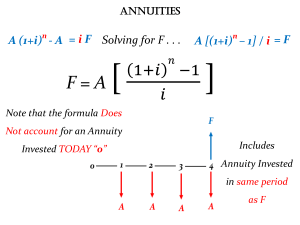

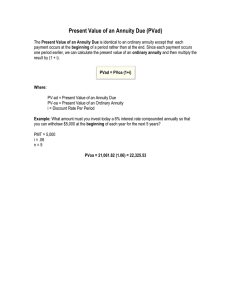

Section 1 1 Ordinary Annuity Section Objectives: 1. Define the basic terms involved with annuities. 2. Find the amount of an annuity via Table Factors and Future Value Formula 3. Use the formula to find the present value of an ordinary annuity. OBJECTIVE 1 Define the basic terms involved with annuities. In Module 2, we discussed lump sums that were invested for periods of time. In this module, we talk about an annuity, or a series of equal payments made at regular intervals. Monthly mortgage payments, quarterly payments by a company into an employee retirement account, and monthly checks paid by Social Security to a retired couple are examples of annuities. There are two basic types of annuities. One type grows as regular payments are made and it accumulates compound interest. Regular payments into a retirement account or college savings account are examples of this type of annuity. A second type of annuity involves regular payments made out of an accumulated sum. Monthly payments from a retirement fund are an example. Retirement funds can in fact represent both types, with money being added on a regular basis while an employee is working, then with payments being made from the fund after the employee retires will include a discussion of annuities from which payments are made. The basic terms involved are the same for both types. An ordinary annuity is one in which payments are made at the end of each period, such as at the end of each month. The payment period is the length of time between payments and the term of the annuity is the total time needed for all payments. Interest calculations for annuities are done using compound interest. The total amount in an annuity on a future date is the amount, compound amount, or future value of the annuity. These terms are used interchangeably. The amount an annuity grows to can be found using compound interest techniques from the previous module. For example, suppose a firm makes deposits of P30,000 at the end of each year for 6 years into an investment earning 8% compounded annually. Use the compound interest tables in module 2 for 5 years and 8% to find the future value of the first payment as follows: P 30,000 * 1.46933 = P44,079.9 The future value of the annuity is the sum of the compound amounts of all six payments. The annuity ends on the day of the last payment. Therefore, the last payment, which is made at the end of year 6, earns no interest. The future value of the annuity is P 220, 075.9. Find the total amount deposited in the annuity and interest earned as follows: Total deposits = 6 years * P 30,000 per year = P180,000 Interest earned = Future value of annuity - Total deposits =P 220,075.9 – P 180,000 = P 40,075.9 OBJECTIVE 2 Find the amount of an annuity. The amount of an annuity can also be found using the amount of an annuity table on the next page. The number from the table is the amount or future value of an annuity with a payment of P 1. The amount of an annuity with any payment is found as follows. Finding Amount of an Annuity Amount = Payment * Table Factor from amount of an annuity table As a check, reconsider the annuity of P 30,000 at the end of each year for 6 years at 8% compounded annually. Locate 8% at the top of the table and 6 periods in the far left (or far right) column to find 7.33593. Amount = P 30,000 * 7.33593 = P 220,077.9 This amount is identical to the amount calculated earlier, but sometimes the estimates from the table differ slightly from those found using a calculator. Table Factors for an Amount/Future Value of Annuity - Example 1 A father deposits P10,000 every quarter for 5 years in a firm that pays 12% compounded quarterly. Assuming no withdrawals are made, how much would be in his account at the end of five years? Solution Deposits