 15000 + 9000 = 24000

Anther Solution:

a = 15000

, i = 3% quarterly

,

n = 5 years

Thus, there must be a correlation between the period of time and the period

of rate

The rate of interest = rate × Number of periods per year

i = 3% × 4 = 12 %

24

I = 15000 × 0.12 × 5 = 9000

S = a+ I

S = 15000 + 9000 = 24000

Example: A person invested L.E. 50000 in a bank that calculates a simple interest

rate of 12%

per annum if the date of deposit 13/10/2018 and the date of

withdrawal 3/3/2020.

required: Find the interest and the total sum at the end of the period.

Solution:

a=50000

(S)

i = 12 %

×

13\10\2018

2019

- Period in the year 2018 .

Period = Oct

Nov Dec

= (31- 13) + 30 + 31 = 79 days

- Period in the year 2019 .

Period = 365

- Period in the year 2020 .

Period = Jau

Feb Mar

= 31 + 29 + 3 = 63 days

Total period = 79 + 365 + 63 = 507 days

I=a× i × n

I = 50000 × 0.12 × (507\360) = 8450

25

×

3\3\2020

S= a+I

S = 50000 + 8450 = 58450

S = a (1+ i × n )

Or:

S = 50000 { 1+ 0.12 × (507\360 )} = 58450

How to determine the date of deposit (borrowing) or the date of withdrawal

(payment):

1. Determine the date of withdrawal (payment):

If you give the date of deposit and the period of the investment and ask you

to determine the withdrawal date (payment ), to calculate the withdrawal date, the

investment period will be calculated in the different months starting from the

month of deposit and the following months with the subtraction of the period of

each month of the investment period to determine the remaining period until the

last of each month of investment. We reach less than the number of days of the

next month and the month of withdrawal is the following month and the date of

withdrawal is the same as the number of days calculated.

Example: If the depoists date is February 17, 2019 and the withdrawal is after a

lapse of 125 days, find the date of withdrawal.

Solution:

The year of 2019 is simple year , thus February = 28 days

the month

February

Number of investment

days per month

28 - 17 = 11 days

The remaining investment period

until the end of the month

125 - 11 = 114

March

31

114 - 31 = 83

April

30

83 - 30= 53

May

31

53 - 31 = 22

June

22

26

The remaining period of investment in the last month of May is 22 days.

Therefore, the withdrawal month is the following month , the month of June and

the date of withdrawal is the same as the number of days remaining (calculated

from the month of withdrawal).

The withdrawal date is 22 June 2019.

2. Determination of the date of deposit (borrowing):

If you give the date of withdrawal and the period of the investment

(borrowing) and ask you to determine the date of deposit (borrowing ). To

calculate the date of deposit, the period of investment shall be calculated in the

different months starting from the month of withdrawal and the preceding months (

in reverse) The period of the investment expiring until we reach a period less than

the number of days of the previous month then the previous month is the date of

deposit (borrowing) and that period is the investment period calculated from this

month and thus the date of deposit (borrowing) is the number of days of the month

of deposit (borrowing) Of which the investment period calculated per month.

Example: If the withdrawal date is August 13, 2019 and the investment period is

110 days, what is the date of deposit.

Solution:

Months of

investment

reversed

August

Number of investment

days per month

13

The period of the investment

expiring until the first of each

month

110 - 13 = 97

July

31

97 - 31 = 66

June

30

66 - 30 = 36

May

31

36 - 31 = 5

April

5

27

As the number of investment days until the first of May is 5 days, which is

less than the number of days of the previous month is the month of April, so the

month of deposit is the month of April.

Date of deposit

= Number of days of deposit (April) - the period calculated

= 30 - 5 =25

The depoist date is 25 April 2019.

Example: Someone deposited a sum in a bank on March 19, 2019 and withdrew it

after 175 days, calculate the date of withdrawal of this amount.

Solution :

Months of

investment

reversed

March

Number of investment

days per month

31 - 19 = 12

The period of the investment

expiring until the first of each

month

175 - 12 = 163

April

30

163 - 30 = 133

May

31

133 - 31 = 102

June

30

102 - 30 = 72

July

31

72 - 31 = 41

August

31

41 - 31 = 10

September

10

Where the remaining period at the end of August is 10 days and less than the

number of days of the following month is September, and the month of withdrawal

is the month of September and the date of withdrawal is on 10 September.

Example: On 25/7/2019, a person withdraws a sum of money that he deposited in

a bank. If he knows that the bank has interest on the basis of an investment period

of 127 days, calculate the date of deposit .

28

Solution:

Inverse

months

Number of investment

days per month

July

25

The period of the investment

expiring until the first of each

month

127 - 25 = 102

June

30

102 - 30 = 72

May

31

72 - 31 = 41

April

30

41 - 30 = 11

March

11

The number of days of investment in the first month of April is 11 days,

which is less than the number of days of the previous month (March), so the month

of deposit is the month of March.

Date of deposit

= Number of days of deposit month - Investment period in the first month of April

= 31 – 11 = 20

The date of depoist is March 20.

Example: Ahmed borrowed L.E. 100000 from NCB bank on 15/2/2019 and he

paid this loan from a certain date. The interest on this loan amounted to L.E.

4166.6. If you know that the bank calculates the simple interest rate of 15% per

annum.

Calculate:

- the loan period .

- Loan repayment date.

Solution: It does not specify the type of interest used and therefore is considered a

commercial interest.

a = 100000

, i = 15% annually

,

n = ??

I = 4166.6

29

I= a × i × n

4266.6 = 100000 × 0.15 × n

I

n = ــــــــــــــــــ

a× i

4266.6

n = ــــــــــــــــــــــــــــــــــ

10000 × 0.15

converted into the period to months

= 0.2777

year

= 0.2777 × 360 = 100 days

That is, the loan period = 100 days

- Determination of loan repayment date:

the month

February

Number of

investment days per

month

28 - 15 = 13

The remaining investment

period until the last of each

month

100 - 13 = 87

March

31

87 - 31 = 56

April

30

56 - 30 = 26

May

26

As the remaining period at the end of April is 26 days, which is less than the

number of days of the following month is the month of May.

* Month of payment is May, payment date is 26/5/2019

Example: A person deposits a sum of L.E. 180000 in a bank on a given date for

investing in a simple interest at the rate of 15% per annum. If you know that the

total (sum) of him on 15/11/2019 is L.E.190500. Calculate the date of deposit.

