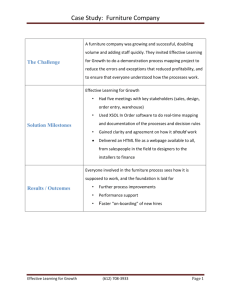

thought-leadership-paper full strategic-roadmap-for-furniture-sector-of-india

advertisement