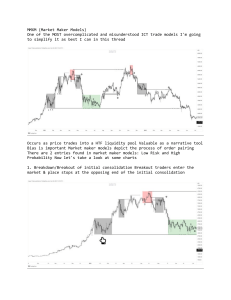

4 Cardinal laws of Price action – Execution protocols 1. Market environment - choppy, asymmetric market structure, no respect of Premium Arrays and inability to displace through opposite side Discount Arrays (Shophunt on low when shorting careful → SMR condition for Longs) 2. There has to be an obvious DOL (no counter DOL) 3. Before price starts moving in the direction of DOL there has to be some manipulation → hit to some HTF Imbalance or liquidity → LRLR 4. SMR conditions have to be fulfilled - Setup + synchronous displacement of at least 3 handles and strong close PDAs are respected and opposite PDA are easily traded through with displacement o LRLR - price has to break certain PDAs that are in the opposition on HTF if they show resistance -> HRLR low probability conditions When you lower your standards for entry a loss in eminent When you are uncertain about the intraday DOL look at both NQ and ES 2 LRLRs in opposite directions could cause PA to be sideway for rest of the day Do not try the same trade twice Most common mistakes: 1. invalid environment (choppy PA/non symmetrical market structure), 2. Manipulation not done, 3. No displacement or no synch. displacement, 4. HTF PDA missed -> SMR missed, 5. SMR condition unfulfilled 4 Cardinal laws of Price action – Execution protocols 1. 2. 3. 4. How is price delivering (LRLR-HRLR) Where is it delivering (DOL) How will it induce retail the other way (manipulation) How is it going to deliver (PDAs matrix - LRLR signatures) Requirements for LRLR 1. 2. 3. 4. Clean PA, symmetric MS on NQ ES Obvious DOL (REL, REH, FVG) Manipulation → liquidity of HTF Imbalance → LRLR SMR conditions How could things go wrong? 1. 2. 3. 4. Choppy PA, asymmetric MS on NQ ES Obvious counter DOL (REL, REH, FVG) No manipulation (no stophunt or HTF PDA hit) Counter SMR condition Price action read for both directions looking for high probability LRLR using 4 cardinal laws of PA (high probability = only frameable in one direction) 1. Constantly look for symmetric MS on ES and NQ, Clean PA (PDAs are supporting price, there is displacement no choppy consolidation or HRLR) 2. Obvious DOL (REL, REH, FVG) in both directions 3. Manipulation (Judas) hitting some HTF PDA (9:30 - 9:50 and on) or stophunt in strong trending market 4. Constantly check PDAs, liquidity, and synchronous displacement in both directions - Displacement through 2 PDAs (FVG, BR, liquidity, IFVG) - Displacement through liquidity → Retrace only to 1st PDA at most → continuation LRLR - HRHR, Both directions 1. Obvious DOL and counter DOL 2. Manipulation → liquidity of HTF Imbalance → LRLR 3. Choppy/clean PDA use, a/symmetric MS on both NQ ES, easy/tough time displacing through opposite PDAs 4. SMR and counter SMR conditions What is it drawn to? (DOL) How will it induce retail the other way? (manipulation) How is price delivering through opposite PDAs? (LRLR-HRLR) How is it going to deliver (PDA use - LRLR signatures) Trading rules No trades pre 9:50 manipulation 1:1 R + 1 tick and mb small partial on, for DOL No reentries of the same trade idea with different setup Questionable displacement = no trade LRLR – HRLR, both directions 1. Find obvious DOL - SSL and BSL → HTF to LTF 2. Expect manipulation → SMR in Liquidity or HTF imbalance 3. Validate the environment → symmetric MS and displacement in NQ = ES - Asymmetric MS or displacement → Choppy PA (accumulation for manipulation) 4. Look for discount and premium arrays and reading the MS (ITLs and ITHs) - → Formation of ITL → displacement to DOL - Inability to displace to DOL → Choppy PA or SMR Mark DOL - sellside and buyside + HTF PDAs Mark the MS in charts for better orientation (STH, ITH, LTH) Mark the discount and premium arrays Trading rules No trades pre 9:50 manipulation 1:1 R + 1 tick and mb small partial on, for DOL No reentries of the same trade idea with different setup Questionable displacement = no trade LRLR principles 1. Find obvious DOL - SSL and BSL → HTF to LTF 2. Expect manipulation → SMR in Liquidity or HTF imbalance Constant read of Order Flow 3. Validate the environment → symmetric MS and displacement in NQ = ES o Asymmetric MS or displacement → Choppy PA (accumulation for manipulation) 4. Mark the Key PD array and Propulsion array → (should resume LRLR to DOL) o Displacement through Key PD array → SMR (reverse Key PDA and Propulsion array) o Inability to displace through Propulsion array → Choppy PA Trading rules No trades pre 9:50 manipulation Questionable displacement = no trade Trades only in Premium for shorts and Discount for longs Only 1 trade per DOL 1:1 R + 1 tick and mb small partial on, for DOL 2 DOLs per session