31

Solution:

a = 180000

,

i = 15% annually

,

S = 190500

I=S- a

I = 190500 – 180000 = 10500

I=a× i × n

10500 = 180000 × 0.15 × n

I

n = ــــــــــــــــــ

a× i

10500

n = ــــــــــــــــــــــــــــــــــ

180000 × 0.15

= 0.3888

year

converted into the period to days

= 0.38888 × 360 = 140 dayss

Or:

S = a (1+ i × n )

190500 = 180000( 1+ 0.15 × n )

(190500 / 180000) = ( 1+ 0.15 × n )

1.05833 = ( 1+ 0.15 × n )

1.05833 – 1 = 0.15 × n

0.05833 = 0.15 × n

0.05833

n = ــــــــــــــــــــــــــــــــــ

0.15

31

= 0.38888 year

converted into the period to months

= 0.38888 × 360 = 140 days

Specify the date of the deposit:

Reverse

months

Nov

Number of

investment days

per month

15

The period of the investment

expiring until the first of each

month

140 - 15 = 125

October

31

125 - 31 = 94

September

30

94 - 30 = 64

August

31

64 - 31 = 33

July

31

33 – 31 = 2

June

2

The number of investment days on the first of July is 2 days (two days), which is

less than the number of days in the previous month (June). It reflects the difference

between the date of deposit and the number of days of the month.

* Date of deposit

= Number of days of deposit month - Investment period from the first of July

= 30 - 2 = 28

Thus, the month of deposit is in June.

The deposit date is 28/6/2019.

Computing the Exact interest and Ordinary interest:

- Exact interest equal:

- if the year is simple:

n = (d /365)

Ie = a × i × (d /365)

And Se = a + Ie

32

Se = a (1+ i × (d /365))

- if the year is leap:

n = (d /366)

Ie = a × i × (d /366)

And S = a + Ie

Se = a (1+ i × (d /366))

- Ordinary interest equal:

n = (d /360)

Io = a × i × (d /360)

And So = a + Io

So = a (1+ i × (d /360))

If there is a part of the period, it falls in a simple year (d1) and another part falls

into a leap year (d2).

- Exact interest equal:

n = (d1 /365) + (d2 /366)

Ie = I = a × i × {(d1 /365) + (d2 /366)}

- ordinary interest equal:

n = {(d1 + d2) /360}

Io = a × i × {(d1 + d2) /360}

We notes the following:

1.Ordinary interest (Io) is always greater than the Exact interest (Ie).

2. If the type of interest is not specified in the exercise, it is always the Ordinary

interest (Io).

3. If not specified in the exercise type of year (simple or leap) is a simple year (the

number of days 365 days).

33

4. If part of the period occurs in a simple year and the other part of the period in a

leap year, the number of days in a simple year should be divided by 365 days and

the number of days in the leap year to 366 days. If we assume that the number of

days in a simple year is d1, and that the number of days in the leap year is d 2, then

the period when calculating the Exact interest equal:

n = {(d1 /365) + (d2 /366)}. While the period when calculate ordinary interest

equal: n = {(d1 + d2) /360}

5. We have stated that Ordinary interest is always greater than the Exact interest,

and therefore the use of Ordinary interest is in the interest of the creditor, so it has

traditionally been used in commercial financial transactions.

Example: Calculate the Exact interest and Ordinary interest of L.E. 10000 at a

simple interest rate of 10% per annum if the period of investment for this amount

from 10/1/2019 to 14/6/2019. Then calculate the amount with the Exact interest

and Ordinary interest.

Solution:

a = 10000

, i = 10% annually

,

n = 155 days

The period from 10/1/2019 to 14/6/2019

Period = Jan

Feb March Apr May June

= (31- 10) + 28 + 31 + 30 + 31 + 14 = 155 days

- Exact interest (Ie) :

Ie = a × i × (d /365)

Ie = 10000 × 0.10 × (155 /365) = 424.66

The amount with the Exact interest:

S e = a + Ie

Se = 10000 + 424.66 = 10424.66

Or:

Se = a ( 1 + i × n)

34

Se = 10000 { 1 + 0.10 × (155 /365)} =10424.66

- Ordinary interest ( Io) :

Io = a × i × (d /360)

Io = 10000 × 0.10 × (155 /360) = 430.56

The amount with the Ordinary interest:

So = a + Io

So = 10000 + 430,66 = 10430,56

So = a ( 1 + i × n)

Or:

So = 10000 { 1 + 0.10 × (155 /360)} =10430,56

The Exact interest is less than Ordinary interest.

Example: Abu-Liath borrowed an amount of L.E. 50,000 on 5/2/2019 from Union

International Bank, which calculates the simple interest rate at 12% per annum.

Calculate the Exact interest and Ordinary interest payable on 15/8/2019.

Solution:

The period from 5/2/2019 to 15/8/2019

Period = Feb March Apr May June July Aug

= (28- 10) + 31 + 30 + 31 + 30 + 31 + 15 = 191 days

a = 50000

, i = 12% annually

- Exact interest (Ie) :

,

n = 191 days

Ie = a × i × (d /365)

Ie = 50000 × 0.12 × (191 /365) = 3139.73

- Ordinary interest ( Io) :

Io = a × i × (d /360)

Io = 50000 × 0.12 × (191 /360) = 3183,33

35

Example: Ahmed borrowed an amount from the National Bank on 5/1/2019 at a

simple interest rate of 12% per annum. On 31/5/2019 he found that the Ordinary

interest owed to him amounted to L.E. 7300.

Required:

1. Calculate the loan principal.

2. Exact interest.

Solution:

The period from 5/1/2019 to 31/5/2019

Period =

Jan Feb March Apr May

= (31- 5) + 28 + 31 + 30 + 31 = 146 days

a = ???

, S = 7300 , i = 12% annually ,

n = 146 days

Io = a × i × (d /360)

- Ordinary interest ( Io) :

7300 = a × 0.12 × (146 /360) = 3183.33

a = 7300 / (0.12 × (146 /360) = 150000

- Exact interest (Ie) :

Ie = a × i × (d /365)

Ie = 150000 × 0.12 × (146 /365) = 7200

Example: A person borrowed L.E. 200000 from Arab Bank on 24/10/2019. If you

know that the bank calculates the simple interest at the rate of 12% per annum.

find the total amount due on that person on 20/4/2020, using ordinary interest as

well as using the exact interest .

Solution:

Calculate period (n), noting that part of the period is in a simple year (2019) and

another is in leap year (2020).