per quarter = 10,000 Interest earned per quarter for 5 years x 4 = 20 quarters. Look across the top of the table for 3, and down the side for 20 periods to find 26.87037 Amount = P 10,000 x 26.87037= P 268,703.7 Total deposits = 20 quarters * P 10,00 per year = P 200,000 Interest earned = Future value of annuity - Total deposits = P 268,703.7 – P 200,000 = P 68,703.7 Quick Check 1 At the end of every quarter, P 2000 is put into a educational plan that earns 6% compounded quarterly. Find the future value in 5 years. Future value of an ordinary annuity can also be determined using its formula and it is given by: Amount of an Annuity or Future Value of an Ordinary Annuity (FVOA) 𝑭𝑽𝑶𝑨 𝑷𝒎𝒕 ( 𝒊 𝒏 𝒊 𝟏 𝟏 ) Where 𝑭𝑽𝑶𝑨 𝑭𝒖𝒕𝒖𝒓𝒆 𝒗𝒂𝒍𝒖𝒆 𝒐𝒓 𝒂𝒎𝒐𝒖𝒏𝒕 𝑷𝒎𝒕 𝒑𝒆𝒓𝒊𝒐𝒅𝒊𝒄 𝒅𝒆𝒑𝒐𝒔𝒊𝒕 𝒐𝒓 𝒑𝒂𝒚𝒎𝒆𝒏𝒕 𝒏 𝒏𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒅𝒆𝒑𝒐𝒔𝒊𝒕𝒔 𝒐𝒓 𝒑𝒂𝒚𝒎𝒆𝒏𝒕𝒔 𝒎𝒂𝒅𝒆 𝒊 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝒓𝒂𝒕𝒆 𝒑𝒆𝒓 𝒄𝒐𝒎𝒑𝒐𝒖𝒏𝒅𝒊𝒏𝒈 𝒑𝒆𝒓𝒊𝒐𝒅 Example 2 Mark Ezekiel wants to put up his Art Studio 5 years from now. If he deposits P 5,000 from his monthly salary for the next 5 years in an account that yields 12% compounded monthly. How much does he have by that time? Solution Amount deposited at the end of each month is P 5000 for 5 years x 12 = 60 months Using Pmt= P5,000, n=60 and ( ) ( ) Quick Check 2 Verify Quick Check 1 using the formula. Objective 3. Use the formula to find the present value of an ordinary annuity. The present value of an ordinary annuity is the total of the present values of all the payments of the annuity. To get the present value, assume an annuity of n number of payments at rate i per period. Calculate the present value of each payment to the start of the annuity and take their sum. The total is the present value of the annuity. There is also a corresponding table factor for Present Value of an Ordinary Annuity given below. Exa mpl e3 An alu mn us in a cert ain uni vers ity wants to provide a P 250,000 research fellowship fund at the end of each year for the next five years. If the University can invest the money at 10% compounded annually, how much should a man give now to setup the fund for the scholarship? Solution Annual fellowship fund = P 250,000 Interest earned per year for 5 years x 1 = 5. Look across the top of the table for 10, and down the side for 5 periods to find 3.79079 Present Value = P 250,000 x 3.79079= P 947,697.5 The amount P 947, 697.5 is the lump sum need to be deposited in an investment earning 10% compounded annually to be able to provide P 250,000 pesos every end of the year for 5 years. At the end of the 5th year of the scholarship, the fund is fully exhausted. The fund was able to provide P 250,000 x 5= P 1,250,000 by investing P 947, 697.50 The present value of an ordinary annuity formula can also be used and it is given by: Present Value of an Ordinary Annuity (FVOA) 𝟏 𝒊 −𝒏 𝑷𝑽𝑶𝑨 ) 𝒊 Where 𝑷𝑽𝑶𝑨 𝑷𝒓𝒆𝒔𝒆𝒏𝒕 𝑽𝒂𝒍𝒖𝒆 𝒐𝒇 𝒂𝒏 𝑶𝒓𝒅𝒊𝒏𝒂𝒓𝒚 𝑨𝒏𝒏𝒖𝒊𝒕𝒚 𝑷𝒎𝒕 𝒑𝒆𝒓𝒊𝒐𝒅𝒊𝒄 𝒅𝒆𝒑𝒐𝒔𝒊𝒕 𝒐𝒓 𝒑𝒂𝒚𝒎𝒆𝒏𝒕 𝒏 𝒏𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒅𝒆𝒑𝒐𝒔𝒊𝒕𝒔 𝒐𝒓 𝒑𝒂𝒚𝒎𝒆𝒏𝒕𝒔 𝒎𝒂𝒅𝒆 𝒊 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝒓𝒂𝒕𝒆 𝒑𝒆𝒓 𝒄𝒐𝒎𝒑𝒐𝒖𝒏𝒅𝒊𝒏𝒈 𝒑𝒆𝒓𝒊𝒐𝒅 𝟏 𝑷𝒎𝒕 ( Example 4 A company wants to purchase a machine the will require a payment of P100,000 at the end each 6 months for the next four years. How much should the company invest at present to cover for the semiannual payment if the money can be invested 12% compounded semiannually? Solution Amount to be paid at the end of each month is P 100,000 for 4 years x 2 = 8 Using Pmt= P100,000, n=8 and ( ` − ) − ( ) The value can verified using the table factor for present value. Given i=6% and n=8, the corresponding table factor is 6.20979 Present Value = P 100,000 x 6.20979= P 620, 979 The difference in decimal places is due to the limit decimal places used by the table factor. Section Exercises Find the amount of the following ordinary