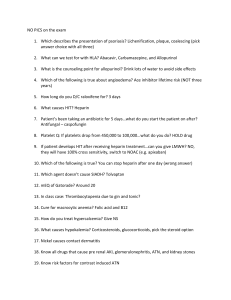

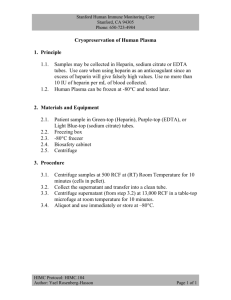

Medicines Company Case Study By Parsa Hoghooghi, Chiara Settineri, and Trilok Sadarangani By submitting this deck of case slides, the members of our team affirm that we all participated in the analysis of the case and the creation of this document. Qualitative Analysis Customer Value Proposition - General Four P’s - Angiomax Jobs-To-Be-Done/Emotional Drive: Resurrecting drugs that could be effective in saving/improving lives but were abandoned mid-development due to obstacles in testing → Principle example: Angiomax - a more effective alternative to Heparin; acts as an anticoagulant (blood thinner) to prevent blood clots from forming in medical procedures for high-risk patients Problem: -Many drugs in development “fail to meet a developer’s initial expectations” and are shelved → All investment in R&D lost → Beneficial drugs don’t reach the market Solution: -Medicines Company acquires drugs in late-stage clinical trials and invests in continued R&D to bring the drugs to market (possibly through repositioning them). In this way, the company bypasses the high initial costs of R&D for drugs and secures higher likelihoods that the drugs will be approved by the FDA (see next slide) Overall Positioning: A safer, more modern, more effective alternative to dated and unreliable heparin with the potential to save millions of Americans from the nation’s biggest killer: heart disease Product: An anti-blood-clotting drug used to treat “high-risk patients undergoing a balloon angioplasty” and is proven to be more effective than the alternative, heparin, which comes with severe side effects and is difficult to properly administer Promotion: Focused on advertising to cardiologists, hospital pharmacists, and hospital administrators, although they admit that the third group would be influenced by first two (less crucial to include as a target) - Weekend getaways for doctors → likely an ineffective allocation of funds w/ cost of $3M (no data on MROI) // Academic/Medical Journals → emphasis on harms of heparin // Innovex → Outsourced marketing services firm // Trade Shows Place: Hospitals/Medical Centers in the U.S. with a high number of angioplasties. Price: To be discussed more on Quantitative Slide Five C’s - Angiomax Key Drivers & Key Risks Customer: Hospitals purchase the drug to administer to high-risk patients undergoing a balloon angioplasty, but may soon expand to be marketed to serve patients who have suffered a heart attack Company: Medicines Company, which acquires promising drugs that have been abandoned during R&D (like Angiomax) and brings them to market Collaborators: Innovex → Marketing services are outsourced // UCB Bioproducts → Contracted producer of Angiomax → Reduced price of COGS to $40 Competition: Heparin - though highly unpredictable, it was viewed as a commodity drug (cardiologists and hospitals were accustomed to using this product) Context: Highly saturated drug market, with downward pressure on prices but overall rise in demand (due to an increase in aging pop). Further, coronary heart disease (which Angiomax is used to fight against) is the number one killer in America Competitive Edge (Angiomax): Drug takes effect quicker than Heparin → Within 30 Min (as opposed to 2-3 Hrs)//Reduced risk of bleeding//Predictable side-effects//No immune reaction Growth Opportunities (Medicines Company): Expanding go-to market plan → Angiomax may soon be marketed to serve 1.1M heart attack patients in U.S. (potential increase in demand and therefore revenue) // Similar to a PE firm for Medical Services/Drugs → Increased research on proposed drugs that fail testing Key Risks (Medicines Company): Rely on breakthrough drugs for revenue, which are difficult to discover and get FDA approved → make high-risk investments, which means they may be losing large sums of money regularly - Ex. The only two other drugs in Medicine Company’s pipeline, IS-159 and CTV-05, have shown signs of failure/volatility → Could be disastrous for future profitability Quantitative Analysis Business Model Total Addressable Market (TAM): -700K patients who go through the Balloon Angioplasty -1.1M heart attack patients who may be approved to use this drug Basic Model: - Bypass at least 41.3% of R&D costs (saving millions), but instead pay royalties of 5% to (potentially) 20% and upfront costs // do have higher rates of success due to this bypass → 5% rather than 0.025% Investment Funding: - 100M in cash from private equity firms - Public co. with volatile stock prices → drop in stock price by a little under 50% in a month Profitability: Minimum Reduction in COGS: $4.5M from IS-159 reaching future milestones, $30M from solving IS-159’s coconut oil issue → $34.5M saved from not pursuing 2 other drugs. We can assume that not pursuing the 2 other drugs can potentially lead to selling the patent and formula back to another pharmaceutical firm -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Pricing Strategy/Total Economic Value (TEV) for Angiomax: TEV = Price of Next-Best Alternative + Value of Performance Differential → Cost of Heparin + Savings on Insurance = Total Economic Value of Angiomax to Hospitals Assumptions: -Doses → Weighted Average: 0.7(1 dose) + 0.3(2.5 doses) = 1.45 doses on average -”Quinn focuses on 700 Centers that facilitate 92% of all angioplasty procedures” -Balloon Angioplasty Procedures per Year: ~700K patients -Additional Cost to Hospitals per Patient using Heparin: $8K for complications -Percentage of Patients with Complications Post-Procedure for both drugs that were equally tested (High-Risk + Very High-Risk) → Herpain: 37.9% - Angiomax: 17.3% → 20.6% decrease in patients with complications post-procedure → 700K * 92% * 50% receiving drug * 20.6% differential in complications = 83,720 ppl w/o complications → Savings of 83,720 * $8,000 = $669,760,000 Savings on Insurance → (($10/dose * 1 dose/patient * 644,000 patients) + ($669,760,000 SoI))/(1.45 doses of Angiomax/patient * 644,000 patients) = ~$724/dose for Angiomax As a team, we would suggest that Medicines Company price Angiomax well below the calculated True Economic Value per dose simply because convincing a hospital to spend such a significant amount to change from the status quo would be challenging and marketing efforts would allow MC to price the drug much higher than COGS to proft. Most drugs sell at a 10:1 based upon COGS ($40) so we suggest a price accordingly → Somewhere between $425 - $475 RECOMMENDATION Thesis: Due to the high-risk investments that are associated with The Medicine Company’s original business model, it would make most sense for the company to focus efforts on producing and promoting Angiomax, which has proven to be a potential disruptor in the market. Considering the scope of the company’s mission, we also suggest a rebranding/renaming of the name to something more specific and memorable. ● ● ● ● Powered by TCPDF (www.tcpdf.org) Pricing strategy for Angiomax should shift towards a consumer value-based approach rather than competitive market approach Patent so that other pharma companies cannot copy the drug and be competitive with pricing Marketing for Angiomax should be catered towards the economic benefits of the drug to hospitals and pharmacists as it has proven to reduce deaths, heart-attacks from angioplasty, need for repeat angioplasty and major bleeding, which are all complications that contribute to high costs for hospitals and may hurt their reputations (which are invaluable) Having only 1 drug under the pipeline is not totally detrimental to the image of Medicines Company as most drug companies aren’t known for multiple successful drugs and the drug itself isn’t consumer facing and only used by a select group of people under specific health conditions