36

a = 200000

, i = 12% annually

,

n =

days

The period from 24/10/2019 to 20/4/2020

Period = Oct

Nov Dec Jan Feb March Apr

= (31- 24) + 30 + 31 + 31 + 29 + 31 + 20 = 179 days

It is noted in this example that part of the period occurs in a simple year (2019)

and the other part of the period in a leap year (2020), the number of days in a

simple year ( 68) should be divided by 365 days and the number of days in the leap

year (111) should be divided by 366 days.

then the period when calculating the Exact interest equal:

n = {(68 /365) + (111/366)}.

While the period when calculating ordinary interest equal:

n = {(68 + 111) /360}

First: Finding the total due to the debtor using the Exact interest (Ie):

- Exact interest (Ie) :

-

n = {(d1 /365) + (d2 /366)}

Ie = a × i × {(d1 /365) + (d2 /366)}

Ie = 200000 × 0.12 × {(68 /365) + (111/366)} = 11736

Thus, the total amount with the Exact interest at the end of the period (Se):

Se = a + Ie

Se = 200000 + 11736 = 211736

Or:

Se = a ( 1 + i × n)

Se = 200000 { 1 + 0.12 × {(68 /365) + (111/366)} } =211736

Second: finding the total receivable on the debtor using commercial interest (I o).

- Ordinary interest ( Io) :

Io = a × i × (d1 +d2 /360)

Io = 10000 × 0.12 × {(68 + 111) /360} = 11933.33

37

Thus, the total amount with the Ordinary interest at the end of the period (So).

So = a + Io

So = 200000 + 11933,33 = 211933,33

Or:

So = a ( 1 + i × n)

So = 200000 { 1 + 0.12 × (179 /360)} =211933,33

Thus, the total receivable at the end of the period (S).

The relationship between Ordinary interest (Io) and Exact interest (Ie):

A) - Relationship ratio between Ordinary interest and Exact interest:

1. If the year is simple:

Io / Ie = 73 / 72

it is possible to calculate the value of one of the two interests in the other.

Io = (73 / 72) Ie

Thus , Io is 1 /72 more than Ie

Io = Ie + (1 / 72) Ie

and

Ie = (72 /73) Io

so , Ie is 1 /73 less than Io

Ie = Io - (1 / 73) Io

2. If the year is a leap:

Io / Ie = 61 / 60

then it is possible to calculate the value of one of the two interest in the other.

Io = (61 /60) Ie

Thus , Io is 1/60 more than Ie

Io = Ie + (1 / 60) Ie

and

Ie = (60 /61) Io

so , Ie is 1 /61 less than Io

Ie = Io - (1 / 61) Io

38

B) - The relationship differenace between Ordinary interest and Exact interest:

1. If the year is simple:

Io - Ie = (73/72) Ie - Ie

Io - Ie = (1 /72) Ie

Io - Ie = Io - (72 /73) Io

Io - Ie = (1 /73) Io

2. If the year is a leap:

Io - Ie = (61/60) Ie - Ie

Io - Ie = (1 /60) Ie

Io - Ie = Io - (60 /61) Io

Io - Ie = (1 /61) Io

Example: Find the Exact interest and the Ordinary interest if the difference

between the two interest L.E. 1000 for the same amount , period and rate.

The solution:

1. If the year is simple:

Io - Ie = (1 /72) Ie

1000 = (1 /72) Ie

Ie = 72 × 1000 = 72000

Io - Ie = (1 /73) Io

1000 = (1 /73) Io

Io = 73 × 1000 = 73000

Note: After finding the Exact interest = L.E.72.000, Ordinary interest can be found.

Io = (Ie) + Difference between the two interests

Also, after finding a Ordinary interest of L.E. 73,000, the Exact interest can be

found.

Ie = (Io) - Difference between the two interests

39

Where the Ordinary interest is greater than the Exact interest.

2. If the leap year:

Io – Ie = (1 /60) Ie

1000 = (1 /60) Ie

Ie = 1000 × 60 = 60000

Io – Ie = (1 /61) Io

1000 = (1 /61) Io

Io = 1000 × 61 = 61000

Note: You can find Ordinary interest after finding the Exact interest or you can

find the Exact interest after finding the Ordinary interest:

Io = (Ie) + Difference between the two interests

Ie = (Io) - Difference between the two interests

Example: A person deposited a sum of L.E. 20,000 at Banque Misr on February 9,

2019 to invest at a simple interest rate. On June 9 of the same year, he found that

his Ordinary interest amounted to L.E. 854, calculate the Exact interest and then.

Find the public investment rate.

Solution:

2019 is a simple year and so when calculating the Exact interest.

Ie = (72 /73) Io

Ie = (72 /73) 854 = 842.3

Calculate the period :

The period from 9/2/2019 to 9/6/2019

Period = Feb Mar Apr May June

= (28 - 9) + 31 + 30 + 31 + 9 = 120 days

Or:

The period from 9/2/2019 to 9/6/2019

41

Period = 4 months

Calculate the rate :

- By using Ordinary interest ( Io) :

Io = a × i × (d /360)

854 = 20000 × i × (120 /360)

i = 854 / {20000 × (120 /360} = 12.8%

or :

- By using Exact interest ( Ie) :

Ie = a × i × (d /365)

842.3 = 20000 × i × (120 /365)

i = 842.3 / {20000 × (120 /365} = 12.8%

Example: If the difference between the ordinary interest and the Exact interest of

the amount L.E. 150000 was invested in a simple interest for 235 days in 2019 is

L.E. 150 .

Find the following:

1. the ordinary and the Exact interest

2. Rate of investment used.

Solution:

2019 is a simple year and so when calculating the Exact interest.

Io - Ie = (1 /72) Ie

150 = (1 /72) Ie

Ie = 72 × 150 =10800

Io - Ie = (1 /73) Io

150 = (1 /73) Io

41

Io = 73 × 150 = 10950

Calculate the rate :

- By using Ordinary interest ( Io) :

Io = a × i × (d /360)

10950 = 150000 × i × (235 /360)

i = 10950 / {150000 × (235 /360} = 11,2%

or :

- By using Exact interest ( Ie) :

Ie = a × i × (d /365)

10800 = 150000 × i × (235 /365)

i = 10800 / {150000 × (235 /365} = 11.2%

Example: If the difference between the ordinary and the Exact interest of the

amount of L.E. 150 and the simple interest rate used 12% per annum if this

amount invested from 24/6/2019 until 15/12/2019.

Required: Find the amount invested , period , principle.