annuities rounded to the nearest cent. Find the total interest earned. Amount of Each Deposit Deposited Rate Time (Years) Amount of Annuity Interest 1. P 900 annually 5% 18 __________ __________ 2. P 2900 annually 8% 5 __________ __________ Earned 3. P 7500 semiannually 6% 10 __________ __________ 4. P 9200 semiannually 8% 5 __________ __________ 5. P 3500 quarterly 7 __________ __________ 10% Find the present value of the following annuities. Round to the nearest cent Amount per Payment Payment at End of Each Time (Years) Rate of Investment P 1800 year 18 10% P 4100 year 7 Compounded annually 6% annually ______________ ______________ Present Value P 2000 6 months 12 8% semiannually ______________ P 1700 6 months 14 5% semiannually ______________ P 894 quarter 6 4% quarterly ______________ Solve the following application problems. 1. Roman Rodriguez would like to know if he can retire in 35 years at age 60, when he plan to fish a lot. Assume the total deposit into his retirement account at the community college is P 3800 at the end of each year and that the fund earns 6% per year. Find (a) the amount of the annuity and (b) the interest earned. 2. Monique Chaney places P 250 of her quarterly child support check into an annuity for the education of her child. She does this at the end of each quarter for 8 years into an account paying 8% per year, compounded quarterly. Find the amount of the annuity and (b) the interest earned. 3. In 4 years, Jennifer Videtto will need to purchase a delivery van for her plumbing company. She estimates it will require a down payment of P 10,000 with payments of P 950 per month for 48 months. (a) Find the total amount needed in 4 years assuming 12% compounded monthly. (b) Will she have enough if she invests P 2200 at the end of every quarter for 4 years and earns 6% compounded quarterly? 4. Jessica Thames expects to receive P 18,400 per year based on her deceased husband’s contributions to Social Security. Assume that she receives payments for 14 years and a rate of 4% per year, and find the present value of this annuity. Section 2 1 Manipulating the Ordinary Annuity Formula Objective 4. Solve the Size of the Periodic Payment for Ordinary Annuity The size of each periodic payment (Pmt) must be determined when the future value or present value of an annuity is known. In this type of problem, the interest rate and the term of the annuity are usually given. Present value is known (Pmt)= ( ) Future value is known ( ) Example 5: (Present Value is Given) To help finance the purchase of house and lot, couple borrows P 350,000. The loan is to be repaid in equal monthly installment over a period of 8 years. If the interest rate is 15 compounded monthly, how much is the monthly payment? Solution: Amortization of loans are examples of application of present value, for this case, P350,000 is a Present value. The number of payments, n, is 8 years times 12 compounding periods per year is 96 monthly payments. The interest compounding period is 15 divided by 12 compounding periods is 1.25%. Then the size of each payment is, − ( ) ( − ) =P 6,280.89 Example 6: (Cash Value and Down payment given) A man wants to buy a car worth P 450,000. He pays P150,000 down payment and agrees to [ay the rest by paying in monthly installments for 5 years. If the money is worth 12% compounded monthly, how much is the monthly payment? Solution Down payment= P150,000 Cash Value = P450,000 Interest compounding period, i = 12/12= 1% n=(5 years)(12)=60 months Present Value= Cash value – Down payment= P450,000-P150,000=P300,000 ( ) ( ) = P6,673.33 Example 7: Future Value is given A young accountant wishes to accumulate a fund amounting to 1 million pesos for future business ventures ten years from now. How much should be invested at the end of each quarter in an investment firm earning 8% compounded quarterly? Solution: FV= P 1,000,000 i= 8%/4= 2% n= (4) (10 years)=40 ( ) ( ) =P16,555.75 Finding the interest rate in an ordinary annuity The interest rate per compounding period, I can be solved by means of interpolation using table factors since there is no direct formula can be derived. Example: At what nominal rate compounded monthly is P 200,000 the present value of P 10,000 payable every end of each month for 4 years? Solution: PV= P200,000 Pmt= P10,000 n= (12)(4 years)=48 From − ( − ) ( ) From the present value table factor, for n= 48 with unknown i, the ( − )=20 which is between i=5%(21.19513) and i=4%(18.07716) Linear interpolation states that, the if the two known points are given by the coordinates (x0 , y0) and (x1 , y1) , the linear interpolant is the straight line between these points. For a value x in the interval (x0 , x1) , the value y along the straight line is given from the equation of slopes ( ) ( ) which can be derived geometrically from the figure on the right. Solving this equation for y, which is the unknown value at x, gives which is the formula for linear interpolation in the interval (x0 , x1) . Transforming the given data of the problem into coordinates, as how in the table below, Table factor 18.07716 20 21.19513 interest 5% i 4% (x0 , y0) (x,y) (x1 , y1) (18.07716, 5% ) (20, i) (21.19513, 4% ) Therefore, y is the unknown value of i. Solving for the value of y ( ( ) ) Which implies that the nominal rate is, compounded monthly. Example 8: Payments of P10,000 each are made every 6 months. At what rate compounded semi-annually will these payments amount to P143,000 in 5 years? Solution: Pmt= P10,000 FV= P 143,000 n=mt=(2)(5)=10 a From ( − ( − ), ) − On the Future Value table for n=10, the value of interest which is between 6% and 8%. =14.3 with unknown Transforming the given data of the problem into coordinates, as how in the table below, Table Factor 13.18079 14.3 14.48656 Interest 6% I 8% (x0 , y0) (x,y) (x1 , y1) ( ( Which implies that the nominal rate is, compounded semi-annually. Finding the term of an ordinary annuity (13.18079, 6% ) (14.3, i) (14.48656, 8% ) ) ) The number of payments n of an ordinary annuity can be determined if the future value or present value, size of each periodic payment and interest rate is given. When the integral number of payments is not exactly the equivalent to the original amount or present value, a smaller concluding or final payment can be made on period after the last full payment, but a certain amount of money is to be accumulated, this smaller final payment may not be necessary because the interest after the last payment will equal or exceed the balance needed. Formula of n if Future value is given: Formula of n if Present value is given: Example 9: If P 1750 is deposited in a fund at the end of 3 months, when will the fund amount at least P75,000 if the interest rate is 12% compounded quarterly? Solution: Pmt=P 1750 Future Value=P 75,000 m=4 Using the formula for n where FV is given, This means that the fund will be less than P75,000 just after the 27 th payment and greater than P 75,000 just after the 28th payment. Thus the fund will amount at least P P75000 at the end of 28 quarters or equivalent to 7 years (28/4=7). It should be remembered that n should be an integral number of payments. Example 10 A man borrows P 80,000 at an interest rate of 24% compounded monthly. He agrees to pay P 5000 at the end of each month until the final payment date. How long must he pay? Solution: Pmt=P 5000 PV= P80,000 m=12 To find t, we use formula for n given a present value. This means that the present value of 19 payments is less than P80,000 but if 20 payments are made, the present value will be over P80,000. Thus the debtor must pay 19 whole payments of P5000 plus amount less than P5000 at the end of the 20th month. The next example will provide a computation for the size of the last payment which is less than the periodic payment size.