Solution:

2019 is a simple year and so when calculating the Exact interest and ordinary

interest:

Io - Ie = (1 /72) Ie

150 = (1 /72) Ie

Ie = 72 × 150 =10800

Io - Ie = (1 /73) Io

150 = (1 /73) Io

42

Io = 73 × 150 = 10950

Calculate the period :

The period from 24/6/2019 until 15/12/2019.

Period = June July Aug Sep Oct Nov Dec

= (30 - 24) + 31 + 31 + 30 + 31 + 30 + 15 = 174 days

Io = 10950

, i = 12% annually

,

n = 174 days

Calculate the principle :

- By using Ordinary interest ( Io) :

Io = a × i × (d /360)

10950 = a × 0.12 × (174 /360)

a = 10950 / {0.12 × (174 /360} = 188793.1

or :

- By using Exact interest ( Ie) :

Ie = a × i × (d /365)

10800 = a × 0.12 × (174 /365)

a = 10800 / {0.12 × (174 /365} = 188793.1

Example: On 13/5/2019 Zaki Labib borrowed L.E. 30000 from a bank that

calculates simple interest at the rate of 15% per annum and agreed with the bank to

repay the loan on 18/8/2019.

Required: Calculate the interest and the amount with the ordinary interest once and

with the exact interest.

Solution:

a = 30000

, i = 15% annually

,

n = 97 days

The period from 13/5/2019 to 18/8/2019

43

Period = May June July Aug

= (31- 13) + 30 + 31 + 18 = 97 days

- Exact interest (Ie) :

Ie = a × i × (d /365)

Ie = 30000 × 0.15 × (97 /365) = 797.26

The amount with the Exact interest:

Se = a + Ie

Se = 30000 + 797.26 = 30797.26

Se = a ( 1 + i × n)

Or:

Se = 30000 { 1 + 0.15 × (97 /365)} = 30797.26

- Ordinary interest ( Io) :

Io = a × i × (d /360)

Io = 30000 × 0.15 × (97/360) = 808.33

The amount with the Ordinary interest:

So = a + Io

So = 30000 + 808.33 = 30808.33

So = a ( 1 + i × n)

Or:

So = 30000 { 1 + 0.15 × (97 /360)} =30808.33

Calculate interest and amount for several unequal amounts :

Financial transactions are not limited to the deposit or borrowing of one

amount but can be deposited or borrowed several amounts and each amount has its

own period, whether this period months or days, the interest can be found on these

amounts.

Under this method, if interest rate (i) is held constant for all amounts, the total

interest on the amounts can be calculated by the following steps:

44

1- Total interest :

I = I 1 + I2 + I3 + I4

I = (a1 × i × n1) + (a2 × i × n2) + (a3 × i × n3) + (a4 × i × n4)

I = i { (a1 × n1) + (a2 × n2) + (a3 × n3) + (a4 × n4)}

I = i% × (ai × ni)

{(ai)× (ni)}

I = i% × ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

12 or 360 or 365 or 366

2- Total amount

S = S1 + S2 + S3

+ S4 + S5

S = (a1 + I1 ) + (a2 + I2 ) + (a3 + I3 )

S = {a1 + (a1 × i × n1)} + {a2 + (a2 × i × n2)} + {a3 + (a3 × i × n3)} + {a4 +

(a4 × i × n4)} + {a5 + (a5 × i × n5)}

S = {a1 + a2 + a3 + a4 + a5 } + i { (a1 × n1) + (a2 × n2) + (a3 × n3) + (a4 ×

n4)} + { (a5 × n5)}

S = ( ai ) + { i × (ai × ni)}

{(ai)× (ni)}

S = ( ai ) + i % × ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

12 or 360 or 365 or 366

Example: Abu Ali invested the following amounts in 2019 using a simple interest

rate of 12% per annum.

10000 L.E. for 50 days.

20000 L.E. for 100 days.

45

40000 L.E. for 200 days.

25000 L.E. for 300 days.

Calculate the total interest on these amounts as well as the total receivable in both

cases:

1. Using Ordinary interest .

2. Using the Exact interest .

Solution:

- First: Total interest Using Ordinary interest (Io):

I = I 1 + I2 + I3

I = (a1 × i × n1) + (a2 × i × n2) + (a3 × i × n3) + (a4 × i × n4)

Io = {10000 × 0.12 × (50\360)} + {20000 × 0.12 × (100\360)} + {40000 × 0.12

×(200\360)} + {25000 × 0.12 × (300\360)}

I = 166.67 + 666.67 + 2666.67 + 2500 = 6000

- Total amount Using Ordinary interest (Io):

S = S1 + S2 + S3

S = (a1 + I1 ) + (a2 + I2 ) + (a3 + I3 )

So= a1 ( 1 + i × n1) + a2 ( 1 + i × n2) + a3 ( 1 + i × n3)

So= 10000{1 + 0.12 × (50\360)} +20000 {1 + 0.12 × (100\360)} + 40000{1 +

0.12 × (200\360)} + 25000{1 + 0.12 × ( 300\360)}

So= 10166.67 + 20666.67 + 42666.67 + 27500 = 106000

- Second: Total interest Using Exact interest:

- Exact interest (Ie) : 2019 is a simple year

I = I 1 + I2 + I3

I = (a1 × i × n1) + (a2 × i × n2) + (a3 × i × n3) + (a4 × i × n4)

46

Ie = {10000 × 0.12 × (50\365)} + {20000 × 0.12 × (100\365)} + {40000 × 0.12

×(200\365)} + {25000 × 0.12 × (300\365)}

Ie = 5917.8

- Total amount Using Exact interest:

S = S1 + S2 + S3

S = (a1 + I1 ) + (a2 + I2 ) + (a3 + I3 )

Se= a1 ( 1 + i × n1) + a2 ( 1 + i × n2) + a3 ( 1 + i × n3)

Se= 10000{1 + 0.12 × (50\365)} +20000 {1 + 0.12 × (100\365)} + 40000{1 +

0.12 × (200\365)} + 25000{1 + 0.12 × ( 300\365)}

Se= 105917.8

Anther Soluation:

Calculate the sum of ( The amounts × Number of days):

The amounts

(ai)

Number of days

(ni)

The amounts × Number of

10000

50

500000

20000

100

1000000

40000

200

8000000

25000

300

7500000

95000

18000000

days {(ai)× (ni)}

- First: Total interest Using Ordinary interest (Io):

Total interest = i% ×

( The amounts × Number of days)

ــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

360

47

{(ai)× (ni)}

Io = i% × ــــــــــــــــــــــــــــــــــ

360

18000000

Io = 0.12 × = ــــــــــــــــــــــــــــــــــــــــــــ6000

360

The total amount with the Ordinary interest:

Total due to him at the end of the period =Total amounts + Total Ordinary interest:

S o = a + Io

So = 95000 + 6000 = 106000

- Second: Total interest Using Exact interest:

- Exact interest (Ie) :

Total interest = i% ×

( The amounts × Number of days)

ــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

365

{(ai)× (ni)}

Ie

= i% × ــــــــــــــــــــــــــــــــــ

365

Ie = 0.12 ×

18000000

= ــــــــــــــــــــــــــــــــــــــــــــ5917.8

365

The total amount with the Ordinary interest:

Total due to him at end of period = Total amount + Total

S e = a + Ie

Se = 95000 + 5917.8 = 105917.8

48

Exact interest:

Example: A person borrowed money from Al-Orouba Bank, which calculates

simple interest at the rate of 12% per annum.

40000 L.E. for 4 months.

60000 L.E. for 5 months.

50000 L.E. for 6 months.

Find the accured interest on that person and total amount.

Solution:

- First: Total interest

I = I 1 + I2 + I3

I = (a1 × i × n1) + (a2 × i × n2) + (a3 × i × n3) + (a4 × i × n4)

Io = {40000 × 0.12 × (4\12)} + {60000 × 0.12 × (5\12)} + {50000 × 0.12

×(6\12)}

I = 1600 + 3000 + 3000 = 7600

- Total amount Using Ordinary interest (Io):

S = S1 + S2 + S3

S = (a1 + I1 ) + (a2 + I2 ) + (a3 + I3 ) = ai ( 1+ i × ni)

S = a1 ( 1 + i × n1) + a2 ( 1 + i × n2) + a3 ( 1 + i × n3)

S = 40000{1 + 0.12 × (2\12)} +60000 {1 + 0.12 × (5\12)} + 50000{1 + 0.12

×(6\12)}

S = 41600 + 63000 + 53000 = 157600

49

Anther Solution:

Where the periods of months and therefore:

The amounts

(ai)

Number of

months (ni)

The amounts × Number of

40000

4

160000

60000

5

300000

50000

6

300000

001111

760000

months {(ai)× (ni)}

( The amounts × Number of Months)

Total interest = i% × ــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

12

{(ai)× (ni)}

I = i% × ــــــــــــــــــــــــــــــــــ

12

760000

I = 0.12 × = ـــــــــــــــــــــــــــــــــــــ7600

12

The total amount :

Total due to him at the end of the period =Total amounts + Total interest:

S= a + I

S = 150000 + 7600 = 157600

Or

{(ai)× (ni)}

S = ( ai ) + i × ـــــــــــــــــــــــــــــــــــــــــــــــــ

12

Example: Hadi owes the following amounts:

5000 L.E. due in (or payment on) 1/3/2018.

6000 L.E. due in (or payment on) 1/5/2018.

51

7000 L.E. due in (or payment on) 1/6/2018.

If Hadi is unable to pay its due dates, all of them are required to be paid on

1/12/2018 at a simple interest rate of 12% per annum.

Solution:

5000

6000

7000

S

12%

1\3\2018

1\5

1\6

1\12

On the maturity date of the new debt 1\12\2018

Thus, the first debt period of the debt is 9 months.

Thus, the second debt period is 7 months.

Thus, the period of the third debt is 6 months.

Using the method, you can calculate interest to be paid:

The amounts

(ai)

Number of

months (ni)

The amounts × Number of

5000

9

45000

6000

7

63000

7000

6

63000

18000

171000

months {(ai)× (ni)}

( The amounts × Number of Months)

Total interest = i% ×

ــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

12

{(ai)× (ni)}

I = i% × ــــــــــــــــــــــــــــــــــ

12

51

I = 0.12 ×

171000

= ــــــــــــــــــــــــــــــــــــــــــــ1710

12

- The total amount :

Total due to him at the end of the period =Total amounts + Total interest:

S= a + I

S = 18000 + 1710 = 19710

Or

{(ai)× (ni)}

S = ( ai ) + i% × ـــــــــــــــــــــــــــــــــــــــــــــ

12

Example: A trader borrowed the following amount from a bank:

30000 L.E. on 25/3/2020.

40000 L.E. on 18/5/2020.

80000 L.E. on 29/6/2020.

All of which were to be repaid on December 15, 2018 at an interest rate of 8% per

annum.

Required: Calculate of the amount to pay for the Exact

interest as well as

Ordinary interest.

Solution:

- Calculate the period :

Period = Mar Apr May June July Aug Sep Oct Nov Dec

= 6 + 30 + 31 + 30 +31 + 31+ 30 + 31 + 30 + 15 = 265

=

=

13 + 30 +31 + 31+ 30 + 31 + 30 + 15 = 211

1 +31 + 31+ 30 + 31 + 30 + 15 = 169

52

The amounts

(ai)

Number of days

(ni)

The amounts × Number of

30000

265

7950000

40000

211

8440000

80000

169

13520000

150000

29910000

days {(ai)× (ni)}

- First: Total interest Using Ordinary interest:

Total interest = i% ×

( The amounts × Number of days)

ــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

360

{(ai)× (ni)}

Io

= i% × ــــــــــــــــــــــــــــــــــ

360

29910000

Io = 0.08 × = ــــــــــــــــــــــــــــــــــــــــــــ6646.67

360

The total amount with the Ordinary interest:

Total due to him at the end of the period =Total amounts + Total Ordinary interest:

S o = a + Io

So = 150000 + 6646.67 = 156646.67

- Second: Total interest Using Exact interest:

Exact interest (Ie) : 2020 is a leap year

( The amounts × Number of days)

Total interest = i% ×

ــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ

366

53

{(ai)× (ni)}

= i% × ــــــــــــــــــــــــــــــــــ

366

29910000

Ie = 0.08 × = ــــــــــــــــــــــــــــــــــــــــــــ6537.7

366

The total amount with the Exact interest:

Ie

Total due to him at end of period = Total amount + Total

Exact interest:

S o = a + Ie

Se = 150000 + 6537.7= 15637.7

Thus, It is noted that the total ordinary interest is greater than the total of the exact

interest .

54

Exercise

1) Find the simple interest in each of the following cases, assuming that the year

contains 360 days when the time expressed in days:

1

2

3

4

Principal

(L.E.)