````````````````````````````````````````````````````````````````` Example 11: A man wants to accumulate P50,000 by making deposits of P10,000 at the end of each year. If he gets 3% of his money, how many regular payments will he make and what is the size of the last payment if there’s any? Solution: F=P 50,000 Pmt=P 10,000 at the end of each year m=1 Using the formula for n where FV is given, The value 4.73 means that 4 regular payments of P10,000 and the 5th payment is less than 10,000. To find the value of the last payment, we use the concept of equation of values. P41,836.27 P 50,0000 0 1 2 3 4 5 CD P 10,000 P 10,000 P 10,000 P 10,000 x Step 1: Find the future value of the 4 regular payments of P10,000 ( ) ( ) Step 2: Use the value of FV for n=4 and setup the equation of value where the comparison date is at the 5th year as indicated in the timeline given above. Then the equation of values P41,836.27(1+.03)1 + x=P 50,000 x=P50,000- P41,836.27(1+.03)1 x= P6908.64 Thus, the man needs to make 4 regular deposits of P10,000 each end of the year and P6908.64 at the end of the 5th year in order to accumulate the exact amount of P50,000 in his account within 5 years. Example 12: A father left his son an inheritance of P500,000 which will be released in monthly pension of P10,000 which accumulates at 12% compounded monthly. How long will the inheritance last? Determine the size of last amount to be received. Solution: PV=P 500,000 Pmt=P 20,000 at the end of each month m=12 To find t, we use formula for n given a present value. The pension will last 70 months, in which the son will receive P10,000 69 times and the 70th will be smaller than P10,000. To solve for the last month’s pension, P500,000 0 1 2 3 67 P986,894 69 68 70 CD P 10,000 P 10,000 P 10,000 P 10,000 P 10,000 P 10,000 x Step 1: Get the future value of 69 regular payment of P10,000 ( ) ( ) Step 2: Use the value of FV for n=69 and setup the equation of values where the comparison date is at the 70th month as indicated in the timeline given above. Then the equation of values P 986, 894.42(1+.01)1 + x = P 500,000(1+.01)70 x= P 500,000(1+.01)70 - P 986, 894.42(1+.01)1 x=6,618.32 Therefore, the son will receive 69 times of P10,000 and P 6,618.32 on the 70 th month as the last pension. Section 2 Exercises 1. A P 300,000 loan is due in one year. To repay the loan, the debtor deposits an amount every month in a fund earning 8% m= 12. How much should he deposit monthly? 2. A couple would like to accumulate P 500,000 in 5 years by making deposits at the end of each quarter in an account that pays 16% compounded quarterly. What is the size of each deposit? 3. A man borrows P 50,000. He agree to settle by paying every 6 months in 2 years. If the interest is 8% compounded semi annually, how much should he pay every 6 months? 4. A man left his wife P1 million insurance policy. What monthly income would this provide for 10 years if the insurance company pays 9% compounded monthly? 5. The cash price of a 32 inch LED TV is P25,000. A buyer who prefers installment by paying P5000 as down payment and P1250 monthly installment for 18 months. What is the nominal rate compounded monthly? 6. Find the rate of interest per period and the nominal rate compounded semi-annually at which payments of P15000 at the end of each 6 months will amount to P200,000 in 5 years? 7. A man borrows P60,000 at 24% compounded monthly. He will discharge the debt by paying P 4500 monthly. Find the number of regular payments and the size of the final payment. 8. A newlywed couple would like to accumulate P 500,000 by making P15,000 deposits at the end of each quarter in an account that pays 16% compounded quarterly. How long will it take for them to save the said amount and determine the size of the last deposit?