15000

3000

5000

2000

Interest Rate

(%)

8

7.5

9

6.8

5

9000

9.2

6

4000

8.4

No

Time

4 years

6 years

185 days

18 months

3 years, 3

months

75 days

2) Determine the number of days using the exact and the approximate methods in

each of the following cases:

From

To

1. January 13. 2020

May 16. 2020

2. April 6.2020

July 27.2020

3. October 8.2020

March 21, 2021

4. December 24.2020

April 9.2021

5. November 28.2020

May 13.2021

6. February 14.2019

June 18.2019

3) Determine the times as a fraction of a year for calculating ordinary interest and

exact interest in each of the following cases:

No

1

2

3

4

5

6

From

January 3.2020

April 8.2021

October, 3.2020

December 4.2020

November 8.2020

February 4.2019

To

May 6.2020

July 7.2021

March 2.2021

April 5.2021

May 3.2021

June 8.2019

4) Find the ordinary interest using the formula method and the exact interest by

the relationship between the two interests in each of the following cases:

55

No

1

2

3

4

5

6

Principal (L.E.)

5000

7000

5000

1000

8000

4000

Interest Rate (%)

8

7.5

9

6.8

9.2

8.4

Time

140 days

175 days

150 days

173 days

125 days

173 days

5) For each of the following (I0 - Ie) find Io then Ie:

1.) 30 L.E.

3. ) 40 L.E.

2.) 50 L.E.

4. ) 80 L.E.

6) For each of the following (I0 - Ie ) find Io then Ie:

1.) 16 L.E.

3. 4 L.E.

2.) 15 L.E.

4.) 8 L.E.

7) For each of the following (I0 + Ie) find Ie then Io:

1.) 605 L.E.

3.) 968 L.E.

2.) 726 L.E.

4.) 1331 L.E.

8) For each of the following (I0 + Ie) find Io then Ie:

1.) 209 L.E.

3.) 1015 L.E.

2.) 870 L.E.

4.) 725 L.E.

9) In each of the following problems, find the unknown symbols:

No

p

i

n

I

S

1

10000

10%

6 months

?

?

2

15000

?

4 months

?

1560

3

2000

8%

? years

400

?

4

30000

?

150 days

?

3045

5

50000

6%

? months

?

200

10)

a)

b)

c)

Solve the following problems :

Find the simple interest and the amount on 40000 L.E. at 6% for 90 days?

Find the simple interest and the amount on 50000 L.E. at 7.5% for 2.5 years?

A woman borrowed a loan of 20000 L.E. from a bank at 12% for 9 months.

How much must she repay at the end of this period?

d) If a loan of 50000 L.E. is borrowed at 10%, what is the amount due at the

end of 2.75 years?

56

e) If a loan of 20000 L.E. is borrowed at 11% for 9 months, what is the amount

due at the end of the period?

f) A man borrowed 10000 L.E. for 80 days at 10%. How much he must repay?

g) On February 22, 2012, a man borrowed 24000 L.E. at 8.5% for 160 days.

What is the amount must he repay? And when?

h) At what interest rate will 20000 L.E. yield 212.3 L.E. in 140 days? And what

is the amount?

i) A man borrowed 10000 L.E and paid 10712.5 L.E. after 9 months. What

was the interest rate charged for this debt?

j) How many years are needed for 5010 L.E. to yield 1200 L.E simple interest

at 8% rate of interest?

k) How many days will be required for 18000 L.E. to yield 202.5 L.E. interest

at 9%?

l) How many months are necessary for 12000 L.E. to yield 640 L.E. interest at

8%?

57

58

Chapter ( 2 )

Present value and discount

95

06

Chapter ( 2)

Present value and discount

Introduction:

In the previous chapter, we discussed how to calculate the sum of an amount

at the end of a given investment or borrowing period (n), by indicating the value of

the principle (a) and the rate of interest (i). In some cases, however, the value is

the sum of the amount due at the end of a certain period, which is usually called

the matuitry value (or face value) of the loan in the case of borrowing or the sum

of the amount invested in the case of investment or deposit. It is required to know

the value of the loan on a date preceding the date of entitlement, , This value is

called the present value and is usually less than matuitry value of the amount

called the discount, since the creditor usually gives the debtor a discount in case of

repayment of the loan before the date of entitlement.

present value (a)

Discount× (D)

period (n)

Rate of interest (i%)

Rate of discount (d%)

Amount (S)

×

We have explained above that the owner of the capital is entitled to the

operation of his money so-called interest whether in the form of investment interest

or loan interest, and that this interest is due to the exploitation of capital, if it was a

limited number of days, so that the capital does not remainidle one day, A person

for the capital of another person obliges the debtor to pay the interest of such

money at an agreed interest rate and for the duration of the debtor's possession of

06

the money. If a person borrows L.E. 1,000 from another person and agrees that the

debtor will pay the amount at the end of one year from now,with the rate of interest

12% Annually, this means that the debtor is obliged to pay the amount of L.E.

1120 at the end of the year, which is For the principal amount plus interest for the

year at a rate of 12%.

If a person is a creditor of another person in the amount of L.E. 1000 , which

is worth paying after one year, this means that the amount is not equal to L.E.

1000 except on the due date, ie after one year. If the debtor wants to pay his debt

now( befor the due date) he will the obtains discount, This is called the discount

(deduction) of the acceleration of the payment and the reward for repaying its debt

before the payment date. Therefore, what is being paid now is the present value of

the debt rather than the original debt and the difference between them is the

discount.

Basic concepts:

Suppose if a person borrowed from a bank an amount today and this amount is

payable at the end of a certain period, the value of the amount on the due date or

payment called maturity (or fase) value, and the amount on the date of borrowing

is called the present value.

If we assume that the debtor wanted to repay the debt before the maturity date, it

will pay a value less than the maturity value by the amount of deduction it is

entitled to for the period from the date of repayment of the debt until the date of

entitlement.

From the above, the following concepts can be reached:

- Maturity value or ( face value) : Is the value of the debt on the maturity

date and is the sum of the amount, symbolized by the symbol (S).

- Present value: Is the value of the debt at a date prior to the date of

entitlement (maturity date), symbolized by the symbol (a).

06

-

Simple present value: Is the difference between the maturity value and the

simple discount. This difference, if invested by simple interest for the

period (duration) of the debt and at the rate used, is at the end of the period

equal to the maturity value and is symbolized by the symbol (ae).

- Bank present value or commercial present value (proceeds) : Is the

difference between the maturity value and the bank discount. This

difference, if invested by simple interest rate (or discount rate) for the period

(duration) of the debt and the rate used, is at the end of the period equal to

the maturity value and is symbolized by the symbol (a0).

-

Discount : The amount that to be wavied by the creditor to the debtor for

the repayment of the debt before the due date or the interest due to the debtor

as a result of the repayment of the debt on any date prior to maturity. This is

the difference between the maturity value and the present value and is

symbolized by the symbol (X).

- Simple discount: Which is the difference between the maturity value and

the simple present value or the interest of the simple present value of the

due to the debtor as a result of repayment of the debt on a date prior to

maturity date and is symbolized by the symbol (Xe).

- Bank discount: Is the difference between the maturity value and the bank

(commercial) present value or the interest of the bank present value of the

due to the debtor as a result of repayment of the debt on a date prior to

maturity and is symbolized by the symbol (X0).

- Discount Date:Is the date on which the debt is discounted, ie its present value is

determined before the due date.

- Duration of the discount (discount period):Is the period between the date of

the discount and the due date.

Equation of calculating present value and discount:

06

In general,

Maturity Value = Present Value + Discount

S=a+X

Such as:

Present Value = Maturity Value - Discount

a=S–X

Discount = Maturity Value - Present Value

X= S–a

The Present value and discount laws can be expressed as follows:

1- Simple present value and simple discount:

-

Simple present value:

Simple Present Value = Maturity Value - Simple Discount

ae = S - Xe

or

S

ae = ـــــــــــــــــــــــــ

1+i× n

- Simple discount:

Simple Discount = Maturity Value - Simple Present Value

Xe = S – ae

Or

Xe = ae × i × n

Or

Xe =

S× i× n

ـــــــــــــــــــــــــ

1+ i× n

2- Commerial present value or bank present value( proceeds) and bank

discount:

- Commerial present value or bank present value( proceeds):

06

Bank Present Value = Maturity Value – Bank Discount

ao = S – Xo

ao = S ( 1 – i × n)

or

- Bank discount:

Bank Discount = Maturity Value - Bank Present Value

Xo = S – ao

Or

Xo = S × i × n

From the above we note that:

- Bank discount (X0) is always greater than the Simple discount (Xe) because the

Bank discount is calculated on the basis of the maturity value ,while, the Simple

discount is calculated on the basis of the present value, and where the maturity

value is greater than the present value:

Xe < X0.

- The Commerial present value ( proceeds) (ao) is always less than the Simple

present value (ae) where:

ae = S – Xe

ao = S – Xo

Since:

Xe < X0

is:

a o < ae

- If the desired present value type and the type of discount required are not

specified in the exercise, the bank present value and the bank discount is required.

- We can calculate the simple discount if we know the bank discount by using the

equation:

X0

Xe = ـــــــــــــــــــــــــ

1+i× n

09

- We can calculate the bank discount if we know the simple discount by using the

equation:

Xo = Xe ( 1 + i × n)

Example: A debt whose maturity value is L.E. 20000 is payable after 18 months

with a simple interest rate of (equal discount rate ) 12% per annum.

Required:

1- Simple present value and simple discount.

2- Commerial present value and bank discount.

Soluation:

S = 20000

,

n = 18 months = 18 \ 12= 1.5

,

i = 12 %

1- Simple present value and simple discount:

-

Simple present value:

Simple Present Value = Maturity Value - Simple Discount

ae

ae = S - Xe

S

= ـــــــــــــــــــــــــ

1+i× n

20000

ae = ـــــــــــــــــــــــــ

( 1+ 0.12 × 1.5)

20000

ae = = ـــــــــــــــــــــــــ16949.15

1.18

- Simple discount:

Simple Discount = Maturity Value - Simple Present Value

Xe = S – ae

Xe = 20000 – 16949.15 = 3050.85

Or:

Xe = ae × i × n

00

Xe = 16949.15 × 0.12 × 1.5 = 3050.85

Note: We can calculate the simple discount , if we know the meturity value by

using the following formula:

S× i× n

ـــــــــــــــــــــــــ

1+ i× n

Xe =

Xe =

(20000 × 0.12 × 1.5)

ـــــــــــــــــــــــــــــــــــــــــــــــــ

( 1+ 0.12 × 1.5)

Xe =

(3600)

= ــــــــــــــــــــــــــــ3050.85

(1.18)

Note: We can calculate the simple peresnt value , if we know the simple discount

by using the following formula:

Simple Present Value = Maturity Value - Simple Discount

ae = S – Xe

ae = 20000 – 3050.85 = 16949.15

2- Commerial present value or bank present value (or proceeds):

ao = S ( 1 – i × n)

ae = 20000 ( 1 – 0.12 × 1.5) = 16400

- Bank discount:

Bank Discount = Maturity Value - Bank Present Value

Xo = S – ao

Xo = 20000 – 16400 = 5600

Or:

Xo = S × i × n

Xo = 20000 × 0.12 × 1.8 = 3600

Note: We can calculate the simple discount , if we know the simple discount by

using the following formula:

Xo = Xe ( 1 + i × n)

06

Xo = 3050.85 ( 1 + 0.12 × 1.5) = 5600

Note: We can calculate the peresnt value , if we know the bank discount by using

the following formula:

Bank Present Value = Maturity Value – Bank Discount

ao = 20000 – 3600 = 16400

Note: We can calculate the simple discount , if we know the bank discount by

using the following formula:

X0

Xe = ـــــــــــــــــــــــــ

1+i× n

3600

Xe = = ـــــــــــــــــــــــــ3050.85

( 1+ 0.12 × 1.5)

Example: A person who owes a loan that is repayable at the end of 6 months. The

simple present value of this loan is calculated on the basis of a discount rate of 9%

per annum, which is L.E. 60000.

Required: Calculate the simple discount and matuirty value of the loan.

Soluation:

ae = 60000 ,

n = 6 months = 6 \ 12= 0.5

,

i=9%

- Simple discount:

Xe = ae × i × n

Xe = 60000 × 0.09 × 0.5 = 2700

-

Maturity Value = Present Value + Discount

S = ae + Xe

S = 60000 + 2700 = 62700

06

Or :

S= p ( 1+ i × n)

S= 60000 ( 1+ 0.09 × 0.5) = 62700

Example: A maturity value of L.E. 60000, payable at the end of 6 months, with a

bank present value of L.E. 528,000.

Required: Calculate the simple present value and the simple discount.

Soluation:

ae = 60000 ,

n = 6 months = 6 \ 12= 0.5

,

ao = 52800

- Calculate the bank discount

Bank discount = maturity value - bank present value.

Xo = S – ao

Xo = 60000 – 52800 = 7200

- Calculate the rate of interest:

Xo = S × i × n

7200 = 60000 × i × 0.5

7200

i = = ــــــــــــــــــــــــــــــــــــــ24%

( 60000 × 0.5)

- Simple present value:

S

ae = ـــــــــــــــــــــــــ

1+i× n

60000

Xe = = ــــــــــــــــــــــــــــــــــــــ53571.43

( 1+ 0.24 × 0.5)

05

- Simple discount:

Simple Discount = Maturity Value - Simple Present Value

Xe = S – ae

Xe = 60000 – 53571.43 = 6428.57

Or : you can calculate the simple discount using the formula:

Xe = ae × i × n

Xe = 53571.43 × 0.24 × 0.5 = 6428.57

Or Note: We can calculate the discount , if we know the meturity value by using

the following formula:

S× i× n

Xe = ـــــــــــــــــــــــــ

1+i× n

(60000 × 0.24 × 0.5)

Xe = = ــــــــــــــــــــــ ـــــــــــــــــــــــــ6428.57

( 1+ 0.24 × 0.5)=

Or We can calculate the simple discount if we know the bank discount by using

the equation:

X0

Xe = ـــــــــــــــــــــــــ

1+i× n

2700

Xe = = ـــــــــــــــــــــــــ6428.57

( 1+ 0.24 × 0.5)

Example: If the bank discount of a debt is due (repayable) at the end of 18

months at a simple interest rate of 8% per annum is L.E. 1080 .

66

Required: Calculate the simple discount for this debt as well as the matuirty value,

simple present value, and commercial present value.

Soluation:

Xe = 1080 ,

-

n = 18 months = 18 \ 12= 1.5

,

i=8%

calculate the simple discount if we know the bank discount by using the

equation:

X0

Xe = ـــــــــــــــــــــــــ

1+i× n

1080

Xe = = ـــــــــــــــــــــــــ964.29

( 1+ 0.08 × 1.5)

- calculate the matuirty value , if we know the bank discount by using the

following formula:

Xo = S × i × n

1080 = S × 0.08 × 1.5

1080

S = = ـــــــــــــــــــــــــ9000

(0.08 × 1.5)

- calculate the peresnt value , if we know the bank discount by using the

following formula:

Bank Present Value = Maturity Value – Bank Discount

ao = S – Xo

ao = 9000 – 1080 = 7920

- Simple present value:

S

ae = ـــــــــــــــــــــــــ

1+i× n

66

9000

Xe = = ـــــــــــــــــــــــــ8035.71

( 1+ 0.08 × 1.5)

or : Simple Present Value = Maturity Value - Simple Discount

ae = S – Xe

ae = 9000 – 694.29 = 8035.71

Relationship between the bank discount (X0 ) and the simple discount (Xe ):

1. The ratio between the bank discount simple discount:

Xo

S× i× n

ـــــــــــــــــــــــــــــــــ = ــــــــــــــ

Xe

ae × i × n

Xo

S

ـــــــــــــــ = ــــــــــ

Xe

S

Xo = × ــــــــــــــــ

ae

Xe

ae

ae

Xe = × ــــــــــــــــ

Xo

S

Previous relationships are used to find one of the discount if the other

opponent knows the face value and the simple present value.

S× i× n

Xe = ـــــــــــــــــــــــــ

1+i× n

Xo

S× i× n

ــــــــــــــــــــــــــــــــــــــــــــــــ = ــــــــــــــ

Xe

(S × i × n)\ 1 + i × n

Xo

= ــــــــــــــ1 + i × n

Xe

66

Previous relationships are used to find one of the discount if the opponent

knows the other and the interest rate and period.

2. The difference between the bank discount (Xo) and the simple discount (Xe):

Xo

S × i2 × n2

- Xe = ـــــــــــــــــــــــــ

1+i× n

Or:

Xo = S × i × n

Xo × i × n

Xo - Xe = ـــــــــــــــــــــــــ

1+i× n

or

S× i× n

Xe = ـــــــــــــــــــــــــ

1+i× n

Xo - Xe = Xe × i × n

Or

S

ae = ـــــــــــــــــــــــــ

1+i× n

Xo - Xe = ae × i2 × n2

Use previous relationships if the exercise gives the difference between the

bank discount and the simple discount, the interest rate, the period, and ask for the

face value, the bank discount, the simple discount, and the simple present value.

Example: a debtor owes L.E. 9900 due in (payment after) a certain period,

calculated the simple present value of this debt was L.E. 9000.

Required: Find bank present value and bank discount.

66

The solution:

S = 9900

,

a0 = 9000

- Simple discount:

Simple Discount = Maturity Value - Simple Present Value

Xe = S – ae

Xe = 9900 – 9000 = 900

Xo

S

ـــــــــــــــ = ــــــــــ

Xe

ae

Xo

9900

ـــــــــــــــ = ــــــــــ

900

9000

9900

Xo = × ــــــــــــــــ

900 = 990

9000

- Bank present value:

Bank Present Value = Maturity Value – Bank Discount

ao = S – Xo

ao = 9900 – 990 = 8910

Example: A debt whose face value is L.E. 36630 , with a bank present value of

L.E. 36297 , what is the simple present value of this debt.

The solution:

S = 36630

,

ao = 36297

- Bank discount (Xo):

Xo = S – ao

Xo = 36630 – 36297 = 333

66

in which :

Xe = S – ae

Xe = 36630 – ae

333

= ــــــــــ ــــــــــ

36630

ـــــــــــــــ

(36630 - ae )

333 ae =

ae

36630 ( 36630 - ae )

ae = 1341756900 \ 36960 = 36300

Example: Caculate the difference between the bank discount and the simple

discount for a debt that is repayable after 15 months, it is found that it is L.E.

1085.21 with a simple interest rate of 12% per annum.Find the face value.

The solution:

Xo - Xe = 1085.21 , n = 15 months = 15\12 = 1.25 , i = 12%

Xo

S × i2 × n2

- Xe = ـــــــــــــــــــــــــ

1+i× n

S = 55466.29

Example: A person owes the bank a sum of L.E. 40000 payable at the end of the

year. If you know that the ratio of the bank discount to the simple discount is

equal to 1.04 and that the interest rate is equal to the discount rate: caculate

- Simple present value and bank present value.

- The simple discount and bank discount.

- The interest rate (discount rate).

69

The solution:

S = 40000 , n = 1 year

, Xo \ Xe = 1.04

- Calculate the simple present value:

Xo

S

ـــــــــــــــ = ــــــــــ

Xe

ae

S

1.04 = ـــــــــــــــ

ae

40000

1.04 = ـــــــــــــــ

ae

ae = 40000 \ 1.04 = 38461.54